sglv pdf can be filled in effortlessly. Just open FormsPal PDF tool to accomplish the job without delay. The tool is consistently updated by our team, receiving useful features and becoming much more versatile. Here's what you will want to do to begin:

Step 1: Access the form in our editor by pressing the "Get Form Button" above on this page.

Step 2: The editor will let you modify your PDF in a range of ways. Enhance it with personalized text, correct what is originally in the file, and add a signature - all at your disposal!

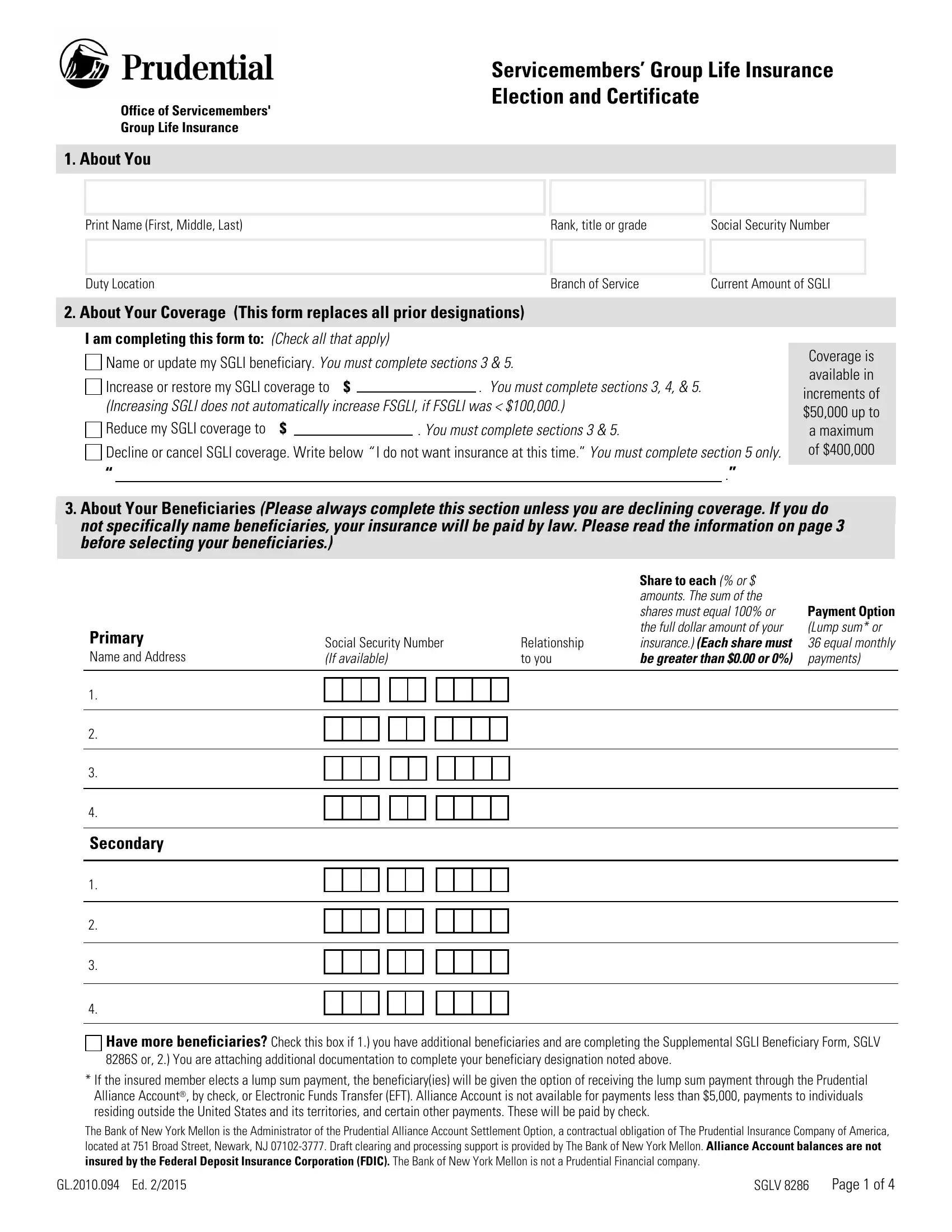

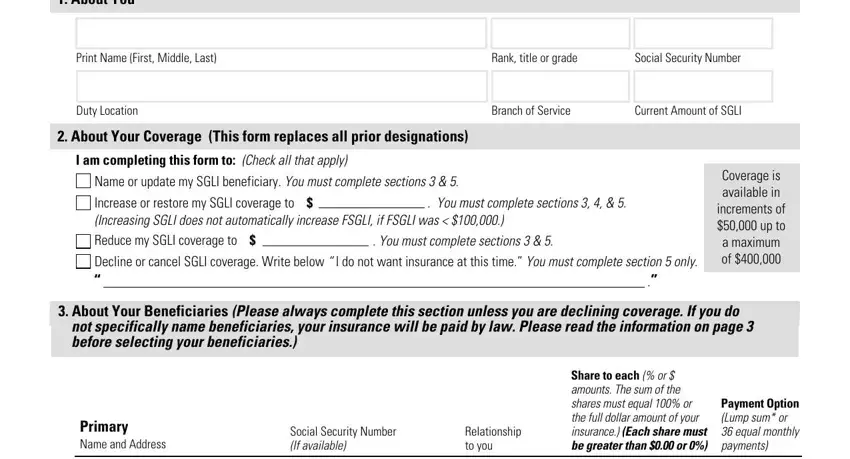

This form requires particular info to be filled in, so be sure you take the time to provide exactly what is required:

