You can complete Form Rpd 41071 effectively with the help of our online PDF tool. Our expert team is constantly working to expand the tool and make it much faster for clients with its multiple functions. Take full advantage of the latest innovative possibilities, and find a heap of unique experiences! Here's what you would have to do to get going:

Step 1: First of all, access the editor by pressing the "Get Form Button" at the top of this webpage.

Step 2: With this advanced PDF file editor, you can accomplish more than simply complete blank form fields. Express yourself and make your forms appear great with customized textual content added in, or adjust the original content to perfection - all accompanied by the capability to insert stunning graphics and sign the PDF off.

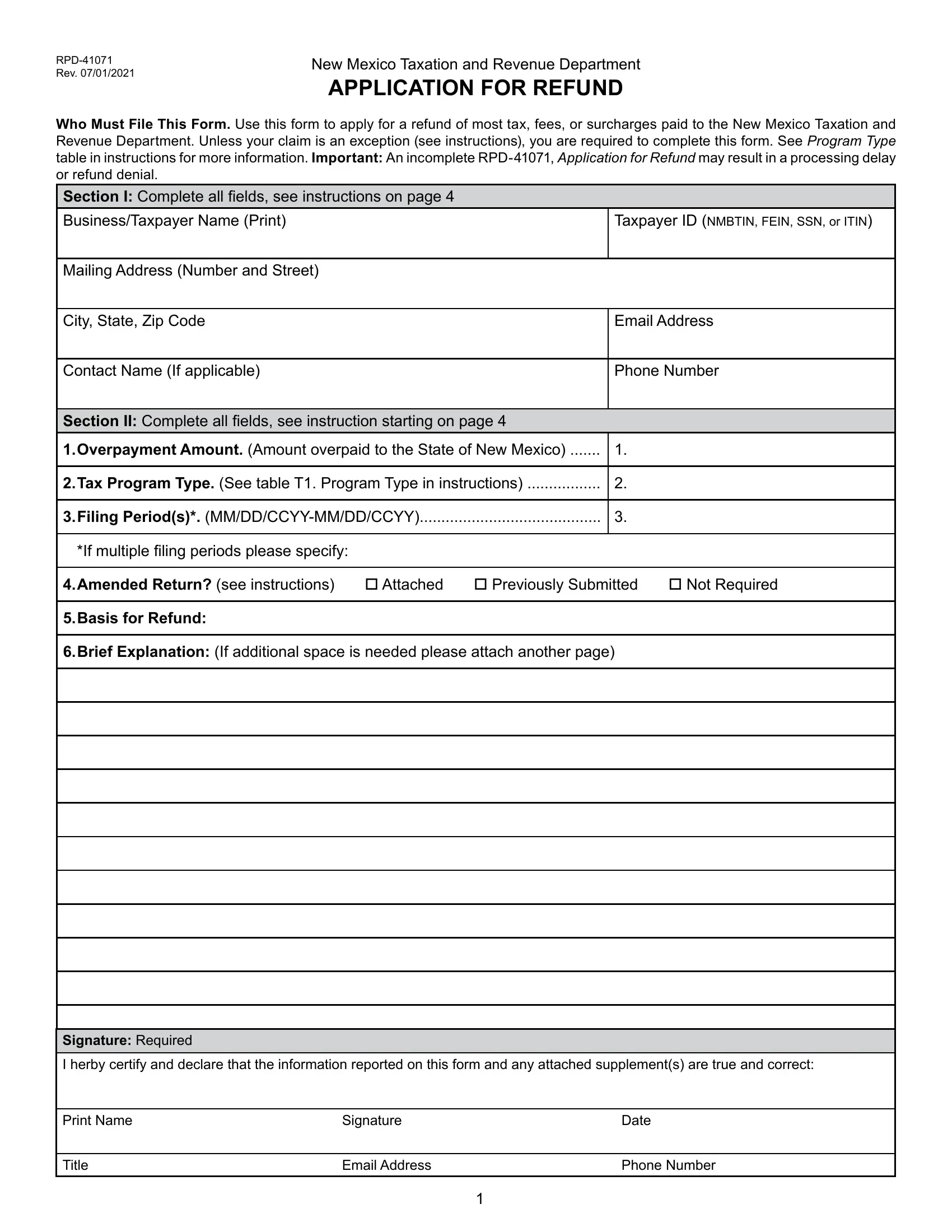

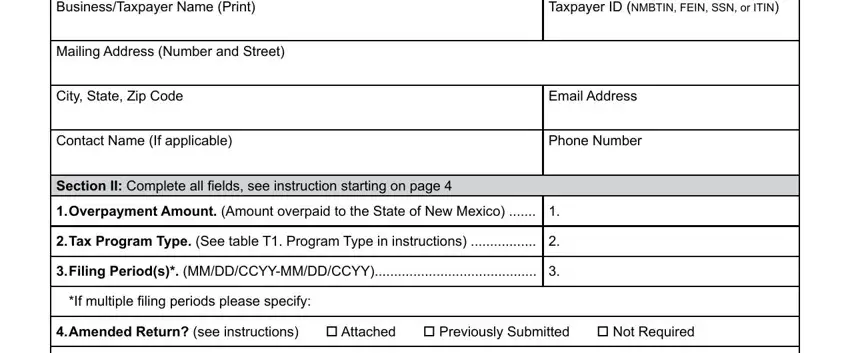

This PDF form will require specific information to be filled in, so be sure you take some time to type in what's required:

