The RI-1040X form is an essential document for individuals who need to amend their previously filed Rhode Island Individual Income Tax Returns. This includes residents, nonresidents, and part-year residents who have discovered errors or omissions after their initial filing. It covers a range of adjustments, from changes in income and tax calculations to updates in personal information, such as addresses and filing status. This form is also used in cases where amendments to the federal return necessitate corrections to the state return. Additionally, it addresses various financial adjustments including tax withholdings, estimated tax payments, credits, and deductions. Aspects like interest and penalties for any additional amounts owing, or the procedure to claim a refund for overpayment, are also covered. The RI-1040X form facilitates the accurate recalibration of a taxpayer's obligations or entitlements, ensuring compliance and fairness in the tax system. Potential changes in tax liability due to federal audits, adjustments in credits, or the discovery of mistakes in the original return are rectified through this form. Mailing addresses for refunds and payments are clearly specified, as are deadlines for filing and procedures for rounding off dollar amounts. The form underscores the importance of accuracy and completeness in tax reporting, providing taxpayers with a structured avenue to correct discrepancies post-filing.

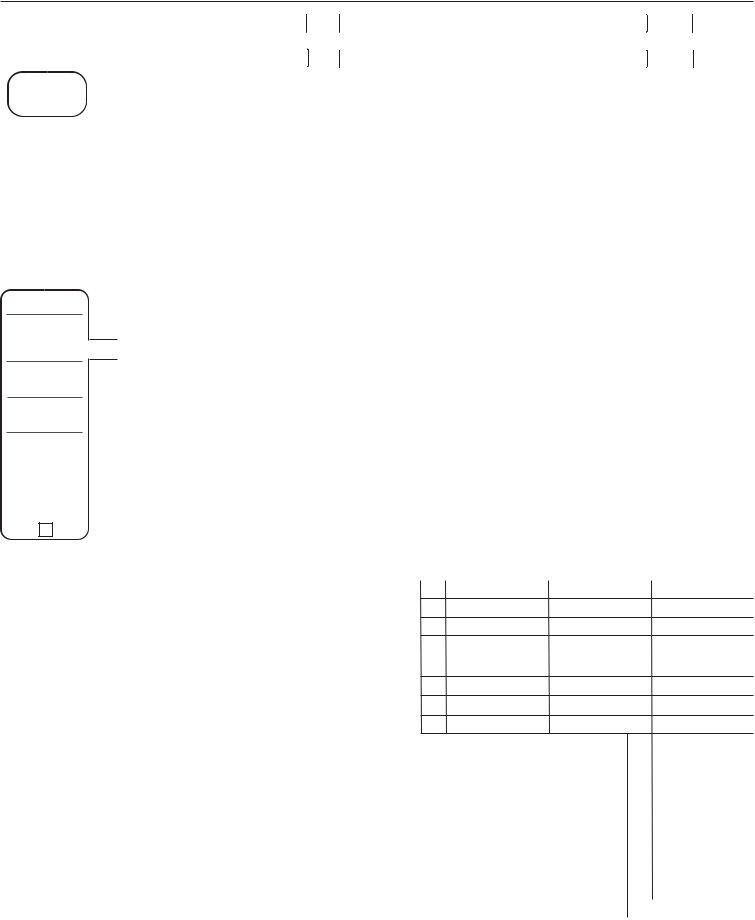

| Question | Answer |

|---|---|

| Form Name | Form Ri 1040X |

| Form Length | 7 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 45 sec |

| Other names | 2009 RI 1040X 2009 fillable 1040x form |

Amended Rhode Island Individual Income Tax Return |

2009 |

|

(To be used by resident, nonresident and |

NAME AND ADDRESS

Please

print or type

First Name |

Initial |

Last Name |

|

Your Social Security Number |

|

|

|

|

|

|

|

Spouse’s First Name |

Initial |

Last Name |

|

Spouse’s Social Security Number |

|

|

|

|

|

||

Present Home Address (number and street, including apartment no. or rural route) |

|

|

Daytime Telephone Number |

||

|

|

|

|

( |

) |

|

|

|

|

|

|

City, Town or Post Office |

State |

|

Zip Code |

City or Town of Legal Residence |

|

|

|

|

|

|

|

ADDITIONAL |

A. Enter name and address used on original return (if same as above write “SAME”) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B. Are you filing an amended federal income tax return? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

C. Have you been advised your federal return is under examination? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

|||||||||||||||

|

|

............................................................... |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FILING |

