The RI-1120C form stands as a critical document for C corporations within Rhode Island, serving as their Business Corporation Tax Return. It is specifically designed for these entities to report their income, deductions, and taxes for either the calendar year 2010 or for a fiscal year starting in 2010. This form encompasses several sections, including initial, consolidated, final return, and provisions for reporting a short year or an address change. What sets this form apart is its detailed breakdown of income, including gross receipts, depreciable assets, total assets, and specific identification numbers such as the Rhode Island Secretary of State ID. Additionally, it meticulously outlines the calculation of taxes, incorporating federal taxable income, various deductions and additions, Rhode Island-specific adjustments, and apportionment ratios to accurately determine the state tax obligations. Credits form a noteworthy part of the return, highlighting incentives and adjustments that can significantly impact the tax owed. For compliance, the form mandates the attachment of all necessary federal schedules and detailed documentation to support deductions and additions, emphasizing the importance of thorough record-keeping for corporations. Furthermore, the form provides spaces for reporting payments made through estimated tax contributions, withholdings, and explores the possibilities of overpayments, further underscoring the complexities of corporate taxation and the critical role of accurate, complete filings.

| Question | Answer |

|---|---|

| Form Name | Form Ri 1120C |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | 2010 1120C 2005 ri 1120c form |

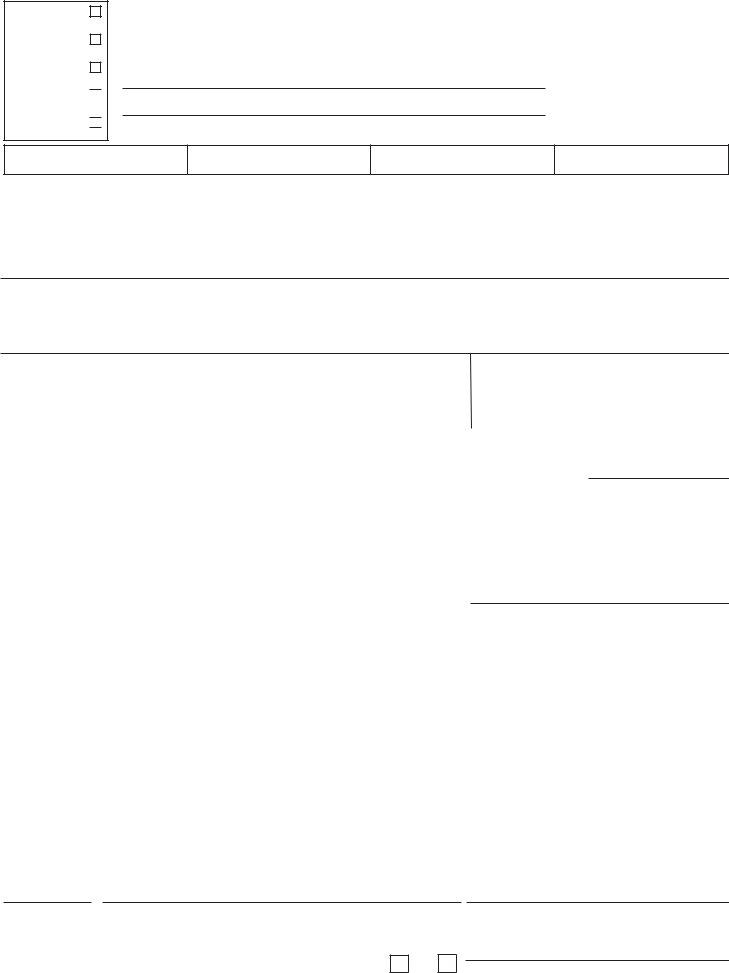

Initial Return

CConsolidated

Return

Final Return

Short Year Address Change

Rhode Island Business Corporation Tax Return

TO BE FILED BYC CORPORATIONS ONLY for calendar year 2010 or |

2010 |

|||

fiscal year beginning ___________________ |

- ending _________________ . |

|||

Due on or before the 15th day of the 3rd month after close of the taxable year |

|

|

||

NAME |

|

|

|

|

|

|

|

|

|

ADDRESS |

|

|

|

|

CITY |

STATE |

ZIPCODE |

|

|

FEDERALIDENTIFICATION NUMBER |

|

TELEPHONE NUMBER |

|

|

|

|

|

||

|

|

|

|

|

A. Gross Receipts

B. Depreciable Assets

C. Total Assets

D. RI Secretary of State Identification Number

NOTE: THIS RETURN WILLNOT BE CONSIDEREDCOMPLETE UNLESS ALLREQUIRED FEDERALSCHEDULES ARE ATTACHED

Schedule A - Computation of Tax

|

|

|

1. |

...........................................................................Federal Taxable Income (see instructions) |

