The RPD-41289 form plays a pivotal role for employers in New Mexico aiming to avail themselves of the high-wage jobs tax credit, a benefit established to encourage the creation of well-paying jobs within the state. As delineated in the documentation, this form is integral for employers to certify the wages and benefits disbursed to eligible employees during a specific period that qualifies for this tax credit. The meticulous completion of the RPD-41289 entails confirming the eligibility of both the job position and the employee occupying it, ensuring that the employment meets the salary threshold set forth by the program—differentiated by geographical location within New Mexico. Employers seeking this tax credit must first fill out the RPD-41288 to apply, thereafter attaching an RPD-41289 for each qualifying employment instance within the claimed period. The amount of credit calculated—up to a $12,000 cap per qualifying period—reflects a percentage of the total eligible wages and benefits paid. Moreover, the submission process, including necessary certifications and verifications, underscores the state's commitment to integrity and compliance in disbursing tax credits. Broadly, the form not only serves as a financial mechanism for rewards but also exemplifies New Mexico's strategy to bolster high-wage employment, underscoring pertinent instructions, definitions, and the significance of adherence to eligibility requirements.

| Question | Answer |

|---|---|

| Form Name | Form Rpd 41289 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | rpd41289 high wage jobs tax credit form |

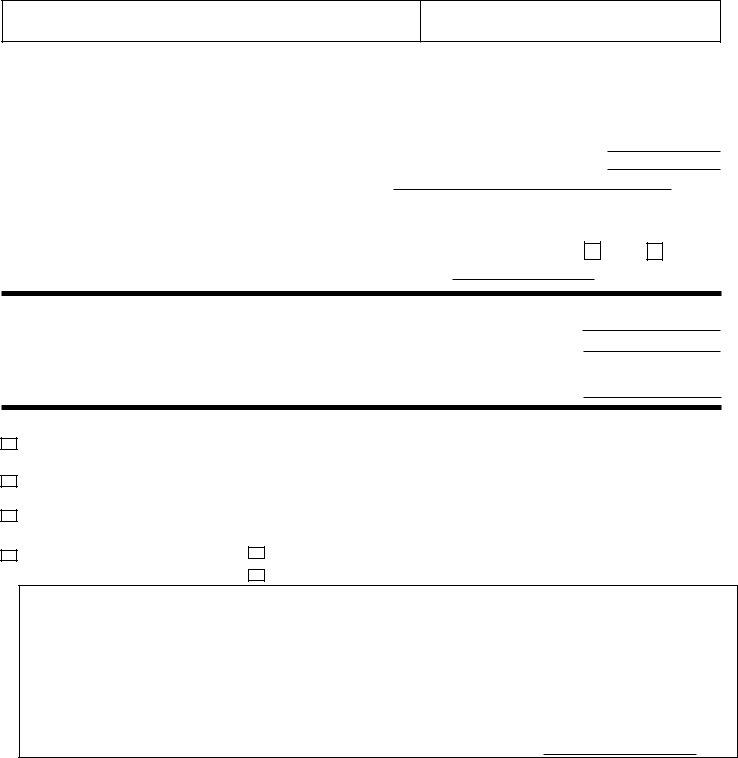

State of New Mexico - Taxation & Revenue Department

CERTIFICATE OF ELIGIBILITY FOR THE

Who Must File.

How to File. To apply for the

Name of eligible employer

New Mexico CRS identification number

Qualification verification

1. |

The date the qualifying job was created: |

|

|

Job Title: |

|

|

|

|

|

|

|

2. |

Name of eligible employee: |

|

|

|

|

|

Last 4 digits of SSN: |

|

|

||

3. |

The current qualifying period for this qualifying job is: |

|

|

|

through |

|

|||||

|

|

|

|

|

|

|

|

||||

4.The total number of employees with

5.The total number of employees with

6.The number of qualified periods previously claimed for this job:

7.During the current qualifying period, the employee listed on Line 2 was paid wages of $40,000 or more if the qualifying job was located in Albuquerque, Las Cruces, Rio Rancho, Roswell, or Santa Fe, or the employee was paid wages of $28,000 or more if the qualifying job was

located anywhere else in New Mexico. Mark one. |

YES |

No |

8. Enter a unique number identifying this qualifying job. See instructions.

Compute the

9.Total eligible wages and benefits paid to the eligible employee during this period were:

10.Multiply Line 9 by 0.10 (10%).

