Using PDF forms online is actually super easy with this PDF tool. You can fill in where to mail rp 467 here painlessly. Our editor is continually evolving to give the very best user experience possible, and that is due to our dedication to constant improvement and listening closely to comments from customers. It just takes just a few basic steps:

Step 1: Hit the orange "Get Form" button above. It is going to open up our pdf editor so that you could begin filling out your form.

Step 2: The editor will allow you to work with your PDF in a range of ways. Enhance it with personalized text, adjust original content, and put in a signature - all when you need it!

Filling out this form needs focus on details. Make sure that all necessary blank fields are done correctly.

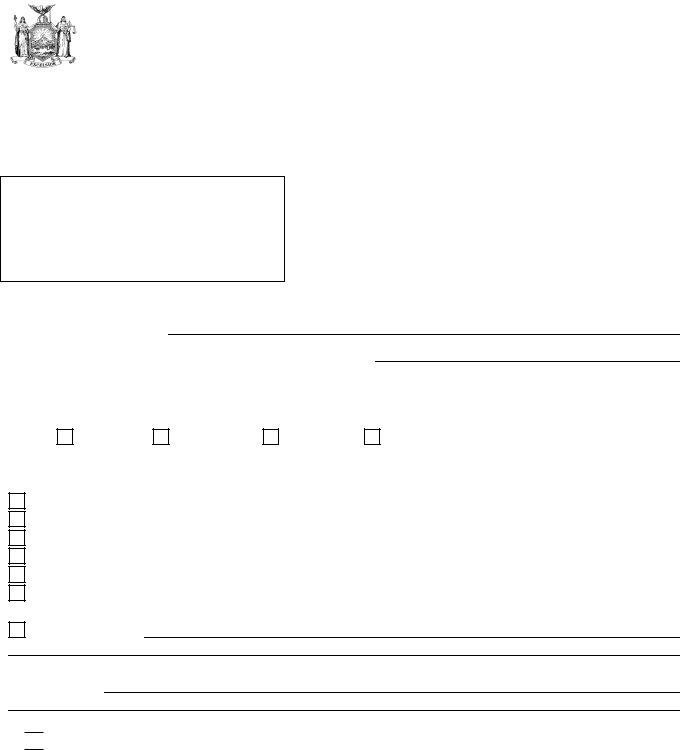

1. It is recommended to complete the where to mail rp 467 correctly, so take care when filling in the sections that contain these specific blank fields:

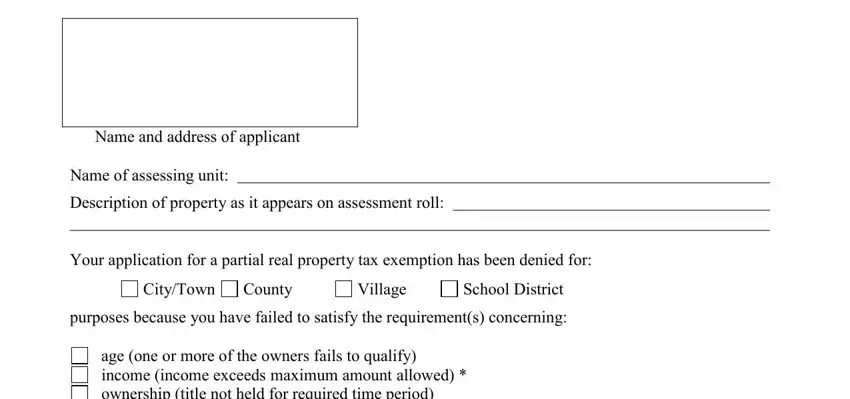

2. The next stage would be to fill in these particular blanks: age one or more of the owners, other specify, premises and school district does, Explanation STAR exemption and, If box is checked your income, If you disagree with the assessors, and Assessors signature.

Be very careful while filling in age one or more of the owners and If box is checked your income, as this is the section where a lot of people make errors.

Step 3: When you have looked once more at the information in the blanks, simply click "Done" to finalize your form. Grab the where to mail rp 467 the instant you register here for a free trial. Readily access the pdf document in your personal account page, along with any modifications and adjustments being all saved! FormsPal provides secure form editing devoid of personal data record-keeping or sharing. Rest assured that your information is secure here!