D. On original return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

STATUS |

|

|

|

|

|

1. Single |

2. Married filing jointly |

3. Married filing separately |

|

4. Head of Household |

|

|

|

|

|

5. Qualifying widow(er) |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

E. On this return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

1. Single |

2. Married filing jointly |

3. Married filing separately |

|

4. Head of Household |

|

|

|

|

|

5. Qualifying widow(er) |

|||||||||||||||||||||||

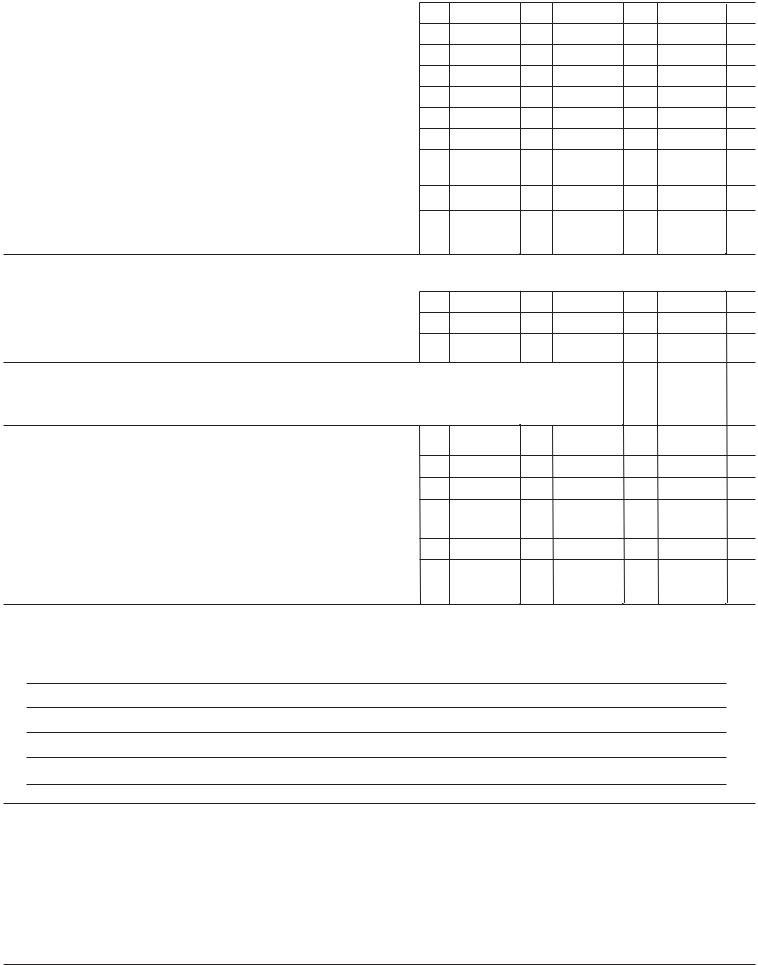

INCOME AND TAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. Originally reported |

B. Net change |

C. Correct amount |

||||||||||||||||||||

Single |

1. |

...........................................Federal AGI (Adjusted Gross Income) |

|

|

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

$5,700 |

|

2. Modifications from |

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Married filing jointly |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

3. |

Modified Federal AGI - Combine lines 1 and 2 |

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

or Qualifying |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

widow(er) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Deductions (see instructions) |

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

$9,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Married filing |

5. |

Subtract line 4 from line 3 |

|

|

|

|

|

|

|

|

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

separately |

6. |

Exemptions - Enter the number of federal exemptions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

$4,750 |

|

|

|

|

|

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

claimed on this return in the box then multiply by |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Head of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

$3,650 and enter the result on line 6, column C. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

household |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

7. |

RI Taxable Income - subtract line 6 from line 5 |

|

|

|

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

$8,350 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

However, |

8A. RI income tax |

|

|

|

|

|

|

|

|

8A. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

people over 65, blind |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

or can be claimed as |

|

|

|

|

Check method used on |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

a dependent, see |

|

|

|

|

line 8A, column C |

|

|

RI Tax Table or Tax |

|

|

RI Schedule CGW |

|

|

RI Schedule D |

RI Schedule J |

|||||||||||||||||||||||||

the RI Deduction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

Computation Worksheet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Schedules, check |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

this box and attach 8B. Other RI Taxes from |

|

|

8B. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

the schedule. |

9. RI Alternative Minimum Tax from |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

10. Total RI income tax - add lines 8A, 8B and 9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

10. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

FORM TYPE |

|

|

|

|

Residents - Enter the amount from page 1, line 10 on |

|

|

|

|

Nonresidents - Enter the amount from page 1, line 10 |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

page 2, part 2, line 10 and complete page 2, part 2. |

|

|

|

|

on page 2, part 3, line 10 and complete page 2, part 3. |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

PAYMENTS |

17. Total RI Tax and checkoff contributions |

|

|

17. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

18. |

..................................................A. RI 2009 income tax withheld |

|

|

18A. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

B. 2009 estimated tax payments and 2008 carryforward |

|

18B. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

C. Property tax relief credit from |

18C. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

D. Residential lead paint credit from |

18D. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

E. Nonresident real estate withholding (nonresidents only) |

18E. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

F. Withholding from |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

G. RI Earned Income Credit |

|

|

|

|

|

|

|

|

18G. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

H. Other Payments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18H. |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

I. Total - Add lines 18A, 18B, 18C, 18D, 18E, 18F, 18G and 18H |

|

|

|

|

|

|

|

|

|

|

|

|

18I. |

|

|

|

|

||||||||||||||||||||

|

|

|

J. Overpayment allowed on original return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18J. |

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

K. Total payments after overpayment - subtract line 18J from 18I |

|

|

|

|

|

|

|

|

|

|

|

|

18K. |

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

AMOUNT |

19. |

A. If line 17 is larger than 18K, subtract line 18K from 17. |

This is the amount you owe |

|

|

|

|

19A. |

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

DUE |

|

B. Interest due on amount on line 19A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19B. |

|

|

|

|

||||||||||||||

|

|

|

........................................................................................C. Total balance due - add lines 19Aand 19B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19C. |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

REFUND |

20. If line 18K is larger than line 17, subtract line 17 from 18K. |

This is the amount you overpaid |

20. |

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☺ |

|

|

|

|

|

|

|

||||||

|

|

.....................................................................................................21. Amount of overpayment to be refunded |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21. |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

22. Amount of overpayment to be applied to 2010 estimated tax |

|

|

|

|

|

22. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

RETURN MUST BE SIGNED - SIGNATURE LINE IS LOCATED ON PAGE 2 |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

Mail returns to: Refunds: RI Division of Taxation - One Capitol Hill - Providence, RI |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

