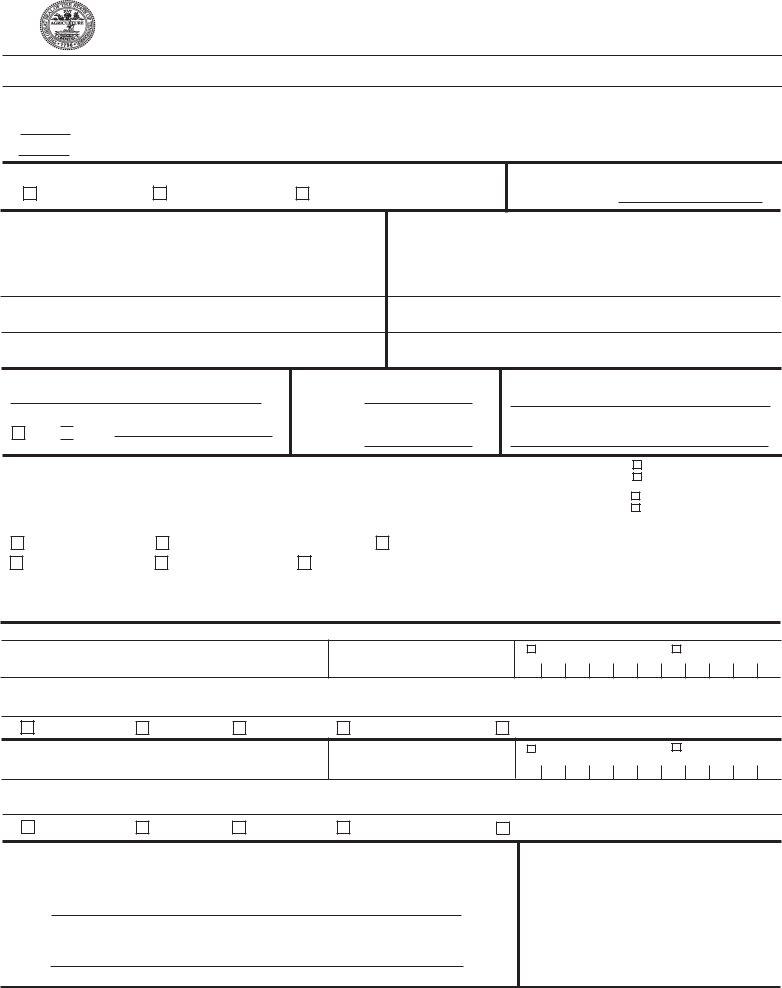

Entrepreneurs and business owners looking to establish or expand their operations within the Town of Smyrna, Tennessee, need to familiarize themselves with the RV-F1321001 form, a crucial document required for obtaining a business tax license. This comprehensive application mandates thoroughness in its completion, with sections that cover various critical facets of the business, such as the classification of business activity, which is essential for tax purposes. These classifications range from 1A to 5, determined by the dominant business activity, ensuring that businesses are taxed appropriately based on their primary operations. The form also addresses several reasons for applying, including starting a new business, adding a location, or purchasing an existing business. Moreover, it requires detailed information about the business, like the start date, physical and mailing addresses, contact details, type of ownership, and a description of business activities. Additionally, it probes into more specific data such as the Federal Employer's Identification Number (FEIN), sales tax number, and the legal structure of the company. Prospective or existing business owners must also provide personal details of owners, partners, or officers and swear to the truthfulness of the provided information by signing the form. For those seeking guidance on completing the form, instructions are outlined to assist in determining the correct classification and filling out the various sections accurately. This attention to detail ensures that businesses comply with local tax regulations from the outset, laying a solid foundation for their operational legality and fiscal responsibilities.

| Question | Answer |

|---|---|

| Form Name | Form Rv F1321001 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | RV-F1321001, EIN, TENNESSEE, business license tn |

Town of Smyrna

APPLICATION FOR BUSINESS TAX LICENSE 315 South Lowry Street

Smyrna, TN 37167

ALL QUESTIONS MUST BE ANSWERED COMPLETELY. INCOMPLETE AND UNSIGNED APPLICATIONS WILL DELAY PROCESSING. FOR ASSISTANCE, PLEASE CONTACT YOUR LOCAL COUNTY CLERK OR DESIGNATED CITY OFFICIAL.

1.INDICATE THE CLASSIFICATION IN WHICH YOU ARE REGISTERING. CLASSIFICATION IS DETERMINED BY THE DOMINANT BUSINESS ACTIVITY. INDICATE ONLY ONE CLASSIFICATION.

Classification 1A |

|

|

Classification |

1C |

|

|

Classification |

2 |

|

|

|

Classification |

4 |

||

|

|

|

|

|

|

||||||||||

Classification 1B |

|

|

|

Classification |

1D |

|

|

|

Classification |

3 |

|

|

|

Classification |

5 |

2. REASON FOR APPLYING:

1. New business |

2. Additional location |

3. Purchase of existing business

3.DATE BUSINESS BEGAN IN TENNESSEE AT THIS LOCATION:

4. |

BUSINESS NAME AND EXACT LOCATION |

5. |

BUSINESS MAILING ADDRESS |

BUSINESS NAME |

NAME (ENTER LEGAL NAME, IF DIFFERENT) |

||

|

|

||

STREET OR HIGHWAY (DO NOT USE P.O. BOX NUMBER OR RURAL ROUTE NUMBER) |

P.O. BOX, STREET, ROUTE, OR HIGHWAY |

||

APARTMENT OR SUITE NUMBER (DO NOT ENTER P.O. BOX OR RURAL ROUTE NUMBER)

APARTMENT OR SUITE NUMBER

CITY |

STATE |

ZIP CODE |

CITY |

STATE |

ZIP CODE |

6.COUNTY IN WHICH BUSINESS IS LOCATED

IS BUSINESS LOCATED INSIDE A TENNESSEE CITY?