|

|

|

1. |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Total Deductions from page 2, Schedule B, line 2G |

|

|

|

3. |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Total Additions from page 2, Schedule C, line 4G |

|

|

|

5. |

|

|||||

Apportioned |

6. |

Adjusted taxable income - Line 1 less line 3 plus line 5 |

....................................................... |

|

|

|

6. |

|

||||||

Taxable Income |

|

|

|

|

|

|

|

|

|

|

||||

7. |

Rhode Island Apportionment Ratio - from Schedule J, line 5 |

|

|

|

7. |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

8. |

Apportioned Rhode Island taxable income - Multiply line 6 by line 7 |

................................... |

|

|

8. |

|

|||||

Adjustments |

9. |

Research and development adjustments (see instructions, attach schedule) |

9. |

|

|

|

|

|||||||

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

10. a. Pollution control and hazardous waste adjustment (see instructions) |

10a. |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. Capital investment deduction |

..................................................................... |

|

10b. |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

11. |

TOTALADJUSTMENTS - Add lines 9, 10a and 10b |

|

|

|

11. |

|

|||||

|

|

|

|

|

|

|

|

|

|

|||||

Tax and Credits |

12.Rhode Island adjusted taxable income - line 8 minus line 11 |

|

|

|

12. |

|

||||||||

|

|

|

13.Rhode Island income tax - 9% of line 12 |

|

|

|

13. |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

14.Rhode IslandCredits from page 2, Schedule D, line 14O |

........................................................... |

|

|

|

14. |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

15.Tax - line 13 less line 14, but not less than Franchise Tax from Schedule H, Line 7 (Minimum $500). |

15. |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

16. |

(a.) Recapture of credits _______________ (b.) Jobs Growth Tax _______________ |

Total (a.)+(b.) |

16. |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

17.Tax due - add lines 15 and 16 |

|

|

|

|

17. |

|

|||||

|

|

|

|

|

||||||||||

Check if a |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

Jobs Growth |

18.Payments made on 2010 declaration of estimated tax |

18. |

|

|

|

|

||||||||

Tax is being |

|

|

|

|

|

|

|

|

|

|

|

|

||

reported on |

19.a. Other payments |

|

|

19a. |

|

|

|

|

||||||

line 16b. |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

b. Rhode Island |

19b. |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

20.TOTALPAYMENTS - add lines 18, 19a and 19b |

|

|

|

20. |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Balance Due |

21.Net tax due - Line 17 less line 20 |

|

|

|

|

21. |

|

|||||||

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

22. |

(a) Interest |

|

|

(b) Penalty |

|

(c) Form 2220 Interest |

|

22. |

|

||

|

|

|

|

|

|

|

|

|

||||||

|

|

|

23.Total due with return - Add lines 21 and 22. (Please use |

23. |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Refund |

24.Overpayment - Line 20 less line 17 |

|

|

|

|

24. |

|

|||||||

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

25.Amount of overpayment to be credited to 2011 |

|

|

|

25. |

|

||||||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

26.Amount to be refunded - line 24 less line 25 |

|

|

|

26. |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Under penalties of perjury, I declare that I have examined this return, including the accompanying schedules and statements, and to the best of my knowledge it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which he has any knowledge.

