The SA-44 form, a crucial document issued by the U.S. Census Bureau under the Department of Commerce, plays a pivotal role in the collection of data for the Annual Retail Trade Report. With its validity and urgency underscored by an OMB approval number and a stated expiration date, this form encapsulates a wide array of information essential for statistical purposes, ensuring confidentiality and legal protection for the respondents' information as mandated by Title 13, U.S. Code. Designed to cover all retail establishments under a given Employer Identification Number (EIN), the form includes but is not limited to sales data, e-commerce transactions, merchandise inventories, and methods of inventory valuation, further delving into specifics such as e-commerce sales and the period data covers. Retailers are required to provide detailed operating receipts, accounting for sales taxes forwarded to taxing authorities and distinguishing between different types of sales and inventory valuation methods, including the Last-In, First-Out (LIFO) approach. Furthermore, the form queries about purchases of merchandise for resale, aiming to understand the scale and sourcing of goods within the retail sector, alongside probing into the mechanisms and balances of customer credit, thereby offering a comprehensive snapshot of a retailer's fiscal health and operational dynamics for the year 2003.

| Question | Answer |

|---|---|

| Form Name | Form Sa 44 |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | expeditures, Jeffersonville, 2Aa, 2003 |

OMB No.

U.S. DEPARTMENT OF COMMERCE

Economics and Statistics Administration

U.S. CENSUS BUREAU

|

|

|

|

|

ME |

NT |

OF |

C |

|

|

|

|

|

|

|

T |

|

|

|

|

|

||

|

|

|

R |

|

|

|

O |

|

|

|

|

|

|

|

A |

|

|

|

|

M |

|

|

|

. |

D |

E |

P |

|

|

|

|

M |

|

FORM |

|

|

|

|

|

|

|

R |

|||||

|

|

|

|

|

|

|

E |

|

|||

S |

|

|

|

|

|

|

|

|

|

C |

|

. |

|

|

|

|

|

|

|

|

|

|

|

U |

|

|

|

|

|

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

U |

|

|

|

|

|

|

S |

||||

B |

|

|

|

|

|

|

|

|

|

||

|

|

R |

|

|

|

|

S |

U |

|

|

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

EN |

|

|

|

|

|

|

|

|

U |

O F THE |

C |

|

|

|

||

ANNUAL RETAIL TRADE REPORT

2003

DUE |

|

DATE |

|

NOTICE |

|

Bureau is confidential by law (Title |

|

13, U.S. Code). It may be seen only |

|

by persons sworn to uphold the |

|

confidentiality of Census Bureau |

|

information and may be used only for |

|

statistical purposes. The law also |

|

provides that copies retained in your |

|

files are immune from legal |

|

process. |

|

RETURN COMPLETED TO |

|

➥ U.S. CENSUS BUREAU |

|

1201 East 10th Street |

|

Jeffersonville, IN |

|

FAX |

|

Any questions call |

|

|

|

8:30 a.m. to 5:00 p.m. EST |

|

PROMPT RETURN WILL RESULT IN |

|

CONSIDERABLE SAVINGS TO YOUR |

|

GOVERNMENT. |

(Please correct any error in name, address, and ZIP Code) |

|

YOUR RESPONSE IS REQUIRED BY LAW. Title 13, U.S. Code, requires businesses and other organizations that receive this questionnaire to answer the questions and return the report to the Census Bureau.

GENERAL INSTRUCTIONS

Please read all instructions and complete all items in this report. If book figures are not available, carefully prepared estimates, labeled "Est." are acceptable.

This report should cover ALL retail establishments whose payroll was reported on the Employer’s Quarterly Federal Tax Return, Treasury Form 941, under the Employer Identification Number (EIN) shown in the address label (or as corrected in item 1A).

Data for auxiliary facilities operated under this EIN primarily engaged in furnishing supporting services to your retail establishments (such as warehouses, garages, central administrative offices, and repair services), should also be included in this report.

Data for retail establishments operated by other firms, such as franchises, should be excluded from this report.

