Navigating the complexities of quarterly tax and wage reporting in Florida necessitates familiarity with several essential forms, one of which is the Rt 6A Florida form. This form serves as an Employer's Quarterly Report Continuation Sheet, a crucial document for businesses that must file quarterly reports with the Florida Department of Revenue. Employers are mandated to submit these reports irrespective of their employment activity or whether taxes are owed. A distinctive feature of the Rt 6A form is its use of Social Security numbers (SSNs) as unique identifiers for the administration of Florida’s taxes. While the inclusion of SSNs underscores the importance of privacy and confidentiality, the Florida Department of Revenue assures that these numbers are used strictly for tax administration purposes. Statutory protections under sections 213.053 and 119.071, Florida Statutes, safeguard the confidentiality of SSNs, preventing their disclosure as public records. The form also outlines that the collection of SSNs is authorized under both state and federal laws, with further details on privacy rights accessible through the department's website. The Rt 6A form not only facilitates the detailed reporting of employees' wages and taxable wages but also emphasizes the first $7,000 of income paid to each employee within a calendar year as taxable, highlighting specific regulatory thresholds for tax responsibilities. Understanding the form's intricacies, from accurately reporting employee information to calculating taxable wages, is essential for compliance with Florida's tax laws and for ensuring the thorough and confidential treatment of sensitive information.

| Question | Answer |

|---|---|

| Form Name | Form Rt 6A Florida |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | florida quarterly report, florida form rt 6a, employer quarterly report, florida quarterly tax payments |

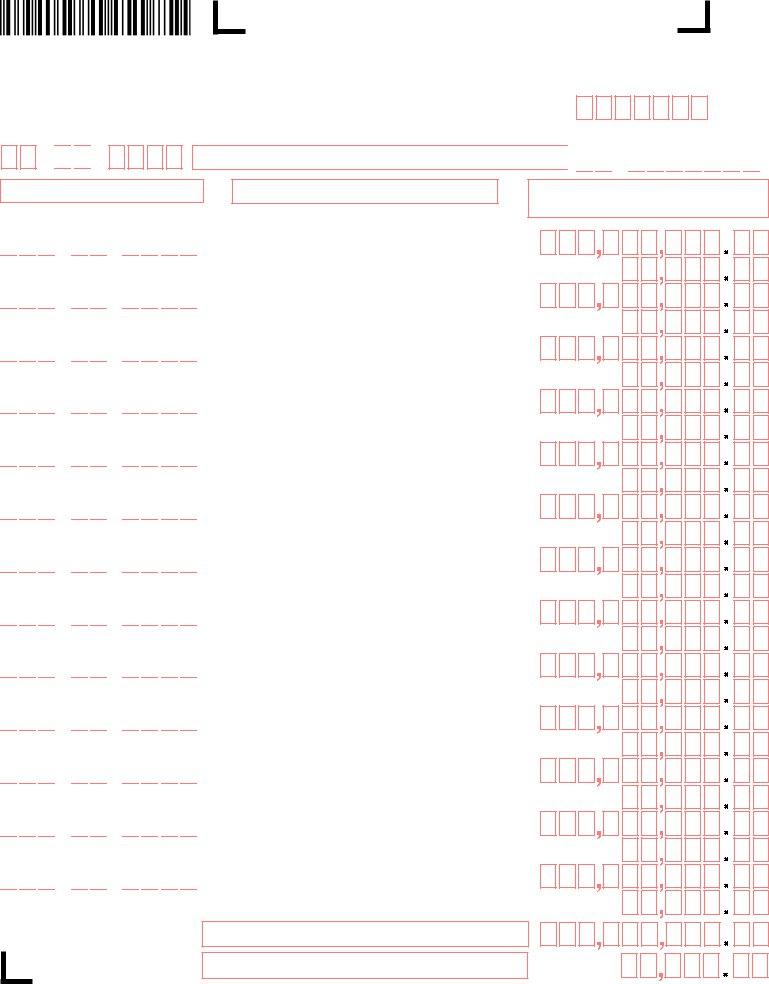

Florida Department of Revenue

Employer’s Quarterly Report Continuation Sheet

Employers are required to ile quarterly tax/wage reports regardless of employment activity or whether any taxes are due.

Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identiiers for the administration of Florida’s taxes. SSNs

obtained for tax administration purposes are conidential under sections 213.053 and 119.071, Florida Statutes, and not subject to disclosure as public RT ACCOUNT NUMBER records. Collection of your SSN is authorized under state and federal law. Visit our website at www.mylorida.com/dor and select “Privacy Notice” for

more information regarding the state and federal law governing the collection, use, or release of SSNs, including authorized exceptions.

QUARTER ENDING |

EMPLOYER’S NAME |

F.E.I. NUMBER |

/ /

-

10. EMPLOYEE’S SOCIAL SECURITY NUMBER

- -

- -

- -

- -

- -

- -

- -

- -

- -

- -

- -

- -

- -

TC

Rule

Florida Administrative Code

Effective Date 11/14

11. EMPLOYEE’S NAME (please print irst twelve characters of last name and irst eight characters of irst name in boxes)

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

13a. Total Gross Wages (add Lines 12a only). Total this page only. Include this and totals from additional pages in Line 2 on page 1 of the

13b. Total Taxable Wages (add Lines 12b only). Total this page only. Include this and totals from additional pages in Line 4 on page 1 of the

12a. EMPLOYEE’S GROSS WAGES PAID THIS QUARTER

12b. EMPLOYEE’S TAXABLE WAGES PAID THIS QUARTER

Only the irst $7,000 paid to each employee per calendar year is taxable.