Navigating the complexities of wage garnishment in West Virginia necessitates a deep understanding of specific forms like the SCA M 641 1, a critical document for enforcing judgments related to salary and wages. This form, integral within the Magistrate Court system, is fundamental when a creditor seeks to garnish a debtor's earnings to satisfy an outstanding judgment. The procedure outlined in the SCA M 641 1 form ensures that a portion of the debtor's salary is directed towards the unpaid balance, including principal, interest, and any additional execution costs as awarded by the court. Employers, upon receiving this suggestee execution notice, are mandated to withhold a particular fraction of the debtor's wages, adhering strictly to state and federal guidelines to compute the withholding amount. This process not only safeguards the creditor's rights but also provides a structured pathway for debt repayment, with specific instructions for both private and public employers on how periodically to remit the withheld amounts. Additionally, the form extends critical information to the judgment debtor, elucidating their rights including exemptions they might be eligible for, thereby encouraging a fair and transparent garnishment process. Hence, the SCA M 641 1 form represents a crucial link between judgment enforcement and the respect of individual financial boundaries as dictated by law.

| Question | Answer |

|---|---|

| Form Name | Form Sca M 641 1 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | wv suggestee exectuion, suggestee, wv suggestee executin, wv suggestee wages |

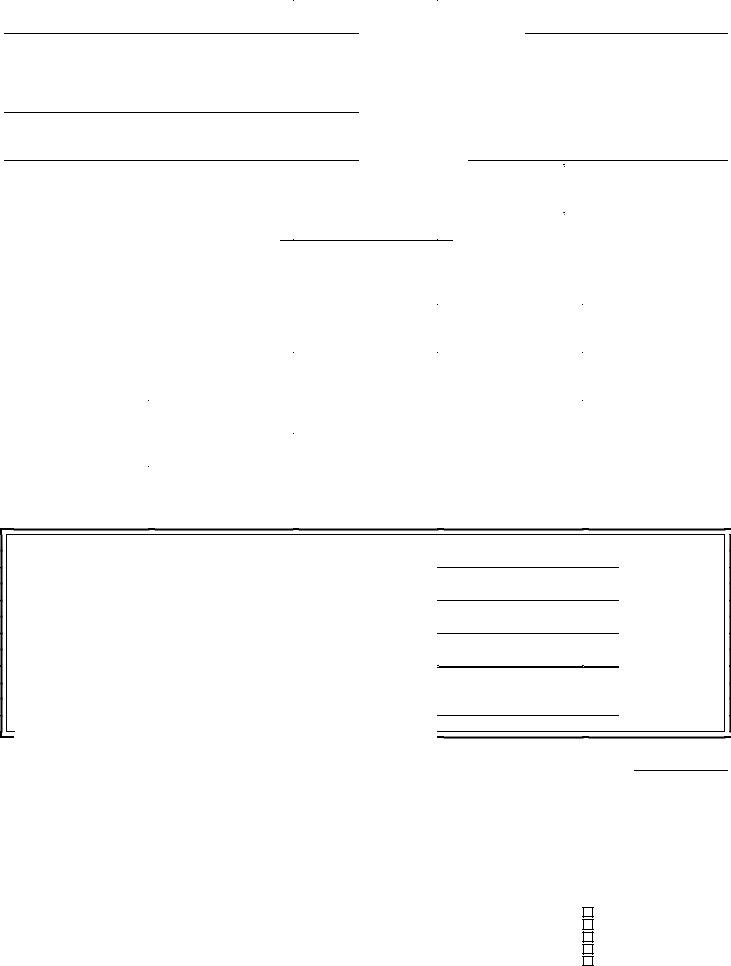

IN THE MAGISTRATE COURT OF |

|

COUNTY, WEST VIRGINIA |

Case No.

Plaintiff v.

Defendant

Name of Judgment Debtor subject to this suggestee execution |

|

Judgment Debtor s Social Security No. |

|

|

|

Address |

|

Judgment Debtor s Date of Birth |

|

|

|

|

|

|

SUGGESTEE EXECUTION |

|||

|

|

|

|

|

|

[Garnishment of Salary and Wages] |

|||

TO: |

|

|

|

|

|

|

|||

|

Name of Employer |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Address of Employer |

|

|

|

|

|

|

||

|

On |

|

|

|

, a money judgment was awarded to |

|

|||

as judgment creditor , in the amount of $ |

|

|

|

, with interest from the date of judgment at the rate of |

|

||||

percent per year, plus $ |

|

|

in costs. The current unpaid balance of the judgment, with any partial payments applied |

||||||

to reduce accrued interest, then to reduce the judgment principal, is:

Unpaid Principal |

$ |

|

Unpaid Interest |

|

|

Unpaid Costs |

|

|

Costs of this Execution (if costs awarded in judgment) |

|

|

TOTAL |

$ |

|

|

||

|

|

|

|

|

|

with additional interest to accumulate on the unpaid principal from the date of this suggestee execution at the rate of percent per year.

