By using the online PDF editor by FormsPal, you'll be able to fill in or change Form Rv F1406301 right here. To retain our editor on the cutting edge of efficiency, we aim to put into action user-oriented capabilities and improvements regularly. We're at all times thankful for any suggestions - play a vital role in revolutionizing PDF editing. It just takes a couple of easy steps:

Step 1: First, access the pdf tool by pressing the "Get Form Button" above on this page.

Step 2: With the help of this handy PDF editing tool, you're able to do more than merely complete blank fields. Try each of the functions and make your documents seem high-quality with custom text put in, or fine-tune the original content to excellence - all backed up by an ability to add any images and sign it off.

This PDF form needs some specific information; in order to guarantee consistency, make sure you adhere to the guidelines further down:

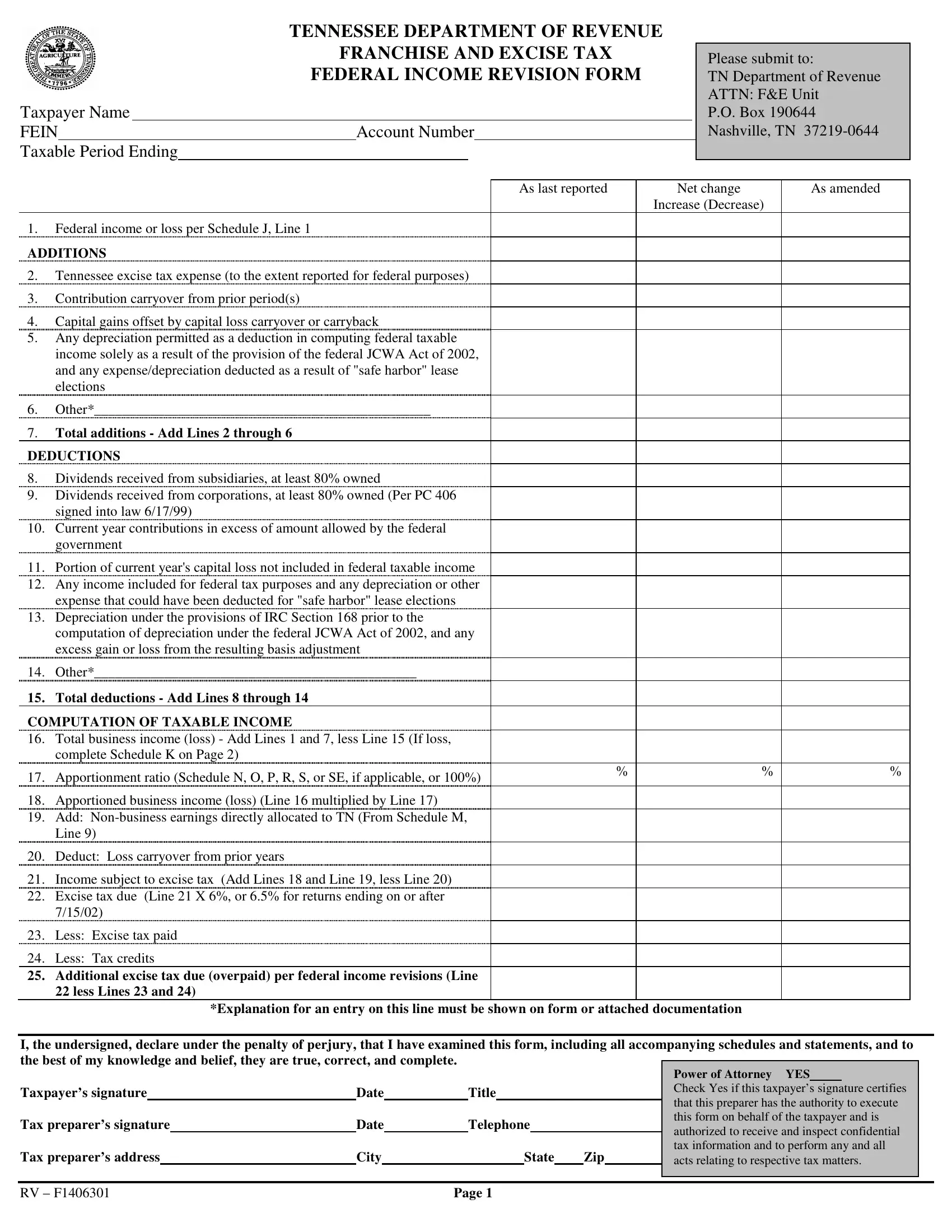

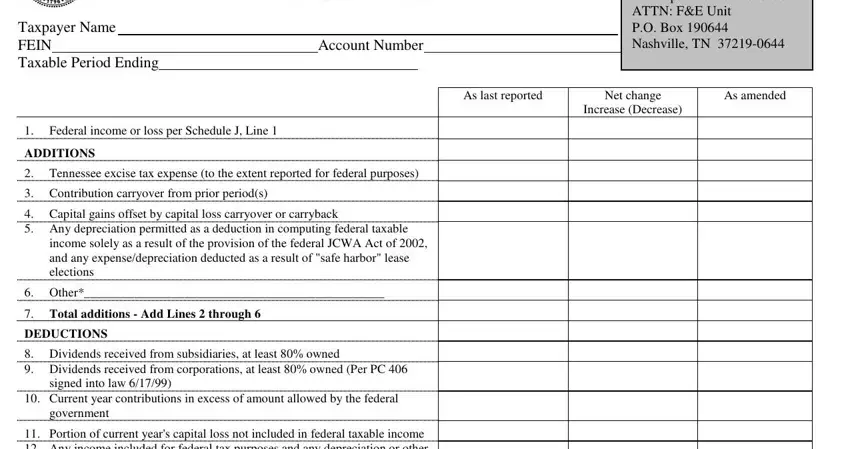

1. Whenever completing the Form Rv F1406301, make sure to include all of the needed blank fields in its associated section. It will help hasten the work, enabling your details to be handled swiftly and correctly.

