|

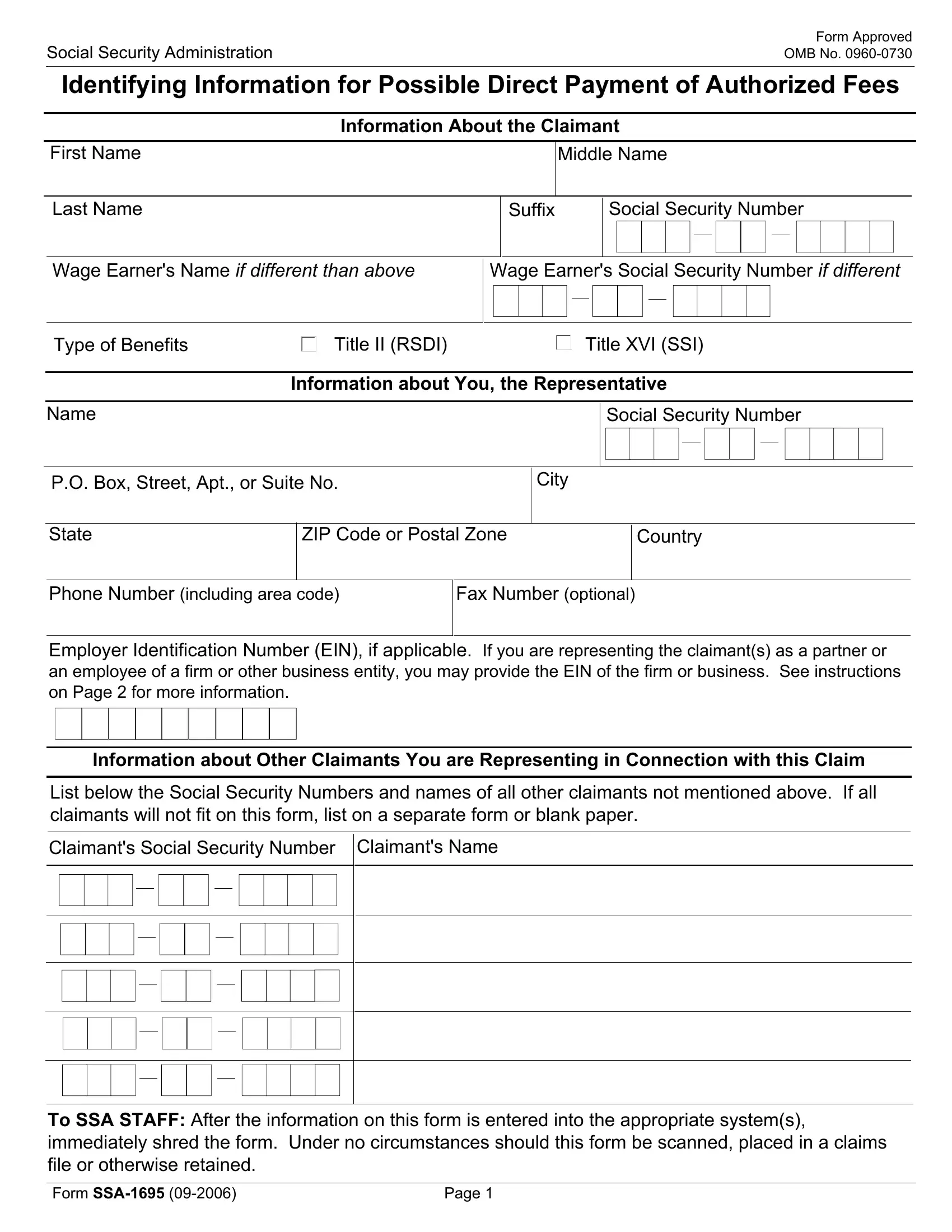

Form Approved |

Social Security Administration |

OMB No. 0960-0730 |

|

|

Identifying Information for Possible Direct Payment of Authorized Fees

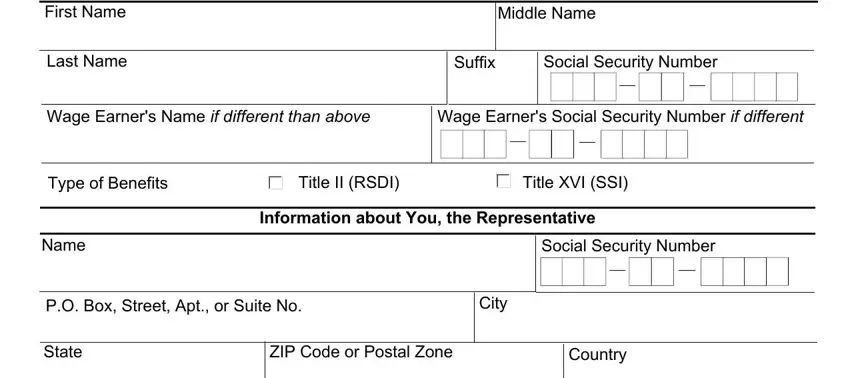

Information About the Claimant

Wage Earner's Name IF DIFFERENT THAN ABOVE

Wage Earner's Social Security Number IF DIFFERENT

Information about You, the Representative

P.O. Box, Street, Apt., or Suite No. |

City |

|

|

|

|

|

|

|

|

|

|

State |

ZIP Code or Postal Zone |

|

|

Country |

|

|

|

|

|

|

|

|

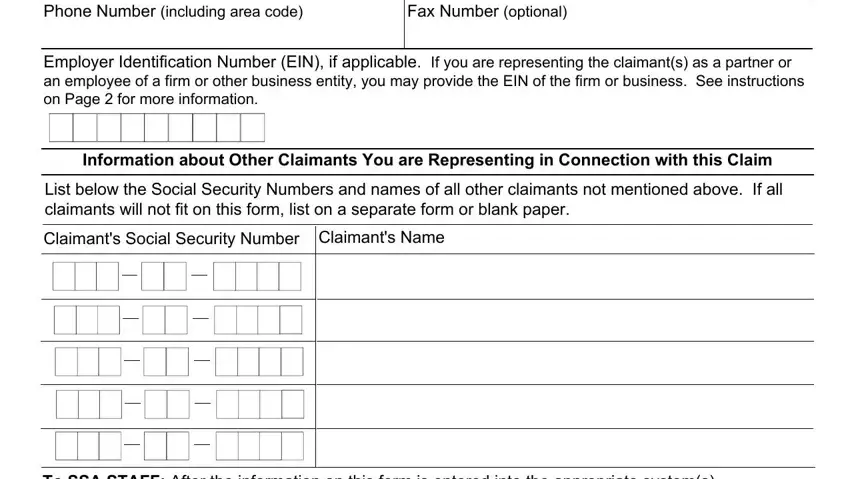

Phone Number (including area code)

Employer Identification Number (EIN), if applicable. If you are representing the claimant(s) as a partner or an employee of a firm or other business entity, you may provide the EIN of the firm or business. See instructions on Page 2 for more information.

Information about Other Claimants You are Representing in Connection with this Claim

List below the Social Security Numbers and names of all other claimants not mentioned above. If all claimants will not fit on this form, list on a separate form or blank paper.

Claimant's Social Security Number

To SSA STAFF: After the information on this form is entered into the appropriate system(s), immediately shred the form. Under no circumstances should this form be scanned, placed in a claims file or otherwise retained.

Form SSA-1695 (09-2006) |

Page 1 |

IMPORTANT INFORMATION

Purpose of Form

An attorney or other person who wishes to charge or collect a fee for providing services in connection with a claim before the Social Security Administration (SSA) must first obtain approval from SSA. The request for appointment is generally made using the SSA-1696-U4, Appointment of Representative, or equivalent written statement. An attorney or other person who wishes to receive direct payment of authorized fees from SSA must have completed an SSA-1699, Request for Appointed Representative's Direct Payment Information, in order to provide the identifying information that will be used to process these direct payments, including the possible use of direct deposit to a financial institution, and to meet any requirements for issuance of a Form 1099-MISC. It is important to complete a new SSA-1699 whenever there are changes to identifying information. In addition, an attorney or other person must complete this SSA-1695, Identifying Information for Possible Direct Payment of Authorized Fees, for each claim in which a request is being made to receive direct payment of authorized fees.

Instructions for Completing the Form

Claimant Information--Please provide the Social Security Number (SSN) and name of the claimant that you will represent before SSA.