1. To get started, once filling out the sglv pdf, start out with the form section containing following blanks:

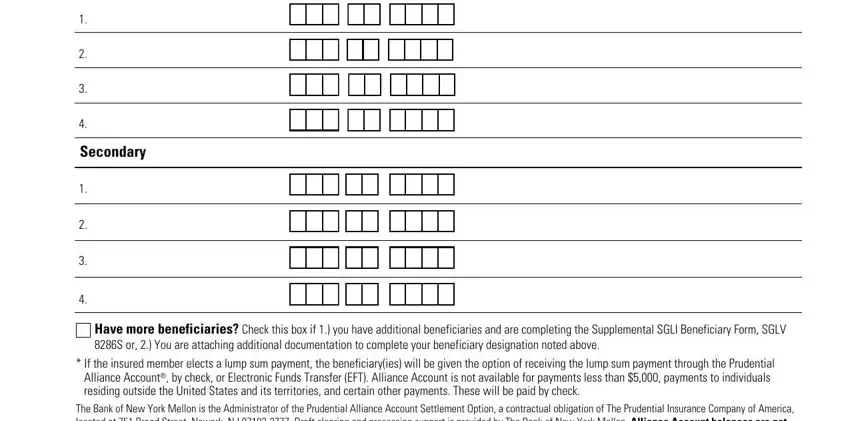

2. After the first part is done, go on to enter the applicable information in these: Secondary, Have more beneficiaries Check this, If the insured member elects a, and The Bank of New York Mellon is the.

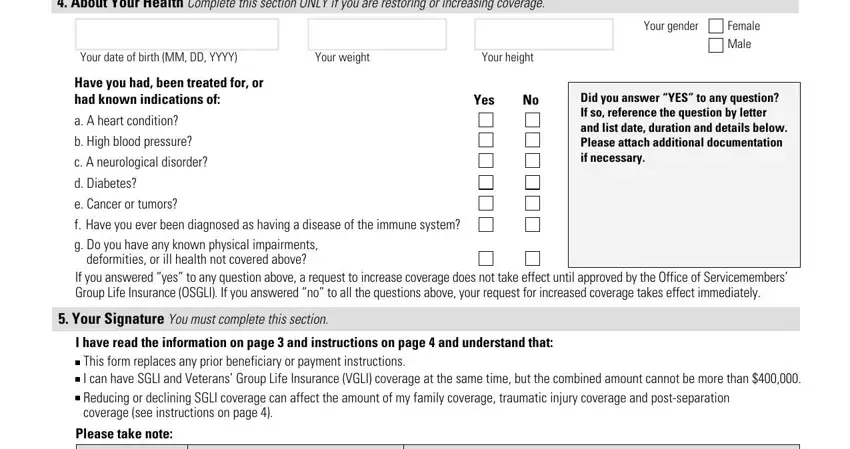

3. Your next part is generally simple - fill out all of the blanks in About Your Health Complete this, Your date of birth MM DD YYYY, Your weight, Your height, Your gender, Female Male, Have you had been treated for or, a A heart condition, b High blood pressure, c A neurological disorder, d Diabetes, e Cancer or tumors, Yes, Did you answer YES to any question, and f Have you ever been diagnosed as in order to finish this segment.

Always be extremely careful when filling in c A neurological disorder and Yes, as this is where many people make errors.

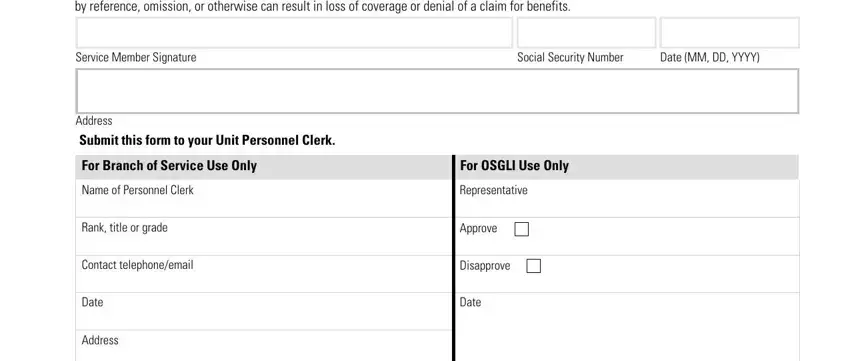

4. This fourth part comes next with these form blanks to fill out: I certify that to the best of my, Service Member Signature, Social Security Number, Date MM DD YYYY, Address Submit this form to your, For Branch of Service Use Only, Name of Personnel Clerk, Rank title or grade, Contact telephoneemail, Date, Address, For OSGLI Use Only, Representative, Approve, and Disapprove.

Step 3: Be certain that your information is correct and then simply click "Done" to continue further. Sign up with us right now and easily get access to sglv pdf, prepared for downloading. All adjustments made by you are kept , helping you to customize the document at a later stage if needed. Whenever you work with FormsPal, it is simple to fill out documents without having to worry about personal data breaches or entries being distributed. Our secure software ensures that your private details are stored safe.