If you are a business owner, then you know that staying compliant with the IRS is essential to keeping your business running. One of the most important forms you will need to file is Form W-2 Wage and Tax Statement. This form reports wages paid to employees and the taxes withheld from those wages. Here we will outline what information is required on Form W-2, as well as how to file it. Stay compliant and keep your business running smoothly with Form W-2 Wage and Tax Statement. Thank you for reading our blog post! If you have any questions, please don't hesitate to reach out to us. We're here to help!

| Question | Answer |

|---|---|

| Form Name | Form St 100 101 810 Ws |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | MCTD, st 100 101 810, New_York, taxable |

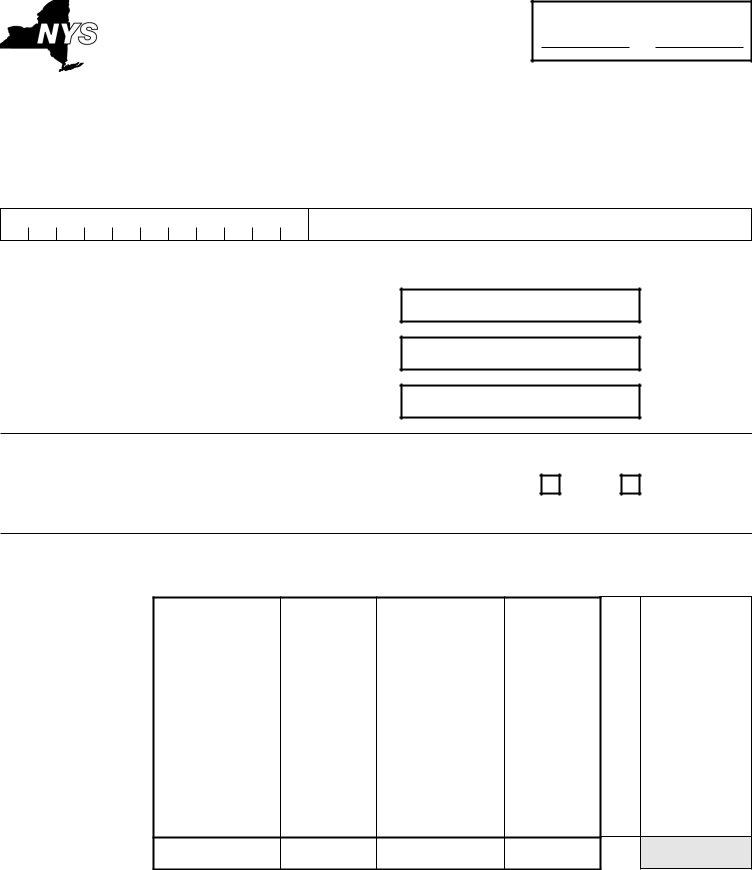

New York State Department of Taxation and Finance

NEW YORK STATE AND LOCAL SALES AND USE TAX RETURN WORKSHEET

For quarterly period (mm/dd/yy):

/ / to / /

Do not file this worksheet with the Tax Department.

(This worksheet is to be used to assist in Web Filing only.)

Sales tax identification number

Legal name

Summary

Gross sales ................................................................

Credit card and debit card deposits (optional) .............

Final return

Are you Web Filing a final return? |

Yes |

If Yes, see Form

No

Jurisdiction information — No

Enter the information for each jurisdiction in the boxes below.

A |

B |

|

C |

D |

E |

F |

G |

H |

Jurisdiction |

Jurisdiction |

|

Taxable |

Credits |

Taxable |

Credits |

Tax |

Tax |

name |

code |

|

sales |

against |

purchases |

against |

rate* |

due* |

|

|

|

|

sales |

|

purchases |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals:

NOTE: This table may be used for the main return only. Worksheets for each schedule will be available soon.

*Web File will populate the tax rate and compute the amount of tax due when you file.

Page 1 of 2 |

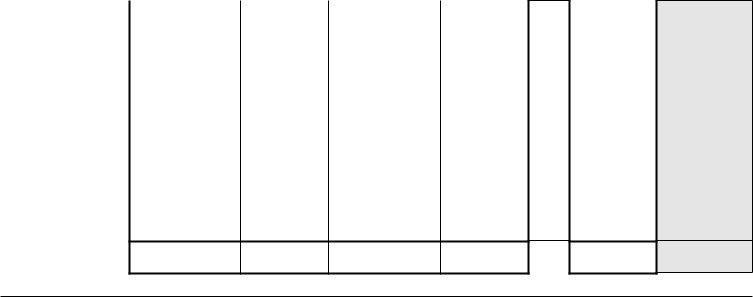

Page 2 of 2

Jurisdiction information — Including

If you are remitting

If you have

A |

B |

|

C |

D |

E |

F |

G |

H |

I |

Jurisdiction |

Jurisdiction |

|

Taxable |

Credits |

Taxable |

Credits |

Tax |

Tax |

|

name |

code |

|

sales |

against sales |

purchases |

against |

rate* |

tax |

due* |

|

|

|

|

|

|

purchases |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals:

Special taxes B x C = D

A |

|

B |

C |

D |

|

Special taxes |

|

Taxable receipt |

Tax |

Tax |

|

|

|

|

rate* |

due* |

|

|

|

|

|

|

|

Passenger car rental (outside MCTD) |

|

|

|

|

|

Passenger car rental (inside MCTD) |

|

|

|

|

|

Information and entertainment services |

|

|

|

|

|

|

Total: |

|

|

|

|

|

|

|

|

|

|

NOTE: If you are claiming credits on the return you are Web Filing, see Form

*Web File will populate the tax rate and compute the amount of tax due when you file.

Do not file this worksheet with the Tax Department.

(This worksheet is to be used to assist in Web Filing only.)