For those establishments acquired or sold during 2003, only include data for the period they were operated by your firm.

Leased departments and concessions

1.Include in all items of this report, retail leased departments and concessions operated by this firm in establishments of others (e.g., shoe departments in department stores, prescription counters in food stores, gift shops in hotels, concession operations in sports stadiums) which report payroll under this firm’s current EIN shown in the address label (or as corrected in item 1A).

2.Exclude from all items of this report, departments and concessions operated by other firms in your retail stores.

SPECIAL INSTRUCTIONS

Item 1A FEDERAL EMPLOYER IDENTIFICATION NUMBER

021

Does your firm currently report payroll under the |

|

|

|

{ |

(1) |

Enter your present EIN |

||||

EIN shown in the address label? |

|

|

|

|||||||

|

|

|

|

|

||||||

020 1 |

|

YES — Go to item 1B |

|

|

2 |

|

NO |

(2) When did you start reporting payroll under |

||

|

|

|

|

|||||||

|

|

|

||||||||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

this EIN? |

|

–

Month |

Year |

022

Item 1B NUMBER OF RETAIL ESTABLISHMENTS

Enter the total number of retail establishments, including departments and concessions, covered by this report as of December 31, 2003.

Number as of

December 31, 2003

110

CONTINUE ON REVERSE SIDE

Page 2

Item 2A TOTAL SALES OF MERCHANDISE AND OTHER OPERATING RECEIPTS FOR 2003

See instruction sheet for detailed directions.

Book figures for the calendar year 2003 should be reported in items 2Aa through 2Ac below. If book figures for the calendar year are not available, carefully prepared estimates for the calendar year are preferable to book figures covering another period.

a.Sales of merchandise and other receipts for all retail establishments, departments, and concessions.

NOTE — Include excise taxes on sales of items such as gasoline, liquor, and tobacco. Include

Do not include in item 2Aa receipts collected from customers for carrying charges or other charges for credit or sales taxes which were forwarded directly to taxing authorities.

b.Did your firm collect sales taxes which were forwarded directly to taxing authorities?

NOTE — Do not include excise taxes reported in item 2Aa.

120 1 YES — Report the amount of such taxes collected.

2 NO

c.TOTAL sales of merchandise and other operating receipts including sales taxes collected and forwarded directly to taxing authorities —

Sum of items 2Aa and 2Ab

2003

Bil. |

Mil. |

Thou. |

Dol. |

100

$

102

$

103

$

Item 2B |

|

|

|

|

|||||||||

|

|

|

|

||||||||||

the buyer or price and terms of the sale are negotiated over an Internet, extranet, EDI network, electronic mail, |

|

|

|

|

|||||||||

or other online system. Payment may or may not be made online. |

|

|

|

|

|||||||||

|

2003 |

|

|||||||||||

a. Did your firm have |

|

|

|||||||||||

|

|

|

|

||||||||||

Bil. |

Mil. |

Thou. |

Dol. |

||||||||||

130 |

1 |

|

YES |

2 |

|

NO |

|||||||

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

113 |

|

|

|

|

b. |

$ |

|

|

|

|||||||||

sales taxes.) |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

Item 2C |

SALES REPORT PERIOD |

104 |

Month |

Day |

Year |

||||||||

a.Do the data reported in items 2A and 2B represent the calendar year (January 1 through December 31) for

2003? |

|

|

|

|

From |

|

|

|

|

||

|

|

105 |

|||

|

|

||||

121 1 |

|

YES — Go to item 3 |

|||

2 |

|

NO — Enter the period that the data represent. |

|

|

|

|

|

|

|

||

|

|

||||

To

Item 3 |

MERCHANDISE INVENTORIES (December 31) |

|

Report cost value of all merchandise. Cost figures for December 31 should be reported in items 3a through 3c. If book figures are not available, carefully prepared estimates of inventories for December 31 are preferable to book figures representing another date. For inventories at LIFO cost, report the LIFO amount plus the LIFO reserve.

