You may fill out 308 formula form easily using our online editor for PDFs. The editor is continually improved by us, receiving awesome functions and becoming better. For anyone who is looking to start, here is what it's going to take:

Step 1: Click the "Get Form" button above on this webpage to access our editor.

Step 2: When you start the online editor, you will notice the document ready to be filled in. Besides filling in different blanks, you could also do some other actions with the form, including putting on custom text, modifying the initial text, inserting illustrations or photos, signing the form, and much more.

Completing this document will require attention to detail. Make sure every single blank field is done properly.

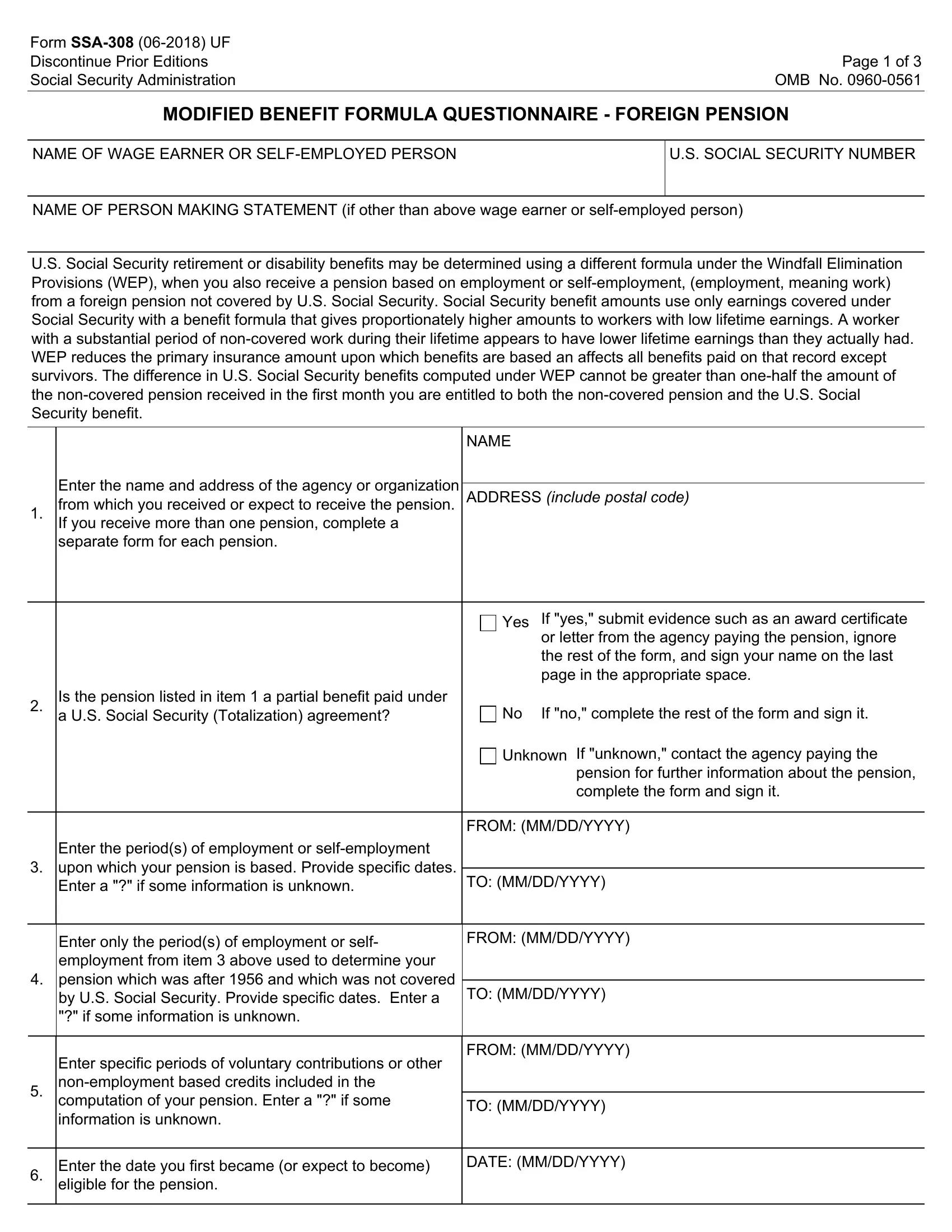

