Dealing with PDF documents online is always a piece of cake with this PDF tool. You can fill out rp 467 instructions here without trouble. To retain our editor on the cutting edge of efficiency, we strive to integrate user-oriented features and enhancements regularly. We're always looking for feedback - assist us with reshaping PDF editing. By taking a couple of simple steps, you may begin your PDF journey:

Step 1: Simply press the "Get Form Button" above on this page to launch our pdf editor. There you will find all that is required to work with your document.

Step 2: This tool will allow you to change almost all PDF forms in a variety of ways. Modify it by adding your own text, correct what is already in the file, and put in a signature - all doable within minutes!

It is actually easy to complete the pdf with this practical tutorial! Here's what you want to do:

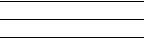

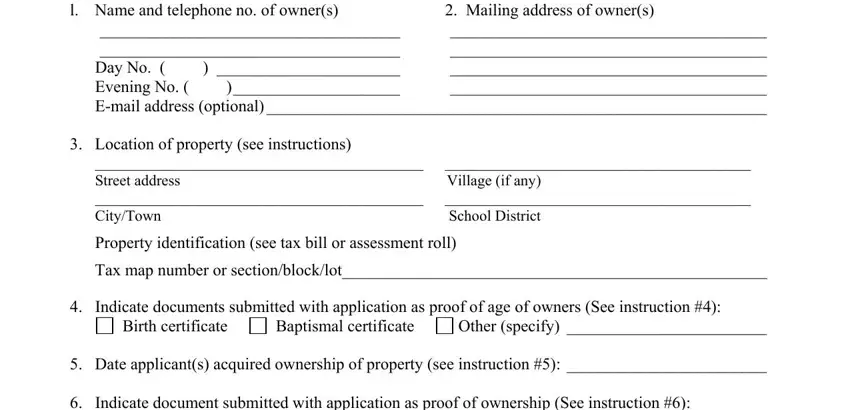

1. Begin filling out the rp 467 instructions with a number of necessary blank fields. Gather all the necessary information and make sure absolutely nothing is missed!

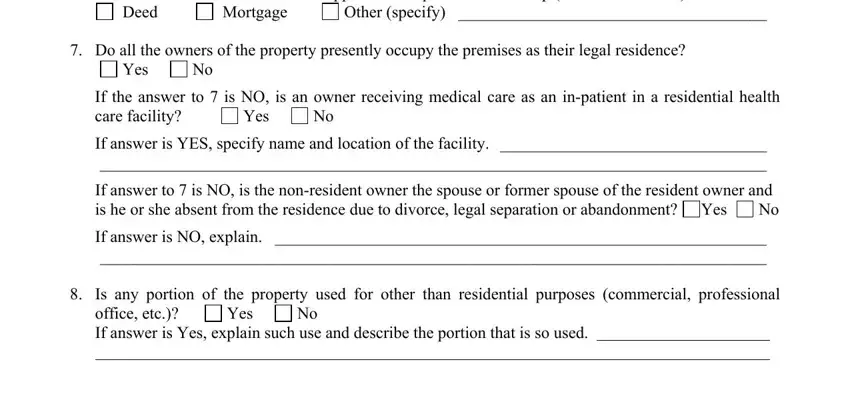

2. After the previous part is finished, you're ready to add the required specifics in Date applicants acquired, Other specify, Mortgage, Deed, Yes, If the answer to is NO is an, Yes, If answer is YES specify name and, If answer to is NO is the, If answer is NO explain, Is any portion of the property, Yes, and office etc If answer is Yes in order to progress further.