Date |

|

Signature of authorized officer |

|

Title |

|

|

|

|

|

Date |

|

Signature of preparer |

|

Address of preparer |

MAYTHE DIVISION CONTACTYOUR PREPARER ABOUTTHIS RETURN? YES

NO

Phone number

MAILING ADDRESS: OVERPAYMENTS/REFUNDS - RI DIVISION OF TAXATION, ONE CAPITOLHILL, PROVIDENCE,

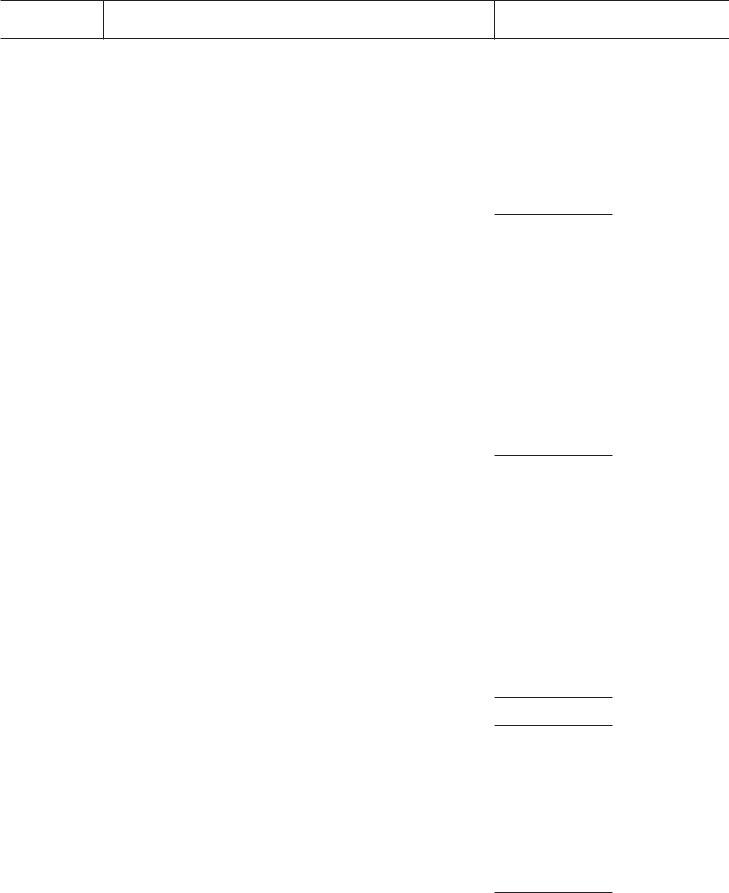

page 2

Your Federal Identification Number

Schedule B - Deductions to Federal Taxable Income |

NOTE: You must attach documents supporting your deductions. |

|||||

Otherwise, the processing of your return may be delayed. |

||||||

|

||||||

2. A. Net operating loss deduction (see instructions - attach schedule) |

|

|

|

|||

2A. |

|

|

|

|||

B. Special deductions |

|

|

|

|||

2B. |

|

|

|

|||

C. Exempt dividends and interest - from page 3, Schedule E, line 10 |

|

|

|

|

||

2C. |

|

|

|

|||

D. Foreign dividend |

|

|

|

|||

2D. |

|

|

|

|||

E. Bonus Depreciation and Section 179 expense adjustment |

|

|

|

|||

2E. |

|

|

|

|||

F. Discharge of business indebtedness claimed as income on Federal return and previously included |

2F. |

|

|

|||

as RI income under American Recovery and Reinvestment Act of 2009 under |

|

|

|

|

||

G. TOTALDEDUCTIONS - Add lines 2A, 2B, 2C, 2D, 2E and 2F - Enter here and on page 1, Line 3 |

...................................... |

|

2G. |

|

||

|

|

|

|

|

|

|

Schedule C - Additions to Federal Taxable Income |

NOTE: You must attach documents supporting any additions. |

|||||||

Otherwise, the processing of your return may be delayed. |

||||||||

4. |

A. Interest (see instructions) |

|

|

|

|

|

|

|

|

4A. |

|

|

|

||||

|

B. Rhode Island corporate taxes (see instructions) |

|

|

|

|

|

|

|

|

|

4B. |

|

|

|

|||

|

C. Bonus Depreciation and Section 179 expense adjustment |

|

|

|

|

|

|

|

|

|

4C. |

|

|

|

|||

|

D. Add back of captive REITdividends paid deduction |

|

|

|

|

|

|

|

|

|

4D. |

|

|

|

|||

|

E. Intangible Addback |

|

|

|

|

|

|

|

|

|

4E. |

|

|

|

|||

|

F. Income from the discharge of business indebtedness deferred under American Recovery and |

|

4F. |

|

|

|

||

|

Reinvestment Act of 2009 under |

|

|

|

|

|

||

|

...........................................G. TOTALADDITIONS - Add lines 4A, 4B, 4C, 4D, 4E and 4F - Enter here and on page 1, Line 5 |

