decedents can be filled out without any problem. Just try FormsPal PDF tool to get the job done fast. Our tool is consistently evolving to provide the best user experience achievable, and that's because of our commitment to continuous development and listening closely to user feedback. Starting is easy! All that you should do is adhere to the next basic steps below:

Step 1: Just hit the "Get Form Button" above on this webpage to open our pdf editing tool. This way, you will find everything that is required to fill out your document.

Step 2: This editor provides you with the ability to change your PDF document in a variety of ways. Enhance it with your own text, adjust what's already in the document, and place in a signature - all when it's needed!

So as to finalize this PDF form, make sure you provide the required information in every single blank field:

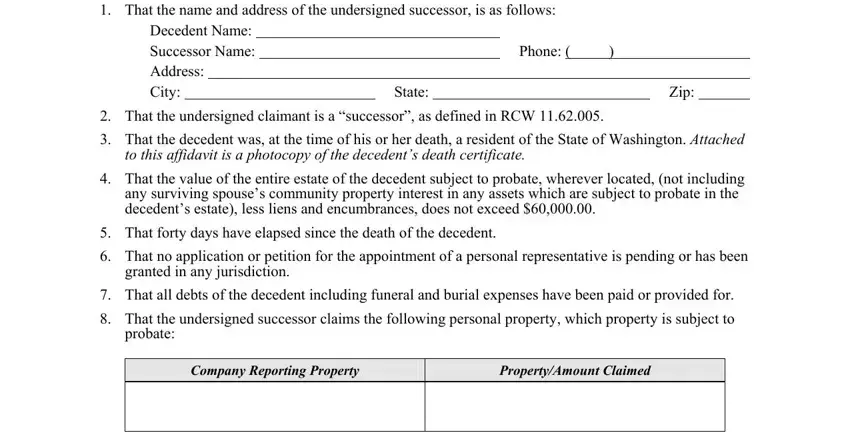

1. You will need to complete the decedents correctly, thus take care when working with the parts comprising all these blank fields:

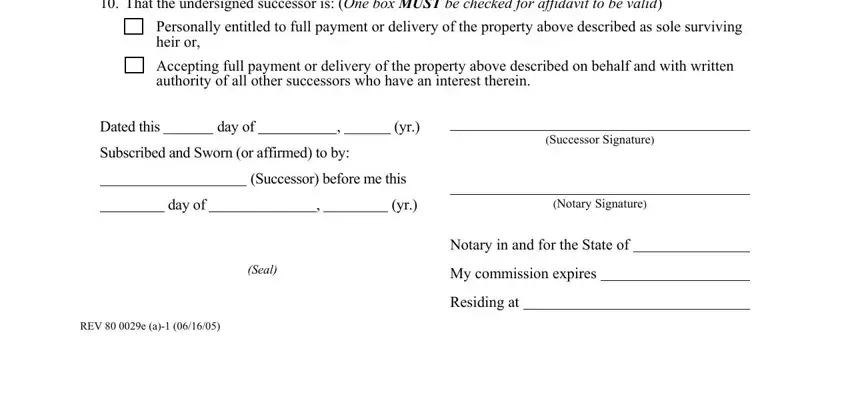

2. Once your current task is complete, take the next step – fill out all of these fields - That the undersigned successor is, Personally entitled to full, heir or, Accepting full payment or delivery, authority of all other successors, Dated this day of yr, Subscribed and Sworn or affirmed, Successor before me this, day of yr, Seal, REV e a, Successor Signature, Notary Signature, Notary in and for the State of, and My commission expires with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Many people often make errors while filling in Notary Signature in this section. Be sure you revise what you enter right here.

Step 3: After going through the entries, press "Done" and you are all set! Grab the decedents as soon as you sign up for a free trial. Readily get access to the document within your personal account, along with any modifications and adjustments being automatically synced! At FormsPal, we strive to guarantee that all your details are kept private.