Within the intricate webs of the tax system, the SC3911 form surfaces as a beacon for those navigating the often tumultuous seas of tax refunds in South Carolina. Crafted by the South Carolina Department of Revenue, this form, officially known as the Refund Tracer, plays a pivotal role for taxpayers who find themselves in the peculiar position of not receiving their expected tax refund. With its inception rooted in the legislative soil as far back as July 1995, its continuity into the present day underscores its importance. Taxpayers are implored to exhibit patience, allowing a minimum of ten weeks for the processing of their returns prior to initiating inquiry via this form. The SC3911 demands meticulous attention to detail in furnishing personal information, a reflection of one's tax return, and covers scenarios ranging from unissued to lost, stolen, or destroyed refund checks. The completion and submission of this document trigger a thorough examination by the Department, aiming to rectify any discrepancies and ensure that taxpayers receive their rightfully owed refunds. Instructions embedded within the form caution against common pitfalls that lead to delays, such as errors in the filing process or insufficient documentation, thus painting a picture of a procedural safeguard designed to navigate the complexities of tax refund issuance. Mailed to a specific address at the SC Department of Revenue, the resolution of the taxpayer's issue hinges on the successful completion and evaluation of the SC3911, making it an indispensable tool in the arsenal of South Carolina's taxpaying populace.

| Question | Answer |

|---|---|

| Form Name | Form Sc3911 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | sc3911 refund tracer sc form |

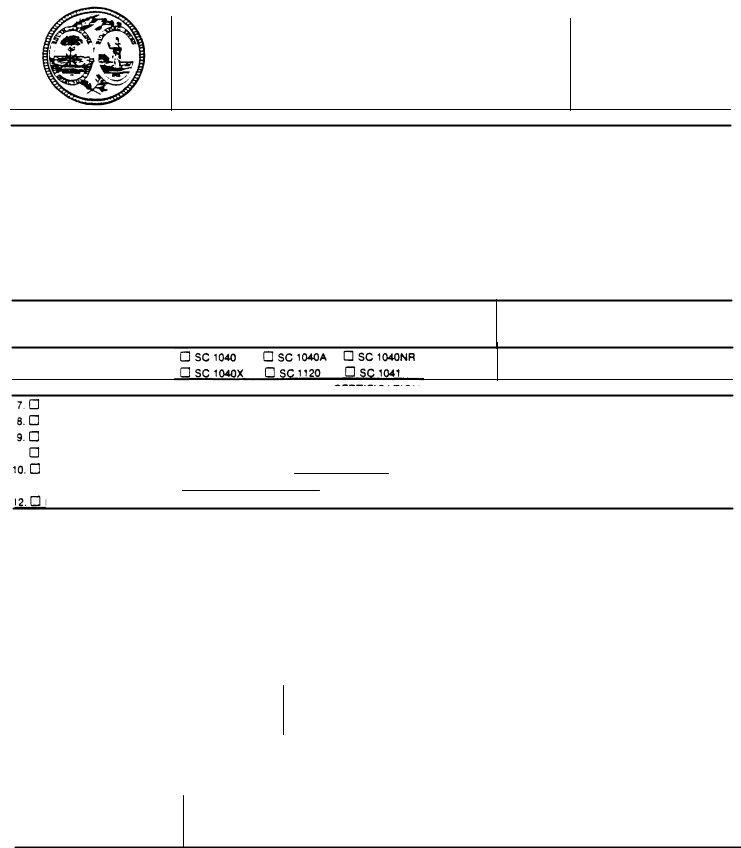

STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE

REFUND TRACER

9 0

S C 3 9 1 1

(REV. 7/95) 3101

PLEASE ALLOW AT LEAST TEN WEEKS TO PROCESS A RETURN BEFORE FILING THIS FORM!