Complete each item; enter "0" if none.

a.Merchandise in retail store(s), departments, and concessions . . . . . . . . . . .

b.Merchandise in warehouses, offices, or in transit for distribution to your retail outlet(s), including merchandise to be distributed to retail departments and concessions operated

by your firm in other establishments . . . . . . . . . . . . . . . . . . . . . . . . . .

c.TOTAL merchandise inventories —

Sum of items 3a and 3b

d.Are the data reported in items 3a through 3c for December 31?

2201 YES — Go to item 4

2 NO — Enter the date that the data represent.

Merchandise inventories at cost value

|

2003 |

|

|

|

2002 |

|

|

||

|

|

|

|

|

|

|

|

|

|

Bil. |

Mil. |

Thou. |

|

Dol. |

Bil. |

Mil. |

Thou. |

|

Dol. |

201 |

|

|

|

|

251 |

|

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

202 |

|

|

|

|

252 |

|

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

200 |

|

|

|

|

250 |

|

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

203 |

|

|

|

|

253 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

Day |

Year |

|

Month |

Day |

Year |

|

||

|

|

|

|

|

|

|

|

|

|

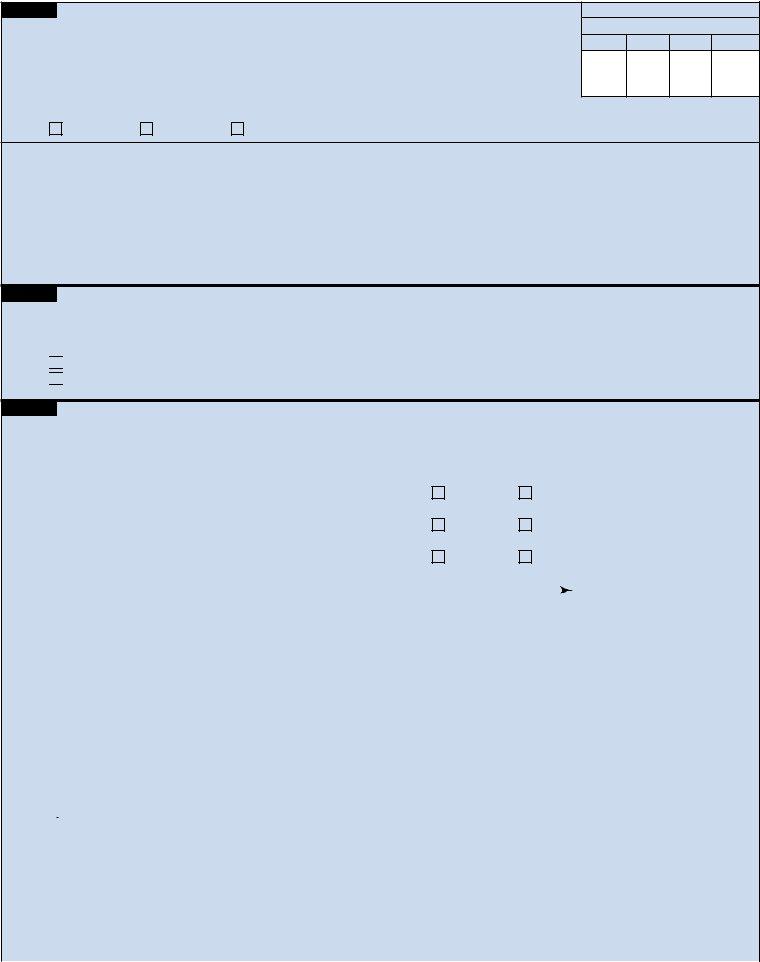

Item 4 INVENTORY VALUATION METHOD — See instruction sheet for detailed directions.

a.Were any of the inventories reported in item 3 above valued using the

305 1 YES2 NO

b.Amount of inventories in item 3c subject to LIFO — Exclude

LIFO reserve. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c.Amount of LIFO Reserve

for example,

valued at LIFO (i.e.,

d.Amount of total inventories subject to LIFO —

Sum of items 4b and 4c

e.Amount of total inventories in item 3c which was not subject to LIFO . . . . . .

