Working with PDF forms online is definitely quite easy with this PDF editor. Anyone can fill out Rma Form here in a matter of minutes. To maintain our tool on the forefront of practicality, we aim to adopt user-oriented features and improvements regularly. We are at all times grateful for any suggestions - play a pivotal part in revolutionizing how we work with PDF files. For anyone who is looking to begin, here is what it requires:

Step 1: Just press the "Get Form Button" in the top section of this site to access our pdf file editing tool. Here you will find all that is needed to work with your file.

Step 2: When you access the editor, you will get the form all set to be completed. Other than filling in various blanks, you might also do other sorts of actions with the form, namely writing your own text, editing the initial text, adding graphics, signing the document, and a lot more.

This document requires particular info to be typed in, therefore you should take some time to type in exactly what is required:

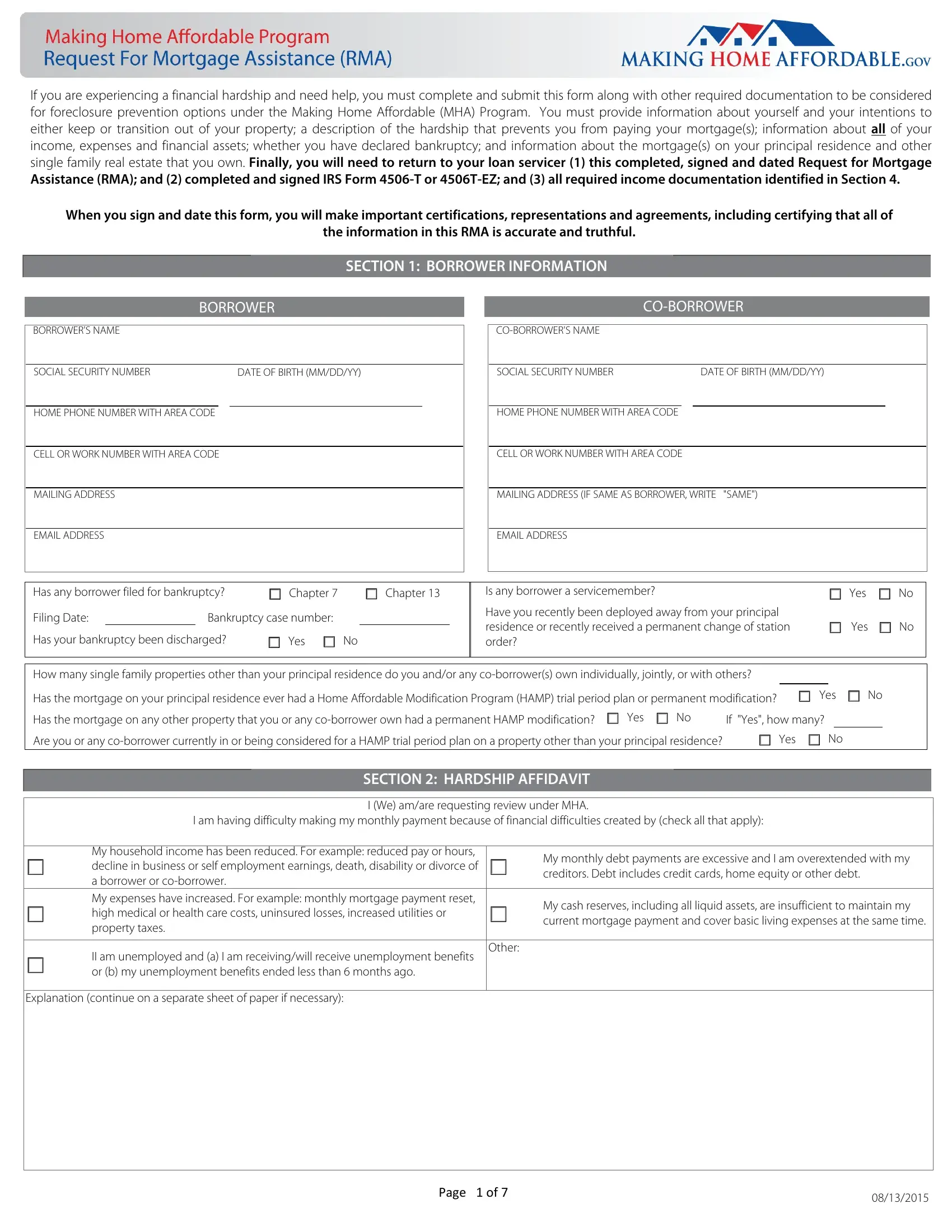

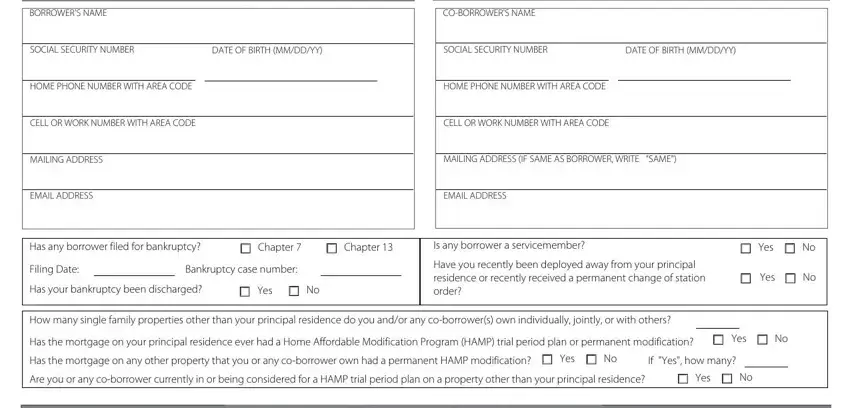

1. It is important to fill out the Rma Form correctly, so pay close attention while filling in the parts containing all these blanks:

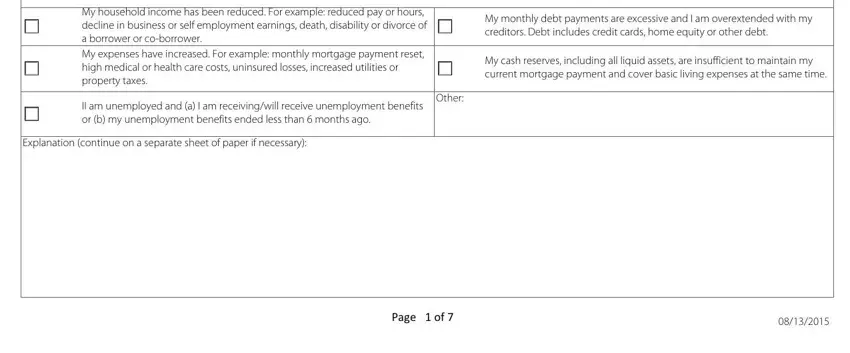

2. After the last section is complete, you're ready to add the needed details in My household income has been, II am unemployed and a I am, Other, Explanation continue on a separate, My monthly debt payments are, My cash reserves including all, and Page of so you're able to move on to the 3rd step.

