You may complete Annualized instantly by using our PDFinity® online PDF tool. Our development team is relentlessly working to develop the editor and make it much faster for people with its handy features. Enjoy an ever-evolving experience today! Getting underway is easy! All that you should do is stick to the following basic steps directly below:

Step 1: Simply click the "Get Form Button" in the top section of this webpage to launch our pdf editing tool. Here you'll find all that is needed to work with your document.

Step 2: Using our handy PDF file editor, you'll be able to do more than just fill in blanks. Express yourself and make your documents appear sublime with customized text put in, or fine-tune the file's original input to excellence - all accompanied by the capability to insert any kind of photos and sign the document off.

This PDF form requires some specific details; to guarantee correctness, make sure you bear in mind the suggestions below:

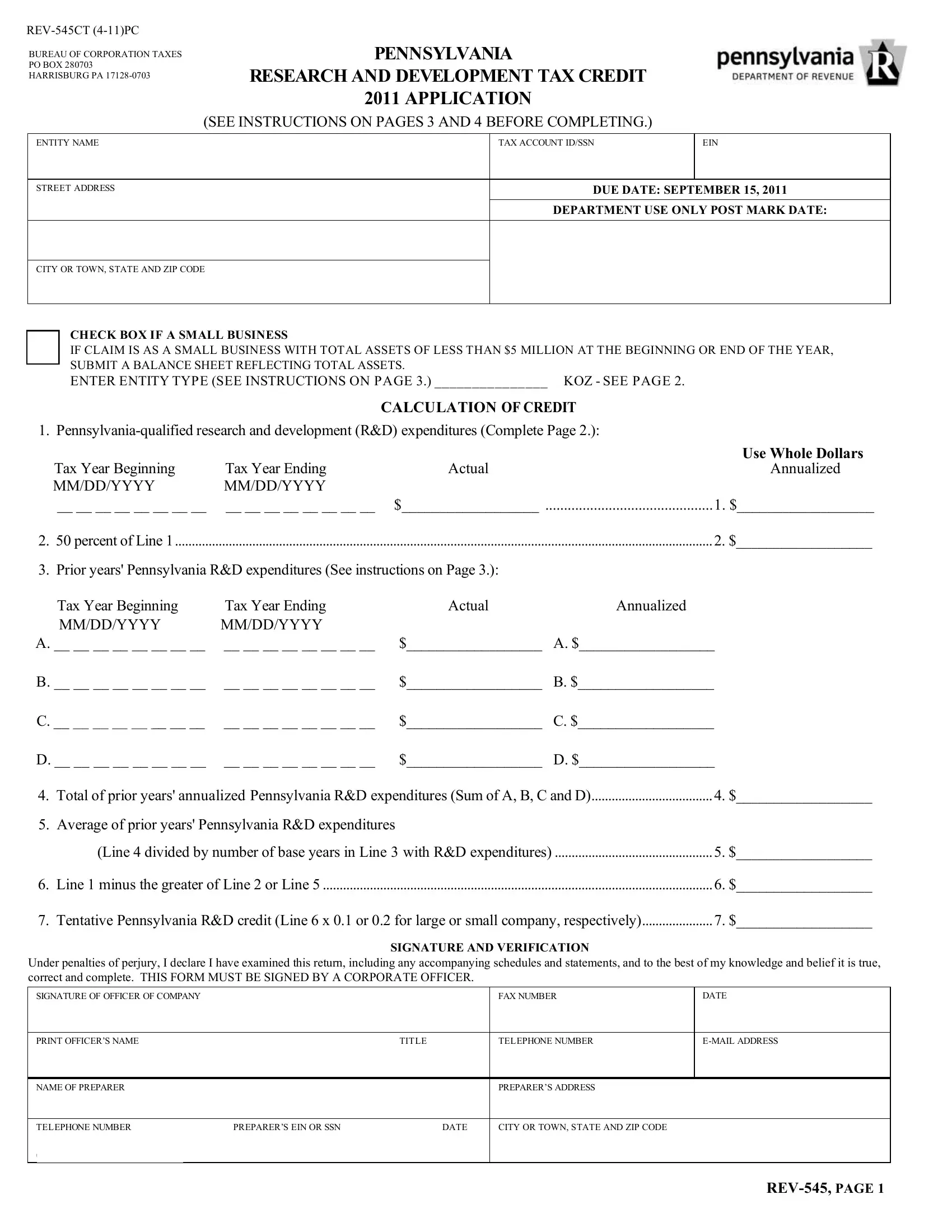

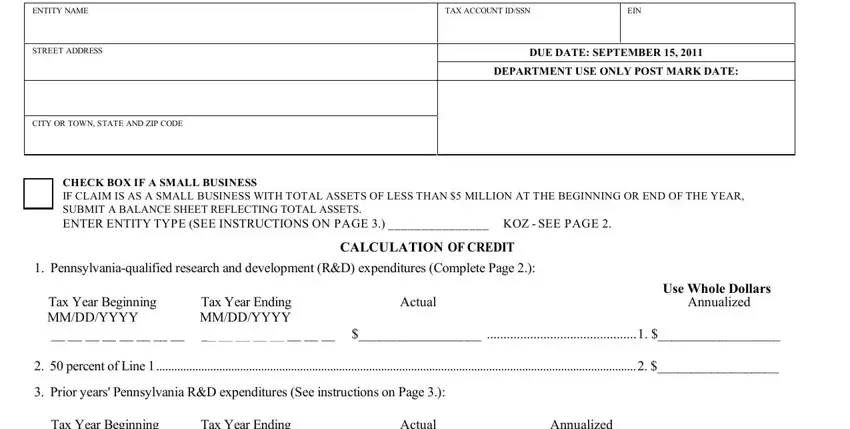

1. Fill out your Annualized with a group of essential blank fields. Collect all of the necessary information and make certain nothing is omitted!

