Through the online editor for PDFs by FormsPal, you're able to complete or alter form 2800 form here and now. To make our editor better and more convenient to utilize, we consistently implement new features, considering feedback from our users. With some simple steps, you may begin your PDF journey:

Step 1: Just press the "Get Form Button" at the top of this page to get into our pdf editing tool. There you'll find all that is needed to fill out your document.

Step 2: As you access the PDF editor, you will get the document made ready to be filled out. In addition to filling in different blanks, you could also perform other actions with the form, such as writing your own text, modifying the original text, inserting graphics, affixing your signature to the form, and much more.

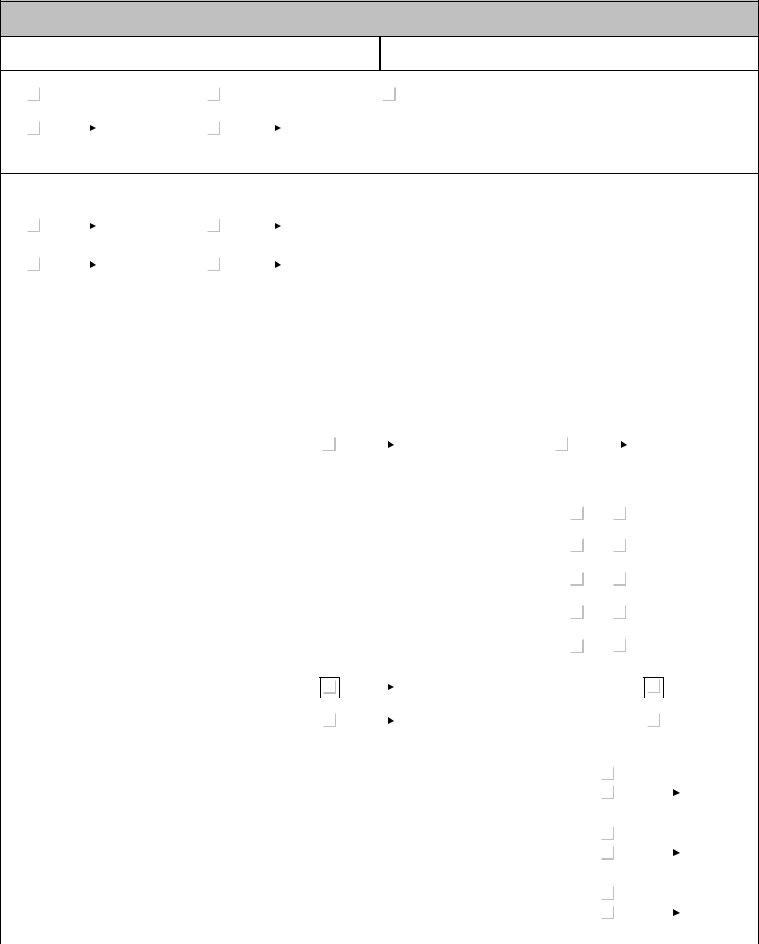

This PDF form will require you to type in some specific details; to ensure accuracy, you should bear in mind the following steps:

1. Complete your form 2800 form with a group of major fields. Consider all the information you need and make sure absolutely nothing is overlooked!

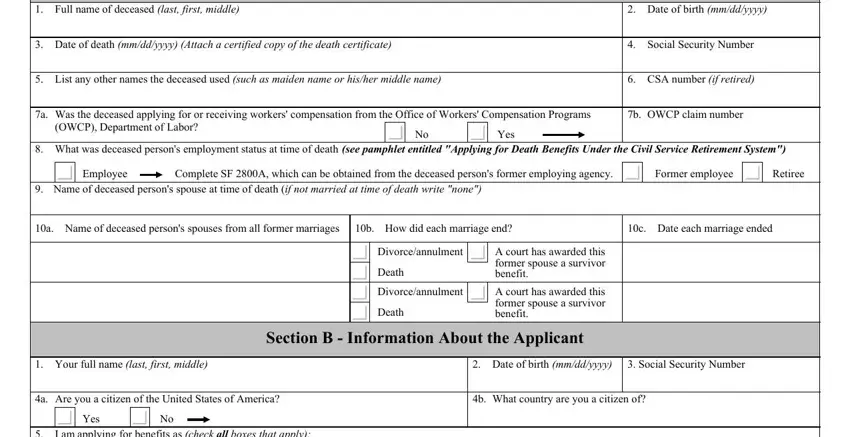

2. Just after the previous section is completed, go to enter the suitable details in these - Full name of deceased last first, Date of birth mmddyyyy, Date of death mmddyyyy Attach a, Social Security Number, List any other names the deceased, CSA number if retired, a Was the deceased applying for or, b OWCP claim number, OWCP Department of Labor, Yes, What was deceased persons, Employee, Complete SF A which can be, Former employee, and Retiree.