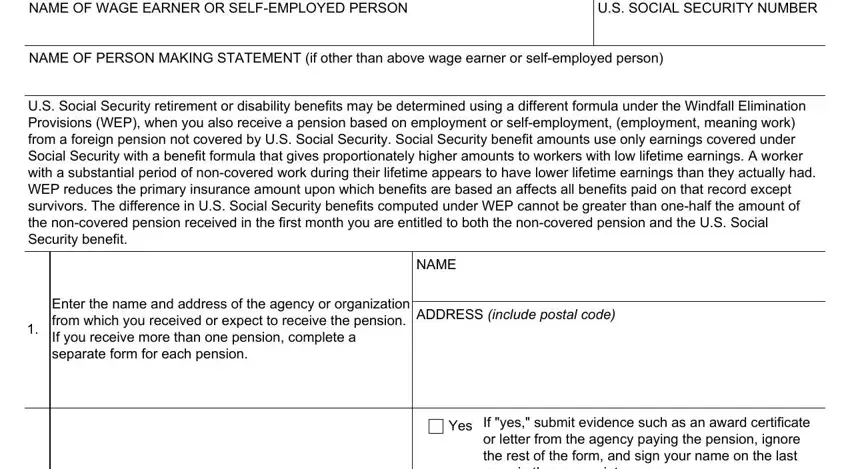

1. When submitting the 308 formula form, ensure to include all of the necessary blank fields in the associated part. It will help to speed up the process, making it possible for your information to be handled efficiently and correctly.

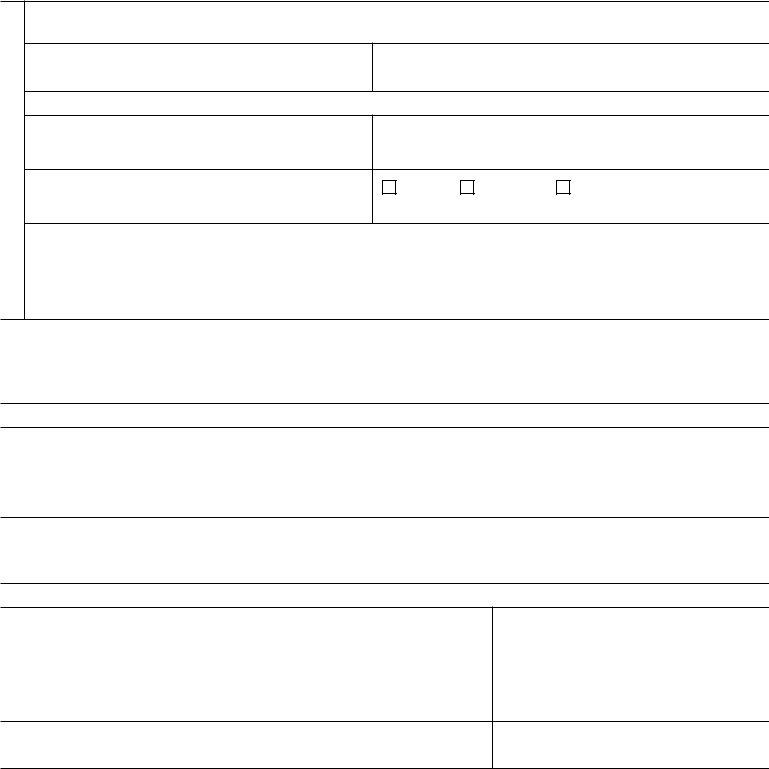

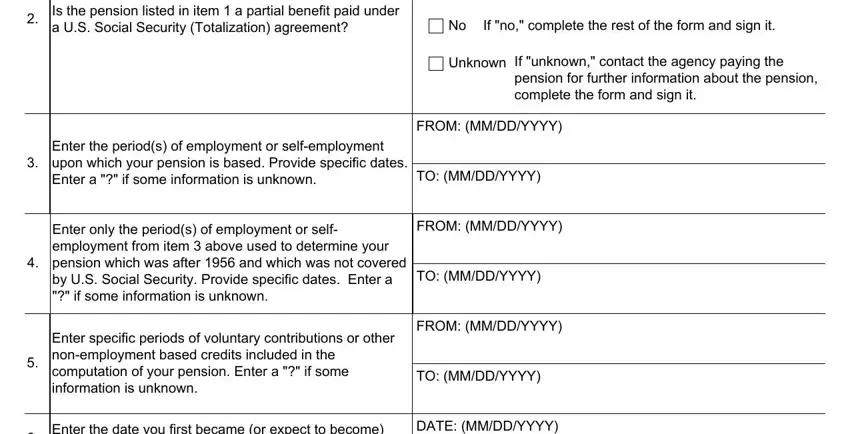

2. Immediately after this section is completed, proceed to enter the relevant information in these - Is the pension listed in item a, If no complete the rest of the, Unknown If unknown contact the, pension for further information, Enter the periods of employment or, TO MMDDYYYY, FROM MMDDYYYY, Enter only the periods of, FROM MMDDYYYY, TO MMDDYYYY, Enter specific periods of, FROM MMDDYYYY, TO MMDDYYYY, Enter the date you first became or, and DATE MMDDYYYY.

