sd100x 2019 can be filled in online very easily. Just try FormsPal PDF editor to complete the task in a timely fashion. FormsPal team is always working to enhance the editor and ensure it is even easier for users with its handy functions. Uncover an ceaselessly innovative experience now - check out and uncover new opportunities along the way! Starting is effortless! Everything you need to do is follow these easy steps below:

Step 1: Open the form in our tool by hitting the "Get Form Button" above on this webpage.

Step 2: With the help of this advanced PDF tool, it is possible to do more than simply complete blank form fields. Edit away and make your documents appear perfect with customized textual content added, or optimize the file's original input to perfection - all that comes with an ability to insert your own pictures and sign the document off.

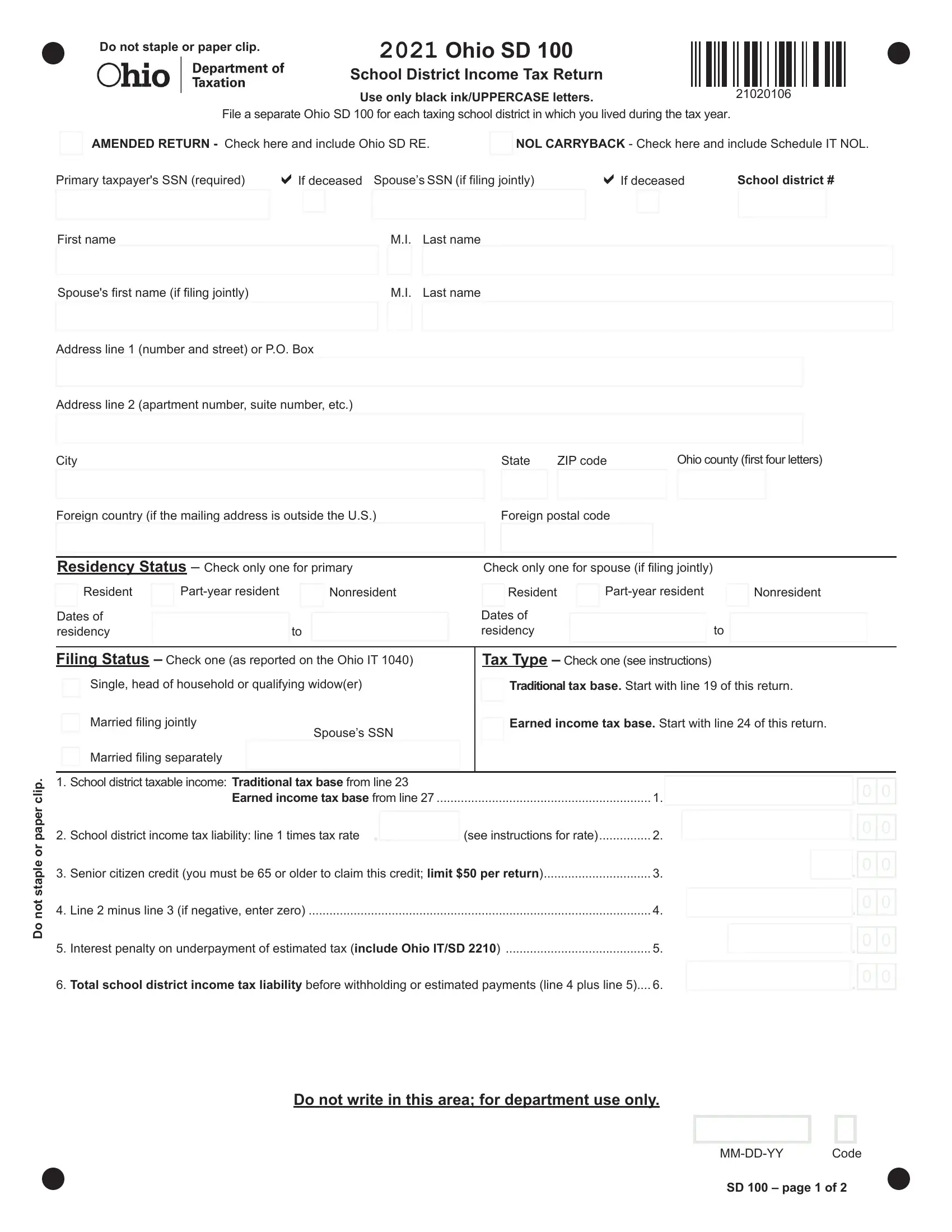

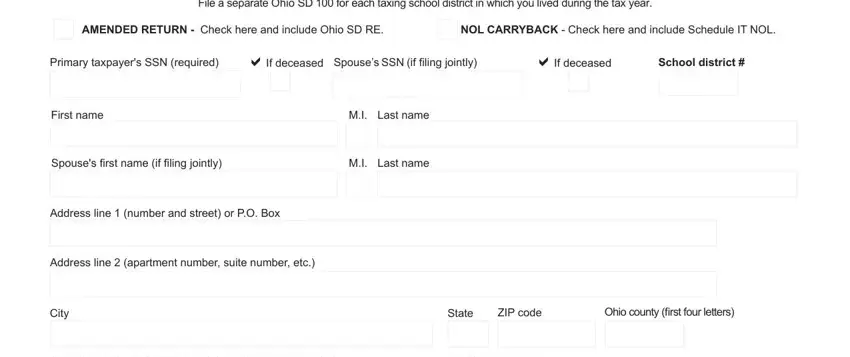

