summarized can be completed online without any problem. Simply use FormsPal PDF editing tool to finish the job quickly. Our team is aimed at providing you with the best possible experience with our editor by constantly releasing new capabilities and upgrades. With all of these improvements, working with our editor gets better than ever before! It merely requires a couple of easy steps:

Step 1: Access the form in our editor by pressing the "Get Form Button" above on this page.

Step 2: As soon as you access the file editor, you'll see the form prepared to be filled out. Apart from filling in different blanks, you can also perform several other things with the file, that is writing your own textual content, modifying the original textual content, inserting illustrations or photos, signing the PDF, and much more.

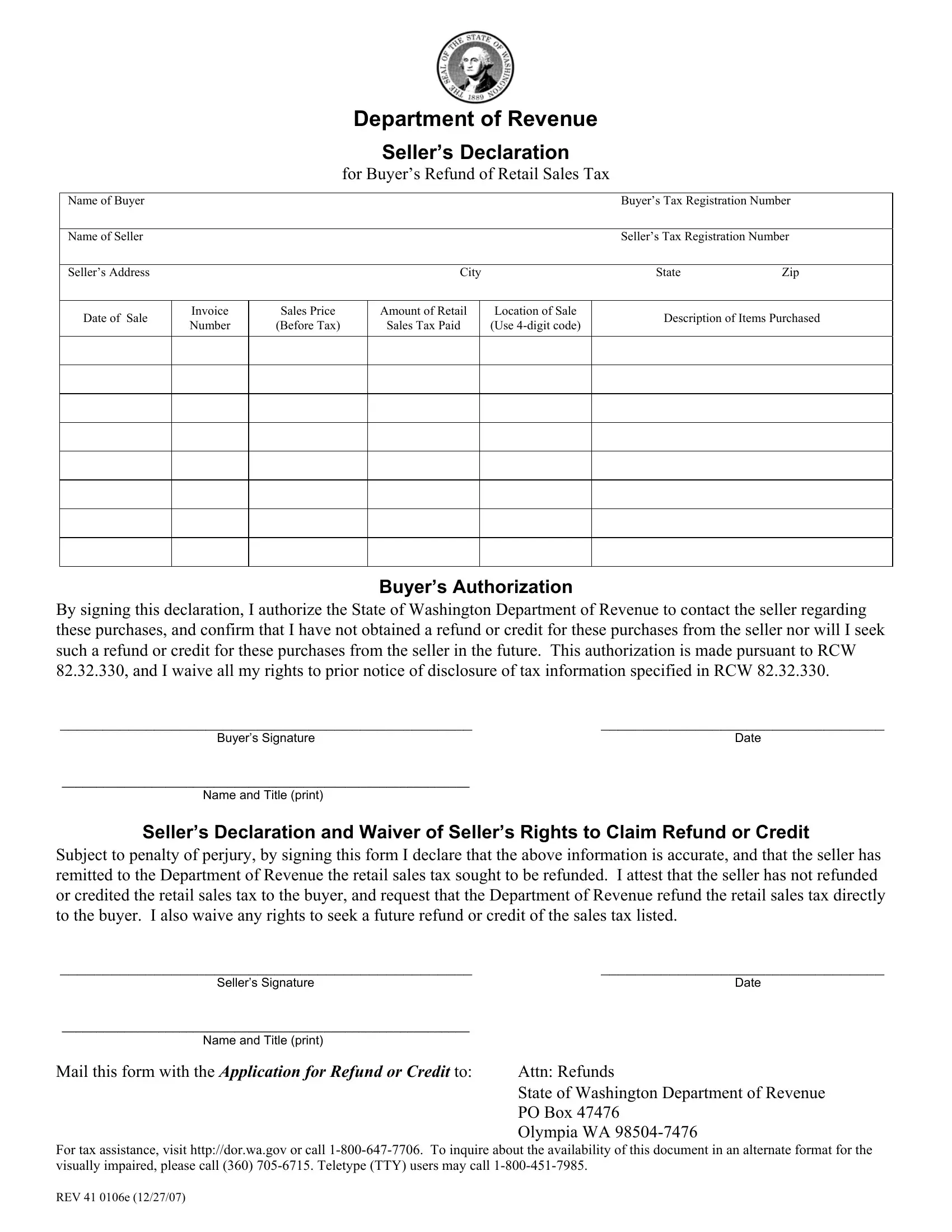

As for the blank fields of this particular document, this is what you need to know:

1. It is recommended to fill out the summarized properly, therefore be attentive while working with the sections comprising these specific blanks:

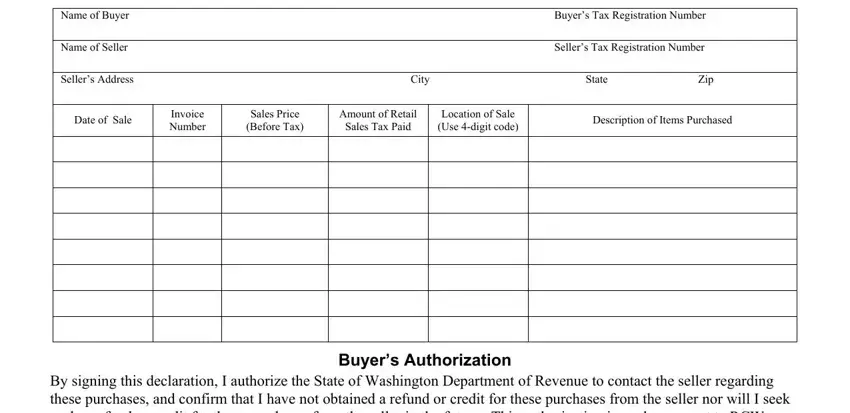

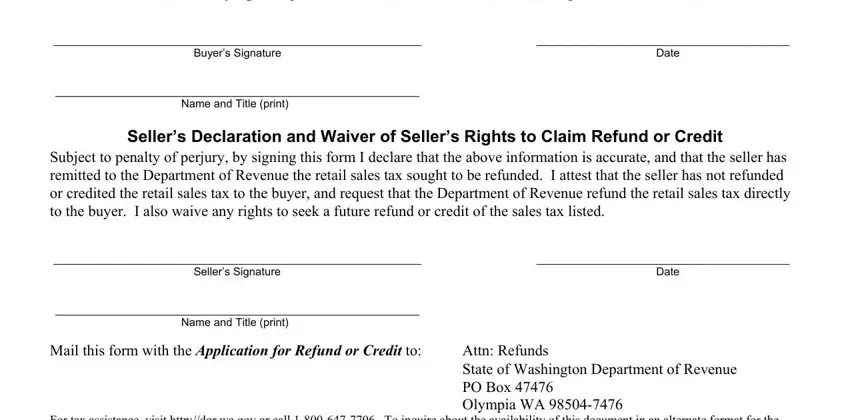

2. Now that this array of fields is done, it's time to insert the necessary particulars in By signing this declaration I, Buyers Signature, Date, Name and Title print, Sellers Declaration and Waiver of, Subject to penalty of perjury by, Sellers Signature, Date, Name and Title print, Mail this form with the, and Attn Refunds State of Washington allowing you to proceed to the third stage.

People frequently make mistakes when filling out Buyers Signature in this section. Ensure that you read twice whatever you type in right here.

Step 3: Make sure your details are correct and just click "Done" to progress further. Sign up with FormsPal today and instantly access summarized, ready for downloading. All alterations you make are preserved , so that you can edit the form at a later stage when necessary. We don't sell or share the information you enter while working with forms at FormsPal.