Whenever you intend to fill out ssa 783, you won't need to install any kind of software - just try our online PDF editor. To make our editor better and more convenient to work with, we continuously design new features, with our users' suggestions in mind. By taking a couple of basic steps, you can start your PDF journey:

Step 1: Click on the "Get Form" button in the top part of this page to open our PDF tool.

Step 2: With our state-of-the-art PDF file editor, you could accomplish more than simply fill out blanks. Express yourself and make your docs look faultless with custom text added, or tweak the original input to excellence - all that comes with an ability to incorporate almost any images and sign the PDF off.

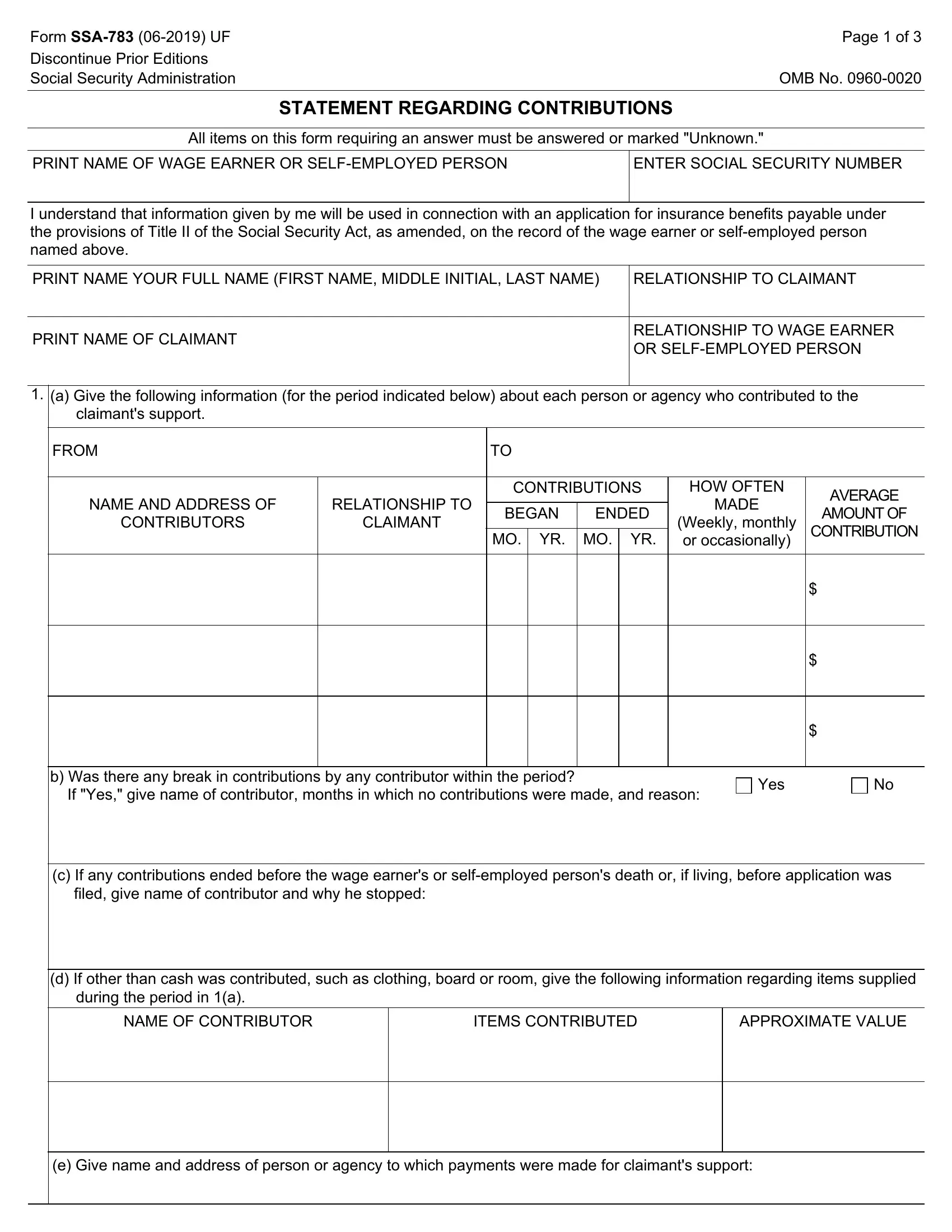

When it comes to blank fields of this specific document, this is what you need to know:

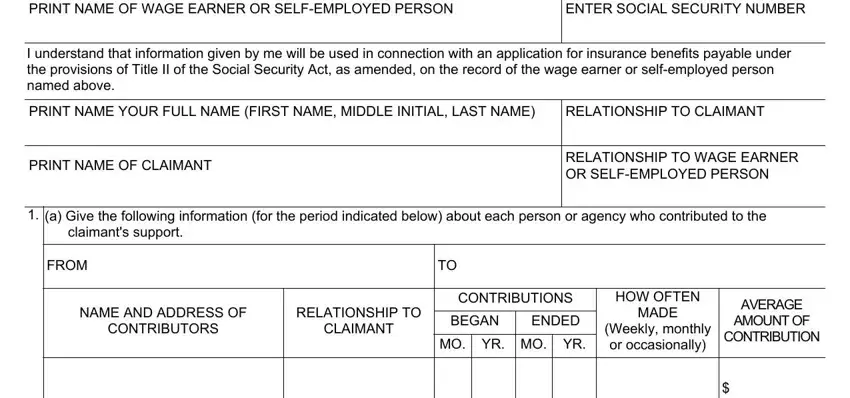

1. First of all, once filling out the ssa 783, start with the page that features the following fields:

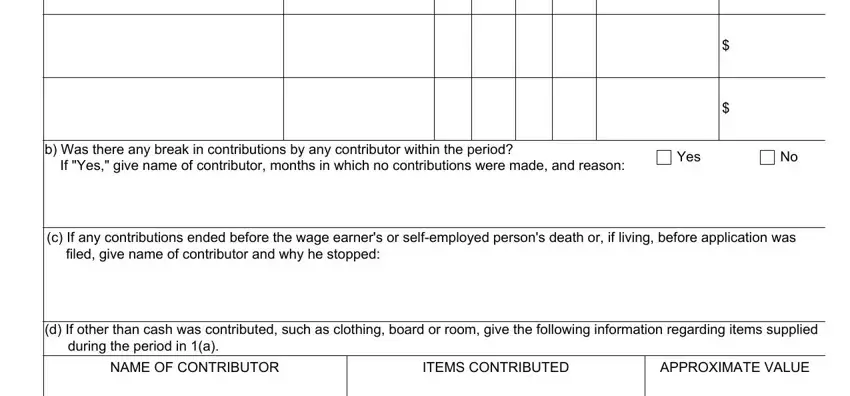

2. Just after filling out the last section, go on to the subsequent part and fill out the essential particulars in these fields - b Was there any break in, Yes, c If any contributions ended, d If other than cash was, NAME OF CONTRIBUTOR, ITEMS CONTRIBUTED, and APPROXIMATE VALUE.

It's very easy to make a mistake when filling out your ITEMS CONTRIBUTED, so make sure that you reread it prior to deciding to submit it.

3. Completing e Give name and address of person is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

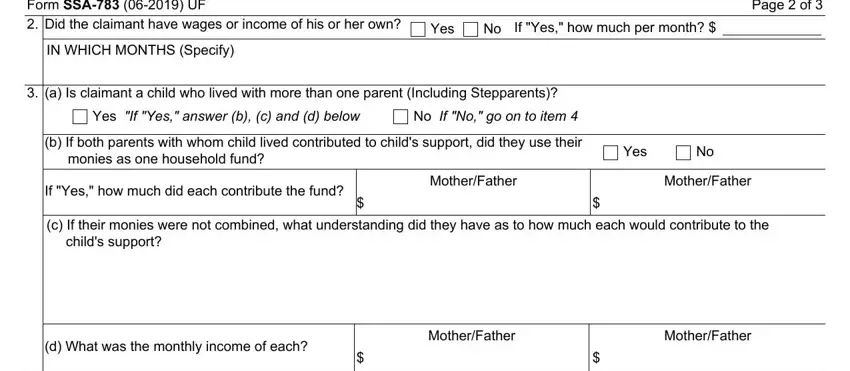

4. The subsequent paragraph requires your involvement in the following parts: Form SSA UF Did the claimant, IN WHICH MONTHS Specify, Yes, If Yes how much per month, Page of, a Is claimant a child who lived, Yes If Yes answer b c and d below, No If No go on to item, b If both parents with whom child, Yes, If Yes how much did each, MotherFather, MotherFather, c If their monies were not, and d What was the monthly income of. Remember to enter all of the requested details to move further.

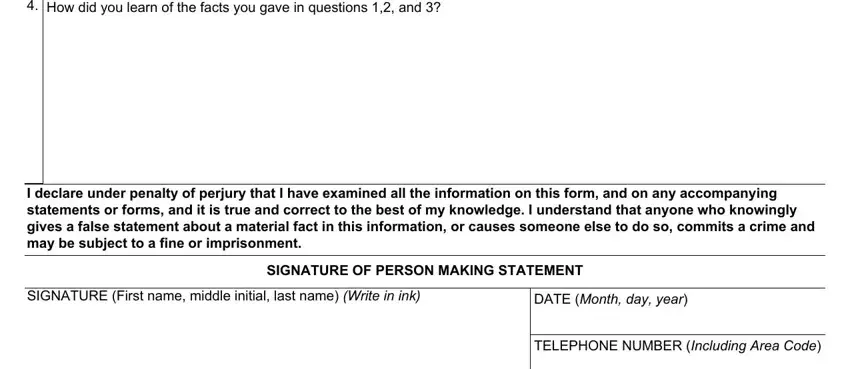

5. The very last notch to finalize this PDF form is crucial. You need to fill out the required form fields, consisting of How did you learn of the facts you, I declare under penalty of perjury, SIGNATURE First name middle, DATE Month day year, SIGNATURE OF PERSON MAKING, and TELEPHONE NUMBER Including Area, prior to using the file. Otherwise, it could give you a flawed and potentially incorrect document!

Step 3: Check all the details you have typed into the form fields and then press the "Done" button. Join FormsPal right now and easily get access to ssa 783, ready for downloading. All changes made by you are kept , making it possible to change the document at a later stage as required. FormsPal is devoted to the personal privacy of all our users; we make certain that all personal information processed by our system remains protected.