To be able to complete this document, make sure that you enter the necessary information in each and every area:

1. Fill out the sd100x 2019 with a group of essential blanks. Get all the required information and ensure there's nothing omitted!

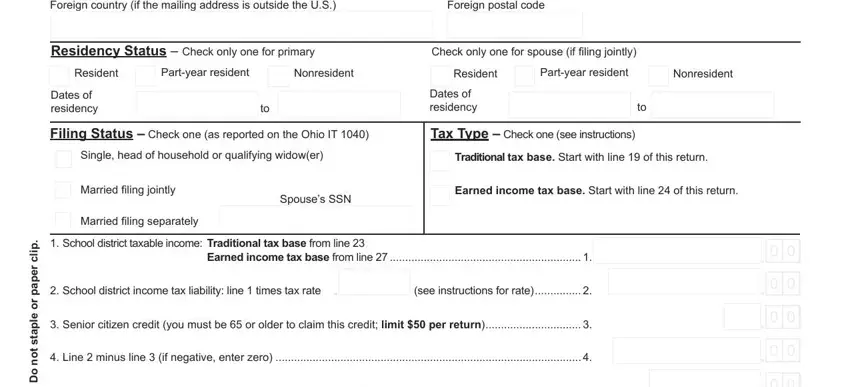

2. Soon after filling in the last section, go on to the subsequent part and fill out the essential details in all these blank fields - Foreign country if the mailing, Foreign postal code, Residency Status Check only one, Check only one for spouse if, Resident, Partyear resident, Nonresident, Resident, Partyear resident, Nonresident, Dates of residency, Dates of residency, Filing Status Check one as, Tax Type Check one see, and Single head of household or.

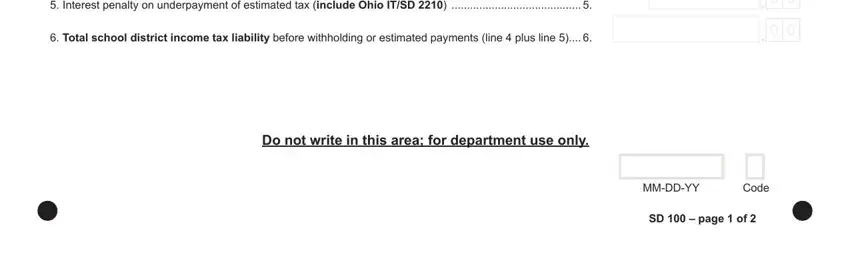

3. In this particular stage, take a look at Interest penalty on underpayment, Total school district income tax, Do not write in this area for, MMDDYY, Code, and SD page of. Each one of these must be taken care of with highest precision.