|

|

4G. |

|

|||

|

|

|

|

|

|

|

|

|

Schedule D - Rhode Island Credits |

NOTE: You must attach documents supporting your Rhode Island |

|||||||

credits. Otherwise, the processing of your return may be delayed. |

||||||||

14. |

A. |

- Investment Tax Credit - RIGL |

|

|

|

|

|

|

|

14A. |

|

|

|

||||

|

B. |

|

|

|

|

|

|

|

|

|

14B. |

|

|

|

|||

|

C. |

|

|

|

|

|

||

|

|

14C. |

|

|

|

|||

|

D. |

|

|

|

|

|

||

|

|

14D. |

|

|

|

|||

|

E. |

- Adult and Child Day Care Assistance and Development Tax Credit - |

|

|

|

|

|

|

|

|

14E. |

|

|

|

|||

|

F. |

- Motion Picture Production Company Tax Credit - |

|

14F. |

|

|

|

|

|

G. |

- Jobs Training Tax Credit - |

|

14G. |

|

|

|

|

|

H. |

- Adult Education TaxCredit - |

|

|

|

|

|

|

|

|

14H. |

|

|

|

|||

|

I. |

|

|

|

|

|

||

|

|

14I. |

|

|

|

|||

|

J. |

- Jobs Development Rate Reduction Credit - |

|

|

|

|

|

|

|

|

14J. |

|

|

|

|||

|

K. |

|

|

|

|

|

|

|

|

....................................... |

|

14K. |

|

|

|

||

|

L. |

- Employment Tax Credit - |

|

|

|

|

|

|

|

|

14L. |

|

|

|

|||

|

M. |

- Incentives for Innovation and Growth - |

|

14M. |

|

|

|

|

|

N. Other Credits |

|

|

|

|

|

|

|

|

|

14N. |

|

|

|

|||

|

|

|

|

|

|

|

||

|

O. TOTALRHODEISLANDCREDITS - Add lines 14Athrough 14N - Enter here and on page 1, Line 14 |

14O. |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

Page 2 |

|

|

|

|

|

|

|

Name |

|

|

|

Your Federal Identification Number |

|

|

|

|||||||||

|

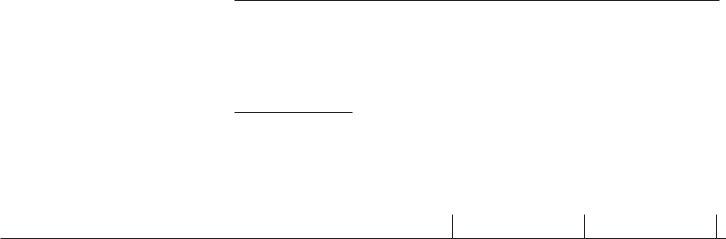

page 3 |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Schedule E - |

Exempt Dividends and Interest |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

1. |

|

|

|

|

|

|

||||||

|

1. |

Dividends received from shares of stock of any payer liable for RI taxes as outlined in Chapters 11, 13, & 14 - (attach Schedule) |

|

|

|

|

|

|

|||||||||

|

2. |

Amount of such dividends included in Special Deductions, Schedule B, line 2B |

2. |

|

|

|

|

|

|

||||||||

|

3. |

Balance of Exempt Dividends - Line 1 less line 2 |

3. |

|

|

|

|

|

|

||||||||

|

|

Foreign Dividends included on line 13, 14 &17Schedule C, US 1120 |

|

|

|

|

|

|

|

||||||||

|

4. |

Less than 20% owned |

|

|

X 70% |

4. |

|

|

|

|

|

|

|||||

|

5. |

More than 20% owned |

|

|

X 80% |

5. |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

6. |

100% owned |

|

X 100% |

6. |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

7. |

Interest on obligations of public service corporations liable for Rhode Island Gross Earnings Tax |