NOTE

|

|

2003 |

|

|

2002 |

|

||

Bil. |

Mil. |

|

Thou. |

Dol. |

Bil. |

Mil. |

Thou. |

Dol. |

|

|

|

|

|

|

|

|

|

300 |

|

|

|

|

350 |

|

|

|

$ |

|

|

|

|

$ |

|

|

|

301 |

|

|

|

|

351 |

|

|

|

$ |

|

|

|

|

$ |

|

|

|

302 |

|

|

|

|

352 |

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

303 |

|

|

|

|

353 |

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

FORM

Page 3

Item 5 PURCHASES OF MERCHANDISE (AT COST)

See instruction sheet for detailed directions.

a.Report total cost of merchandise purchased for resale (net of returns, allowances, and trade and cash discounts), for which you took title during 2003 whether or not payment was made during the year. Exclude expeditures for supplies, equipment, and parts purchased for your company’s own use.

Purchases at cost value

2003

Bil. |

Mil. |

Thou. |

Dol. |

400

$

b.Were any of the goods purchased for resale in item 5a ordered over an Internet, extranet, EDI, or other online system?

405 1 |

|

YES |

2 |

|

NO |

3 |

|

DON’T KNOW |

DEFINITIONS OF ACCOUNTS RECEIVABLE

INSTALLMENT ACCOUNTS

CHARGE ACCOUNTS — Credit accounts for which full payment is scheduled to be made at the end of the customary billing period.

PLEASE READ THE INSTRUCTIONS ABOVE BEFORE ANSWERING ITEM 6B.

Item 6A ACCOUNTS RECEIVABLE BALANCES

Does this company extend credit to customers at any of its retail establishments or departments and concessions covered by this report?

NOTE — Exclude credit which may have originated at this firm, but is actually provided by others, such as banks, finance companies, oil or other credit card issuing companies.

520 1 YES

2 NO

Item 6B UNPAID BALANCES FOR ALL RETAIL ESTABLISHMENTS COVERED BY THIS REPORT

|

|

|

|

|

|

|

|

|

|

|

|

Balances outstanding as of — |

|

|||||

Type of account |

|

|

|

|

|

|

|

|

|

December 31, 2003 |

|

|||||||

Mark (X) one box for each line to indicate type of credit account carried. |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

Bil. |

|

Mil. |

Thou. |

Dol. |

|

|||||

1. INSTALLMENT ACCOUNTS |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

501 |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) |

521 |

1 |

|

YES |

2 |

|

NO |

$ |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

502 |

|

|

|

|

|

|

(b) |

522 |

1 |

|

YES |

2 |

|

NO |

$ |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

503 |

|

|

|

|

|

|

2. CHARGE ACCOUNTS |

523 |

1 |

|

YES |

2 |

|

NO |

$ |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

500 |

|

|

|

|

|

|

3. Total — Sum of lines 1(a), 1(b), and 2 |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REMARKS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

962 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CENSUS USE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

961 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Public reporting burden for this collection of information is estimated to average 24 minutes per response, including the time for assembling data from existing records and completing the form. Send comments regarding this burden estimate or any other aspect of this collection of information, including suggestions for reducing this burden, to: Paperwork Project

Item 7 |

CERTIFICATION |

|

||||

Name and |

Address — Number and street, city, State, ZIP Code |

954 |

Telephone |

|

||

regarding this report – Print or type |

951 |

|

|

|

|

|

|

Area code |

Number |

Extension |

|||

950 |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

955 |

Fax number |

|

|

|

|

|

|

|

|

|

|

|

|

Area code |

Number |

|

Signature of authorized person |

Title |

Date |

|

|||

|

|

|

||||

|

|

952 |

953 |

|

|

|

|

|

|

|

956 Internet address (firm’s homepage) |

||

|

|

|

|

http:// |

|

|

|

|

|

|

|

|

|

FORM