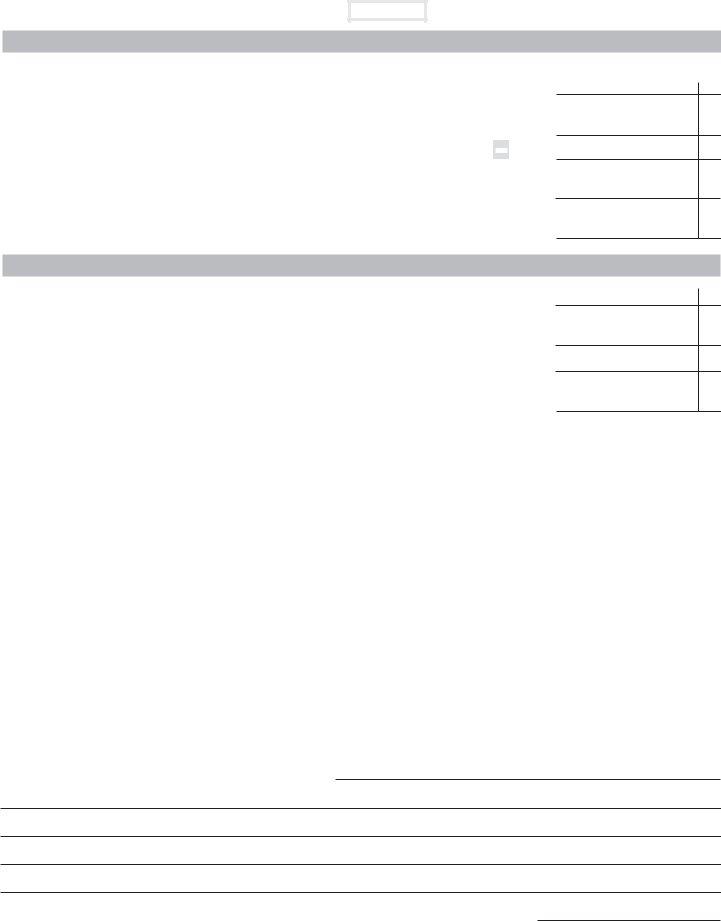

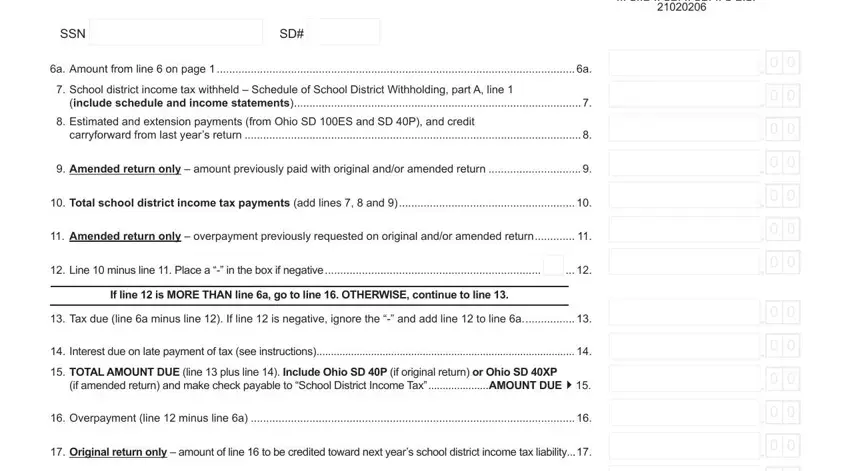

4. The following subsection requires your involvement in the following places: SSN, a Amount from line on page a, School district income tax, include schedule and income, Estimated and extension payments, carryforward from last years, Amended return only amount, Total school district income tax, Amended return only overpayment, Line minus line Place a in the, If line is MORE THAN line a go to, Tax due line a minus line If, Interest due on late payment of, TOTAL AMOUNT DUE line plus line, and if amended return and make check. Be sure that you enter all of the requested info to move forward.

It is easy to make a mistake when filling out your Interest due on late payment of, so make sure you go through it again before you decide to send it in.

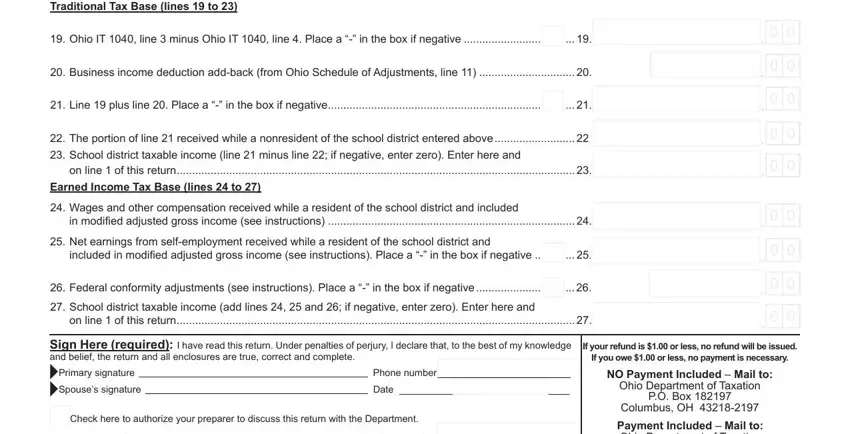

5. When you near the conclusion of this form, you'll notice a few more requirements that need to be fulfilled. In particular, REFUND line minus line YOUR, Ohio IT line minus Ohio IT, Business income deduction addback, Line plus line Place a in the, The portion of line received, School district taxable income, on line of this return, Earned Income Tax Base lines to, in modified adjusted gross income, Net earnings from selfemployment, included in modified adjusted, Federal conformity adjustments, School district taxable income, on line of this return, and Sign Here required I have read should be filled out.

Step 3: Be certain that your information is right and then click "Done" to progress further. Right after getting a7-day free trial account with us, it will be possible to download sd100x 2019 or send it through email right away. The PDF file will also be available via your personal account with your every modification. We do not share or sell any information you use whenever filling out documents at our website.