When you need to fill out cra form taxpayer, it's not necessary to download and install any kind of software - just use our online tool. To have our tool on the forefront of convenience, we aim to put into action user-driven capabilities and improvements on a regular basis. We're routinely pleased to get suggestions - join us in revolutionizing how you work with PDF files. By taking a few easy steps, you can begin your PDF journey:

Step 1: Press the orange "Get Form" button above. It'll open our pdf tool so you can begin filling out your form.

Step 2: This tool will let you customize PDF forms in many different ways. Transform it by writing customized text, correct existing content, and put in a signature - all within a couple of clicks!

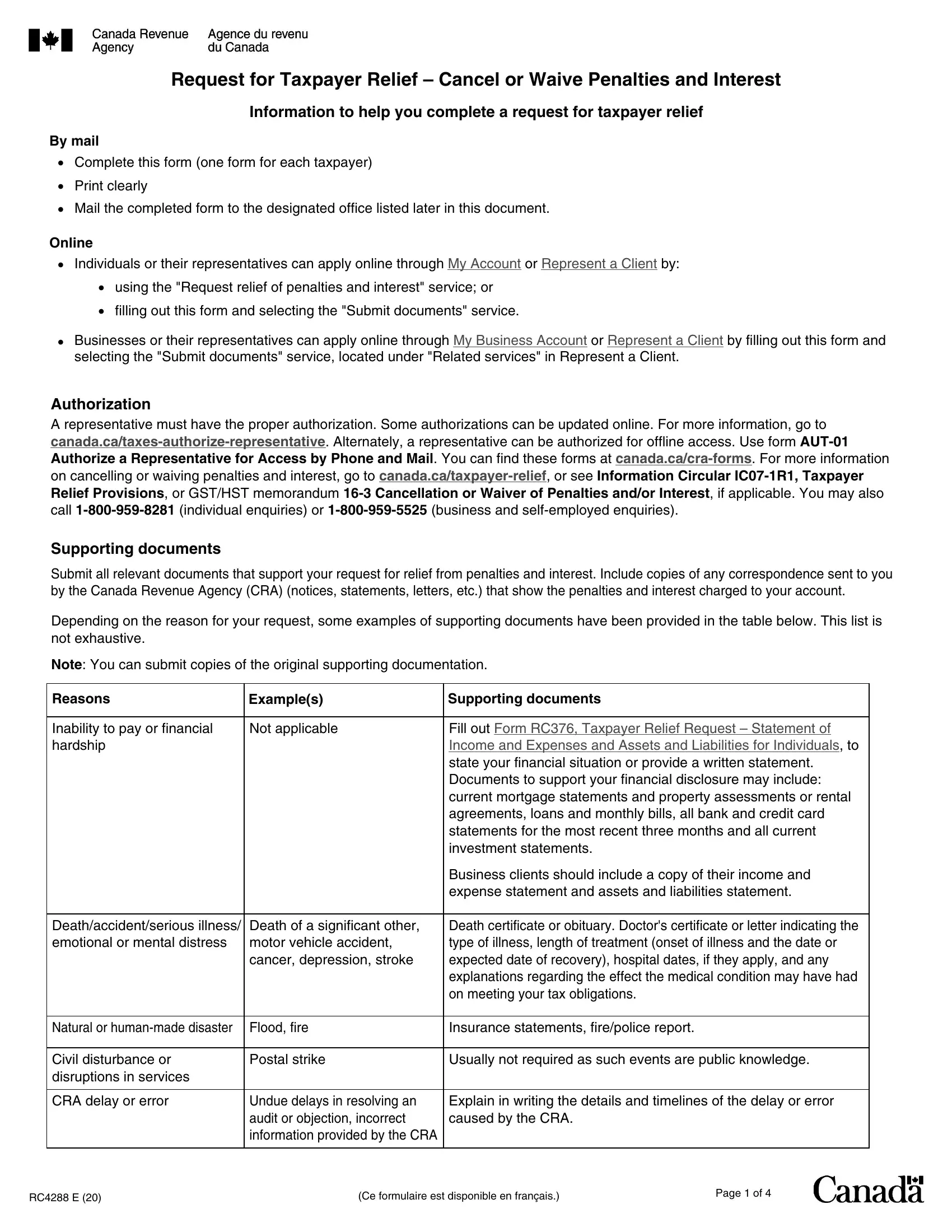

As a way to finalize this PDF document, ensure that you type in the necessary details in every single blank:

