The RPD-41286 form, integral to oil and gas revenue transactions in New Mexico, serves as a tax agreement between nonresident recipients and payers. Initiated by the New Mexico Taxation and Revenue Department, this document outlines the necessary details for ensuring compliance with state tax regulations, specifically for those not residing within its borders but earning from New Mexico's oil and gas proceeds. As laid out in the form, both the recipient and the remitter (payer) must disclose their names, addresses, and identification numbers, essentially affirming the recipient's obligation to file New Mexico income tax returns and remit payments on taxes imposed by the state. This includes an accountability to the state for any potential unpaid tax, alongside penalties and interest. The arrangement stands until explicitly revoked in writing by the nonresident owner, and while the agreement itself doesn't go to the Department, it's the remitter's responsibility to keep it on file. They might also need to produce a copy upon the Department's request. Ensuring such compliance through the RPD-41286 form illustrates the state's mechanism for tax collection from nonresident individuals profiting from its natural resources. This process underscores the importance of adherence to fiscal duties and the legal framework established to govern these specific income streams.

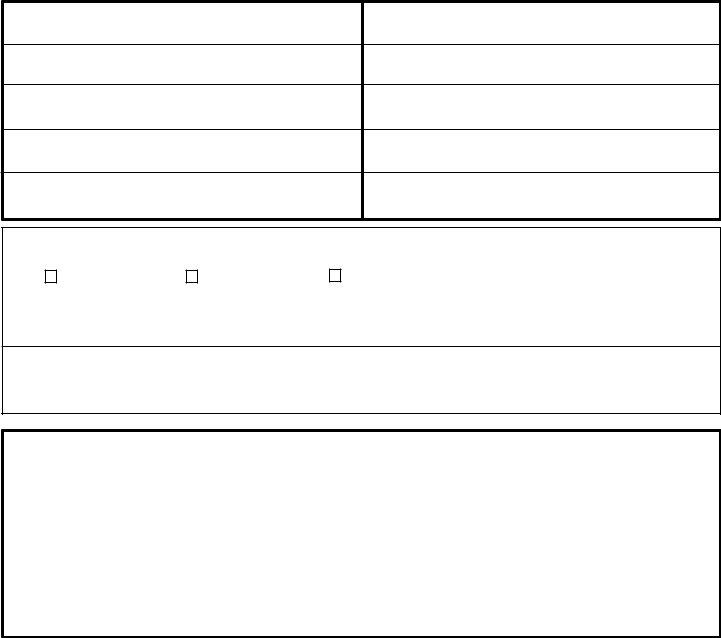

| Question | Answer |

|---|---|

| Form Name | Form Rpd 41286 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | RPD41286 rpd 41286 form |

State of New Mexico - Taxation and Revenue Department

NEW MEXICO NONRESIDENT RECIPIENT OF OIL AND GAS PROCEEDS

INCOME TAX AGREEMENT

NONRESIDENT RECIPIENT (REMITTEE)

NAME AND MAILING ADDRESS

REMITTER'S (Payer) NAME AND MAILING ADDRESS

Name

Name

Street or other mailing address

Street or other mailing address

City, state and zip code

City, state and zip code

Social security number or federal employer identification number

Federal identification number

Effective period of agreement:

YOU MUST CHECK ONE: |

|

Current Year |

Continuous |

Through _____________

Enter first taxable year of agreement period election: Beginning ___________, ending ______________

This agreement is valid until revoked in writing by the nonresident owner.

Nonresident owners must submit this agreement to the remitter named above. Do not submit this agreement to the Department. The agreement must be retained in the remitter’s records. The remitter may be required to furnish a true and correct copy of this agreement upon the Department’s request.

Under penalty of perjury I agree to file New Mexico income tax returns and make timely payment of all taxes imposed by the State of New Mexico with respect to my share of the New Mexico oil and gas proceeds of the remitter (payer) named above. I also agree to be subject to the jurisdiction of the State of New Mexico for purposes of the collection of unpaid income tax, related penalties and interest.

Authorized signature _____________________________________________________ Date _______________

State of _________________ County of ___________________

Subscribed and sworn to before me by ___________________________ on this ________

day of ________________________, ___________.

__________________________________________ My commission expires:_____________

Notary Public