PLEASE PRINT NAMES AND ADDRESSES, INCLUDING ZIP CODE. EXACTLY AS SHOWN ON YOUR TAX RETURN. IF A JOINT OR COMBINED RETURN, SHOW THE NAMES OF BOTH HUSBAND AND WIFE ON LINES 1 AND 2 BELOW.

1. |

YOUR NAME |

|

2. SPOUSE'S NAME (IF A NAME IS ENTERED HERE.SPOUSE SHOULD |

SIGN ON LINE 16.) |

|

|

|

|

|

3. |

STREET |

CITY |

STATE |

ZIP CODE |

|

|

|||

IF YOU HAVE MOVED SINCE FILING YOUR RETURN, YOUR PRESENT MAILING ADDRESS, INCLUDING ZIP CODE. |

|

|||

4. STREET |

CITY |

STATE |

ZIP CODE |

|

IF YOU WISH, PLEASE GIVE A PHONE NUMBER WHERE YOU CAN BE REACHED BETWEEN 8:30 A.M. AND 5:00 P.M. INCLUDE AREA CODE.

AREA CODE |

Number |

5. KIND OF RETURN FILED

6. TAX PERIOD ENDED

CERTIFICATION

I DID NOT RECEIVE A TAX REFUND CHECK.

I RECEIVED A TAX REFUND CHECK, BUT IT WAS [] LOST [] STOLEN [] DESTROYED.

I HAVE RECEIVED CORRESPONDENCE ABOUT THIS RETURN. (PLEASE ATTACH A COPY, IF POSSIBLE.)

I HAVE NOT RECEIVED CORRESPONDENCE ABOUT THIS RETURN.

AMOUNT OF REFUND SHOWN ON RETURN: $

11.DATE I FILED THE RETURN:

IF THE DEPARTMENT OF REVENUE CANNOT LOCATE THE CHECK. I REQUEST PAYMENT BE STOPPED AND A NEW CHECK ISSUED.

|

|

PLEASE WRITE YOUR NAMES BELOW EXACTLY AS THEY WERE WRlTTEN ON THE RETURN. IF THIS CHECK WAS A REFUND ON A |

|||||||||

|

|

JOINT OR COMBINED RETURN. THE SIGNATURES O F BOTH HUSBAND AND WIFE ARE NEED ED BEFORE THE C LAIM |

|

CAN BE PROCESSED |

|

||||||

|

|||||||||||

|

|

|

13. YOUR SIGNATURE |

14. DATE |

|

|

15. YOUR SOCIAL SECURITY NO. |

||||

|

|

INDIVIDUAL RETURN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16. SPOUSE’S SIGNATURE |

|

|

|

17. SPOUSES SOCIAL SECURITY NO. |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. SIGNATURE OF PERSON AUTHORIZED TO SIGN |

19. TITLE |

|

|

|

|

|||

|

|

ALL OTHER RETURNS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(CORPORATION, TRUST, ETC.) |

20. DATE |

|

21. EMPLOYER IDENTIFICATION NO. |

|

|

|

|

|

|

|

|

|

|

t |

|

|

|

|

|

|

|

|

|

|

DESCRIPTION OF CHECK (FOR OFFICE USE ONLY) |

|

|

|

|

||||

|

|

FILE NUMBER |

DATE OF SEARCH |

|

AMOUNT OF REFUND |

REFUND CHECK NUMBER |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

DATE ON REFUND CHECK

I

REMARKS:

PLEASE ALLOW AT LEAST TEN WEEKS T0 PROCESS A RETURN BEFORE FILING THIS FORM

Delays are caused by (1) filing improper income tax form (2)attaching improper wage and tax statement (3) the failure to attach a copy of the other state’s income tax return when claiming a tax credit. Any errors found when processing the income tax return will cause further delay in issuing a refund check.

If your return has been filed and you have failed to receive your refund within the time limit, as stated, a record search will be made upon request. Complete this form, furnishing the required data. A reply will be made advising you of the results of the record search.

Mail the completed form to: SC DEPARTMENT OF REVENUE

Income Tax

Columbia, SC