11.Enter the lesser of Line 10 or $12,000. The

$

$

$

I certify that: (Mark the boxes that apply and complete the required information.) |

|

|

|

|

12. the person employed in this qualified period is a New Mexico resident and meets the |

|

|

|

|

definition of eligible employee as defined in |

|

|

|

|

13. wages and benefits paid to the eligible employee during this qualified period were: |

$ |

|

||

pursuant to Paragraphs (1), (2), and (3) of 26 U.S.C. Section 51(c). |

|

|

|

|

14. the number of weeks during the qualifying period that the position was occupied by |

|

|

|

|

the employee named on this certificate: |

|

|

|

|

15. the qualifying job is located:

in Albuquerque, Las Cruces, Rio Rancho, Roswell, or Santa Fe anywhere else in New Mexico

Under penalty of perjury I declare that I have examined this claim, and to the best of my knowledge and belief it is true, correct and complete.

Signature of claimant |

|

|

|

|

Date |

|

||

Subscribed and sworn before me this |

|

day of |

|

|

, 20 |

|

||

Notary Public |

|

My commission expires |

State of New Mexico - Taxation & Revenue Department

CERTIFICATE OF ELIGIBILITY FOR THE

INSTRUCTIONS

ABOUT THIS CREDIT: Eligible employers may earn the high- wage jobs tax credit for each qualifying

HOW TO COMPLETE THIS FORM: Complete all information requested. Enter the name and the New Mexico CRS identifica- tion number of the employer. This must be the same name and number on Form

Tax Credit.

Qualification verification.

1. Enter the date the qualifying job was created. The job must be created between 7/1/04 and 6/30/15.

2. Enter the name of the eligible employee occupying the qualifying job. If more than one employee occupied the qualifying job during the current qualifying period, complete a separate Form

3. Enter the qualifying period for which this credit is claimed. See the definition of “Qualifying Period” on this page.

4. Enter the total number of employees with qualified

5. Enter the total number of employees with qualified

6. Enter the number of previous qualified periods claimed for this job. The

7. To qualify for the credit, the eligible employee must receive wages for the qualifying period of at least:

•$40,000 or more if the qualifying job is located in Albu- querque, Las Cruces, Rio Rancho, Roswell or Santa Fe, or

•$28,000 or more if the qualifying job is located anywhere else in New Mexico.

8. Enter a unique

Compute the

9. Enter the total wages and benefits paid to the eligible employee during this qualified period.

10. Multiply Line 9 by 0.10 (10%), and enter here.

11. Enter the lesser of Line 10 or $12,000. If more than one qualified employee occupied this job during this period, adjust the amount on Line 11 so that the total credit claimed for qualified employees during this period does not exceed $12,000. A certificate of eligibil- ity for each employee in a qualified job during the qualified period must be included on the same Form

Certifications.

To qualify for the

12. Certify that the employee who is occupying the job during this period meets the definition of “eligible employee” below.

13. Certify the amount of wages paid to the eligible employee oc- cupying the qualifying job for the qualified period.

14. Certify the number of weeks the employee occupied this job during this qualified period. If less than 48 weeks, write the name of the other employee(s) occupying this job during this period. The total weeks the job was occupied during this period must total 48 weeks. A certificate of eligibility for each qualified employee during the qualified period must be attached and included on the same

Form

15. Certify whether the job is performed or based at a location in Albuquerque, Las Cruces, Rio Rancho, Roswell or Santa Fe, or at a location in New Mexico other than these municipalities.

This form must be signed and notarized. Attach the completed certificate to Form

Section, P.O. Box 630, Santa Fe, NM

IMPORTANT: The Department may require you to furnish additional documentation to verify eligibility.

DEFINITIONS:

“Eligible Employee” means any New Mexico resident employed by an eligible employer other than an individual who:

a.bears any of the relationships described in Paragraphs (1) through (8) of the 26 U.S.C. Section 152(a) to the employer or, if the employer is a corporation to an individual who owns, directly or indirectly, more than 50% in value of the outstanding stock of the corporation or, if the employer is an entity other than a corporation to an individual who owns, directly or indirectly, more than 50% of the capital and profits interest in the entity;

b.if the employer is an estate or trust, is a grantor, beneficiary or fiduciary of the estate or trust, or is an individual who bears any of the relationships described in Paragraphs (1) through (8) of 26 U.S.C. Sec- tion 152(a) to a grantor, beneficiary or fiduciary of the estate or trust;

c.is a dependent, as that term is described in 26 U.S.C. Sec- tion 152(a)(9), of the employer or, if the taxpayer is a corporation of an individual who owns, directly or indirectly, more than 50% in value of the outstanding stock of the corporation or, if the employer is an entity other than a corporation of an individual who owns, directly or indirectly, more than 50% of the capital and profits interest in the entity or, if the employer is an estate or trust of a grantor, beneficiary or fiduciary of the estate or trust, or

d.is working or has worked as an employee or as an inde- pendent contractor for an entity that directly or indirectly owns stock in a corporation of the eligible employer or other interest of the eligible employer that represents 50% or more of the total voting power of that entity or has a value equal to 50% or more of the capital and profits interest in the entity.

“Qualifying Period” means the 12 months beginning on the day an eligible employee begins working in a new

See

liability”.