Payments: RIDivision of Taxation - One Capitol Hill - Providence, |

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

page 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

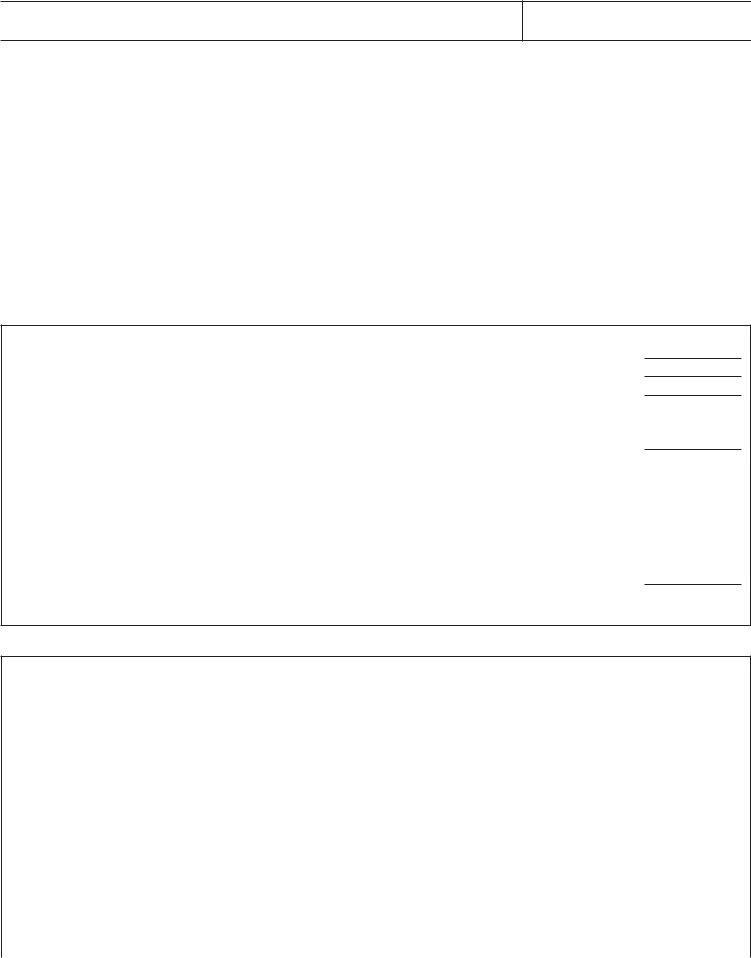

PART 2 RESIDENT CREDIT AND TAX CALCULATION

|

|

|

|

A. Originally reported |

B. Net change |

C. Correct amount |

10. |

Total RI income tax - enter the amount from page 1, line 10 |

10. |

|

|

||

11. |

A. RI percentage of allowable federal credits from |

11A. |

|

|

||

|

B. Other RI credits - from |

11B. |

|

|

||

|

C. RI Credit for income taxes paid to other states from |

11C. |

|

|

||

12. |

Total RI credits - add lines 11A, 11B and 11C |

12. |

|

|

||

13. |

RI income tax after credits - subtract line 12 from line 10 (not less than zero) |

13. |

|

|

||

14. |

Alternative Flat Tax from |

14. |

|

|

||

15. |

Rhode Island Tax - enter the SMALLER of line 13 or 14 |

|

|

|

||

|

|

|

Check box if Alternative Flat Tax method is used |

15. |

|

|

|

|

|

|

|

||

16. |

RI checkoff contributions from |

16. |

|

|

||

17. |

Total RI tax and checkoff contributions - add lines 15, 16 and any Use/Sales tax |

|

|

|

||

|

due $ _____________ (see instructions) Enter here and on page 1, line 17 |

17. |

|

|

||

PART 3 NONRESIDENT CREDIT AND TAX CALCULATION

|

|

A. Originally reported |

B. Net change |

C. Correct amount |

10. |

Total RI income tax to be allocated - enter the amount from page 1, line 10 |

10. |

|

|

11. RI percentage of allowable federal credits from |

11. |

|

|

|

12. |

RI tax after allowable federal credits before allocation |

12. |

|

|

|

subtract line 11 from line 10 (not less than zero) |

|

|

|

|

|

|

|

|

13. RI allocated income tax (check only one)

|

|

|

All income is from RI, enter |

|

Nonresident with income from outside |

|

13. |

|||

|

|

|

the amount from line 12 on |

|

RI, complete |

|

side RI, complete |

|

||

|

|

|

this line. |

Schedule III and enter result on this line. |

Schedule V and enter result on this line. |

|

||||

14. |

Other RI credits - from |

14. |

|

|||||||

15. |

A. RI income tax after credits - subtract line 14 from line 13 (not less than zero).... |

15A. |

|

|||||||

|

|

B. Alternative Flat Tax from |

15B. |

|

||||||

|

|

C. Rhode Island Tax - enter the smaller of line 15Aor 15B |

|

|

||||||

|

|

|

|

|

Check box if Alternative Flat Tax method is used |

15C. |

|

|||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

16. |

RI checkoff contributions from |

16. |

|

|||||||

17. |

Total RI tax and checkoff contributions - add lines 15C, 16 and any Use/Sales tax |

|

|

|||||||

|

|

due $ _____________ (see instructions) Enter here and on page 1, line 17 |

17. |

|

||||||

PART 4 EXPLANATION OF CHANGES TO INCOME, DEDUCTIONS AND CREDITS

Enter the line number from the form for each item you are changing and give the reason for each change. Attach only the supporting forms and schedules for

the items changed. If you do not attach the required information, your Form

Under penalties of perjury, I declare that I have examined this return, and to the best of my knowledge and belief, it is true, correct and complete.

Your |

|

|

|

Spouse’s |

|

|

|

Signature |

Date |

|

|

Signature |

Date |

||

|

|

|

|

||||

If you do not need form mailed to you next year, check box. |

|

|

May the division contact your preparer about this return? Yes |

|

|

||

|

|

|

|

||||

|

|

|

|

|

|

|

|

Paid preparer’s signature and address |

|

|

|

SSN, PTIN or EIN |

|

|

|

|

|

|

|

|

Date |

||

Paid preparer’s address |

|

|

|

Paid preparer’s telephone number |

|

|

|

page 2

2009

PURPOSE OF FORM

Use this form to correct form

WHO MUST FILE AN AMENDED RETURN

RI Form 1040X must be completed by those taxpay- ers who have to correct their Rhode Island return as a result of a change or correction on their federal income tax return; the filing of an amended federal income tax return; the filing of an amended

WHEN TO FILE

Federal Audit Changes: If the Internal Revenue Service increases the amount of your federal tax- able income for any reason, you should file an Amended Rhode Island Income Tax Return within 90 days after the final determination of the change. Refunds: Generally a claim for refund must be filed within 3 years from the time the return was filed or 2 years from the time the tax was paid, whichever is later. In either case, the refund will be limited to the amount of payments made within the allowable peri- od.

Property Tax Relief Credit: If you are filing an amended return to claim the property tax relief cred- it, you must file the return no later than April 15, 2010. An extension of time may be allowed at the Tax Administrator's discretion for sickness, absence or other disability.

ROUNDING OFF TO WHOLE DOLLARS

The money items on your return and schedules may be shown in whole dollars. This means that you may eliminate any amount less than 50 cents and increase any amount from 50 cents to 99 cents to the next higher dollar.

