When most people think of the word "tax" they cringe. The process of filing your taxes can be long, tedious, and confusing. However, there are many tax deductions and credits available that can help reduce the amount you owe or increase your refund. In this blog post we will go over Form Spi Cacfp 1269E Iea, which is a credit available to taxpayers who have paid for child care expenses. We will discuss who is eligible for this credit, how much you can receive, and how to claim it on your tax return. So if you are looking for a way to reduce your taxable income, read on!

| Question | Answer |

|---|---|

| Form Name | Form Spi Cacfp 1269E Iea |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 2011, FDPIR, TANF, CACFP |

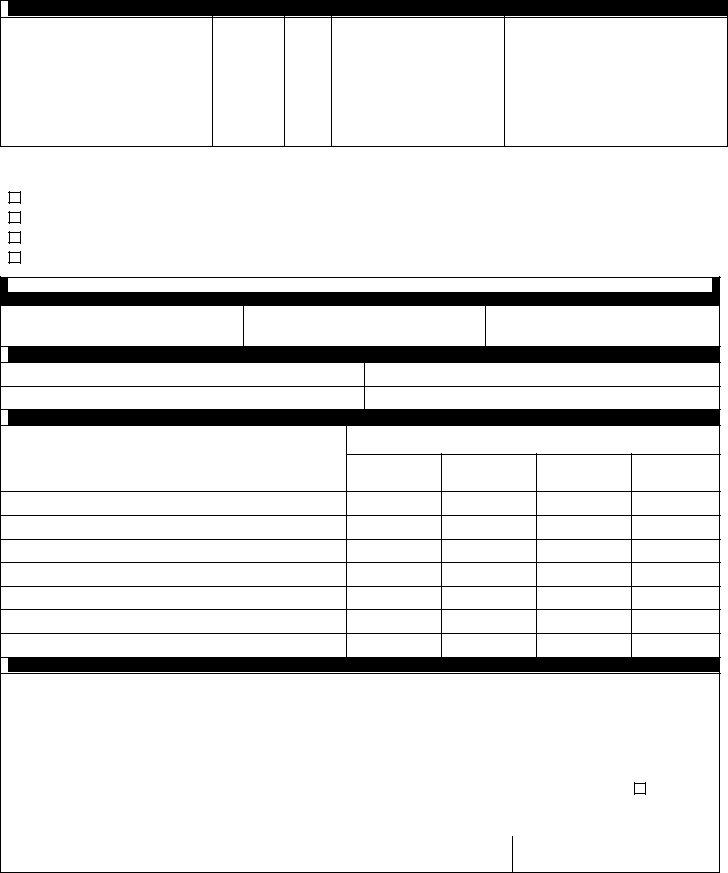

Child and Adult Care Food Program

PART 1 - CHILDREN’S

Child’s Name |

|

Circle Normal Days/ |

|

Circle Meals and |

|||||

Birthdate Age |

Print Normal Hours of Care |

Snacks Normally Received |

|||||||

|

|

Sun Mon Tu Wed Th Fri Sat |

Breakfast |

A.M. Snack |

Lunch |

||||

|

|

Normal Hours |

|

to |

P.M. Snack |

Supper |

Eve. Snack |

||

|

|

|

|

|

|

||||

|

|

Sun Mon Tu Wed Th Fri Sat |

Breakfast |

A.M. Snack |

Lunch |

||||

|

|

Normal Hours |

|

to |

P.M. Snack |

Supper |

Eve. Snack |

||

|

|

Sun Mon Tu Wed Th Fri Sat |

Breakfast |

A.M. Snack |

Lunch |

||||

|

|

Normal Hours |

|

to |

P.M. Snack |

Supper |

Eve. Snack |

||

|

|

Sun Mon Tu Wed Th Fri Sat |

Breakfast |

A.M. Snack |

Lunch |

||||

|

|

Normal Hours |

|

to |

|

|

P.M. Snack |

Supper |

Eve. Snack |

INCOME ELIGIBILITY

Please check the boxes that apply to help determine the other parts of this form to complete:

A family member in our household receives benefits from Basic Food, TANF, or FDPIR. (Please complete Part 2 and 5.)

One or more of the children in Part 1 is a foster child. (Please complete Part 3 and 5.)

My child(ren) may qualify for

My child(ren) will not qualify for

PART 2 – HOUSEHOLD MEMBER RECEIVING BASIC FOOD, TANF, OR

benefits must be listed in order to establish eligibility for all children in the household.

Name |

Circle One |

Case Number or Identification Number |

Basic Food |

TANF |

FDPIR |

PART 3 - FOSTER

PART 4 - TOTAL HOUSEHOLD INCOME FROM LAST

(or net income if

List Names (First and Last) of everyone in your |

Earnings from |

Alimony, |

Retirement, |

Job Two or |

Work Before |

Child Support, |

Pensions, |

Any Other |

|

household, including foster children |

Deductions |

Welfare |

Social Security |

Income |

1.

2.

3.