NO YES

(If Yes, Name of City)

7.BUSINESS TELEPHONE NUMBER

( )

BUSINESS FAX NUMBER

( )

8.CONTACT PERSON’S NAME

CONTACT

9. |

ENTER FEDERAL EMPLOYER'S IDENTIFICATION # |

|

|

|

|

|

|

|

|

|

|

|

|

APPLIED FOR |

|

|

|

|

|

|

|

|

|

|

|

|

NOT REQUIRED |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

CURRENT SALES TAX NUMBER FOR THIS BUSINESS LOCATION |

|

|

|

|

|

|

|

|

|

|

|

APPLIED FOR |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

NOT REQUIRED |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. TYPE OF OWNERSHIP (SELECT ONE): |

|

|

12. TENNESSEE SECRETARY OF STATE |

|

|

||

|

PROPRIETORSHIP |

HUSBAND/WIFE OWNERSHIP |

OTHER |

|

IDENTIFICATION #, IF APPLICABLE |

|

|

|

|

|

|

|

|

||||

|

PARTNERSHIP |

CORPORATION |

LIMITED LIABILITY COMPANY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13.DESCRIBE THE BUSINESS ACTIVITY AT THIS LOCATION, STATING THE MAJOR PRODUCTS AND/OR SERVICES SOLD:

14.IDENTIFY OFFICERS, PARTNERS, OR INDIVIDUAL OR COMPANY OWNERS

(1) NAME

HOME TELEPHONE #

SOCIAL SECURITY #

FEDERAL EIN

HOME ADDRESS (DO NOT USE P.O. BOX #) |

CITY |

STATE |

ZIP CODE |

Member

Officer

Partner

Owner - Individual

Owner - Company

(2) NAME

HOME TELEPHONE #

SOCIAL SECURITY #

FEDERAL EIN

HOME ADDRESS (DO NOT USE P.O. BOX #) |

CITY |

STATE |

ZIP CODE |

Member

Officer

Partner

Owner - Individual

Owner - Company

15.THE STATEMENTS MADE ON THIS APPLICATION ARE TRUE TO THE BEST OF MY KNOWLEDGE AND BELIEF. (THIS APPLICATION MUST BE SIGNED BY THE INDIVIDUAL OWNER, A PARTNER,

OR AN OFFICER OF THE CORPORATION. THE SIGNATORY MUST ALSO BE LISTED IN ITEM 14.)

SIGN

HERE:

SIGNATURE OF OWNER, PARTNER, OR OFFICER (DO NOT PRINT OR USE STAMP)

TITLE |

DATE |

FOR OFFICIAL USE ONLY

Class _____________________

License # __________________

Account # __________________

Date ______________________

Amount Due: $15.00

CODES: Zoning approved by: _____________________________________

INTERNET

APPLICATION FOR BUSINESS TAX LICENSE

INSTRUCTIONS

1.Select the classification under which your dominant business activity falls. “Dominant business activity” means the business activity that is the major and principal source of taxable gross sales of the business. If you need assistance in determining the appropriate business tax classification, please ask your county clerk or the designated city business tax official. You may also wish to refer to the document “Determining Your Business Tax Classification,” which is available at tn.gov/revenue.

2. Select the reason for which the application is being filed - new business, additional location, or the purchase of an existing business.

3. Enter the date on which the applicant began or will begin conducting business activities at the location for which registration is being made.

4.Enter the name and exact location address of the business being registered. Include the business name, street address, city, state, and zip code.

5.Enter the mailing address of the business being registered. Enter the legal name (if different from location name), street address or post office box number, city, state, and zip code. If the legal name and mailing address are identical to the information in Item 4, leave Item 5 blank.

6.Enter the name of the county in which the business is located. Indicate whether the business is located within the limits of a city in the county. If the business is located within the limits of a city, enter the name of the city. Note: A business located within the limits of a city may have a business tax obligation for both the county and the city. If so, the business must obtain a business license from both the county and the city.

7.Enter the telephone number and, if applicable, the fax number of the business being registered.

8.Enter the name of a contact person for the business being registered. Enter the contact person’s email address.

9.Enter the Federal Employer’s Identification Number (FEIN) of the business being registered. If the business has applied for but not received an FEIN, so indicate. If no FEIN is required, so indicate.

10.If the business being registered currently has a sales and use tax account with the Tennessee Department of Revenue, enter the sales and use tax account number. If the business has applied for but not received a sales and use tax account number, so indicate. If no sales or use tax account number is required, so indicate.

11.Select the legal structure type of the business being registered.

12.Enter the Tennessee Secretary of State identification number of the business being registered, if applicable.

13.Enter a description of the business activities being performed by the business at the location being registered. Indicate the main products and services sold at this business location. Please be as detailed as possible.

14.Enter the names, home addresses, and home telephone numbers of two owners, officers, or partners in the business being registered. If the owner is an individual, enter the owner’s social security number and check the appropriate box. If the owner is a business entity, enter the owner’s FEIN and check the appropriate box. Finally, check the box to indicate whether the person is an individual or business entity owner, partner, officer, or member. This information is critical. It will allow us to identify persons with whom we may discuss the business tax account when needed.

15.The application must be signed by an individual owner, partner, or officer of the business being registered. The person who signs the application must be listed in Item 14 on the application form. Indicate the title of the person signing the application (i.e., owner, partner, officer) and the date on which the application is signed.

INTERNET