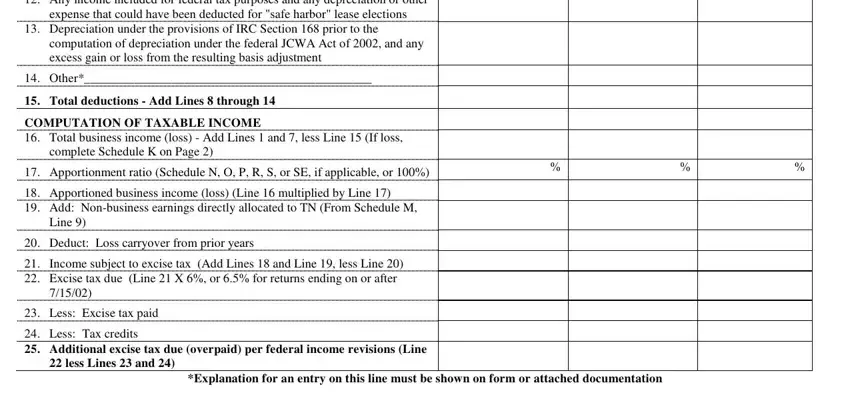

2. Once your current task is complete, take the next step – fill out all of these fields - Portion of current years capital, expense that could have been, Depreciation under the provisions, computation of depreciation under, Other, Total deductions Add Lines, COMPUTATION OF TAXABLE INCOME, complete Schedule K on Page, Apportionment ratio Schedule N O, Line, Deduct Loss carryover from prior, Less Excise tax paid Less Tax, less Lines and, and Explanation for an entry on this with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

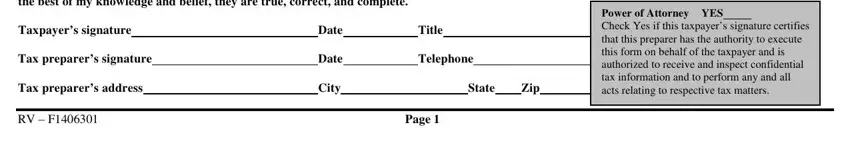

3. Your next part is normally hassle-free - complete every one of the form fields in I the undersigned declare under, Date, Title, Power of Attorney YES Check Yes if, Tax preparers signature, Tax preparers address, Date, City, Telephone, State, Zip, and RV F Page to complete this segment.

As for State and Zip, make sure you don't make any errors in this current part. These are the key fields in this page.

