ss-4523 (10/13)

Business Services Division

Tre Hargett, Secretary of State

State of Tennessee

INSTRUCTIONS

INITIAL WORKERS’ COMPENSATION EXEMPTION REGISTRATION APPLICATION FORM (ss-4523)

SUBMISSION OPTIONS

Applications may be filed using one of the following methods:

•E-file: Go to http://tnbear.tn.gov/wc/default.aspx and use the online tool to complete the application and pay the filing fee by credit card or debit card. When paying by credit card or debit card, there is a convenience fee that covers the credit card fees and transaction costs incurred by the Business Services Division when accepting online payments. Applicants who do not wish to pay the convenience fee to file online may choose the “Print and Mail” option at no additional cost.

•Print and Mail: Go to http://tnbear.tn.gov/wc/default.aspx and use the online tool to complete the

application. Print and mail the application along with the required filing fee to the Secretary of State’s office at 6th FL – Snodgrass Tower, 312 Rosa L. Parks AVE, Nashville, TN 37243.

•Paper submission: A blank application may be obtained by going to http://tnbear.tn.gov/wc/default.aspx by e-mailing the Secretary of State at WorkersComp.ExemptionRegistry@tn.gov, or by calling (615) 741-0526. The application is hand

printed in ink or computer generated and mailed along with the required filing fee to the Secretary of State’s office at 6th FL – Snodgrass Tower, 312 Rosa L. Parks AVE, Nashville, TN 37243.

•Walk-in: A blank application may be obtained in person at the Secretary of State Business Services Division located at 6th FL – Snodgrass Tower, 312 Rosa L. Parks AVE, Nashville, TN 37243.

Applications must be accurately completed in their entirety. Applications that are inaccurate or incomplete will be rejected.

APPLICANT INFORMATION

•The applicant should be the officer, member, partner, or sole proprietor who is engaged in the construction industry and is seeking exemption from carrying workers’ compensation insurance on him or herself. The applicant must meet the requirements set forth in T.C.A. § 50-6-901 et seq. to be eligible for exemption.

•First, MI, Last: Enter the full legal name of the applicant (first name, middle initial, last name).

•Date of Birth: Enter the applicant’s date of birth (two digit month, two digit day, four digit year).

•Last 4 digits of SSN: Enter the last four digits of the applicant’s Social Security Number. If a complete

Social Security Number is entered, the application will be rejected.

Page 1 of 4

ss-4523 (10/13)

•Phone: Enter a telephone number (including the three digit area code) through which the applicant can be reached.

•Email: Enter an e-mail address through which the applicant can be reached.

•Physical Address, City, ST, Zip: Enter the physical address for the applicant. If the applicant does not receive mail at his or her physical address, enter the physical address of the business entity through which the applicant is seeking workers’ compensation exemption. The business entity’s address must be the location of the principal business office. Include the street address, city, two letter state abbreviation, and five digit zip code. You may list the zip + 4 zip code if you know it. A post office box is not an acceptable form of address under this section.

•Mailing Address, City, ST, Zip: Enter the mailing address of the applicant. Include the street address and/or post office box, city, two letter state abbreviation, and five digit zip code. You may list the zip + 4 zip code if you know it. If the mailing address is the same as the applicant’s physical address, enter “same as physical address” in the space provided for mailing address.

INITIAL QUALIFICATION (CHECK ONE)

•Select the qualification under which the applicant meets the requirements to be eligible for exemption.

The applicant can only meet one qualification. A maximum number of five individuals per corporation, limited liability company, limited partnership, limited liability partnership, or general partnership may qualify for exemption. Sole proprietors can only have one qualifying applicant who must own 100% of the business.

INITIAL BUSINESS ENTITY

•Business Entity Name: Enter the business entity name as reflected on the records of the Secretary of State through which the applicant is seeking the workers’ compensation exemption. Do not enter any assumed name associated with the entity in the space provided. If the business entity name entered does not match the business entity name as reflected on the records of the Secretary of State, the application will be rejected.

•SOS Control #: Enter the SOS Control # (Secretary of State Control number) of the business entity through which the applicant is seeking an exemption. The Secretary of State Control number is a unique number assigned to a business entity by the Secretary of State at the time of incorporation, formation, or registration. The business entity must be active and in good standing on the records of the Secretary of State. If the business entity is not active and in good standing, the application will be rejected. If you are a sole proprietor, you are not permitted to register with the Secretary of State; write “not required” in the space provided for Secretary of State Control number.

