Working with PDF forms online is actually very simple with this PDF editor. You can fill in pt 440 here and try out several other options we provide. Our editor is continually evolving to give the very best user experience possible, and that is because of our resolve for continual enhancement and listening closely to comments from users. To get the ball rolling, take these easy steps:

Step 1: Just hit the "Get Form Button" in the top section of this site to see our pdf form editing tool. This way, you'll find everything that is necessary to work with your file.

Step 2: This editor will give you the capability to work with most PDF files in various ways. Improve it with any text, correct original content, and include a signature - all within the reach of a few clicks!

In order to finalize this document, make sure you provide the information you need in each and every blank field:

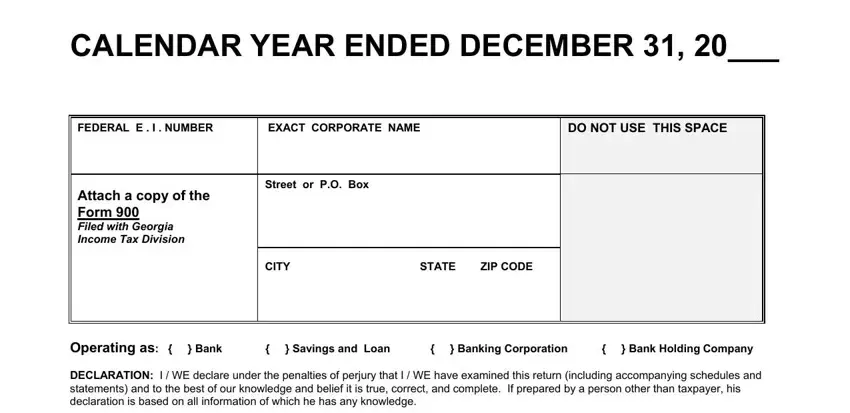

1. It is advisable to complete the pt 440 properly, therefore pay close attention while working with the parts that contain these fields:

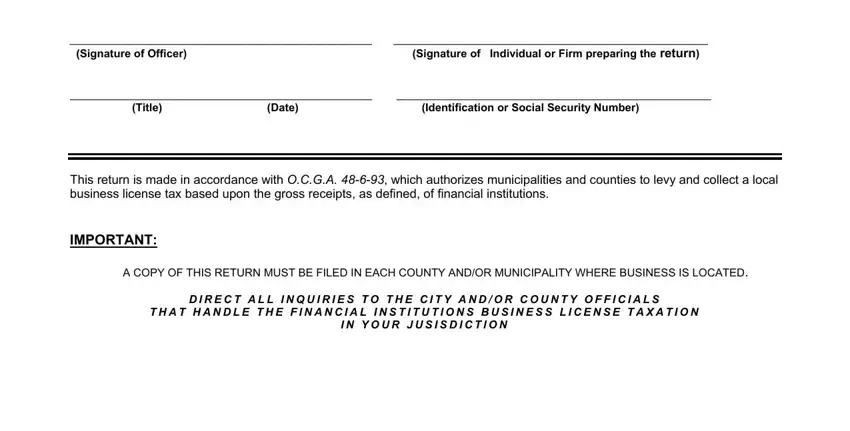

2. Right after performing the previous part, go to the next part and fill in the essential details in all these fields - Operating as Bank Savings and, This return is made in accordance, D I R E C T A L L I N Q U I R I E, T H A T H A N D L E T H E F I N A, and I N Y O U R J U S I S D I C T I O N.

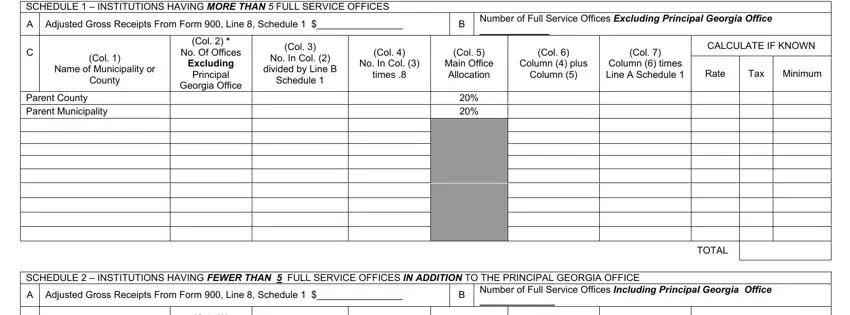

3. Completing SCHEDULE INSTITUTIONS HAVING, A Adjusted Gross Receipts From, Number of Full Service Offices, Col, Name of Municipality or, County, Col, No Of Offices, Excluding Principal, Georgia Office, Col, No In Col, divided by Line B, Schedule, and Col is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

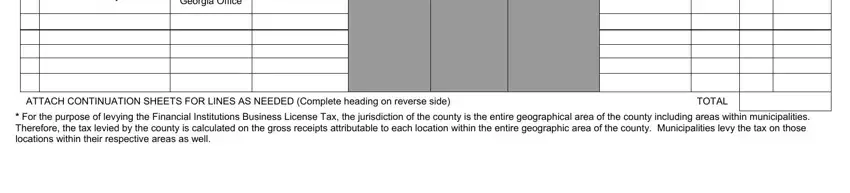

4. To go onward, this next stage requires filling out several empty form fields. These include ATTACH CONTINUATION SHEETS FOR, For the purpose of levying the, County, Georgia Office, Schedule, and TOTAL, which you'll find vital to going forward with this particular form.

It's simple to make errors while completing the ATTACH CONTINUATION SHEETS FOR, therefore be sure to take another look prior to when you send it in.

Step 3: After taking one more look at the fields and details, hit "Done" and you're all set! Join us today and immediately obtain pt 440, available for downloading. Every edit made is conveniently saved , enabling you to change the file at a later point as needed. FormsPal offers risk-free form tools with no data recording or sharing. Rest assured that your information is in good hands here!