DECEASED TAXPAYERS

If the taxpayer died before filing a Rhode Island Amended Income Tax Return, the taxpayer's spouse or personal representative must file and sign a return for the person who died if the deceased was required to file a return. A personal representative can be an executor, administrator or anyone who is in charge of the taxpayer's property.

The person who files the return should write "deceased" after the deceased's name and show the date of death in the name and address space on the return.

If you are claiming a refund as a surviving spouse fil- ing a joint return with the deceased, no other form is needed to have the refund issued to you. However, all other filers requesting a refund due the deceased, must file Form

WHERE TO FILE

Mail your return to:

If making a payment: STATE OF RHODE ISLAND Division of Taxation

One Capitol Hill Providence, RI 02908 – 5807

All other returns: |

STATE OF RHODE ISLAND |

|

Division of Taxation |

|

One Capitol Hill |

|

Providence, RI 02908 – 5806 |

WHERE TO GET FORMS

As far as practical, tax forms and instructions are mailed directly to taxpayers. Additional forms may be obtained from:

The website http://www.tax.ri.gov

The Division of Taxation (401)

USE OF FEDERALINCOME TAX INFORMATION All amounts reported from the Federal Forms 1040, 1040A, 1040EZ, 1040NR and

The Rhode Island Division of Taxation and the Internal Revenue Service exchange income tax information to verify the accuracy of the information reported on Federal and Rhode Island income tax returns.

OTHER QUESTIONS

The foregoing general instructions and the specific instructions for completing the return which follow might not answer all questions that may arise. If you have any doubt regarding the completion of your return, further assistance may be obtained at the Division of Taxation, One Capitol Hill, Providence RI

COMPLETE YOUR 2009 AMENDED FEDERAL INCOME TAX RETURN FIRST

The FederalAmended Individual Income Tax Return is the basis for preparing your Amended Rhode Island Individual Income Tax Return. In general, the Rhode Island income tax is based on your federal taxable income. Accuracy and attention to detail in completing the return in accordance with these instructions will facilitate the processing of your tax return.

Name(s), Address and Social Security Number(s)

Make sure the name(s), address and social security number(s) on the return are correct. Incorrect entries could delay the processing of your return.

Lines A, B & C - Additional Information

Line A: If the address listed is different than the address used on your original return, indicate the address used on your original return. If the address is the same as above, write "SAME"

Lines B & C: Check the "YES" box to any of the questions that apply to you.

Lines D & E - Filing Status

Check the appropriate boxes to indicate your filing status on your original return and your amended return. Generally your filing status for Rhode Island is the same as for federal income tax purposes.

JOINT RETURNS: Generally, if a husband and wife file a joint federal income tax return, they also must file a joint Rhode Island income tax return. However, if either the husband or the wife is a resi- dent and the other is a

If neither spouse is required to file a federal income tax return and either or both are required to file a Rhode Island income tax return, they may elect to file a joint Rhode Island income tax return.

Individuals filing joint Rhode Island income tax returns are both equally liable to pay the tax. They incur what is known as “joint and several liability” for Rhode Island income tax.

Column A - lines 1 through 18G

Enter the dollar amounts as they appear on your original filing or on your most recent filing.

Column B - lines 1 through 18G

This is used for the difference between the amounts listed in column A and C, either increases or decreases.

Column C - lines 1 through 18G - Enter the cor- rected amounts on the appropriate lines.

page 3

Line 1 - Federal AGI (Adjusted Gross Income) Enter the Federal AGI from Federal Form 1040X, line 1, column C.

Line 2 - Modifications to Federal AGI

Line 3 - Modified Federal AGI

Combine lines 1 and 2. Add net increases or sub- tract net decreases.

Line 4 - Deductions

Enter your RI standard deduction or amount from Federal Schedule A, line 29, whichever is greater.

Single |

$5,700 |

Married Joint |

$9,500 |

Qualifying Widow(er) |

$9,500 |

Married Separate |

$4,750 |

Head of Household |

$8,350 |

If you or your spouse were age 65 or older (born BEFORE01/02/1945) or blind at the end of 2009, go to the RI Standard Deduction Schedule Aon page 6 to determine the amount of your standard deduction. If someone else can claim you on their return, you must complete the RI Standard Deduction Schedule B on page 6 to determine the amount of your stan- dard deduction. You only need to attach the sched- ule if you are reporting a change to the amount list- ed on the original return.

If you itemize your deductions and line 3, column C is more than $166,800 ($83,400 if married filing sep- arate), you need to recalculate your itemized deduc- tions based on your modified federal adjusted gross income. Complete the RI Itemized Deduction Schedule C on page 6. You only need to attach the schedule if you are reporting a change to the amount listed on the original return.

If you are filing married filing joint or married filing separate, you may itemize your deductions on your RI return even if you do not itemize on your federal return. Calculate your itemized deductions on your Federal ScheduleA. Compare the amount to your RI standard deduction and enter the larger amount.

Line 5 - Subtract line 4 from line 3

Line 6 - Exemptions

Number of Exemptions: Enter in the box the num- ber of federal exemptions claimed on Federal Form 1040X, page 2, line 29, column C. If you are not making any change to the number of exemptions claimed, enter the amount originally claimed in the box on

ExemptionAmount: Multiply the number of exemp- tions in the box by $3,650.

However, if line 3, column C is more than $125,100, you may need to recalculate your exemptions based on your modified federal adjusted gross income (see worksheet below to compute your exemption amount).

Line 7 - Rhode Island Taxable Income Subtract line 6 from line 5

Line 8A - Rhode Island Income Tax

RI Schedule CGW, RI Schedule D, RI Schedule J or

Line 8B – Other RI Taxes

Line 9 - Rhode Island Alternative Minimum Tax

However, if you have claimed modifications to feder- al adjusted gross income, you may need to recalcu- late your federal alternative minimum tax based on your modified federal adjusted gross income. If you did not report a federal alternative minimum tax, but a federal alternative minimum tax would be required based on your modified federal adjusted gross income, you must calculate a federal alternative minimum tax for Rhode Island purposes.

Line 10 - Total Rhode Island Income Tax Add lines 8A, 8B and 9.

Lines 11 through 17

Residents

Nonresidents

3.See instructions for part 3 for information on lines

11through 17.