Wage Earner Information--If the claim is being filed on the Social Security record of someone other than the claimant, please provide the SSN and name of that wage earner.

Type of Benefits Information--Please specify the type of benefits for which you are representing the claimant(s).

Representative Information--Please enter your SSN and name as shown on your Social Security card and your mailing address. If you have changed your last name (e.g., due to marriage), please contact your local SSA office to make this change to your Social Security record. In addition, if you are representing the claimant(s) as a partner or employee of a firm or other business entity, you may provide the EIN of that entity. This will allow SSA to issue a Form 1099-MISC to that entity to reflect that the direct payment of authorized fees you receive is actually income to that entity for tax purposes.

Information About Other Claimants--If you are representing other claimants in this claim that are not mentioned above, please provide their SSNs and names. If there are more than five individuals, please provide this information on a separate attachment to this form.

Privacy Act Notice

We are required by section 206(a) and 1631(d) of the Social Security Act to ask you to give us the information on this form. The information is needed to facilitate direct payment of authorized fees and to meet the reporting requirements of the law. Although responses to the questions are voluntary, failure to provide answers to the questions on this form will result in nonpayment for your service.

The information obtained on this form is almost never used for any purpose other than that stated above. However, sometimes the law requires us to disclose the facts on this form without your consent. For example, we must release this information to another person or government agency if federal law requires that we do so or to contractors, as necessary, to assist SSA in the efficient administration of its programs.

Explanations about the reasons why information you provide us may be used or given out are available in Social Security offices. If you want to learn more about this, contact any Social Security office.

Paperwork Reduction Act Statement

This information collection meets the requirements of 44 U.S.C. 3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget control number. We estimate that it will take 10 minutes to read the instructions, gather the facts, and answer the questions. SEND THE

COMPLETED FORM TO YOUR LOCAL SOCIAL SECURITY OFFICE. The office is listed under U.S. Government agencies in your telephone directory or you may call Social Security at 1-800-772-1213. You may send comments on our time estimate above to SSA, 6401 Security Boulevard, Baltimore, MD, 21235-6401. Send only comments relating to our time estimate to this address, not the completed form.

Form SSA-1695 (09-2006) |

Page 2 |