When you wish to fill out Form Pt 300, there's no need to download any programs - just try using our PDF tool. Our development team is always working to expand the editor and enable it to be even easier for people with its multiple functions. Bring your experience to the next level with continuously improving and amazing possibilities available today! Here is what you will need to do to start:

Step 1: Access the form inside our editor by pressing the "Get Form Button" in the top section of this webpage.

Step 2: As you open the editor, you will find the form ready to be filled in. Besides filling out various fields, it's also possible to perform several other things with the PDF, namely adding any words, changing the initial textual content, adding images, putting your signature on the form, and much more.

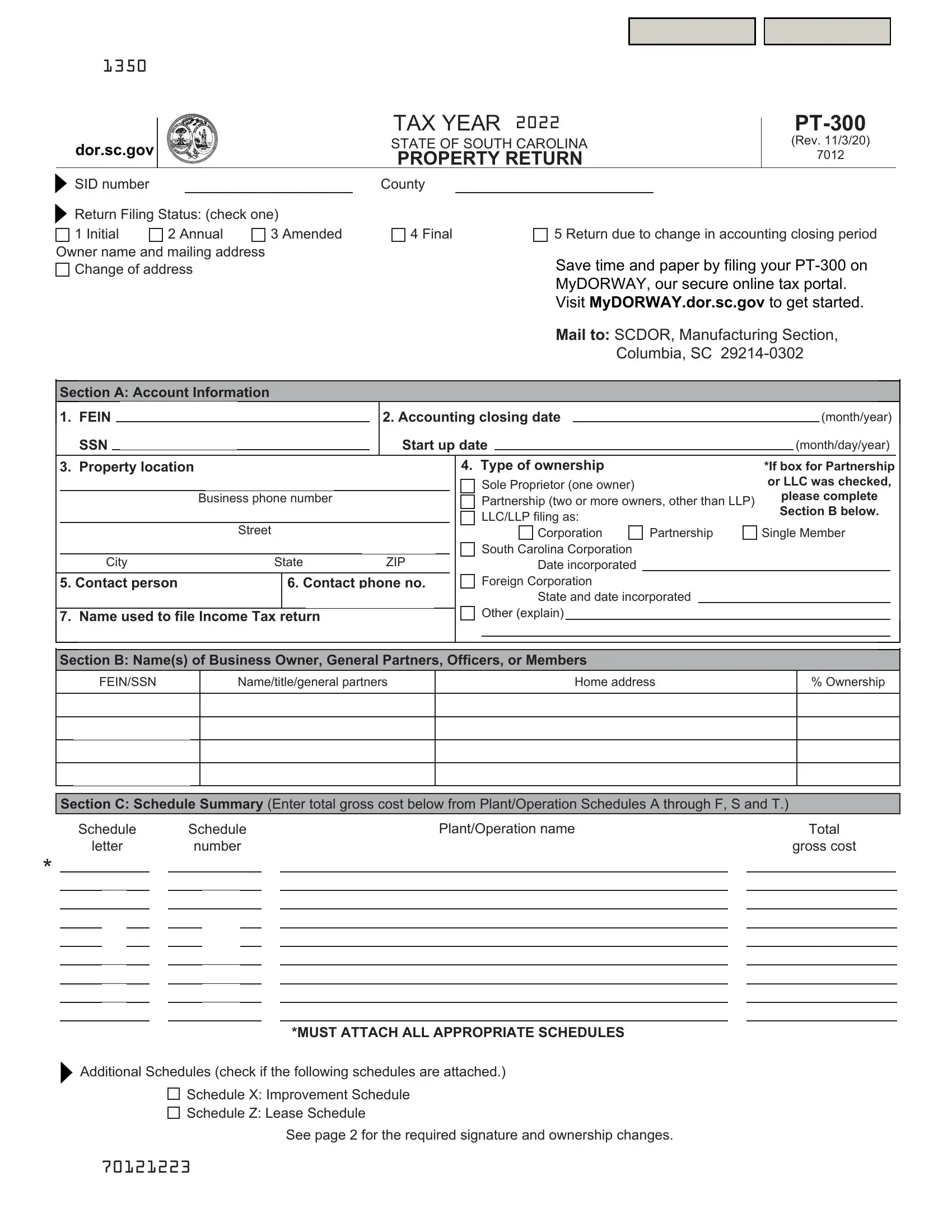

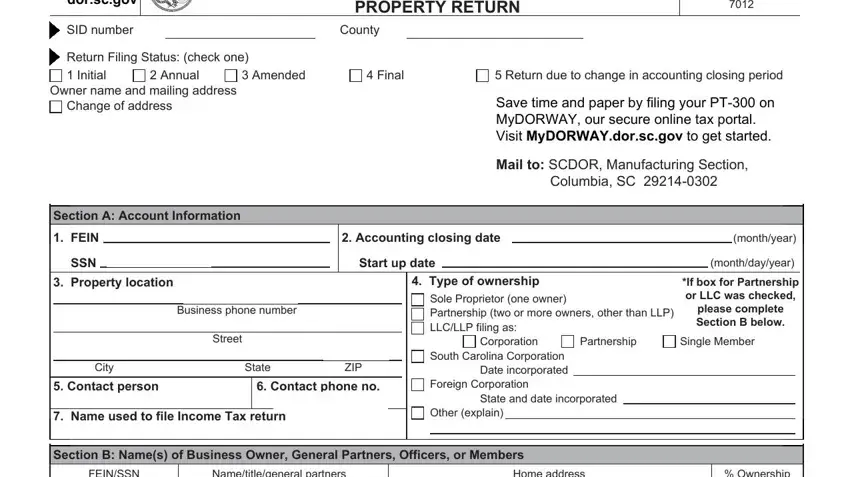

So as to finalize this PDF form, ensure you enter the required information in each and every blank field:

1. The Form Pt 300 involves particular information to be typed in. Make sure the subsequent blank fields are completed:

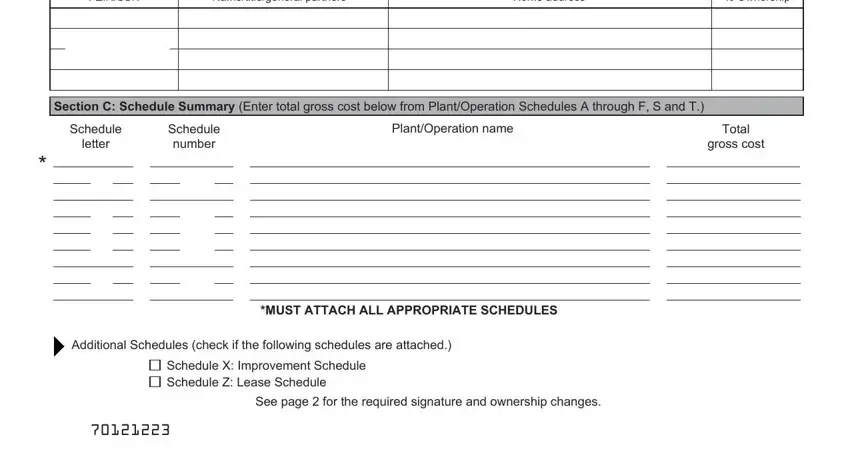

2. After the last section is complete, you'll want to include the required specifics in FEINSSN, Nametitlegeneral partners, Home address, Ownership, Section C Schedule Summary Enter, Schedule, letter, Schedule number, PlantOperation name, Total, gross cost, MUST ATTACH ALL APPROPRIATE, Additional Schedules check if the, Schedule X Improvement Schedule, and See page for the required so you're able to move on to the next step.

A lot of people often make some errors while completing Home address in this section. Make sure you review whatever you type in right here.

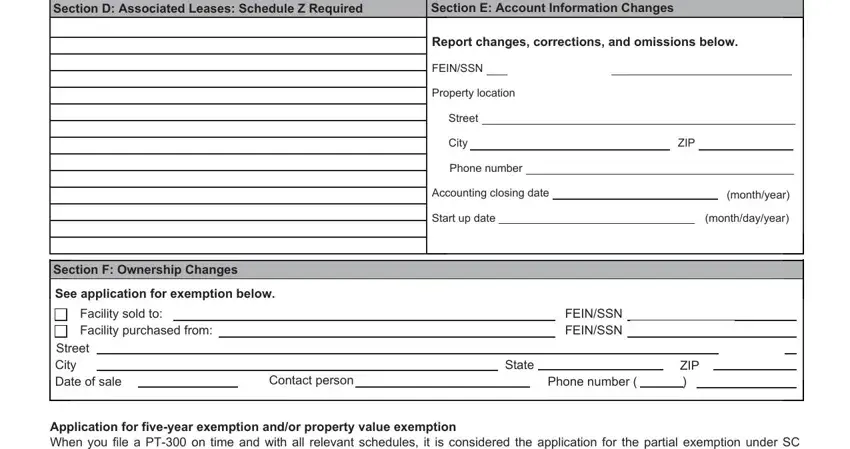

3. This stage is usually hassle-free - complete every one of the empty fields in Section D Associated Leases, Section E Account Information, Report changes corrections and, FEINSSN, Property location, Street, City, Phone number, Accounting closing date, Start up date, ZIP, monthyear, monthdayyear, Section F Ownership Changes, and See application for exemption below to complete this process.

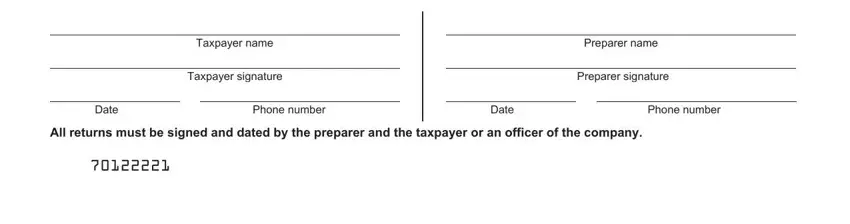

4. The next subsection needs your information in the following areas: Taxpayer name, Taxpayer signature, Preparer name, Preparer signature, Date, Phone number, Date, Phone number, and All returns must be signed and. Make sure that you enter all needed details to go onward.

Step 3: Prior to moving forward, you should make sure that all form fields have been filled out the proper way. When you are satisfied with it, press “Done." Get hold of your Form Pt 300 after you join for a 7-day free trial. Quickly get access to the pdf inside your FormsPal account, along with any modifications and adjustments being conveniently saved! With FormsPal, you can certainly complete documents without worrying about database breaches or entries being shared. Our secure software makes sure that your personal details are kept safe.