It's easy to get it wrong while filling in the Enter specific periods of, therefore make sure to reread it before you'll send it in.

3. This next step is relatively simple, Enter the date you first became or, and DATE MMDDYYYY - each one of these fields is required to be completed here.

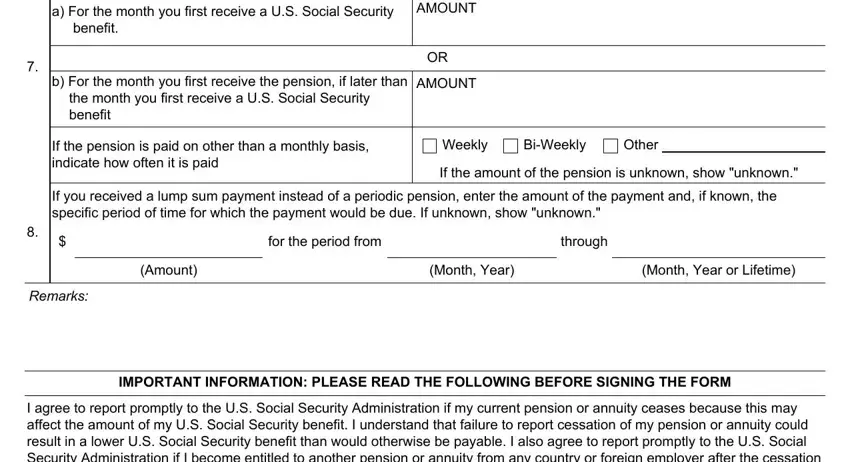

4. The fourth paragraph comes with the following blanks to type in your information in: a For the month you first receive, AMOUNT, benefit, b For the month you first receive, AMOUNT, the month you first receive a US, If the pension is paid on other, Weekly, BiWeekly, Other, If the amount of the pension is, If you received a lump sum payment, Remarks, for the period from, and through.

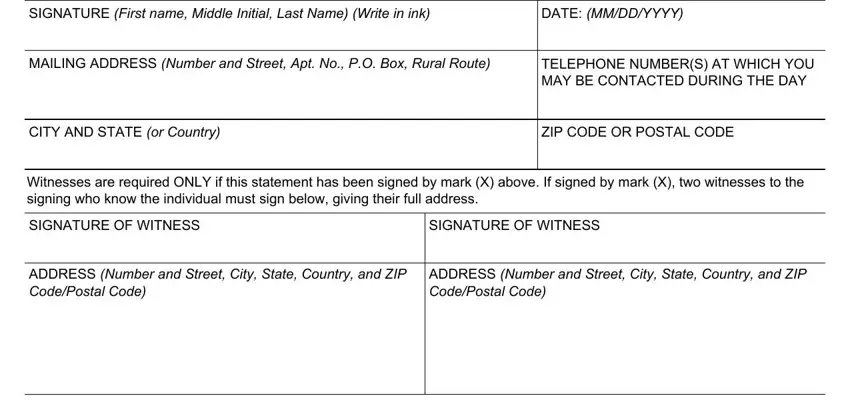

5. This pdf should be wrapped up with this particular part. Further you will notice a comprehensive listing of blank fields that need to be filled in with accurate information to allow your form usage to be complete: SIGNATURE First name Middle, DATE MMDDYYYY, MAILING ADDRESS Number and Street, TELEPHONE NUMBERS AT WHICH YOU MAY, CITY AND STATE or Country, ZIP CODE OR POSTAL CODE, Witnesses are required ONLY if, SIGNATURE OF WITNESS, SIGNATURE OF WITNESS, ADDRESS Number and Street City, and ADDRESS Number and Street City.

Step 3: Before moving on, it's a good idea to ensure that blanks were filled in correctly. As soon as you are satisfied with it, press “Done." Try a free trial option at FormsPal and acquire direct access to 308 formula form - downloadable, emailable, and editable in your FormsPal account. When you work with FormsPal, you'll be able to fill out forms without the need to be concerned about data incidents or entries getting distributed. Our secure system makes sure that your personal information is kept safely.