Line 17 - Total Rhode Island Tax and Checkoff

Contributions

Enter the amount from Part 2, line 17 or Part 3, line 17, whichever applies.

Line 18A - Rhode Island Income Tax Withheld Enter total amount of Rhode Island income tax with- held. Attach state copy of all forms

income tax withheld will be allowed only for those amounts supported by attached

Line 18B - Payments on Form

Credits Carried Forward

Enter the amount of estimated payments on Form

If a taxpayer can reasonably expect to owe more than $250 after allowing for withholding tax and/or credits, he or she must make estimated tax pay- ments. Estimated tax payments are made on Form

Line 18C - Property Tax Relief Credit

RESIDENTS ONLY

NOTE: If you did not claim the Property Tax Relief Credit on the original return, the Property Tax Relief Credit must be filed by April 15, 2010.

Line 18D - Residential Lead Abatement Credit

RESIDENTS ONLY

NOTE: If you calculated your RI tax using the Alternative Flat Tax method, you can not claim the Residential Lead Paint Credit.

If you did not claim the Residential Lead Abatement Credit on the original return, the Residential Lead Abatement Credit must be filed by April 15, 2010.

Line 18E - Nonresident Real Estate Withholding

NONRESIDENTS ONLY

Enter the amount of Rhode Island income tax with- held on sales of real estate located in Rhode Island.

Line 18F - Withholding from

Enter the amount of

Note: If you filed a

Line 18G – RI Earned Income Credit

Enter the amount of RI Earned Income Credit from

Line 18H - Other Payments

Enter the amount of payments made with extension requests, the original return and additional payments made after the return was filed.

Line 18I - Total Payments

Add lines 18A, 18B, 18C, 18D, 18E, 18F, 18G and 18H.

Line 18J - Overpayment Allowed on Original Return

Enter the total overpayment that appeared on your original return. This would include amounts refund- ed and amounts credited to a subsequent year.

Line 18K - Total Payments After Overpayment Subtract line 18J from line 18I.

Line 19A - Balance Due

If the amount on line 17 is greater than the amount on line 18K, SUBTRACT line 18K from line 17 and enter the balance due on line 19A. This is the amount you owe. This amount is payable in full with your return. An amount due of less than one dollar ($1) need not be paid.

Line 19B - Interest Due

Enter the amount of interest due on the tax on line 19A. If you owe underestimating interest, complete Form

Interest: Any tax not paid when due, including fail- ure to pay adequate estimated tax, is subject to interest at the rates of 18% (0.1800).

Penalties: The law provides for penalties in the fol- lowing circumstances:

•Failure to file an income tax return.

•Failure to pay any tax due on or before the due date. •Preparing or filing a fraudulent income tax return.

Line 19C - Total Balance Due

Add lines 19Aand 19B.

EXEMPTION WORKSHEET for

1. |

Multiply $3,650 by the total number of exemptions claimed in box on |

|

|

1. |

|

|

|

|

|||||||

2. |

Is the amount on |

|

|

|

|

|

|

|

|

||||||

|

|

|

Yes. Continue to line 3. |

|

|

No. STOPHERE! Enter the amount from line 1 above on |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||||

3. |

Enter the amount from |

3. |

|

|

|

|

|

|

|||||||

4. |

If your filing status is |

|

|

|

then enter on line 4 |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Single |

|

|

|

$166,800 |

|

|

|

|

|

|

|

|

||

|

Married filing jointly or Qualifying widow(er) |

250,200 |

|

4. |

|

|

|

|

|

|

|||||

|

Married filing separately |

|

|

|

125,100 |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Head of household |

|

|

|

208,500 |

|

|

|

|

|

|

|

|

||

5. |

Subtract line 4 from line 3 |

|

|

|

|

5. |

|

|

|

|

|

|

|||

6. Is the amount on line 5 more than $122,500 ($61,250 if married filing separately)? |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

||||||||

|

|

|

Yes - Multiply $2,433 by the total number of exemptions claimed in box on |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Enter the result here and on |

|

6. |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

No - Divide line 5 by $2,500 ($1,250 if Married filing separately). If the result is not a whole |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

number, increase it to the next higher whole number (for example, increase 0.0004 to 1). |

} |

|

|

7. _ . _ _ _ _ |

|

|||||||

|

|

|

|

|

|

||||||||||

7. Multiply line 6 by 2% (.02) and enter the result as a decimal |

|

|

|

||||||||||||

8. Multiply line 1 by line 7 |

|

|

|

|

|

|

8. |

|

|

|

|

||||

9. Divide line 8 by 3.0 |

|

|

|

|

|

|

|

9. |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||||||

10.Deduction for exemption - Subtract line 9 from line 1. Enter here and on |

10. |

|

|

|

|

||||||||||

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

page 4

Any payment of tax liability shown on your return to be due the State of Rhode Island must be paid in full with your return. Complete and submit Form RI- 1040V with your payment. Make check or money order payable to the Rhode Island Division of Taxation and send them with your return to:

The Rhode Island Division of Taxation One Capitol Hill

Providence, RI

An amount due of less than one dollar ($1) need not be paid.

TO PAY BY CREDIT CARD: You may use your American Express® Card, Discover® Card, Visa® Card or MasterCard® card.

Contact: OFFICIALPAYMENTS CORPORATION

Telephone payments:

www.officialpayments.com

Customer Service:

Aconvenience fee will be charged by the service provider based on the amount you are paying. You will be told what the fee is during the transaction and you will have the option to either continue or cancel the transaction. If you paid by credit card, enter on page 1 of Form

You may also use this method for making 2010 Rhode Island estimated income tax payments.

Line 20 - Overpayment

If the amount on line 18K is greater than the amount on line 17, SUBTRACT line 17 from line 18K and enter the overpayment on line 20.

Line 21 - Amount of Overpayment To Be Refunded

Enter the amount of overpayment on line 20 that is to be refunded.

A REFUND will be made if an overpayment of income tax is shown on your return, unless you indi- cate on your return that such overpayment is to be credited to your estimated tax liability for 2010. No other application for refund is necessary. Please note that no refund can be made unless your return is properly signed. Refunds of less than $1.00 will not be paid unless specifically requested.