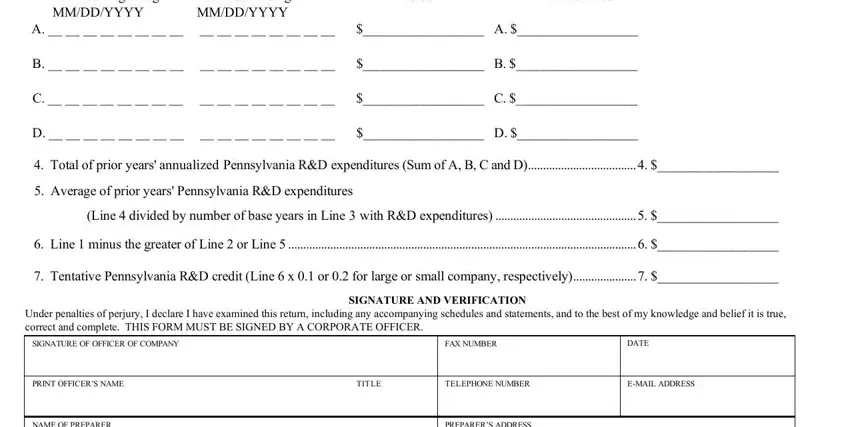

2. Now that the previous section is finished, it is time to insert the essential details in Tax Year Beginning MMDDYYYY, Tax Year Ending MMDDYYYY, Actual, Annualized, B C D, Total of prior years annualized, Average of prior years, Line divided by number of base, Line minus the greater of Line, Tentative Pennsylvania RD credit, SIGNATURE AND VERIFICATION, Under penalties of perjury I, SIGNATURE OF OFFICER OF COMPANY, PRINT OFFICERS NAME TITLE, and NAME OF PREPARER in order to go further.

3. In this particular stage, examine NAME OF PREPARER, PREPARERS ADDRESS, TELEPHONE NUMBER PREPARERS EIN OR, CITY OR TOWN STATE AND ZIP CODE, and REV PAGE. All of these should be filled in with highest precision.

It is easy to make a mistake while filling out your PREPARERS ADDRESS, and so ensure that you go through it again before you'll submit it.

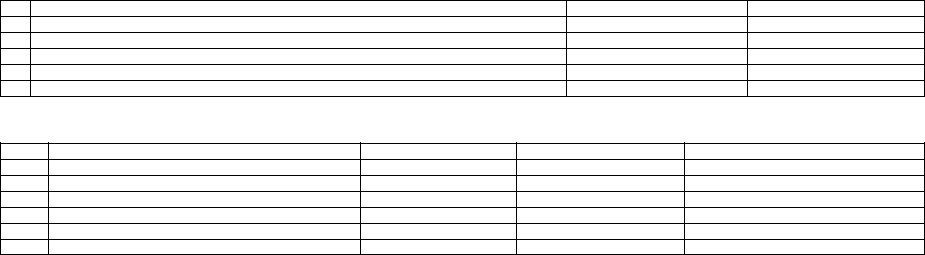

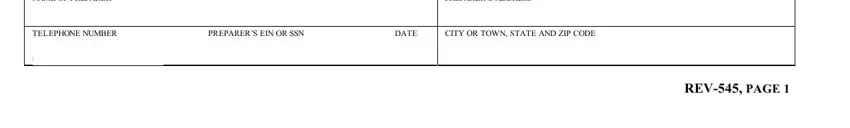

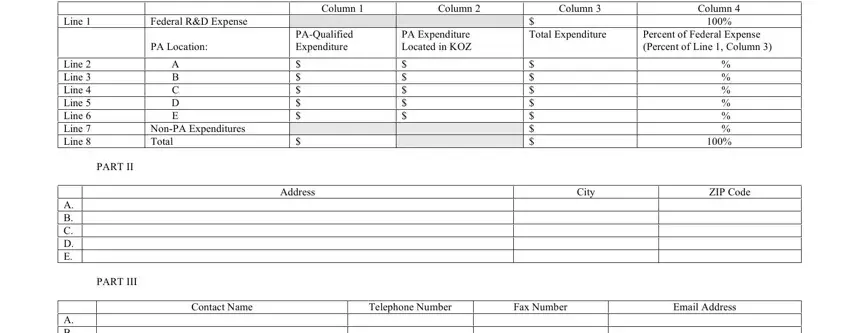

4. To go ahead, the next part will require completing several blanks. Examples of these are PART I, Line, Line Line Line Line Line Line, A B C D E, A B C D E, PART II, PART III, Federal RD Expense PA Location, A B C D E NonPA Expenditures Total, Column, Column, PAQualified Expenditure, PA Expenditure Located in KOZ, Column, and Total Expenditure, which are key to going forward with this particular form.

5. The document must be completed within this section. Here you have an extensive listing of blank fields that require accurate information to allow your document submission to be accomplished: A B C D E, and REV Page.

Step 3: Revise all the details you've typed into the blanks and then hit the "Done" button. Download the Annualized the instant you sign up for a 7-day free trial. Instantly view the pdf document inside your FormsPal account page, together with any modifications and adjustments all saved! At FormsPal.com, we do everything we can to make sure that all of your information is stored private.