1. It is advisable to complete the Form Rpd 41071 accurately, hence be attentive while filling out the segments that contain all of these blank fields:

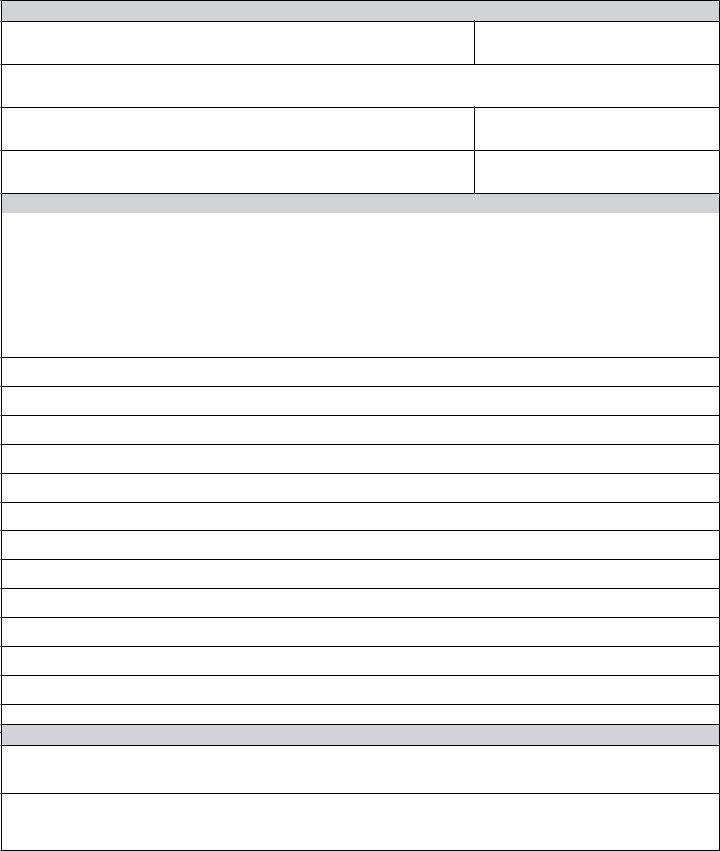

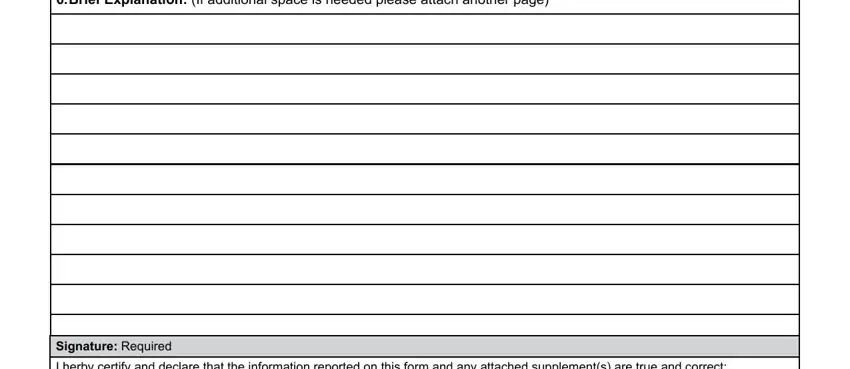

2. After the previous array of blank fields is completed, go on to type in the relevant details in all these - Brief Explanation If additional, and Signature Required I herby certify.

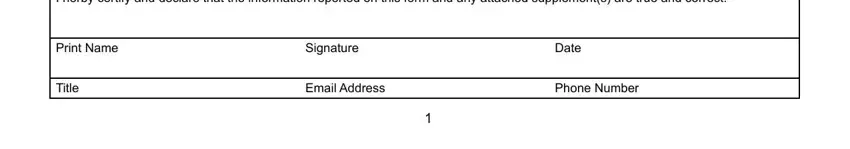

3. Completing Signature Required I herby certify, Print Name, Title, Signature, Date, Email Address, and Phone Number is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