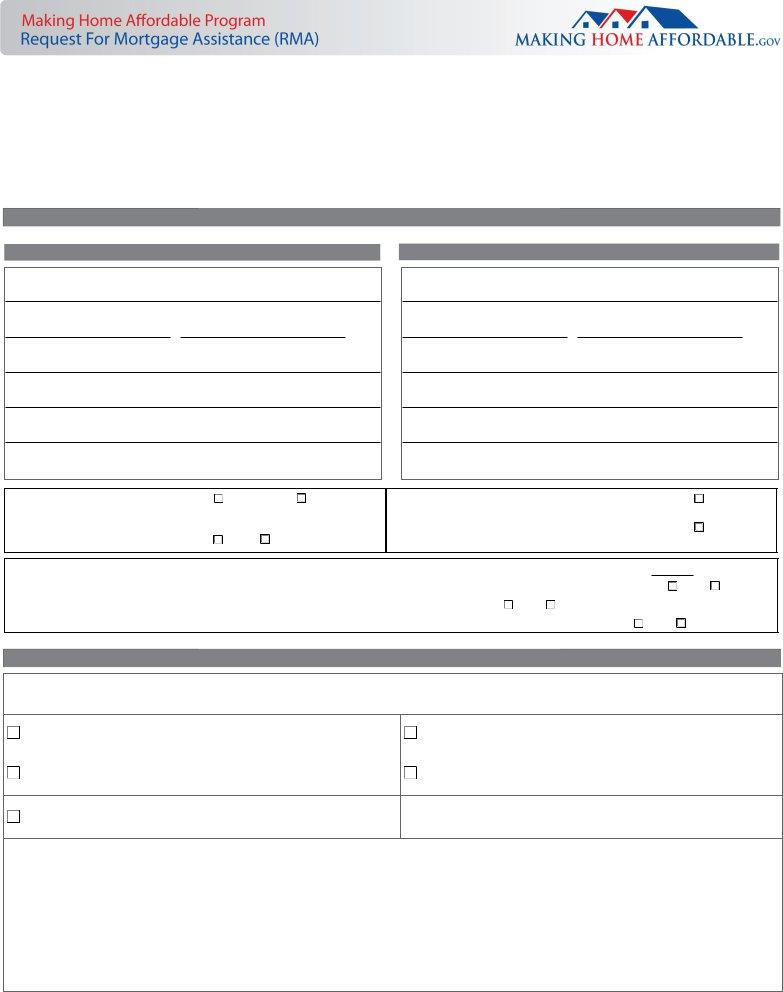

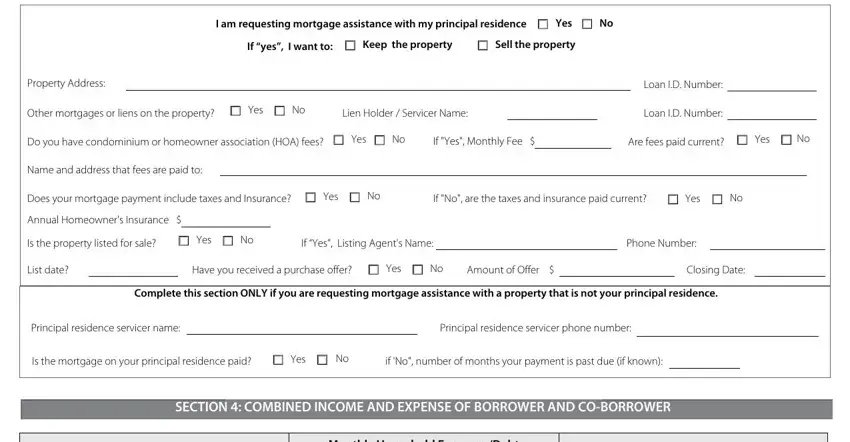

3. The following section will be focused on I am requesting mortgage, Yes, If yes I want to, Keep the property, Sell the property, Property Address, Other mortgages or liens on the, Yes, Lien Holder Servicer Name, Loan ID Number, Loan ID Number, Do you have condominium or, Yes, If Yes Monthly Fee, and Are fees paid current - type in these blank fields.

