Working with PDF forms online is definitely easy with our PDF tool. Anyone can fill in rp 602 form here within minutes. To make our tool better and less complicated to work with, we continuously develop new features, taking into consideration feedback from our users. Starting is effortless! Everything you should do is adhere to the following basic steps directly below:

Step 1: Simply hit the "Get Form Button" in the top section of this page to see our pdf form editor. This way, you will find all that is needed to fill out your file.

Step 2: This tool grants the capability to change PDF files in various ways. Transform it by including any text, adjust what's already in the file, and put in a signature - all within several clicks!

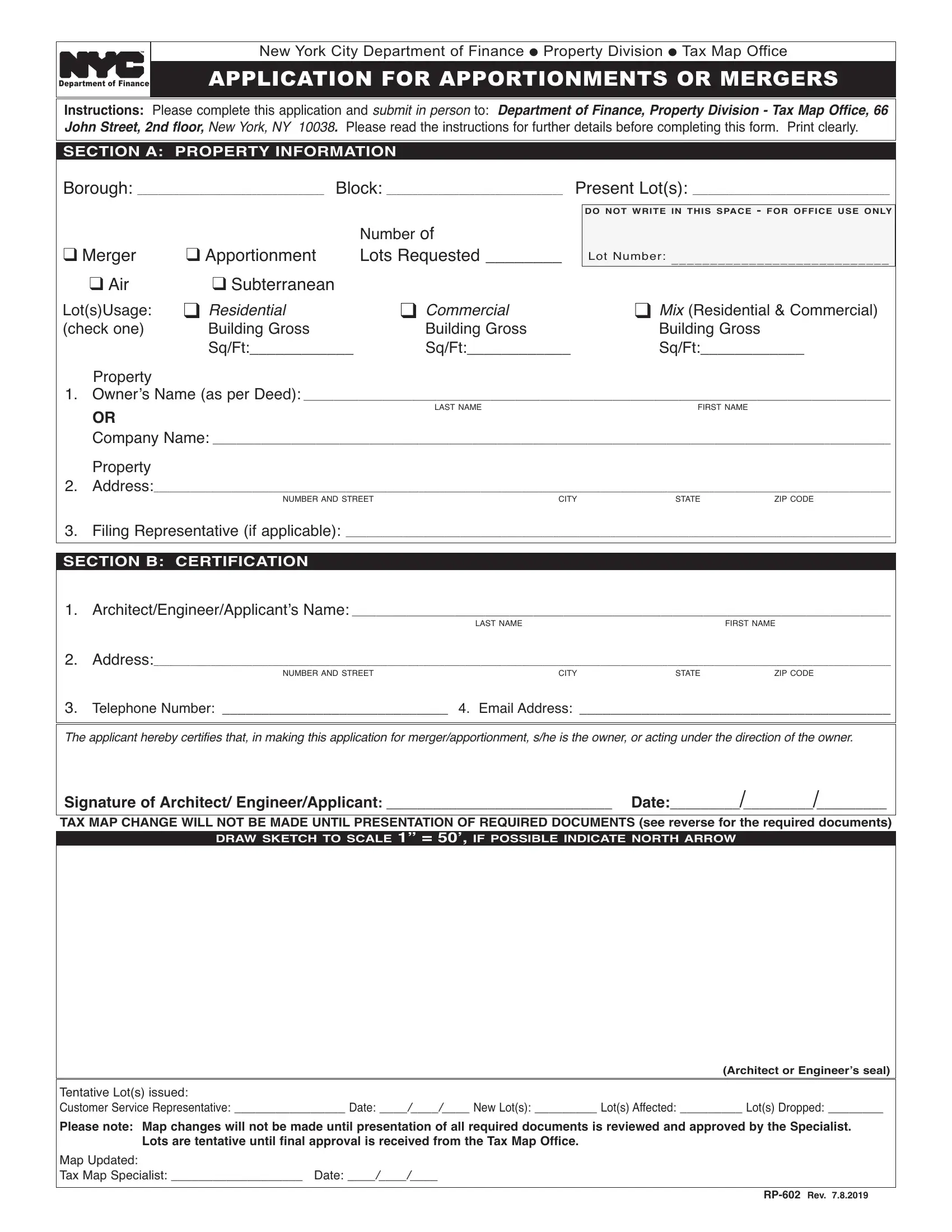

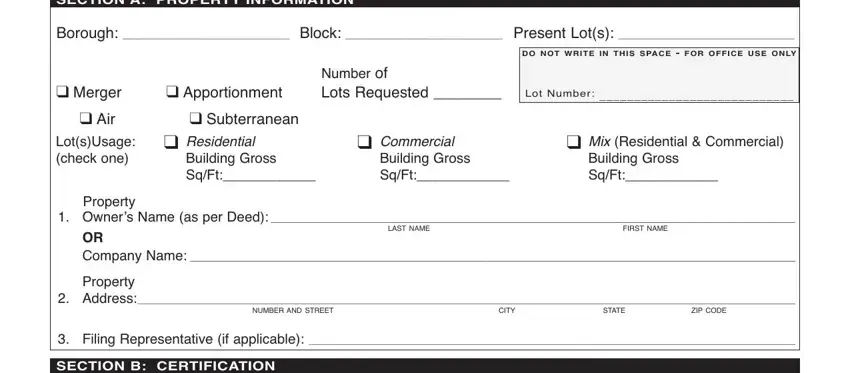

With regards to the fields of this precise PDF, here's what you need to know:

1. Begin completing your rp 602 form with a number of essential fields. Collect all the necessary information and make sure absolutely nothing is left out!

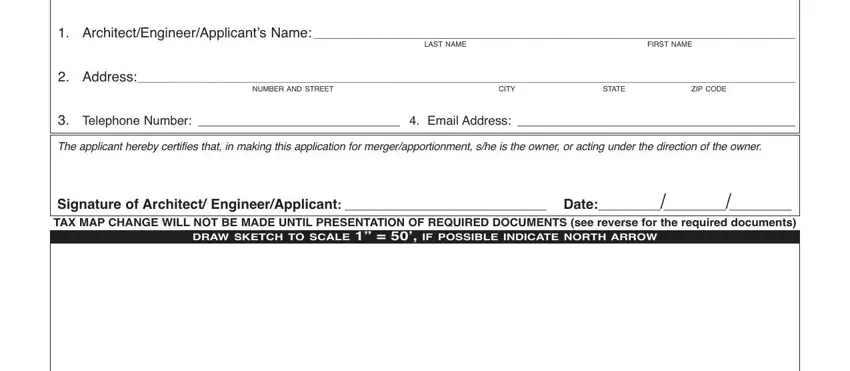