4.

5.

6.

7.

PART 5 - SIGNATURE AND CERTIFICATION - REQUIRED

The adult household member who fills out the application must sign below. If Part 4 is completed, the adult signing the form must also list the last four digits of his/her Social Security Number or check the “I do not have a Social Security Number” box. (See Privacy Act Statement on the back of

this page.) If you have listed a case number in Part 2 or are applying on behalf of a foster child, or have checked the box that your child(ren) will not qualify for

I certify that all of the above information is true and correct and that all income is reported. I understand that this information is being given for the receipt of federal funds; that institution officials may verify the information on the application; and that deliberate misrepresentation of the information may subject me to prosecution under applicable state and federal laws.

Signature of Adult |

Date |

Print Name of Adult Signing |

I do not |

|

|

|

have a Social |

|

|

Social Security Number (last four digits) |

Security |

|

|

Number |

Address |

City/State/Zip Code |

Daytime Phone

FORM SPI CACFP 1269E/IEA (Rev. 5/11) |

Page 1 |

OSPI/Child Nutrition Services |

|

|

Attachment 2 to Bulletin No. |

|

|

June 10, 2011 |

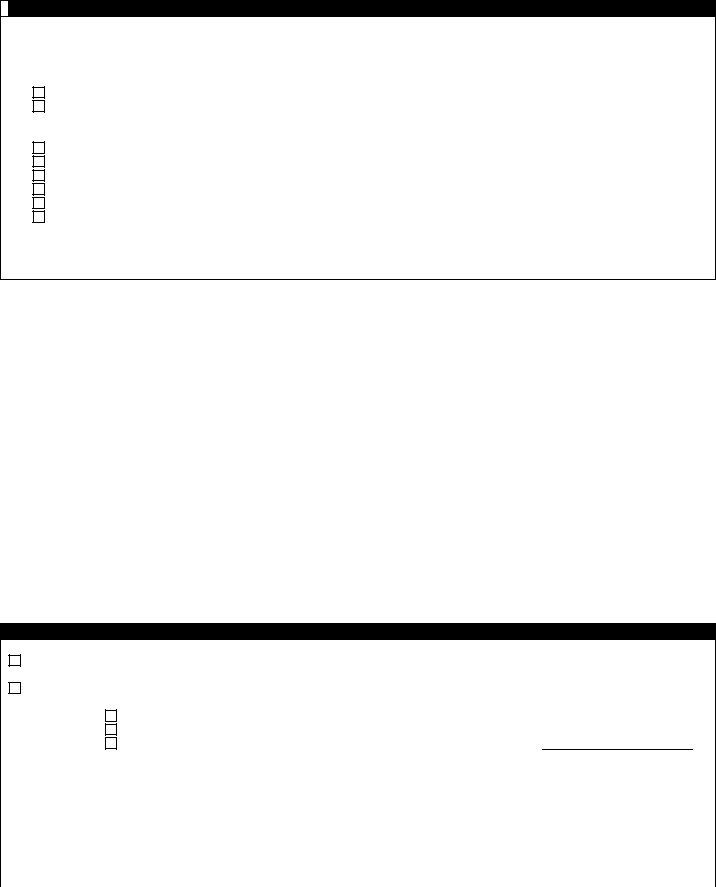

PART 6 – CHILDREN’S ETHNIC AND RACIAL

Check the ethnic and racial category of your child. We need this information to be sure that everyone receives benefits on a fair basis.

Ethnicity: |

|

Hispanic or Latino |

No child will be discriminated against because of race, |

Not Hispanic or Latino |

color, national origin, gender, age, or disability. |

Race: |

|

White |

|

Black or African American |

|

Asian |

|

American Indian or Alaskan Native |

|

Native Hawaiian or Pacific Islander |

|

|

If you feel you have been discriminated against, you should write USDA, Director of Civil Rights, 1400 Independence Avenue SW, Washington, DC

PRIVACY ACT STATEMENT

The Richard B. Russell National School Lunch Act requires that, unless a household member’s Basic Food, TANF, or FDPIR case number is provided or you are applying on behalf of a foster child, you must include the last four digits of the Social Security Number of the adult household member signing the application, or indicate that the household member does not have a Social Security Number. Provision of the last four digits of the Social Security Number is not mandatory, but if the last four digits of the Social Security Number is not provided or an indication is not made that the signer does not have a Social Security Number, the application cannot be approved in the free or

CENTER USE ONLY

Foster child(ren) have been identified on this form and qualify for the free category.

Child(ren) on this form who are not foster children qualify as follows:

Check one:

Free Category |

|

|

|

Total Monthly Income $ |

This form must be signed and dated by the institution’s representative.

|

Signature of Institution’s Representative |

|

Date |

|

|

|

|

|

|

FORM SPI CACFP 1269E/IEA (Rev. 5/11) |

Page 2 |

OSPI/Child Nutrition Services |

|

|

Attachment 2 to Bulletin No. |

|

|

June 10, 2011 |