Using PDF forms online can be a piece of cake using our PDF tool. Anyone can fill in rr certificate pdf here painlessly. Our editor is consistently evolving to grant the very best user experience possible, and that's thanks to our resolve for continual enhancement and listening closely to customer feedback. Should you be looking to begin, here's what it takes:

Step 1: Click the "Get Form" button above on this webpage to access our PDF tool.

Step 2: With this handy PDF editing tool, you'll be able to do more than merely fill out blank fields. Express yourself and make your forms seem high-quality with customized text added, or fine-tune the file's original input to perfection - all that comes along with the capability to insert any photos and sign the PDF off.

This document will require particular data to be typed in, thus be sure you take some time to type in what's asked:

1. Fill out the rr certificate pdf with a group of necessary blanks. Collect all of the information you need and make certain there's nothing omitted!

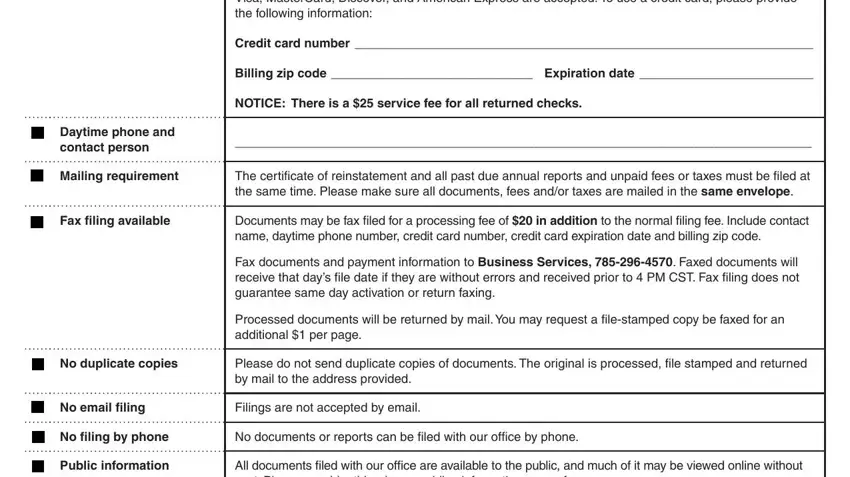

2. Soon after the previous selection of blanks is filled out, proceed to type in the applicable details in these: Note The certificate of, Business entity IDfile, number Not FEIN Federal Employer, Name of corporation, Must match name on record with the, a State or foreign country, of organization, b Date the original articles of, Secretary of State, Kansas corporations only foreign, Month, Day, Year, Name of resident, and agent and address of registered.

Always be really careful while filling in Must match name on record with the and a State or foreign country, since this is the part in which many people make errors.

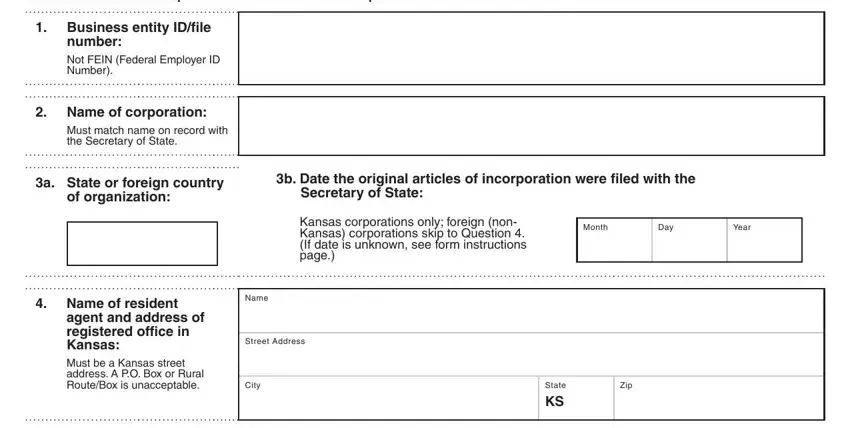

3. This step is normally simple - complete every one of the empty fields in Mailing address, Attention Name, Address will be used to send, Address, City, State, Zip, Country, a This statement only applies to, The corporations articles of, b This statement only applies to, The corporations articles of, Month, Day, and Year in order to finish this part.

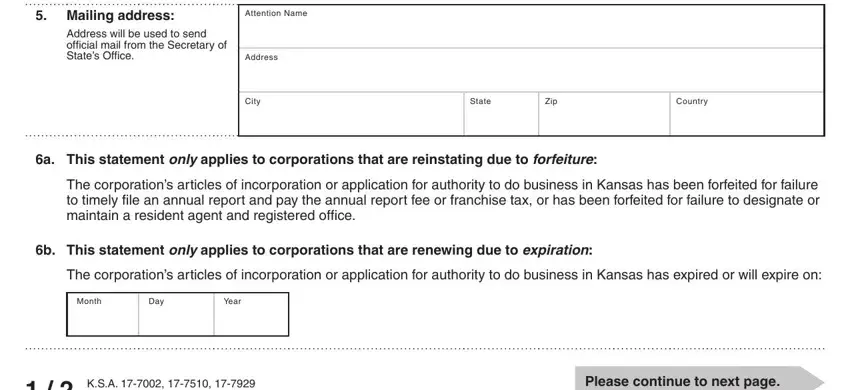

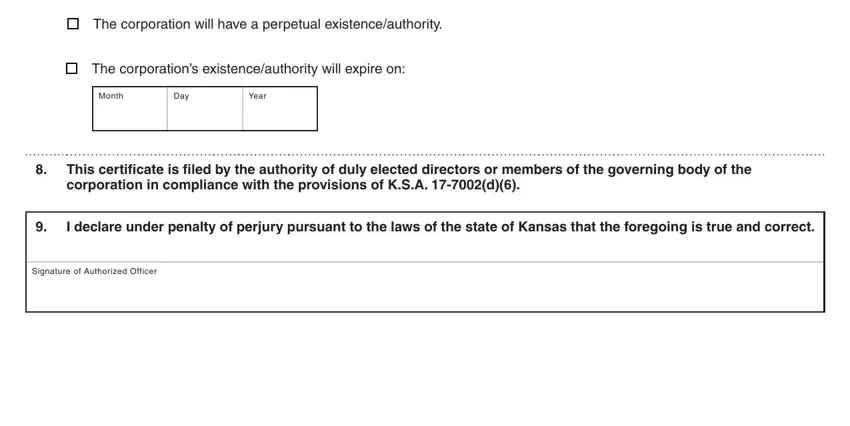

4. This particular paragraph comes next with the next few blank fields to focus on: Duration of corporation upon, o The corporation will have a, o The corporations, Month, Day, Year, This certificate is filed by the, corporation in compliance with the, I declare under penalty of perjury, and Signature of Authorized Officer.

Step 3: Reread the information you have typed into the form fields and then click on the "Done" button. Sign up with FormsPal now and immediately gain access to rr certificate pdf, ready for downloading. All adjustments you make are saved , allowing you to change the document later as needed. FormsPal guarantees protected document completion devoid of data recording or sharing. Rest assured that your data is secure with us!