It's easy to make a mistake while filling in your List any other names the deceased, so make sure that you look again before you finalize the form.

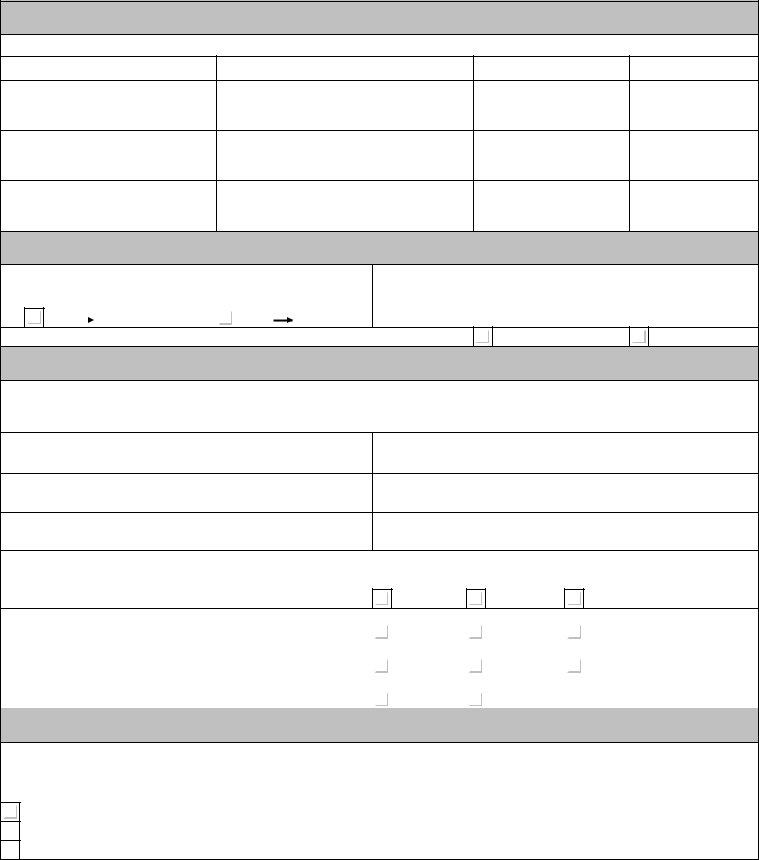

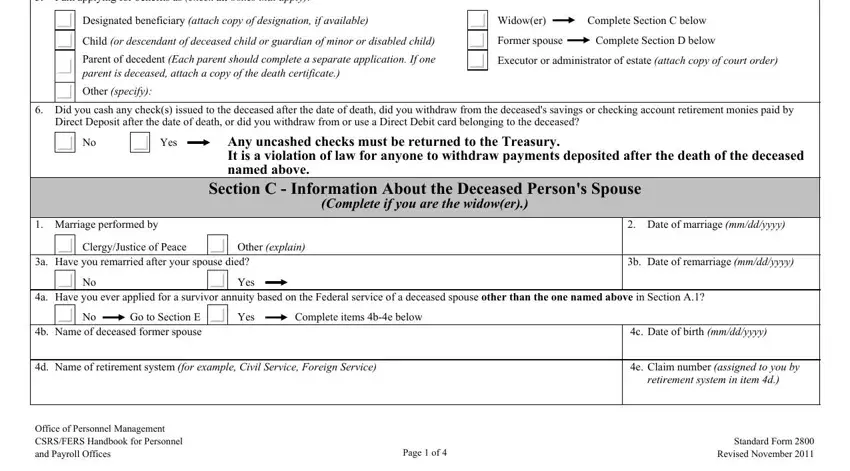

3. The following section should be rather straightforward, I am applying for benefits as, Designated beneficiary attach copy, Widower, Complete Section C below, Child or descendant of deceased, Former spouse, Complete Section D below, Parent of decedent Each parent, Executor or administrator of, Other specify, Did you cash any checks issued to, Direct Deposit after the date of, Yes, Any uncashed checks must be, and Section C Information About the - all of these blanks needs to be completed here.

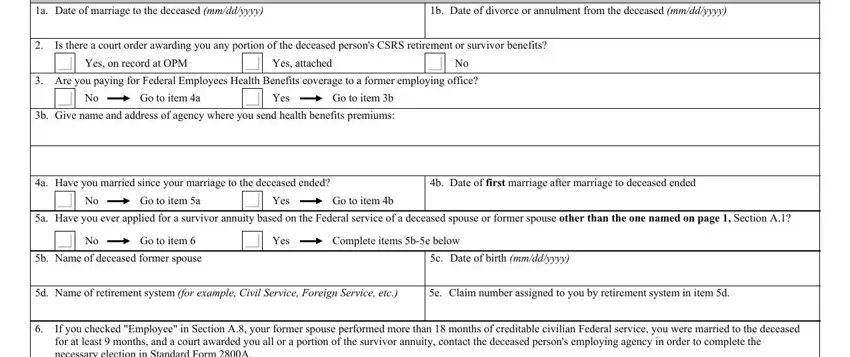

4. This next section requires some additional information. Ensure you complete all the necessary fields - a Date of marriage to the deceased, b Date of divorce or annulment, Is there a court order awarding, Yes on record at OPM, Yes attached, Are you paying for Federal, Go to item a, Yes, Go to item b, b Give name and address of agency, a Have you married since your, b Date of first marriage after, Go to item a, Yes, and Go to item b - to proceed further in your process!