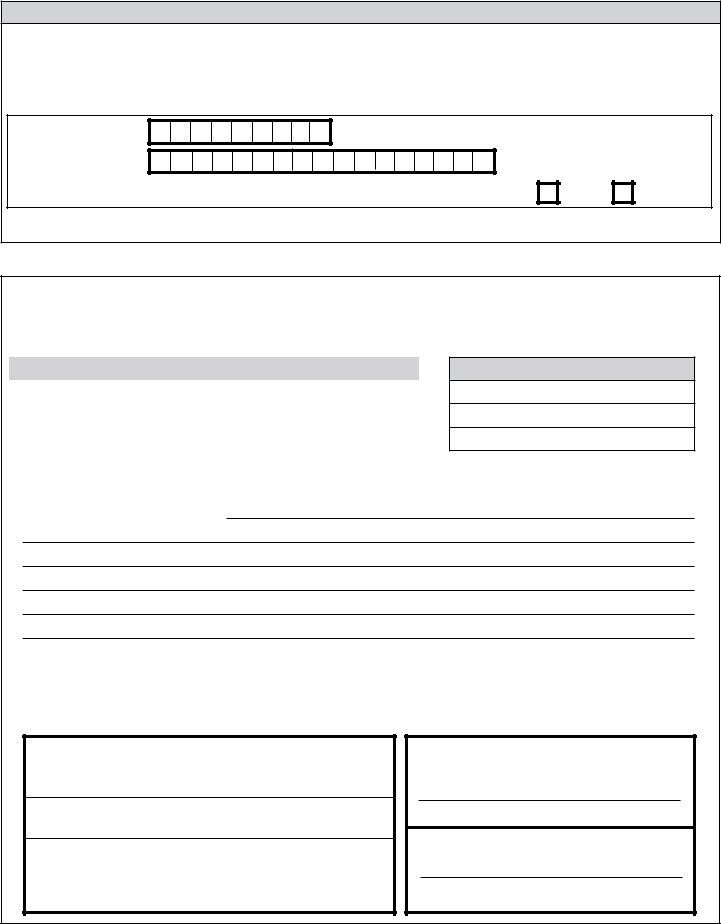

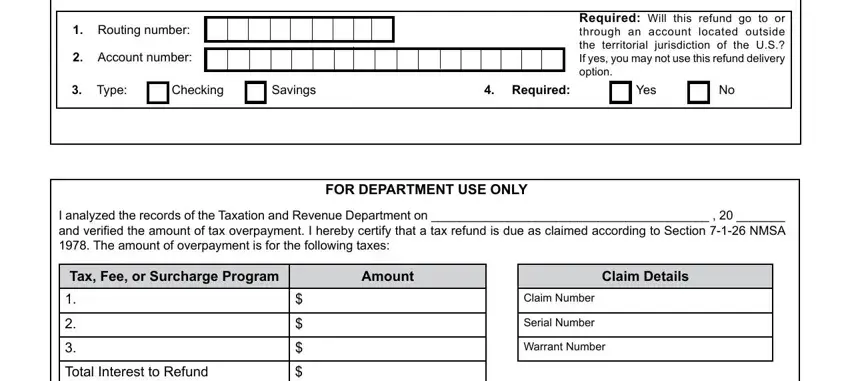

4. Completing Routing number, Account number, Required Will this refund go to or, Type, Checking, Savings, Required Yes, FOR DEPARTMENT USE ONLY, I analyzed the records of the, Tax Fee or Surcharge Program, Amount, Claim Details, Total Interest to Refund, Claim Number, and Serial Number is crucial in this fourth form section - ensure to take the time and be attentive with every single empty field!

It is easy to make a mistake while completing your Account number, and so ensure that you look again prior to deciding to send it in.

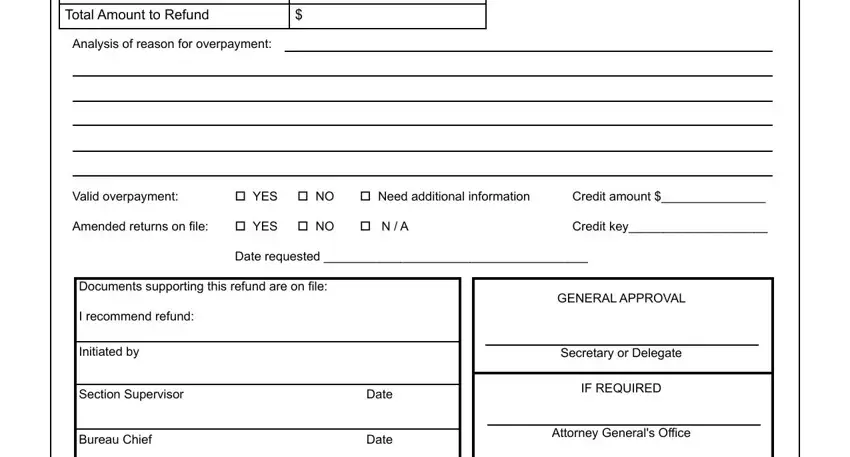

5. The form has to be completed with this particular part. Further you will find a detailed listing of form fields that must be filled out with specific information for your document submission to be complete: Total Amount to Refund, Analysis of reason for overpayment, Valid overpayment, o YES o NO o Need additional, Credit amount, Amended returns on file, o YES o NO o N A, Credit key, Date requested, Documents supporting this refund, I recommend refund, Initiated by, Section Supervisor, Bureau Chief, and Date.

Step 3: After double-checking your entries, click "Done" and you're good to go! Right after creating afree trial account at FormsPal, it will be possible to download Form Rpd 41071 or send it through email promptly. The file will also be available in your personal account page with your every modification. FormsPal guarantees protected form completion with no personal information recording or any sort of sharing. Feel comfortable knowing that your details are secure with us!