•For questions regarding a business entity name, Secretary of State Control number, or the status of an entity, check on-line at http://TNBEAR.TN.gov/Ecommerce/Filingsearch.aspx or contact the Secretary of State at (615) 741-0526.

•Federal EIN (IRS): Enter the Federal Employer Identification Number (FEIN) of the business entity through which the applicant is seeking an exemption. All entities, including sole proprietorships, must enter a FEIN to be registered for exemption. If an FEIN has not been obtained, contact the IRS at http://www.irs.gov/businesses/small/index.html or by calling 1-800-829-4933 and obtain a number

Page 2 of 4

ss-4523 (10/13)

prior to completing this application. An individual Social Security Number may not be used as the FEIN.

An application missing an FEIN will be rejected.

INITIAL STATE BOARD FOR LICENSING CONTRACTORS INFORMATION (CHECK ONE)

•If the business does not have an active contractor’s license issued by the State Board for Licensing Contractors, check the first box. If this box is checked, the applicant will also be registered as a Construction Services Provider as required by T.C.A. § 50-6-904(a)(1)(A).

•If the business does have an active contractor’s license issued by the State Board for Licensing Contractors, check the second box. Enter the license number and the expiration date (two digit month, two digit day, four digit year). For questions regarding licensure, contact the State Board for Licensing Contractors at (615) 741-8307.

INITIAL LOCAL BUSINESS LICENSE INFORMATION

•A business entity may be required to have a county business license issued by the county where the business is located. Enter the name of the county in which the business license was obtained, the license number, and the expiration date (two digit month, two digit day, four digit year). If the business entity is not required to obtain a business license from the county, write “not required” in the space provided for the name of the county. Listing a license with an expiration date that precedes the date of submission of this application will result in the rejection of the application.

•A business entity may be required to have a city or municipal business license issued by the city or municipality where the business is located. Enter the name of the city or municipality in which the business license was obtained, the license number, and the expiration date (two digit month, two digit day, four digit year). If the business entity is not required to obtain a business license from the city or municipality, write “not required” in the space provided for the name of the city or municipality. Listing a license with an expiration date that precedes the date of submission of this application will result in the rejection of the application.

•For questions regarding whether or not you must have a county, city, or municipal business license to apply for the workers’ compensation exemption, contact the Secretary of State by calling (615) 741-0526 or by e-mail at WorkersComp.ExemptionRegistry@tn.gov.

ATTESTATION

•Check the box to attest that you meet all the requirements for the workers’ compensation exemption under T.C.A. § 50-6-901 et seq. and that you understand that any false statement made on the application is subject to the penalties of perjury set out in T.C.A. § 39-16-702. Failure to check this box will result in the application being rejected.

•Check the box to attest that you understand that you waive your right to sue under workers’ compensation law if you are injured on a job and have utilized the workers’ compensation exemption.

Failure to check this box will result in the application being rejected.

•This application must be signed and dated by the applicant seeking workers’ compensation exemption.

Failure to sign and date the application will result in the application being rejected.

Page 3 of 4

ss-4523 (10/13)

FILING FEE

•Filing fee for an application is $100.00 for applicants who do not have a license issued by the Board for Licensing Contractors. This fee pays for both the construction services provider registration and the workers’ compensation exemption registration.

•Filing fee for an application is $50.00 for applicants who do have an active license issued by the Board for Licensing Contractors. This fee pays for the workers’ compensation exemption registration. Applicants licensed by the Board for Licensing Contractors are not required to have a construction services provider registration.

•Make check, cashier’s check, or money order payable to the Tennessee Secretary of State. Cash is only accepted for walk-in filings. Credit cards or debit cards are only accepted for e-file applications.

Applications submitted without the proper filing fee will be rejected.