1. Before anything else, when filling out the cra form taxpayer, start in the area that features the next blanks:

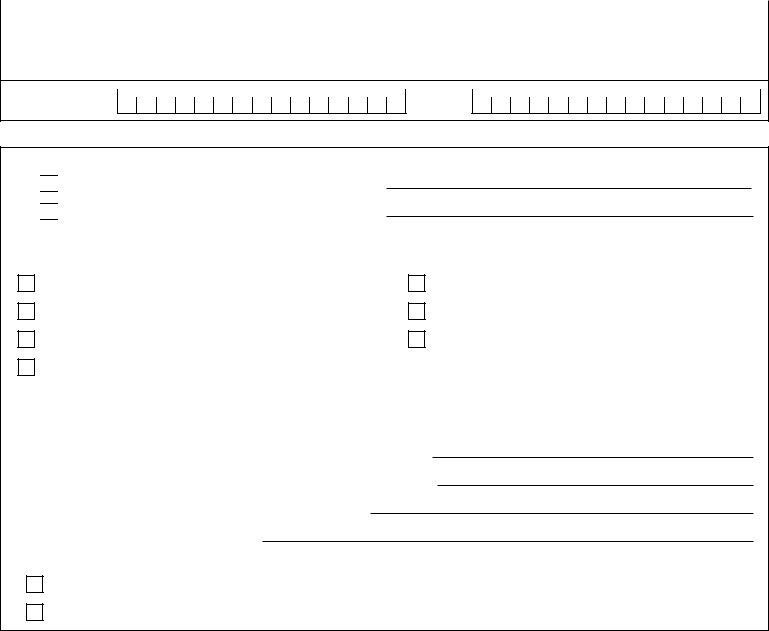

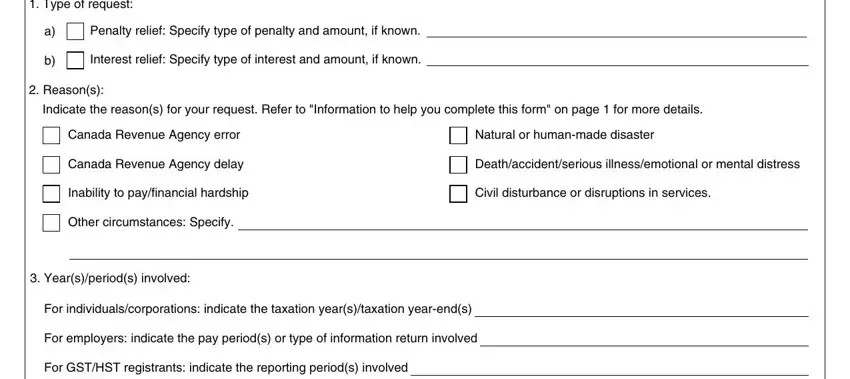

2. The third step is usually to complete all of the following blanks: Type of request, Penalty relief Specify type of, Interest relief Specify type of, Reasons, Indicate the reasons for your, Canada Revenue Agency error, Natural or humanmade disaster, Canada Revenue Agency delay, Deathaccidentserious, Inability to payfinancial hardship, Civil disturbance or disruptions, Other circumstances Specify, Yearsperiods involved, For individualscorporations, and For employers indicate the pay.

3. This next part is relatively straightforward, For other indicate periodsyearss, Indicate if this is a request for, first review, second review, and Page of - all these form fields will need to be filled out here.