2. When this array of fields is filled out, go to enter the relevant information in all these: SECTION B CERTIFICATION, LAST NAME, FIRST NAME, Address Telephone Number Email, NUMBER AND STREET, ZIP CODE, STATE, CITY, The applicant hereby certifies, Signature of Architect, and DRAW SKETCH TO SCALE IF.

Be extremely mindful when filling in The applicant hereby certifies and DRAW SKETCH TO SCALE IF, because this is the part in which a lot of people make a few mistakes.

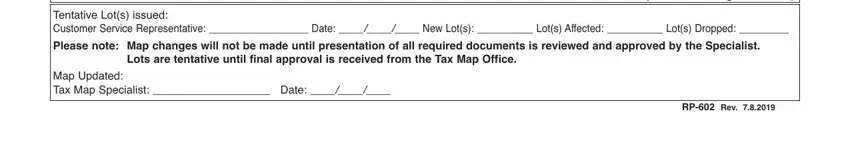

3. Completing Tentative Lots issued Customer, Lots are tentative until final, Architect or Engineers seal, Map Updated Tax Map Specialist, and RP Rev is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Step 3: As soon as you have reread the details in the fields, just click "Done" to complete your FormsPal process. Find the rp 602 form as soon as you sign up for a 7-day free trial. Instantly gain access to the pdf file inside your FormsPal cabinet, along with any edits and changes being conveniently synced! FormsPal ensures your data confidentiality via a secure system that in no way records or shares any personal information involved. Rest assured knowing your documents are kept confidential whenever you work with our service!