Page 4 of 4

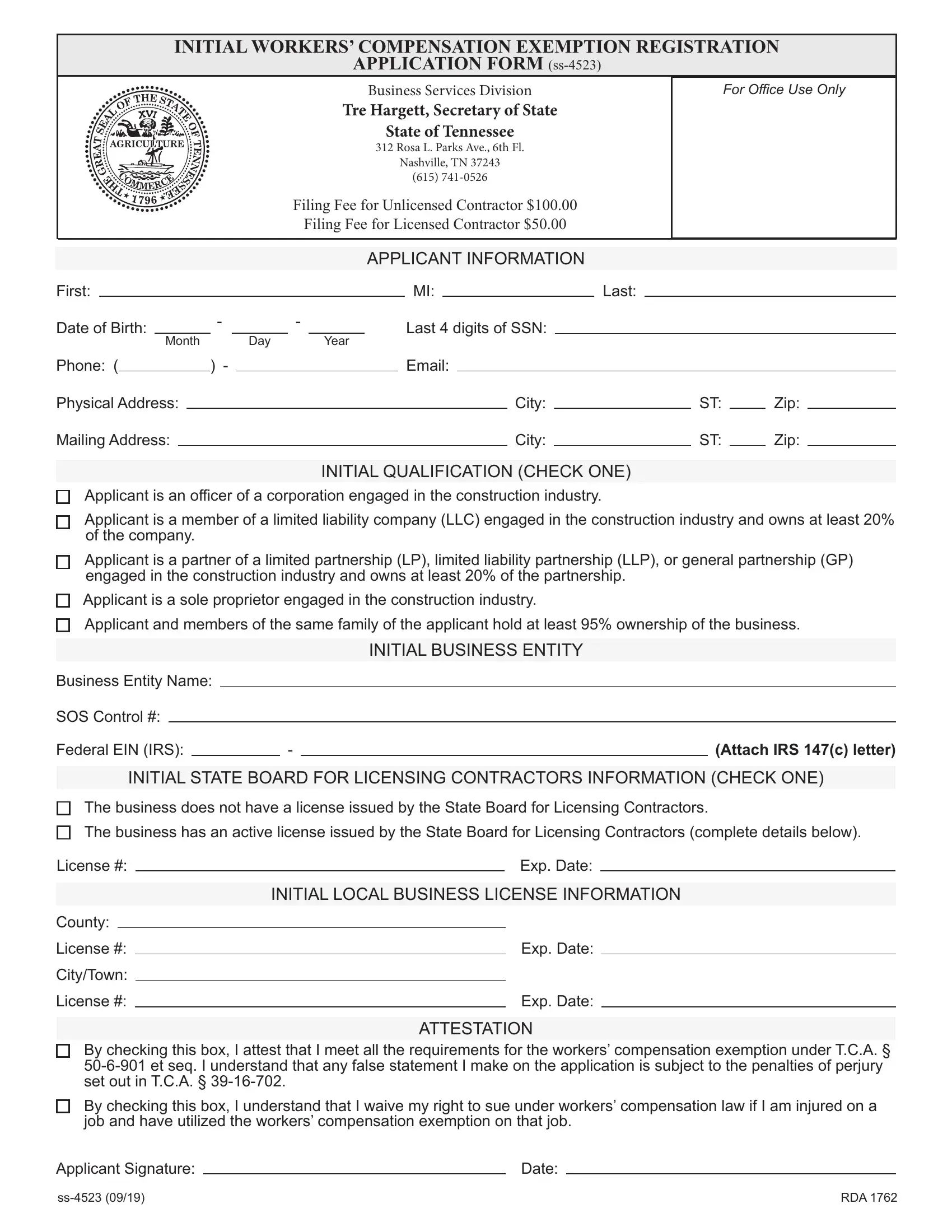

INITIAL WORKERS’ COMPENSATION EXEMPTION REGISTRATION

APPLICATION FORM (ss-4523)

BUSINESS SERVICES DIVISION

Tre Hargett, Secretary of State

State of Tennessee

312 ROSA L. PARKS AVE., 6TH FL.

NASHVILLE, TN 37243

(615) 741-0526

Filing Fee for Unlicensed Contractor $100.00 Filing Fee for Licensed Contractor $50.00