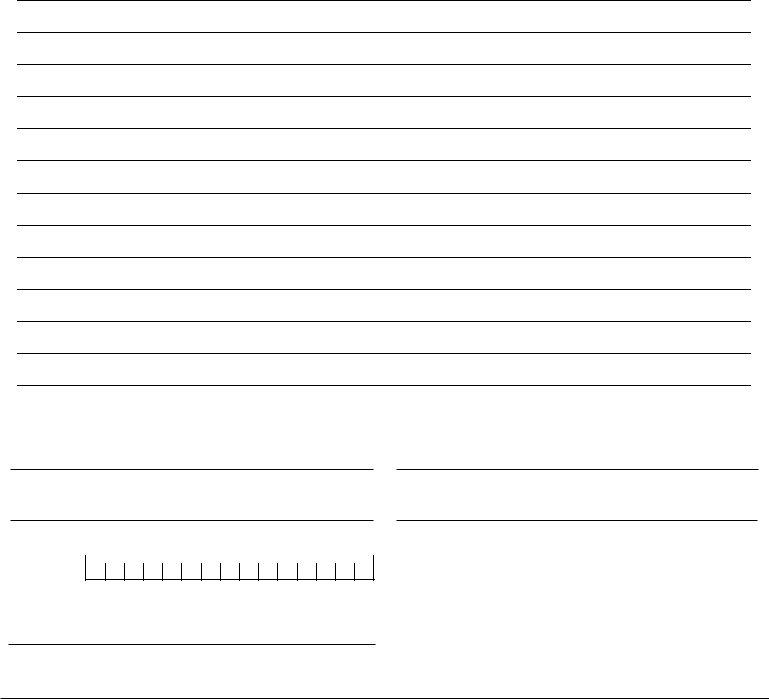

4. To go onward, the following step will require completing a couple of empty form fields. These comprise of , which are key to going forward with this particular PDF.

Always be really careful when filling out this field and next field, as this is the section where a lot of people make errors.

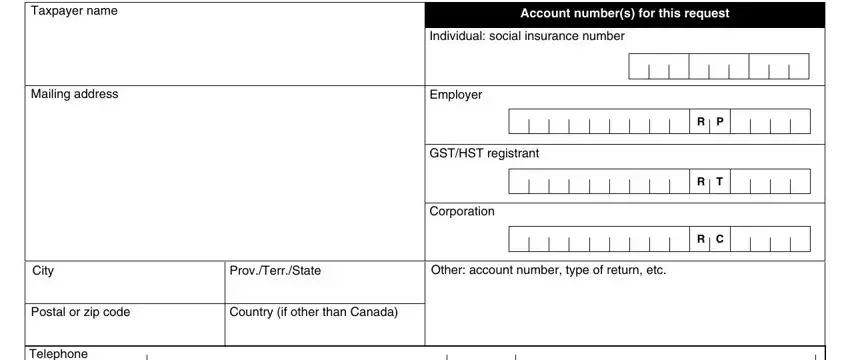

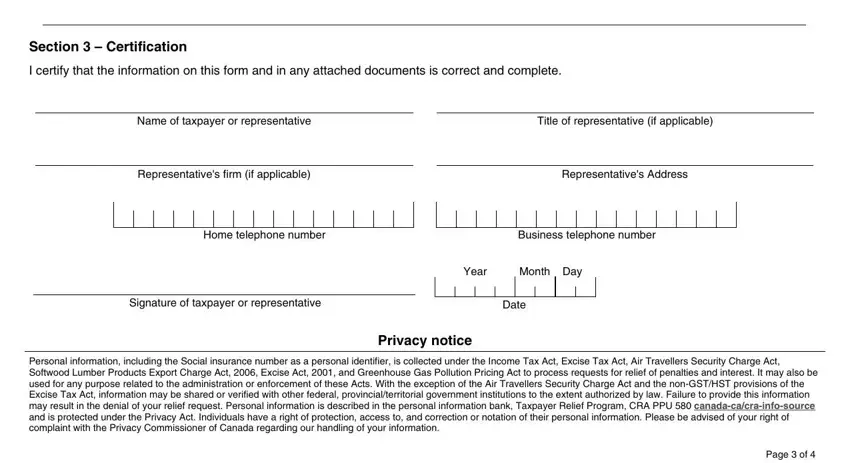

5. To wrap up your document, the particular section requires a couple of additional blank fields. Completing Section Certification, I certify that the information on, Name of taxpayer or representative, Title of representative if, Representatives firm if applicable, Representatives Address, Home telephone number, Business telephone number, Signature of taxpayer or, Date, Year, Month Day, Privacy notice, Personal information including the, and Page of will wrap up everything and you're going to be done in no time!

Step 3: Prior to submitting this file, make sure that all blank fields are filled in correctly. When you think it's all good, press “Done." After getting a7-day free trial account here, it will be possible to download cra form taxpayer or send it through email promptly. The PDF will also be easily accessible in your personal cabinet with your each change. FormsPal ensures your information confidentiality by using a protected method that in no way saves or shares any kind of private data involved. Be assured knowing your files are kept protected any time you use our tools!