7. |

|

|

|

|

|

|

||||||||

|

8. |

Interest on certain obligations of the US - (Attach schedule) |

8. |

|

|

|

|

|

|

||||||||

|

9. |

Interest on obligations of USpossessions and other interest exempt under Rhode Island Law - (Attach schedule) |

9. |

|

|

|

|

|

|

||||||||

|

10. |

..................................................................................................Total |

10. |

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Schedule F - Final Determination of Net Income by Federal Government |

|

|

|

|

|

|

|

|||||||||

|

...................Has the Federal Government changed your taxable income for any prior year which has not yet been reported to The TaxAdministrator? |

|

|

|

Yes |

|

No |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If yes, complete Form

NOTE:Changes made by the Federal Government in the income of any prior year must be reported to the Tax Administrator within 60 days after a final determination.

Schedule G - General Information

Location of principal place of business in Rhode Island

Location of corporation’s books and records |

|

|

|

|

|

|

|

|

||||

List states to which you are liable for income or excise taxes for the taxable year |

|

|

|

|

|

|

|

|||||

USBusiness Code Number |

|

President |

|

|

||||||||

State and date of incorporation |

|

Treasurer |

|

|

||||||||

|

|

|

|

|

|

|

|

|

||||

Schedule H - Franchise Tax Calculation |

|

|

|

|

|

|

|

|||||

1. |

Number of Shares ofAuthorized Stock |

|

|

5. Multiply Line 4 times $2.50 |

|

|||||||

2. |

Par Value per Share of Stock (No par value = $100) |

|

|

|

|

|

|

|||||

|

|

6.Apportionment Ratio from Schedule J, Line 5 |

|

|||||||||

|

|

|

|

|

|

|

|

|||||

3.Authorized Capital - Multiply Line 1 times Line 2 |

|

|

7. Franchise Tax - Multiply Line 5 times Line 6, but |

|

||||||||

|

|

|

|

|

not less than $500.00 |

|

||||||

4. |

Divide Line 3 by $10,000.00 |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule I - Federal Taxable Income (US1120, page 1, line 28)

|

|

Enter amount for year that ended |

|

2010 |

2009 |

2008 |

|

|

|

|

|

2007

2006

Schedule J - Apportionment |

|

COLUMN A |

COLUMN B |

|

|

||

|

RI |

EVERYWHERE |

|

|

|||

Average net |

1. |

a. Inventory |

1a. |

|

|

|

|

book value |

|

b. Depreciable assets |

1b. |

|

|

|

|

|

|

c. Land |

1c. |

|

|

|

|

|

|

d. Rent (8 times annual net rental rate) |

1d. |

|

|

|

|

|

|

e. Total |

1e. |

|

|

|

|

|

|

f. Ratio inRhode Island, line 1e, columnAdivided by line 1e, column B |

|

1f. |

_._ _ _ _ _ _ |

||

Receipts |

2. |

a. Gross receipts - Rhode Island Sales |

2a. |

|

|

|

|

|

|

Gross receipts - Sales Under |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. Dividends |

2b. |

|

|

|

|

|

|

c. Interest |

2c. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d. Rents |

2d. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e. Royalties |

2e. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

f. Net capital gains |

2f. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

g. Ordinary income |

2g. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

h. Other income |

2h. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

i. Income exempt from federal taxation |

2i. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

j. Total |

2j. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

k. Ratio in Rhode Island, Line 2j, columnAdivided by line 2j, column B |

|

2k. |

_._ _ _ _ _ _ |

||

|

|

|

|

|

|

||

Salaries |

3. |

..........a. Salaries and wages paid or incurred - (see instructions) |

3a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. Ratio inRhode Island, line 3a, columnAdivided by line 3a, column B |

|

3b. |

_._ _ _ _ _ _ |

||

|

|

|

|

|

|

||

Ratio |

4 |

Total of Rhode Island Ratios shown on lines 1f, 2k and 3b |

|

|

|

4. |

_._ _ _ _ _ _ |

|

5. |

...........Apportionment Ratio - line 4 divided by 3 or by the number of ratios - enter here and on page 1, scheduleA, line 7 |

5. |

_._ _ _ _ _ _ |

|||

|

|

|

|

|

|

|

|