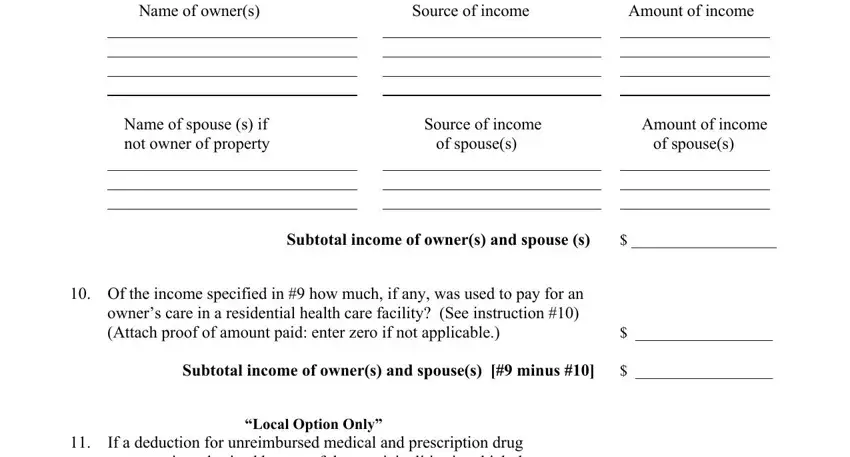

3. The following portion will be focused on Source of income, of spouses, Name of spouse s if, Name of owners not owner of, If a deduction for unreimbursed, Local Option Only, Subtotal income of owners and, Source of income Amount of income, Amount of income, and of spouses - fill in all of these blanks.

When it comes to Subtotal income of owners and and Name of owners not owner of, be sure that you review things in this section. These two are certainly the most important fields in this page.

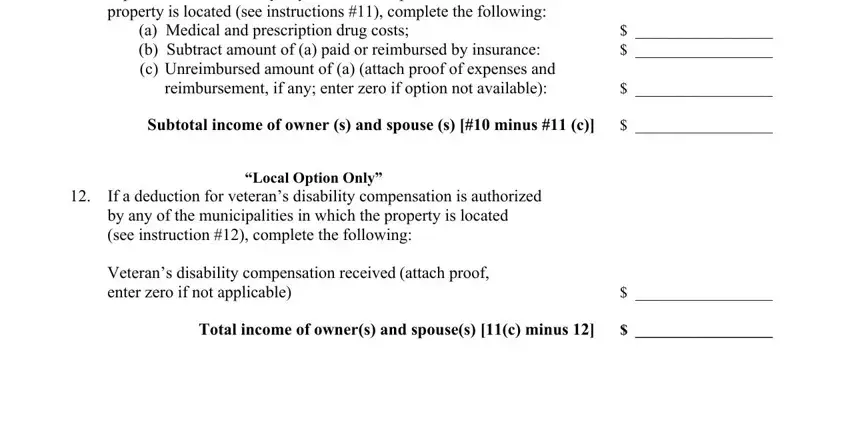

4. This next section requires some additional information. Ensure you complete all the necessary fields - Name of owners not owner of, If a deduction for unreimbursed, c Unreimbursed amount of a attach, Subtotal income of owner s and, Local Option Only, If a deduction for veterans, and Total income of owners and spouses - to proceed further in your process!

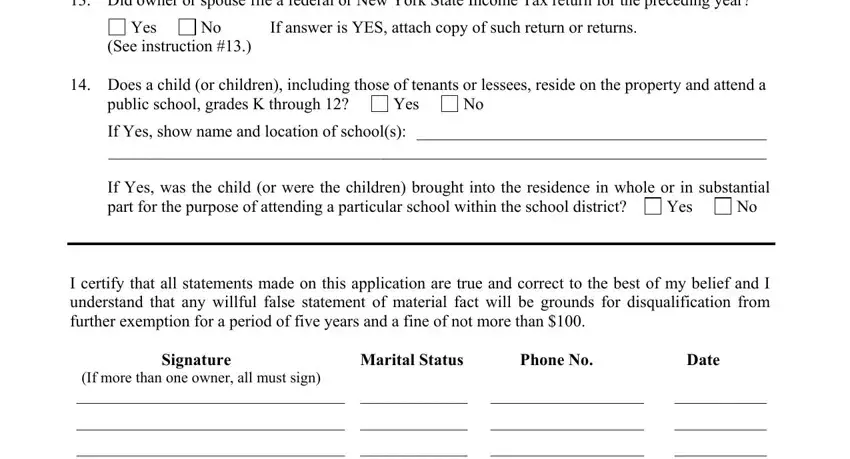

5. Since you near the completion of this document, there are actually a few extra things to do. Specifically, RP Did owner or spouse file a, Yes, If answer is YES attach copy of, See instruction Does a child or, Yes, If Yes was the child or were the, Yes, If Yes show name and location of, I certify that all statements made, Phone No, and Date must all be done.

Step 3: Before moving forward, check that blanks have been filled out properly. When you are satisfied with it, press “Done." Sign up with us today and instantly gain access to rp 467 instructions, ready for download. All adjustments made by you are saved , which means you can customize the form at a later stage as required. When you work with FormsPal, you can certainly complete forms without having to get worried about personal data incidents or records being distributed. Our secure system ensures that your private details are stored safely.