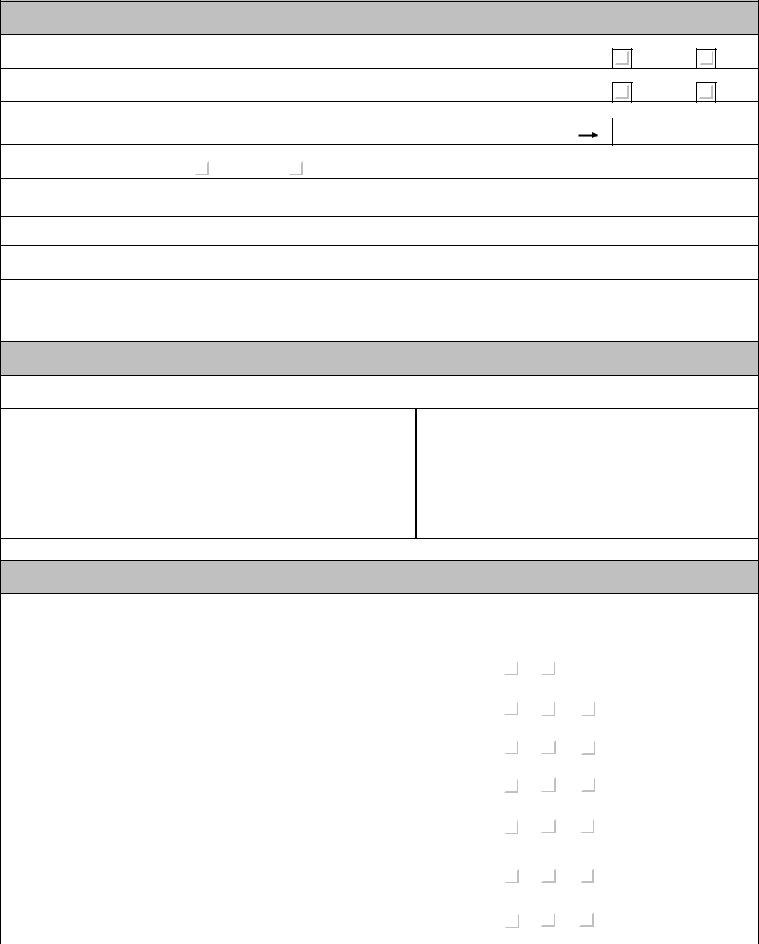

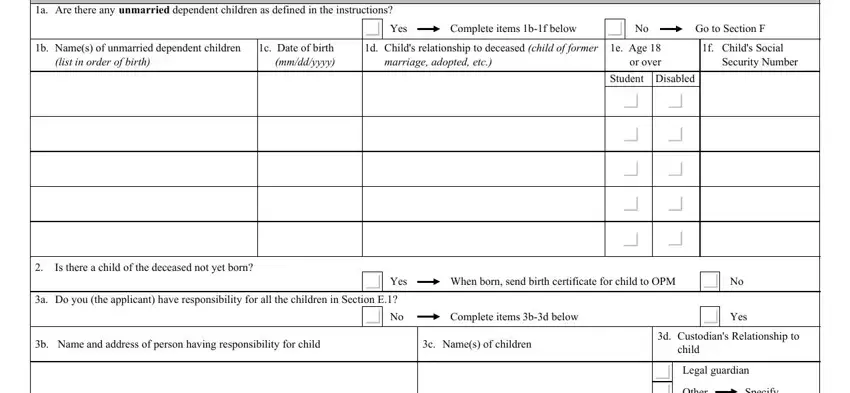

5. This pdf must be finalized within this part. Below you can see a full list of blank fields that need to be filled out with correct information in order for your document submission to be faultless: a Are there any unmarried, b Names of unmarried dependent, list in order of birth, c Date of birth mmddyyyy, d Childs relationship to deceased, marriage adopted etc, e Age or over, f Childs Social, Security Number, Yes, Complete items bf below, Go to Section F, Student, Disabled, and Is there a child of the deceased.

Step 3: Go through everything you've entered into the blank fields and click on the "Done" button. Get hold of your form 2800 form after you subscribe to a 7-day free trial. Conveniently use the pdf file from your personal account, along with any modifications and changes being automatically kept! We do not share the information that you enter when dealing with documents at our website.