You are hereby notified that this suggestee execution constitutes a lien for the above amount upon the salary and wages due or to become due to the above named judgment debtor within one year of the issuance of this suggestee execution.

You are hereby ordered to withhold from the wages of the judgment debtor for each pay period the lessor of:

(1)20 percent of the judgment debtor s wages after deductions of all state and federal taxes, or

Page 1 of 2 |

Return

Employer

File

Defendant

Plaintiff

SUGGESTEE EXECUTION, Case No.

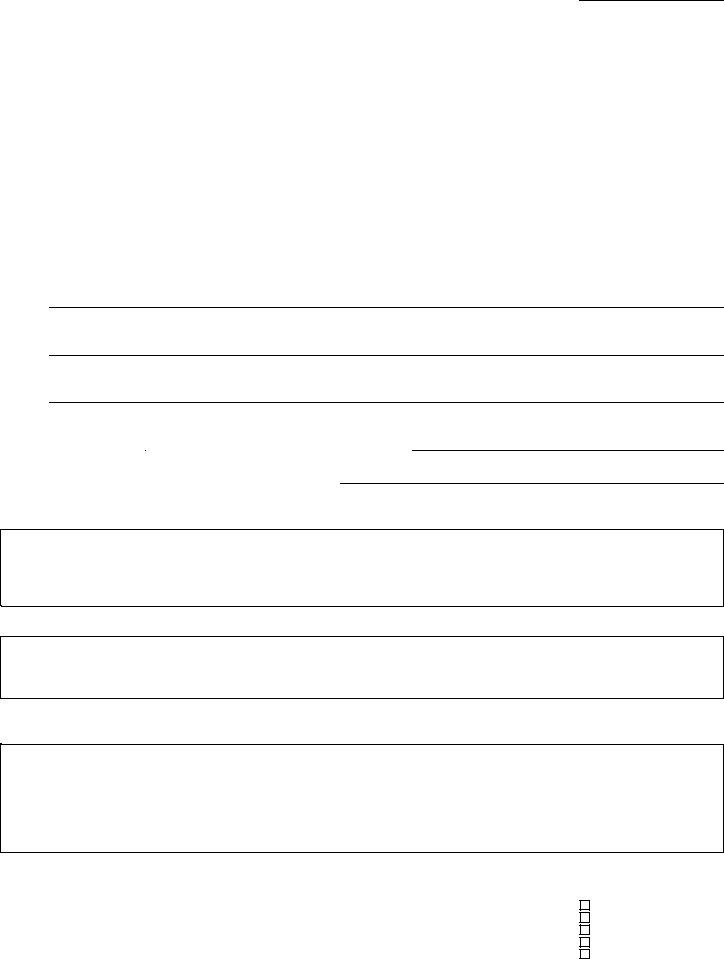

(2)the amount of the judgment debtor s wages, after deductions of all state and federal taxes, that for each week exceeds 30 times the federal minimum hourly wage.

(If the judgment debtor s wages, after deducting state and federal taxes, do not exceed 30 times the federal minimum hourly wage, then no amount shall be withheld.)

Withholding shall continue until one year from the date of issuance of this suggestee execution, unless the above judgment, interest and costs are sooner satisfied or this suggestee execution is sooner released.

Remittance:

Private employers. During the course of this suggestee execution, once every 90 days the amount withheld should be paid to the judgment creditor or to the sheriff for delivery to the judgment creditor.

Public employers. During the course of this suggestee execution, once every 90 days the amount withheld should be paid the clerk, or if served by the sheriff, to either the clerk or the sheriff for delivery to the judgment creditor.

Name of judgment creditor/judgment creditor s attorney

Address of judgment creditor/judgment creditor s attorney

Date: |

|

Magistrate Court Clerk: |

Date and hour of mailing of certified copy to judgment debtor:

INSTRUCTIONS TO SHERIFF: Service of this suggestee execution may not be made upon the employer herein until the expiration of 5 days from the date and hour of mailing a certified copy to judgment debtor (by clerk) as set forth above.

NOTICE TO EMPLOYER: Failure to withhold wages as directed may result in the employer becoming liable for the amount that should have been withheld.

NOTICE TO JUDGMENT DEBTOR: Some or all of your wages subject to withholding under this order may be exempt from withholding under state and federal law. If you wish to claim exemptions, you must do so promptly by filing an affidavit of exemption with the clerk before each pay period and request that the clerk issue a temporary release of this exemption. An affidavit form may be obtained from the clerk. You may wish to consult a lawyer regarding your exemption rights.

W.VA. Code §§

Page 2 of 2 |

Return

Employer

File

Defendant

Plaintiff