Understanding the intricacies of the Washington State Department of Revenue's Rural Area Application for B&O Tax Credit on New Employees is paramount for businesses aiming to leverage tax advantages while expanding their workforce in rural areas. This application, designed to incentivize employment growth in targeted regions, requires businesses to apply for tax credits within 90 days following the hiring of eligible new positions. It highlights a structured approach, necessitating a new application for each set of four quarters if the employment is projected to increase over 15%, emphasizing the legislative intent to foster job growth over sustained periods. Importantly, the application outlines the eligibility criteria, distinguishing that positions qualifying for this credit cannot concurrently benefit from other programs like the Software B&O Job Credit Program or the International Services Job Credit Program. With guidelines set forth from legislative changes effective since January 1, 2008, reflected in House Bill 1566, the application encompasses details from business identification to detailed employment information, charting out the path for businesses to follow for submitting their application correctly to the Special Credits & Assessments Team. Additionally, it sets forth the requirements for subsequent annual reports that are critical for affirming the continued qualification for the tax credit, thereby ensuring businesses not only meet the initial criteria but also maintain the requisite employment levels. This description underscores the application's role as a critical tool for rural employment expansion, providing a comprehensive outline for businesses to navigate the intricacies of applying for and maintaining eligibility for valuable tax credits.

| Question | Answer |

|---|---|

| Form Name | Form Rev 41 0077E |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | Assessments, FTE, 2008, city of everett b o tax form |

Washington State

Department of Revenue

Taxpayer Account Administration

Special Credits & Assessments

Team

PO Box 47476

Olympia WA

Rural Area Application

for B&O Tax Credit on New Employees

Application for tax credits must be made within 90 days after the actual hiring of qualified employment positions. A new application must be submitted after each group of four consecutive quarters that you project employment to increase over 15%. Positions hired after the end of four consecutive calendar quarters are not considered for this credit. Credit for a position may not be received under both this program and the Software B&O Job Credit Program or the International Services Job Credit Program. This application reflects legislative changes of House Bill 1566 effective January 1, 2008.

Business Identification

|

|

|

|

|

|

|

|

|

Name of Business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Contact Person (all correspondence will be directed to this person) |

|

|

Address |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone Number |

|

|

City |

State |

Zip Code |

|

|

||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

Department of Revenue Tax Reporting Account Number |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|||||

Department of Employment Security Identification Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Location of the Facility for Which Job Credits are Being Sought |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Please complete one application for each separate facility that is expanding positions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

Check one: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Rural County |

|

|

County |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Community Empowerment Zone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Street Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

City |

|

|

|

|

|

|

|

State |

|

|

|

|

|

|

|

|

|

|

|

|

|

Zip Code |

|||||||||||

Does the applicant operate in other Washington locations? |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Business Activity to be Conducted at This Business Facility |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

If additional space is needed please attach additional pages. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Describe your manufacturing activity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Describe your research and development activities, if applicable: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Is the applicant engaged in the power and light business, other than |

Yes |

|

No |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

General Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Check one: |

If this is to be a new facility, what is the estimated cost of the project? |

|||||||||||||||||||||||||||||||||||

Business is new |

|

|

Cost of structure |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Cost of equipment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Business is expanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REV 41 0077e (3/20/12) |

Page 1 |

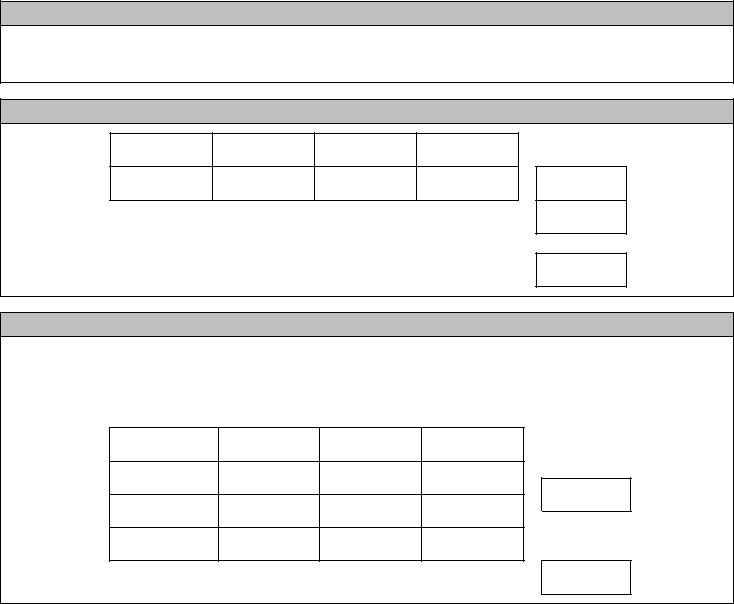

Employment Information for this Facility (please complete attached worksheet)

Date of first hire |

|

Application is due within 90 days of this date |

|

Calendar Quarter for this date |

|

(Enter this calendar quarter under Quarter A) |

|

Employment for previous four quarters (worksheet is available, if needed)

Calendar Quarter

Total FTEs*

To get average number of FTEs, divide by 4

Total for

Year

x1.15

To get 15% target, multiply by 1.15. This target is the minimum average for the next year to qualify for the credit.

Employment for current quarter plus estimates for the next three quarters

For current quarter A enter actual amount, if known, or enter estimate.

For remaining three quarters, enter estimates based on expected hired positions.

A |

B |

C |

D |

This quarter includes |

|

|

Annual report due |

first hire date |

|

|

after this quarter |

Calendar Quarter

Total FTEs* New positions under 40K New positions over 40K

To get average number of FTEs, divide by 4. This number must be greater than the target number above, to qualify for the credit.

Total for

Year

* Full Time Equivalent (FTE) positions:

Add the hours during a quarter for all part time employees who worked less than 455 hours. Divide this number by 455, and add to the total of full time employees. This is the number of FTE positions.

Annual Report is required:

Annual reports will be required for two years after application. The first annual report, due within 30 days of the end of Quarter D above, will be used to check how many employees have been hired and affirm that the 15% target has been achieved. The second annual report, due one year after the first report, will be used to confirm that the employees have been retained. See the Annual Report form for additional information.

Future Credits:

You may apply for additional credits as long as each set of four consecutive quarters continues to have expansion that meets the 15% increase. You may apply for future credits in any quarter after Quarter D above. A new application for each facility is required.

Questions:

Call (360)

Return application to:

Taxpayer Account Administration

Special Credits & Assessments

PO Box 47476

Olympia, WA

To inquire about the availability of this form in an alternate format for the visually impaired, please call (360)

REV 41 0077e (3/20/12) |

Page 2 |