Interest on refunds of tax overpayments will be paid if the refund is not paid within 90 days of the due date or the date the completed return was filed, whichever is later. The interest rate for tax overpay- ments is 3.25% (.0325).

Line 22 - Overpayment to be Applied to 2010 Enter the amount of overpayment on line 20, which is to be applied to your 2010 estimated tax.

PART 2 -

RESIDENT CREDIT AND TAX CALCULATION

Line 10

Enter the amount from page 1, line 10.

Line 11A- Rhode Island Percentage of Allowable Federal Credits

Line 11B - Other Rhode Island Credits

Line 11C - Credit for Taxes Paid to Other States |

IF ALLYOUR INCOME IS FROM RHODE ISLAND |

|||||||||||||||

Check the first box and enter the amount from line |

||||||||||||||||

12 on this line. |

|

|

|

|

|

|

|

|

||||||||

other states from |

IF YOU ARE |

|

|

|

|

|||||||||||

41. If the amended return is the result of a change |

If you are a |

|||||||||||||||

in credit allowed for income taxes paid to another |

Rhode |

Island, |

you |

should complete |

||||||||||||

state, you must attach a signed copy of the return |

page 7, schedule III and enter the result on this line. |

|||||||||||||||

filed with the other state. If |

credit is claimed for |

|||||||||||||||

taxes paid to more than one state, make a separate |

Also, check the second box. |

|

|

|

|

|

||||||||||

calculation of each state on Form |

IF YOU ARE |

|

|

|||||||||||||

form can be obtained by contacting the RI Division |

If you are a |

|||||||||||||||

of Taxation at (401) |

|

|

side Rhode Island, you should complete RI- |

|||||||||||||

|

|

|

|

1040NR, page 9, schedule V and enter the result on |

||||||||||||

Line 12 - Total Rhode Island Credits |

this line. Also, check the third box. |

|

|

|

|

|||||||||||

Add lines 11A, 11B, and 11C. |

|

|

Line 14 - Other Rhode Island Credits |

|

|

|

||||||||||

|

|

|

|

|

|

|

||||||||||

Line 13 - Rhode Island Tax After Credits |

Complete schedule CR. Enter amount from sched- |

|||||||||||||||

Subtract line 12 from line 10. (If zero or less, enter |

ule CR, line 26 on |

|||||||||||||||

zero.) |

|

|

of the appropriate credit form to your |

|||||||||||||

Line 14 – Alternative Flat Tax |

if you are reporting a change. |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Line 15A - Total Rhode Island Income Tax After |

||||||||||||||||

line 13 on line 15. |

|

|

Rhode Island Credits |

|

|

|

|

|

||||||||

Subtract the amount on line 14 from the amount on |

||||||||||||||||

Alternative Flat Tax from |

line 13. |

(If zero or less, enter zero.) |

|

|

|

|||||||||||

Schedule FT, line 26. Attach a copy of RI Schedule |

Line 15B - Alternative Flat Tax |

|

|

|

|

|

||||||||||

FT to your |

|

|

|

|

|

|||||||||||

to the amount on this line. |

|

|

Enter the amount of Rhode Island Alternative Flat |

|||||||||||||

|

|

Tax from |

||||||||||||||

|

|

|

|

|||||||||||||

Line 15 – Rhode Island Tax |

|

|

29. |

Attach a copy of RI Schedule FT to your RI- |

||||||||||||

1040X only if you reporting a change to the amount |

||||||||||||||||

on this line. |

|

|

|

|

|

|

|

|

||||||||

13 or your RI Alternative Flat Tax on line 14. If your |

Line 15C - Rhode Island Tax |

|

|

|

|

|

||||||||||

tax is calculated using the Alternative Flat Tax |

|

|

|

|

|

|||||||||||

method on Schedule FT, make sure you check the |

Enter the SMALLER of your RI tax on line 15A or |

|||||||||||||||

box on line 15. |

|

|

your RIAlternative Flat Tax on line 15B. If your tax is |

|||||||||||||

|

|

calculated using the Alternative Flat Tax method on |

||||||||||||||

|

|

|

|

|||||||||||||

Line 16 - Rhode Island Checkoff Contributions |

Schedule FT, check the box on line 15C. |

|

|

|||||||||||||

Enter the amount of checkoff contributions from RI- |

Line 16 - Rhode Island Checkoff Contributions |

|||||||||||||||

1040S, page 2, line 31 or |

Enter amount of checkoff contributions from RI- |

|||||||||||||||

Attach the schedule only if you are reporting a |

1040NR, page 3, Schedule IV, line 8. Attach sched- |

|||||||||||||||

change in this amount. |

|

|

ule IV only if you are reporting a change in this |

|||||||||||||

|

|

|

|

|||||||||||||

Line 17 - Total Rhode Island Tax and Checkoff |

amount. |

|

|

|

|

|

|

|

|

|||||||

Contributions |

|

|

Line 17 - Total Rhode Island Tax and Checkoff |

|||||||||||||

Add lines 15 and 16 and any Use/Sales Tax from |

||||||||||||||||

Contributions |

|

|

|

|

|

|

|

|

||||||||

line 6 on the worksheet below. Also, enter the |

Add lines 15C and 16 and any Use/Sales Tax from |

|||||||||||||||

amount of Use/Sales tax in the space provided in |

line 6 on the worksheet below. Also, enter the |

|||||||||||||||

line 17. Enter the total here and on page 1, line 17. |

amount of Use/Sales tax in the space provided in |

|||||||||||||||

|

|

|

|

line 17. Enter the total here and on page 1, line 17. |

||||||||||||

|

PART 3 - NONRESIDENT CREDIT |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