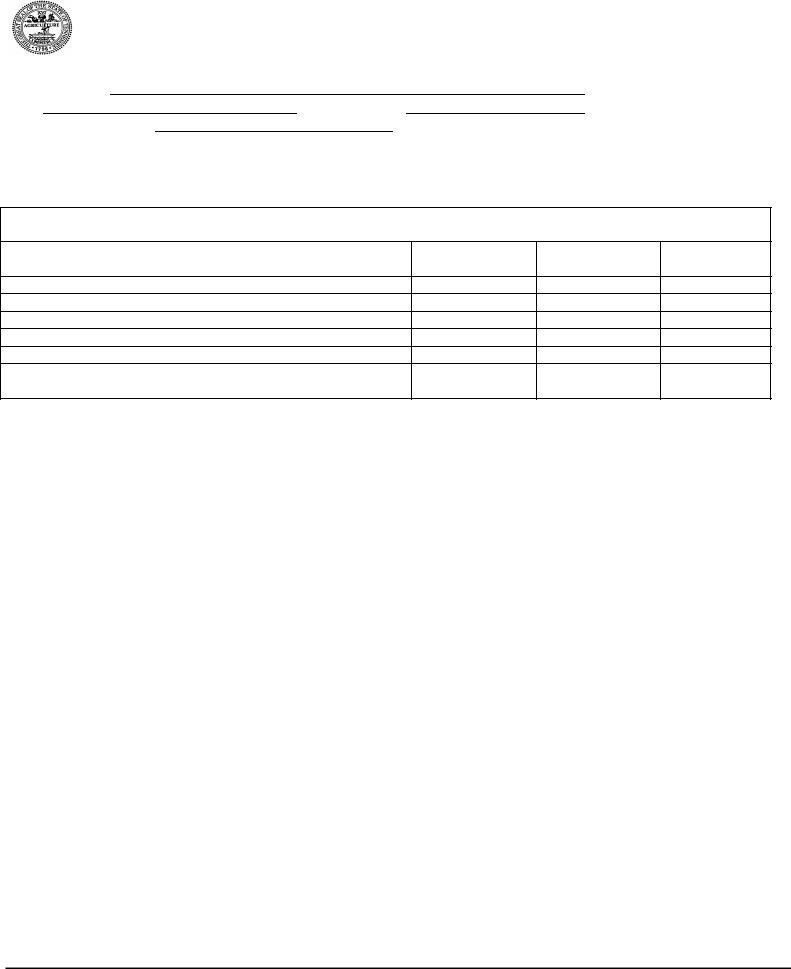

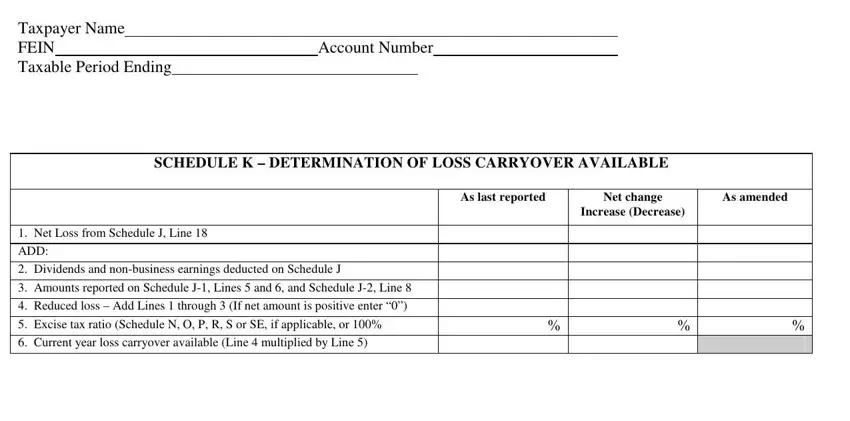

4. The following subsection needs your involvement in the following areas: Taxpayer Name FEIN Taxable Period, Account Number, SCHEDULE K DETERMINATION OF LOSS, As last reported, Net change, As amended, Increase Decrease, Net Loss from Schedule J Line, ADD, Dividends and nonbusiness, Amounts reported on Schedule J, Reduced loss Add Lines through, Excise tax ratio Schedule N O P R, and Current year loss carryover. Be sure to fill in all requested info to go forward.

Step 3: Make sure that the details are correct and click on "Done" to conclude the task. Right after creating afree trial account with us, you will be able to download Form Rv F1406301 or email it immediately. The document will also be accessible through your personal account menu with your every single change. FormsPal is committed to the personal privacy of all our users; we always make sure that all personal data entered into our editor is kept confidential.