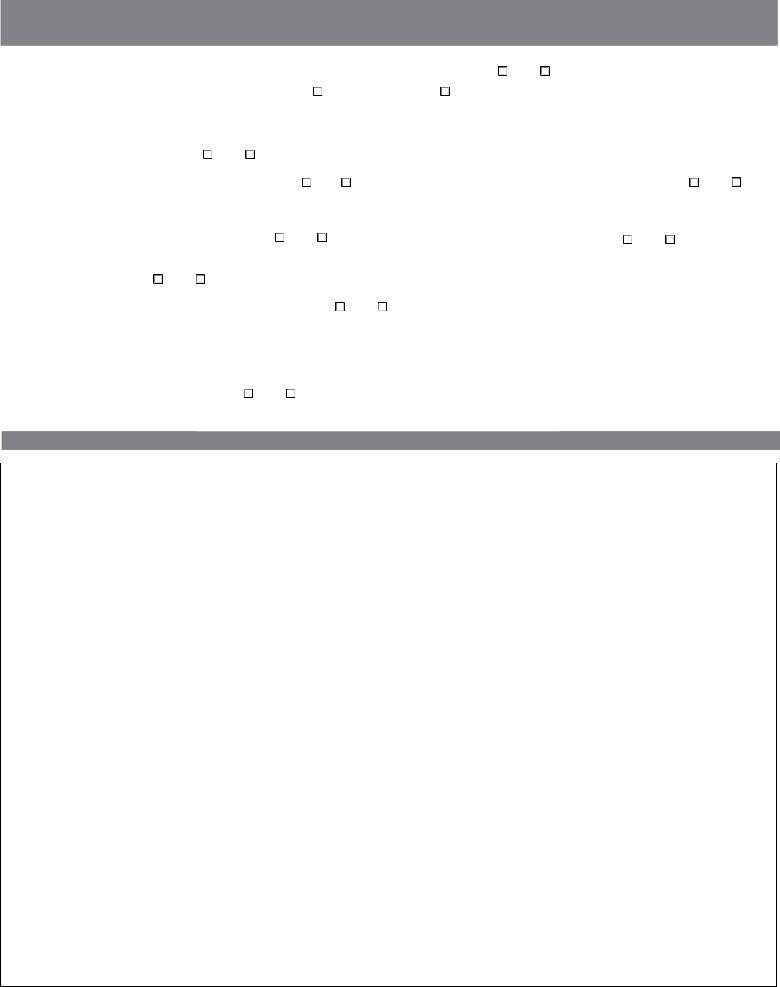

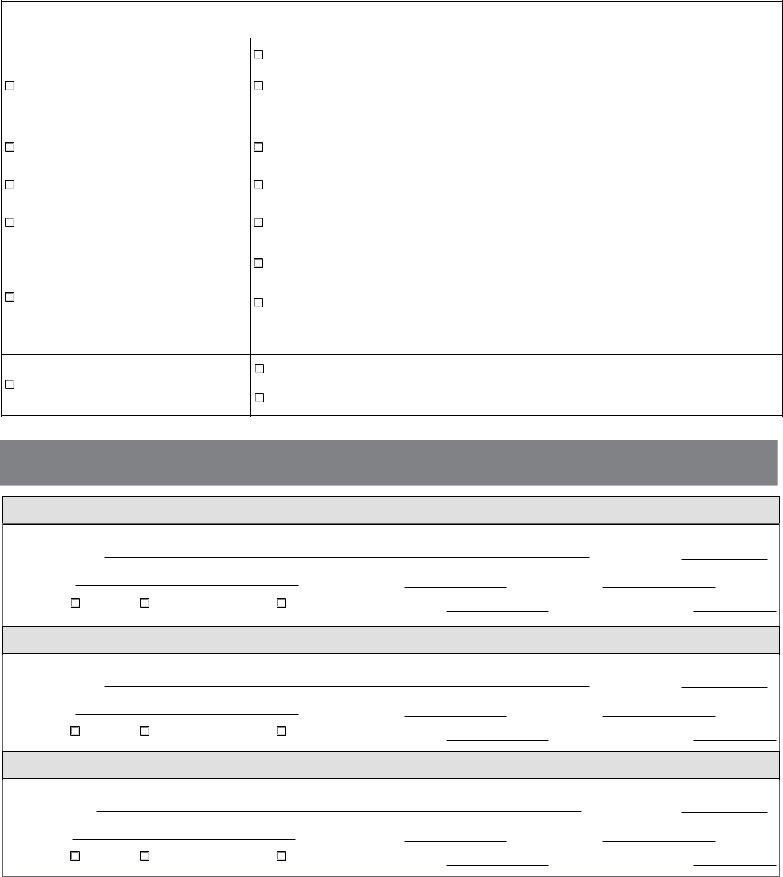

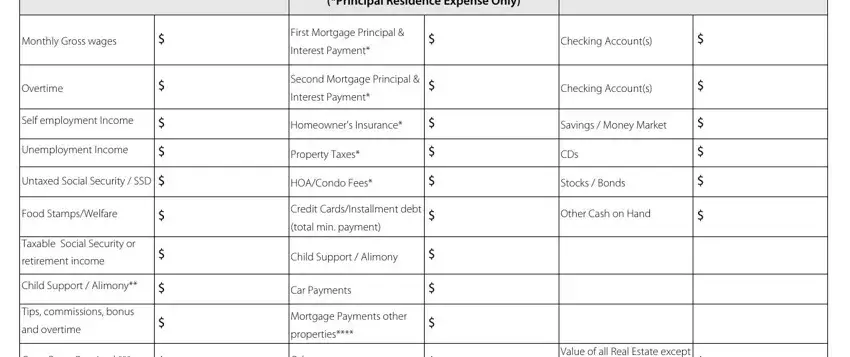

4. Completing Monthly Household Income, Monthly Household ExpensesDebt, Household Assets, Monthly Gross wages, Overtime, Self employment Income, Unemployment Income, Untaxed Social Security SSD, Food StampsWelfare, Taxable Social Security or, retirement income, Child Support Alimony, Tips commissions bonus, and overtime, and Gross Rents Received is crucial in the next form section - make sure you don't hurry and fill out every single blank area!

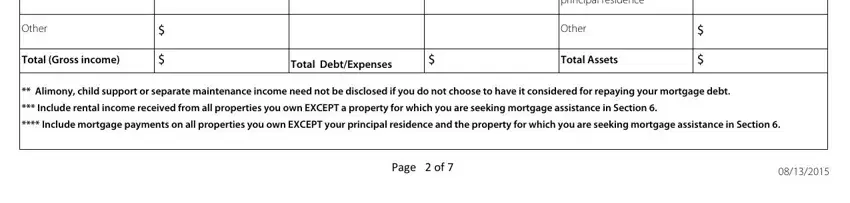

5. And finally, this last segment is what you need to wrap up prior to finalizing the PDF. The blanks in this instance include the following: Other, Total Gross income, Other, Total DebtExpenses, principal residence, Other, Total Assets, Alimony child support or separate, Include mortgage payments on all, and Page of.

Those who work with this document frequently make mistakes when completing Other in this part. You should definitely reread everything you type in here.

Step 3: Right after you've reviewed the information in the file's blanks, click on "Done" to complete your FormsPal process. Sign up with us now and instantly obtain Rma Form, prepared for download. Every single edit made is conveniently saved , meaning you can edit the document at a later stage if needed. With FormsPal, you'll be able to complete forms without being concerned about database leaks or data entries getting distributed. Our protected system makes sure that your personal information is maintained safely.