AND TAX CALCULATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

PART 4 - EXPLANATION OF CHANGES |

|

|

||||||||||||

Line 10 |

|

|

|

|

|

|

||||||||||

|

|

|

TO INCOME, DEDUCTIONS AND CREDITS |

|

|

|||||||||||

Enter the amount from page 1, line 10. |

Enter the line number from the form for each item |

|||||||||||||||

|

|

|

|

|||||||||||||

Line 11 - Rhode Island Percentage of Allowable |

you are changing and give the reason for each |

|||||||||||||||

Federal Credits |

|

|

change. |

Attach only the supporting |

forms |

and |

||||||||||

|

|

schedules for the items changed. |

If |

you do |

not |

|||||||||||

Enter the amount of allowable federal credits from |

||||||||||||||||

attach the required information, your form |

||||||||||||||||

may be returned. |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

Line 12 - Rhode Island Tax After Allowable |

SIGNATURE |

|

|

|

|

|

|

|

|

|||||||

Federal Credits - Before Allocation |

|

|

|

|

|

|

|

|

||||||||

Subtract line 11 from line 10. |

(If zero or less enter |

|

You must sign your Rhode Island income tax |

|||||||||||||

zero.) |

|

|

return and both husband and wife must sign their |

|||||||||||||

Line 13 - Rhode Island Allocated Income Tax |

joint return. |

An |

unsigned |

return |

cannot |

be |

||||||||||

processed. |

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

Any paid preparer who |

||||||

|

INDIVIDUALCONSUMER’S USE/SALES TAX WORKSHEET |

|

||||||||||||||

|

|

prepares a |

taxpayer’s |

|||||||||||||

KEEPFOR YOUR RECORDS - YOU DO NOT NEED TOATTACH THIS WORKSHEET TO YOUR RETURN. |

return must also sign as |

|||||||||||||||

|

1. Schedule of purchases subject to the use/sales tax |

|

|

|

|

|

|

“preparer”. |

If a firm or |

|||||||

|

|

|

|

|

|

|

corporation prepares the |

|||||||||

|

(if you need more space to list your purchases, attach a separate sheet). |

|

|

|||||||||||||

|

|

|

return, |

it |

should |

be |

||||||||||

|

A. |

1A. |

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

signed in the name of |

|||||||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

B. |

1B. |

|

|

|

|

|

|

the preparer on behalf of |

|||||||

|

C. |

1C. |

|

|

|

|

|

|

the firm or corporation. |

|||||||

|

|

|

|

|

|

|

If you wish to allow |

|||||||||

|

2.Total price of purchases subject to tax - add lines 1A, 1B and 1C..2. |

|

|

|

the Tax Division to con- |

|||||||||||

|

|

|

|

tact |

your paid preparer |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

3.Amount of tax - multiply line 2 by 7% (RIRate) ............................. 3. |

|

|

|

should |

questions arise |

||||||||||

|

4.Credit for taxes paid in other states on the items listed on line 1... 4. |

|

|

|

about your return, check |

|||||||||||

|

|

|

|

the |

appropriate |

box |

||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

5.TOTALAMOUNT DUE - subtract line 4 from line 3 - enter here |

5. |

|

|

|

above |

the |

preparer’s |

||||||||

|

|

|

|

name. |

|

|

|

|

||||||||

|

and on |

|

|

|

|

|

|

|

|

|||||||

page 5

RI Deduction Schedules for |

2009 |

Name(s) shown on Form

Your Social Security Number

A. STANDARD DEDUCTION SCHEDULE FOR PEOPLE AGE 65 OR OLDER OR BLIND

DO NOT use this schedule if someone can claim you, or your spouse if filing jointly, as a dependent. Instead use RI Deduction Schedule B below. |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check if: |

|

YOU were 65 or older, (born before 01/02/1945), |

|

Blind, |

|

SPOUSE was 65 or older, (born before 01/02/1945), |

|

|

Blind |

|||

|

A. Enter the number of boxes checked above |

............................................................................................................................... |

|

|

|

A. |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If your filing status is |

AND the number on line Ais .... |

|

THEN your RI standard deduction is .... |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

Single |

|

1 |

|

|

$7,100 |

|

|

|

|

|

|||

|

|

|

|

2 |

|

|

8,500 |

|

|

|

|

|

|

Married filing jointly |

|

1 |

|

|

10,600 |

|

|

|

|

|

|||

or |

|

2 |

|

|

11,700 |

|

|

|

|

|

|||

Qualifying widow(er) |

3 |

|

|

12,800 |

|

|

|

|

|

||||

|

|

|

|

4 |

|

|

13,900 |

|

|

|

|

|

|

Married filing separately |

1 |

|

|

5,850 |

|

|

|

|

|

||||

|

|

|

|

2 |

|

|

6,950 |

|

|

|

|

|

|

|

|

|

|

3 |

|

|

8,050 |

|

|

|

|

|

|

|

|

|

|

4 |

|

|

9,150 |

|

|

|

|

|

|

Head of household |

|

1 |

|

|

9,750 |

|

|

|

|

|

|||

|

|

|

|

2 |

|

|

11,150 |

|

|

|

|

|

|

B. STANDARD DEDUCTION SCHEDULE FOR DEPENDENTS

Use this schedule ONLY if someone can claim you, or your spouse if filing jointly, as a dependent.

1.Add $300 to your EARNED INCOME*. Enter the total here

2.Minimum standard deduction ......................................................................................................................................................

3.Enter the LARGER of line 1 or line 2 .........................................................................................................................................

4.Enter the amount shown below for your filing status. ......................................................................................................

Single....................................................................

Married filing jointly or Qualifying widow(er).........

Married filing separately........................................

Head of household...............................................

1.

2.950

3.

4.

5.STANDARD DEDUCTION

A. Enter the SMALLER of line 3 or line 4. If under age 65 and not blind, STOPHERE and enter this amount on |

|

|

||||||||

|

|

5A. |

|

|

|

|||||

B. |

Check if: |

|

YOU were 65 or older, (born before 01/02/1945), |

|

Blind, |

|

SPOUSE was 65 or older, (born before 01/02/1945), |

|

Blind |

|

|

|

|

|

|||||||

|

If age 65 or older or blind, multiply the number of boxes checked by: $1,400 if Single or Head of household; $1,100 if |

|

|

|||||||

|

Married filing jointly, Married filing separately or Qualifying widow(er) |

|

|

5B. |

|

|

||||

|

............................................................................... |

|

|

|

|

|

||||

C. |

Add lines 5Aand 5B. Enter the total here and on |

5C. |

|

|

||||||

*EARNED INCOME includes wages, salaries, tips, professional fees and other compensation received for personal services you performed. It also includes any amount received as a scholarship that you must include in your income. Generally, your earned income is the total of the amount(s) you reported on Federal Form 1040, lines 7, 12 and 18 minus line 27; Federal Form 1040A, line 7 or Federal Form 1040EZ, line 1.