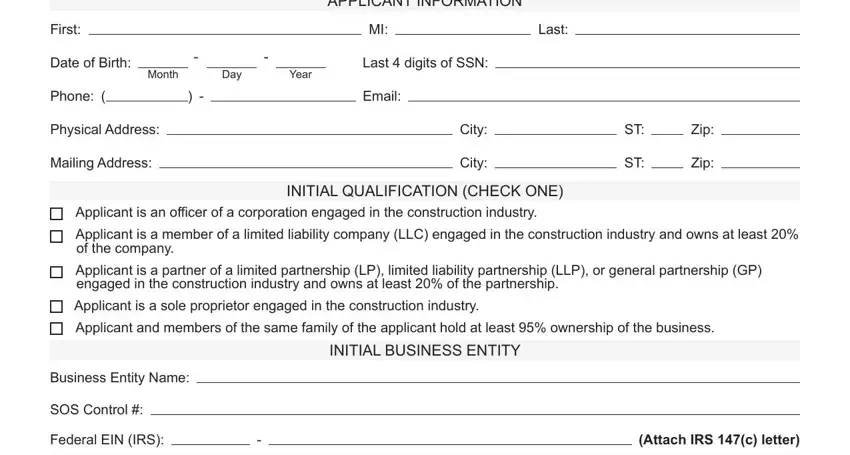

APPLICANT INFORMATION

First: |

|

|

|

|

|

|

|

|

|

|

|

|

|

MI: |

|

|

|

|

Last: |

|

|

|

|

|

|

|

Date of Birth: |

|

- |

- |

|

|

|

|

|

|

|

Last 4 digits of SSN: |

|

|

|

|

|

|

|

|

|

Month |

Day |

Year |

|

|

|

|

|

|

|

|

|

Phone: ( |

) |

|

|

|

- |

|

|

|

|

|

Email: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Physical Address: |

|

|

|

|

|

|

|

|

|

City: |

|

|

|

|

ST: |

|

Zip: |

|

|

Mailing Address: |

|

|

|

|

|

|

|

|

|

City: |

|

|

|

|

ST: |

|

Zip: |

|

|

INITIAL QUALIFICATION (CHECK ONE)

Applicant is an oficer of a corporation engaged in the construction industry.

Applicant is a member of a limited liability company (LLC) engaged in the construction industry and owns at least 20% of the company.

Applicant is a partner of a limited partnership (LP), limited liability partnership (LLP), or general partnership (GP) engaged in the construction industry and owns at least 20% of the partnership.

Applicant is a sole proprietor engaged in the construction industry.

Applicant and members of the same family of the applicant hold at least 95% ownership of the business.

INITIAL BUSINESS ENTITY

Business Entity Name:

SOS Control #: |

|

Federal EIN (IRS): |

|

- |

|

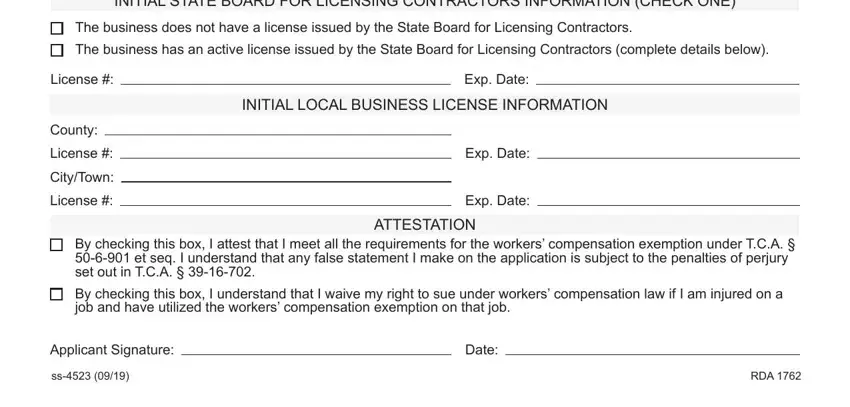

INITIAL STATE BOARD FOR LICENSING CONTRACTORS INFORMATION (CHECK ONE)

The business does not have a license issued by the State Board for Licensing Contractors.

The business has an active license issued by the State Board for Licensing Contractors (complete details below).

License #:Exp. Date:

|

|

INITIAL LOCAL BUSINESS LICENSE INFORMATION |

County: |

|

|

|

|

|

License #: |

|

Exp. Date: |

|

|

City/Town: |

|

|

|

|

License #: |

|

Exp. Date: |

|

|

|

|

|

|

|

ATTESTATION |

|

By checking this box, I attest that I meet all the requirements for the workers’ compensation exemption under T.C.A. §50-6-901 et seq. I understand that any false statement I make on the application is subject to the penalties of perjury set out in T.C.A. §39-16-702.

By checking this box, I understand that I waive my right to sue under workers’ compensation law if I am injured on a job and have utilized the workers’ compensation exemption on that job.

Applicant Signature: |

|

Date: |