When it comes to the intricacies of tax documentation for fiduciaries and partnerships in South Carolina, the SC8736 form plays a pivotal role. As detailed by the State of South Carolina Department of Revenue, this form is essentially a request for extension of time to file a return, covering the fiscal period from 2005 to 2006 or other applicable taxable years. This vital document caters to both fiduciaries, through the SC1041 form, and partnerships via the SC1065, indicating a flexibility designed to address the diverse needs of its filers. What makes SC8736 particularly important is its provision for taxpayers who estimate owing taxes yet require additional time beyond the typical April 15 deadline to organize their returns. Fulfilling such a request necessitates a careful estimation of taxes owed, adequate payment of at least 90% of said estimated tax to avoid penalties, and adherence to specific filing instructions to ensure the request is processed smoothly. Additionally, the form outlines how to claim credit for payments made when the actual tax return is filed, highlighting the SC Department of Revenue’s effort to streamline tax compliance. The form also touches upon consequences for failure to pay the estimated tax amount by the deadline, detailing interest and penalty charges, thereby emphasizing the financial responsibility taxpayers hold in the extension process. In essence, the SC8736 form is a crucial tool for fiduciaries and partnerships in South Carolina, offering a lifeline to those needing extra time to fulfill their tax obligations while underlining the importance of accurate and timely tax payments.

| Question | Answer |

|---|---|

| Form Name | Form Sc8736 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | SC4868, nonresident, 15th, form sc8736 |

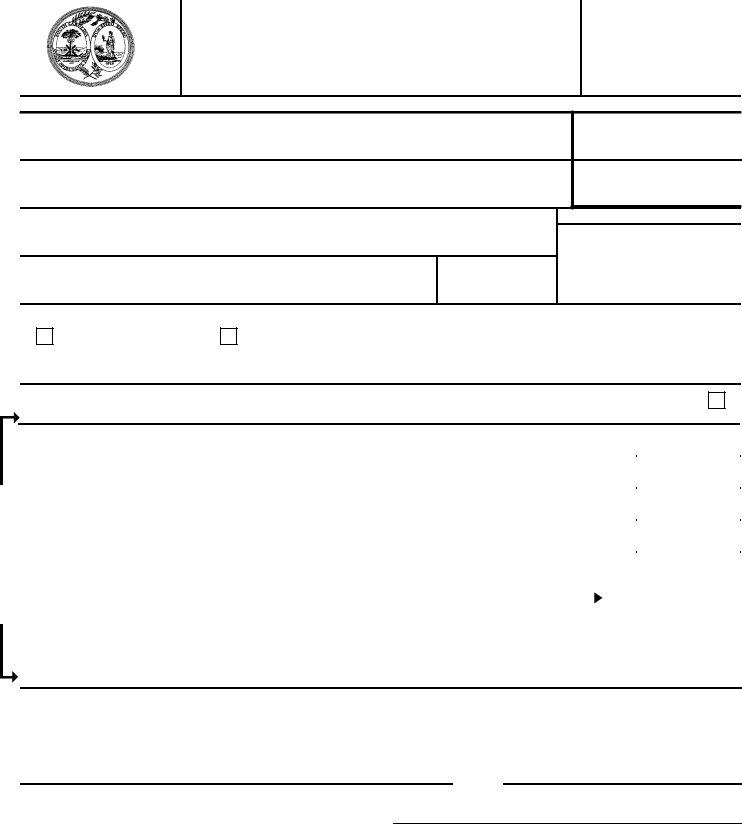

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

REQUEST FOR EXTENSION OF TIME

TO FILE SOUTH CAROLINA RETURN FOR FIDUCIARY AND PARTNERSHIP

SC8736

(Rev. 8/30/05)

3390

2005

Or other taxable year beginning |

, 2005 and ending |

, 2006 |

Name

SC File number, if any

Present home address (number and street, or P. O. Box)

Employer Identification number

City, State and ZIP code

Do not write in this space - OFFICE USE

Area Code Daytime telephone

County code number

This application is a request for extension of time to file the following return:

FIDUCIARY

SC1041

PARTNERSHIP

SC1065

STAPLE PAYMENT HERE

Check this box if this will be your first time filing a return in South Carolina. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PART I. |

|

|

|

|

|

|

|

1. |

Total state income tax |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

1. |

$ |

|

|

2. |

Payments on declaration of estimated tax |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 |

$ |

|

|||

3. |

Tax credits |

. . . . |

3 |

$ |

|

||

4. |

Total credits (add lines 2 and 3) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 |

$ |

|

|||

5. |

Balance due (subtract line 4 from line 1). |

BALANCE |

|

|

|

|

|

|

|

|

|

||||

|

Pay in full with this form |

DUE |

|

5 |

|

$ |

|

|

. . |

|

|

||||

Make check or money order payable to :

SC DEPARTMENT OF REVENUE

(Partnerships enter on line 5 the estimated amount required to be withheld on income of nonresident partners)

PART II.