C. ITEMIZED DEDUCTION SCHEDULE

(If you claimed a modification on

1. |

Add the amounts from Federal Form, Schedule A, lines 4, 9, 15, 19, 20, 27 and 28 |

................................................................. |

|

|

1. |

|

|

|||

2. |

Add the amounts from Federal Form, Schedule A, lines 4, 14 and 20 plus any gambling and casualty or theft losses |

2. |

|

|

||||||

|

|

|||||||||

|

included on line 28 |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

||||

3. |

Is the amount on line 2 less than the amount on line 1? |

|

|

|

|

|

|

|

||

|

|

|

No. STOPHERE! Your deduction is not limited. Enter the amount from line 1 above on |

|

|

|

||||

|

|

|

|

|

|

|||||

|

|

|

Yes. Subtract line 2 from line 1 |

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

4. |

|

|

|

|

|

|

4. |

Multiply line 3 above by 80% (.80) |

|

|

|

|

|

|

|||

5. |

Enter the amount from |

5. |

|

|

|

|

|

|

||

|

|

|

|

|

|

|||||

6. |

Enter $166,800 ($83,400 if Married filing separately) |

6. |

|

|

|

|

|

|

||

|

|

|

|

|

|

|||||

7. |

Is the amount on line 6 less than the amount on line 5? |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||||

|

|

|

No. STOPHERE! Your deduction is not limited. Enter the amount from line 1 above on |

|

|

|

||||

|

|

|

|

|

|

|||||

|

|

|

Yes. Subtract line 6 from line 5 |

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

8. |

Multiply line 7 by 3% (.03) |

|

|

|

|

|

|

|||

9. |

Enter the SMALLER of line 4 or line 8 |

|

|

|

|

9. |

|

|

||

|

|

|

|

|

||||||

10. |

Divide line 9 by 1.5 |

|

|

|

|

10. |

|

|

||

|

|

|

|

|

||||||

11. |

Subtract line 10 from line 9 |

|

|

|

|

11. |

|

|

||

|

|

|

|

|

||||||

12. |

Total itemized deductions - Subtract line 11 from line 1 - Enter the result here and on |

12. |

|

|

||||||

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

page 6 |

|

|

|

|

|

|

|

2009 |

RHODE ISLAND TAX COMPUTATION WORKSHEET |

|

||||||||

|

SCHEDULE X - Use if your filing status is SINGLE |

|

|

|

TAX |

|||||

|

|

If Taxable Income- |

(a) |

|

(b) |

(c) |

|

(d) |

Subtract (d) from (c) |

|

|

|

|

|

|||||||

|

|

Enter the amount from |

|

Multiplication |

Multiply (a) by (b) |

|

Subtraction |

Enter here and on |

||

|

|

|

|

|

amount |

|

|

amount |

||

|

|

At least |

But not over |

|

|

|

||||

|

|

|

|

|

|

|

|

|

||

$0 |

$33,950 |

|

|

3.75% |

|

|

$0.00 |

|

||

$33,950 |

$82,250 |

|

|

7.00% |

|

|

$1,103.38 |

|

||

$82,250 |

$171,550 |

|

|

7.75% |

|

|

$1,720.25 |

|

||

$171,550 |

$372,950 |

|

|

9.00% |

|

|

$3,864.63 |

|

||

|

|

Over $372,950 |

|

|

9.90% |

|

|

$7,221.18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE Y1 - Use if your filing status is MARRIED FILING JOINT or QUALIFYING WIDOW(ER) TAX

If Taxable Income- |

(a) |

(b) |

(c) |

(d) |

Subtract (d) from (c) |

|

Enter the amount from |

Multiplication |

Multiply (a) by (b) |

Subtraction |

Enter here and on |

||

|

|

amount |

|

amount |

||

At least |

But not over |

|

|

|

|

|

$0 |

$56,700 |

|

3.75% |

|

$0.00 |

|

$56,700 |

$137,050 |

|

7.00% |

|

$1,842.75 |

|

$137,050 |

$208,850 |

|

7.75% |

|

$2,870.63 |

|

$208,850 |

$372,950 |

|

9.00% |

|

$5,481.25 |

|

Over $372,950 |

|

9.90% |

|

$8,837.80 |

|

|

|

|

|

|

|

||

SCHEDULE Y2 - Use if your filing status is MARRIED FILING SEPARATELY |

|

TAX |

||||

If Taxable Income- |

|

|

|

|

|

|

(a) |

(b) |

(c) |

(d) |

Subtract (d) from (c) |

||

Enter the amount from |

Multiplication |

Multiply (a) by (b) |

Subtraction |

Enter here and on |

||

|

|

amount |

|

amount |

||

At least |

But not over |

|

|

|

|

|

$0 |

$28,350 |

|

3.75% |

|

$0.00 |

|

$28,350 |

$68,525 |

|

7.00% |

|

$921.38 |

|

$68,525 |

$104,425 |

|

7.75% |

|

$1,435.31 |

|

$104,425 |

$186,475 |

|

9.00% |

|

$2,740.63 |

|

Over $186,475 |

|

9.90% |

|

$4,418.90 |

|

|

|

|

|

|

|

||

SCHEDULE Z - Use if your filing status is HEAD OF HOUSEHOLD |

|

TAX |

||||

If Taxable Income- |

|

|

|

|

|

|

(a) |

(b) |

(c) |

(d) |

Subtract (d) from (c) |

||

Enter the amount from |

Multiplication |

Multiply (a) by (b) |

Subtraction |

Enter here and on |

||

|

|

amount |

|

amount |

||

At least |

But not over |

|

||||

|

|

|

|

|

||

$0 |

$45,500 |

|

3.75% |

|

$0.00 |

|

$45,500 |

$117,450 |

|

7.00% |

|

$1,478.75 |

|

$117,450 |

$190,200 |

|

7.75% |

|

$2,359.63 |

|

$190,200 |

$372,950 |

|

9.00% |

|

$4,737.13 |

|

Over $372,950 |

|

9.90% |

|

$8,093.68 |

|

|

|

|

|

|

|

|

|

page 7