Due to the objective of allowing it to be as simple to work with as possible, we created the PDF editor. The entire process of creating the military leave of absence can be simple in case you keep up with the following actions.

Step 1: To get going, press the orange button "Get Form Now".

Step 2: So you are on the form editing page. You may change and add content to the file, highlight words and phrases, cross or check specific words, insert images, sign it, erase unnecessary fields, or remove them altogether.

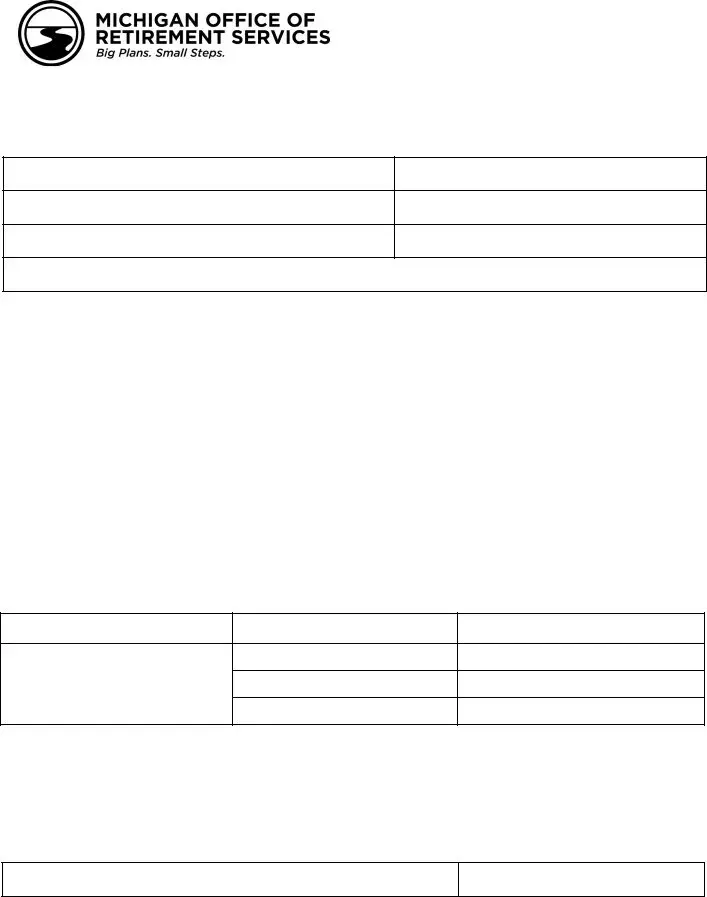

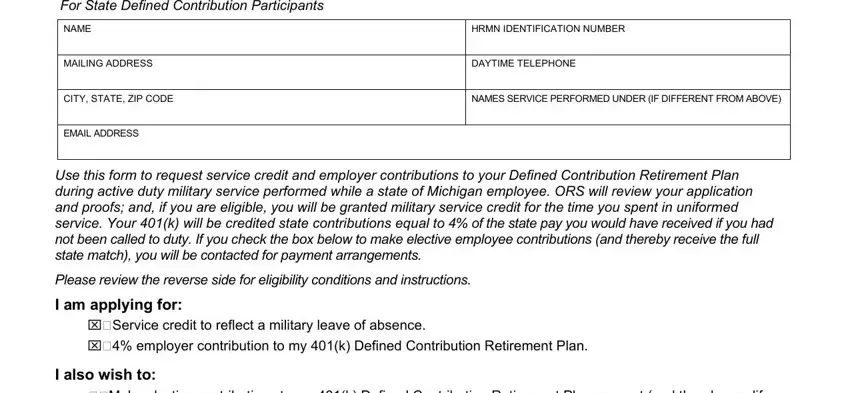

Type in the information demanded by the software to fill out the document.

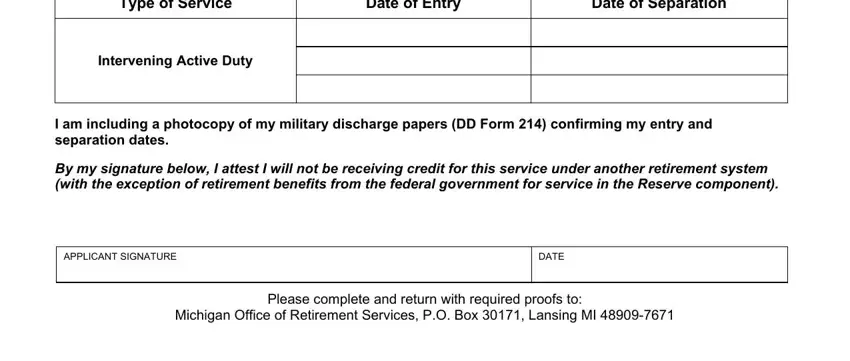

Type in the information in the Type of Service, Date of Entry, Date of Separation, Intervening Active Duty, I am including a photocopy of my, By my signature below I attest I, APPLICANT SIGNATURE, DATE, and Please complete and return with field.

Step 3: At the time you pick the Done button, your finished document is conveniently transferable to any kind of of your gadgets. Alternatively, you can send it by using email.

Step 4: Generate duplicates of your file. This is going to protect you from forthcoming complications. We cannot look at or display your details, therefore you can relax knowing it is secure.