A COPY OF THIS FORM PLUS ANY ADDITIONAL EXTENSION MUST BE ATTACHED TO YOUR FINAL RETURN WHEN FILED.

NOTE: This extension cannot be processed without proper SC file number or EIN.

Date

Signature

Prepared by:

Mail To: SC DEPARTMENT OF REVENUE |

INCOME TAX COLUMBIA SC |

SC8736 |

SC8736 INSTRUCTIONS

A.WHO MAY FILE: This application can be used by the following:

1.a partnership filing an SC1065

2.a fiduciary filing an SC1041

Mark the appropriate box on the front of this form to indicate the type of extension being requested.

If you estimate that your SC income tax return will show a tax balance due, you are required to file a SC extension form and pay all taxes due by the due date of the return (generally April 15). To avoid the failure to pay penalty, you must pay at least 90% of the tax due by this date.

The extension must be properly signed.

To request an extension of time for a partnership, submit this form stating the reason(s) for the extension of time and the number of days. EACH partner must prepare and submit a SC4868 in order to obtain an extension of time for the individual return. NOTE: At the time of the final approval of this form, the Internal Revenue Service (IRS) was considering the approval of a single six month extension to October 15. If the IRS approves this extension, you will have the same amount of time to file your SC return. No additional extension would be required.

REMINDERS:

See SC1065 and instructions for information on the requirement by partnerships to pay withholding tax on South Carolina taxable income of nonresident partners.

Refunds cannot be issued from the SC1065. An overpayment must be claimed and refunded at the partner level.

B.WHEN TO FILE: File this application ON OR BEFORE April 15th, or before the original due date of your fiscal year return. If the due date for filing your return falls on a Saturday, Sunday, or legal holiday, substitute the next regular working day.

C.HOW AND WHERE TO FILE: File the original SC8736 with the SC Department of Revenue and pay the amount on line 5, Part I. Attach a copy to the back of your return when it is filed. Retain a copy of this form for your records. Your tax return may be filed any time prior to the expiration of the extension.

D.HOW TO CLAIM CREDIT FOR PAYMENT MADE WITH THIS APPLICATION ON YOUR RETURN: Show the amount paid with this application on the appropriate line of your tax return. Correct identification numbers in the spaces provided on all forms are very important!

E.COMPUTE AMOUNT DUE WITH EXTENSION:

LINE 1. Enter the amount of income tax you expect to owe for the current tax year (the amount you expect to enter on the tax return, when you file). Be sure to use good judgement in estimating the amount you owe. To avoid the failure to pay penalty, you must pay at least 90% of the tax due by April 15, and pay the balance due when you file your return within the extended time period.

LINE 5. An extension of time to file your tax return will NOT extend the time to PAY your income tax. Therefore, you must PAY IN FULL WITH THIS FORM the amount of income tax shown on line 5, Part I, page 1. Make your check payable to the "SC Department of Revenue". Write your file number and/or EIN and "2005 SC8736" on the payment.

Staple payment to the front of this form in the indicated area.

F. INTEREST AND PENALTY FOR FAILURE TO PAY TAX: The extension of time to file your South Carolina tax return granted by this application DOES NOT extend the time for payment of tax. Any unpaid portion of the final tax due will bear interest at the prevailing federal rates.This amount is computed from the original due date of the tax return to the date of payment. In addition to the interest, a penalty at the rate of 1/2% per month to maximum of 25% must be added when the amount remitted with the extension fails to reflect at least 90% of the tax due by April 15. The penalty will be imposed on the difference between the amount remitted with the extension and the tax to be paid for the period.

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form, if you are an individual. 42 U.S.C 405(c)(2)(C)(i) permits a state to use an individual's social security number as means of identification in administration of any tax. SC Regulation

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the Department of Revenue is limited to the information necessary for the Department to fulfill its statutory duties. In most instances, once this information is collected by the Department, it is protected by law from public disclosure. In those situations where public disclosure is not prohibited, the Family Privacy Protection Act prevents such information from being used by third parties for commercial solicitation purposes.