In understanding the intricacies of sales and use tax compliance within New York State, one encounters the ST-100/101/810-WS form, a pivotal tool furnished by the New York State Department of Taxation and Finance. Designed for businesses navigating the quarterly period of taxation and the obligations tied to it, this worksheet plays a crucial role in ensuring the accuracy of Web Filing for sales and use taxes. It stands as a preparatory document, guiding the user through a detailed account of gross sales, delineating between taxable and non-taxable sales, and incorporating unique elements such as credit card deposits, potentially optional yet significant for accurate reporting. Notably, the form serves as a base for finalizing returns, with clear directives for those concluding their business taxes in a specific period. In addition, the detailed breakdown of jurisdiction information, encompassing taxable sales, credits, and over-collected tax, underscores the meticulous nature of tax reporting. The structural inclusion of tables for jurisdiction-wise tax calculation, enhanced by Web Filing’s capability to automatically populate tax rates and compute taxes due, reflects an intersection of manual diligence and digital efficiency. Moreover, the specific provisions for special taxes related to passenger car rentals and information and entertainment services broaden the scope of tax considerations businesses must navigate. Not to be filed but used as a cornerstone for accurate Web Filing, this worksheet encapsulates a comprehensive approach to sales and use tax preparation, embedding within its framework the essentials of diligent tax practice and compliance in New York State.

| Question | Answer |

|---|---|

| Form Name | Form St 100 101 810 Ws |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | MCTD, st 100 101 810, New_York, taxable |

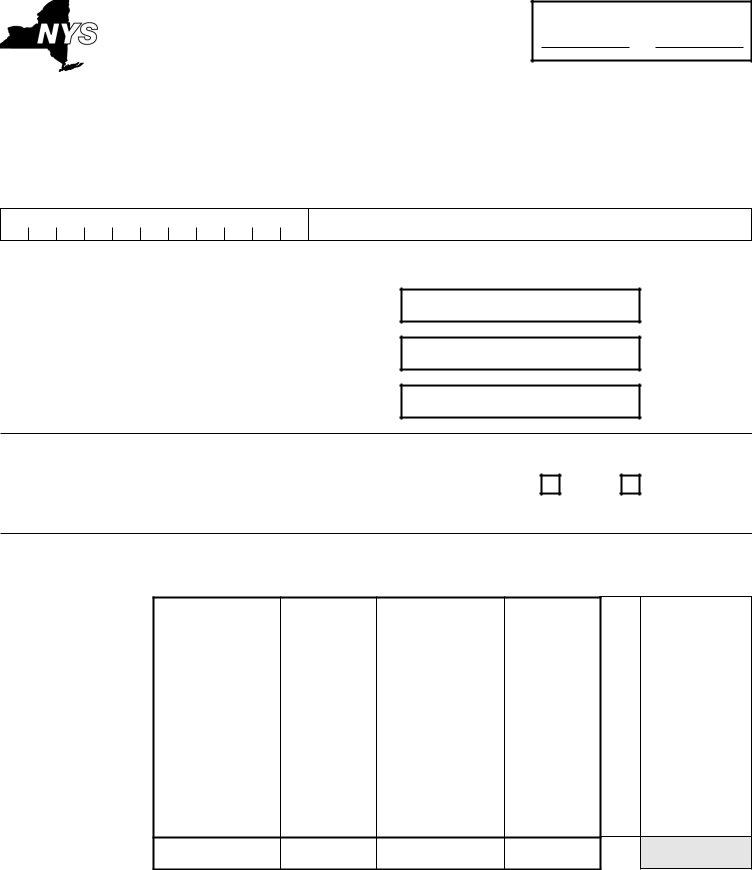

New York State Department of Taxation and Finance

NEW YORK STATE AND LOCAL SALES AND USE TAX RETURN WORKSHEET

For quarterly period (mm/dd/yy):

/ / to / /

Do not file this worksheet with the Tax Department.

(This worksheet is to be used to assist in Web Filing only.)

Sales tax identification number

Legal name

Summary

Gross sales ................................................................

Credit card and debit card deposits (optional) .............

Final return

Are you Web Filing a final return? |

Yes |

If Yes, see Form

No

Jurisdiction information — No

Enter the information for each jurisdiction in the boxes below.

A |

B |

|

C |

D |

E |

F |

G |

H |

Jurisdiction |

Jurisdiction |

|

Taxable |

Credits |

Taxable |

Credits |

Tax |

Tax |

name |

code |

|

sales |

against |

purchases |

against |

rate* |

due* |

|

|

|

|

sales |

|

purchases |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals:

NOTE: This table may be used for the main return only. Worksheets for each schedule will be available soon.

*Web File will populate the tax rate and compute the amount of tax due when you file.

Page 1 of 2 |

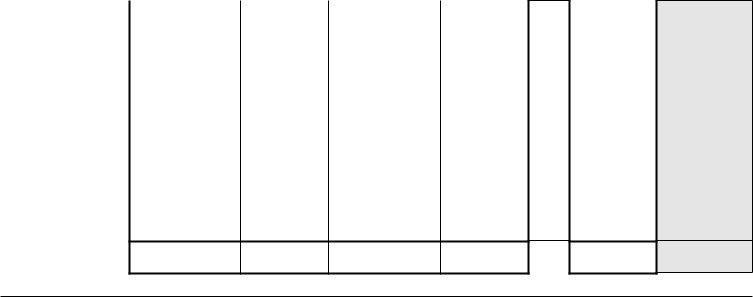

Page 2 of 2

Jurisdiction information — Including

If you are remitting

If you have

A |

B |

|

C |

D |

E |

F |

G |

H |

I |

Jurisdiction |

Jurisdiction |

|

Taxable |

Credits |

Taxable |

Credits |

Tax |

Tax |

|

name |

code |

|

sales |

against sales |

purchases |

against |

rate* |

tax |

due* |

|

|

|

|

|

|

purchases |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals:

Special taxes B x C = D

A |

|

B |

C |

D |

|

Special taxes |

|

Taxable receipt |

Tax |

Tax |

|

|

|

|

rate* |

due* |

|

|

|

|

|

|

|

Passenger car rental (outside MCTD) |

|

|

|

|

|

Passenger car rental (inside MCTD) |

|

|

|

|

|

Information and entertainment services |

|

|

|

|

|

|

Total: |

|

|

|

|

|

|

|

|

|

|

NOTE: If you are claiming credits on the return you are Web Filing, see Form

*Web File will populate the tax rate and compute the amount of tax due when you file.

Do not file this worksheet with the Tax Department.

(This worksheet is to be used to assist in Web Filing only.)