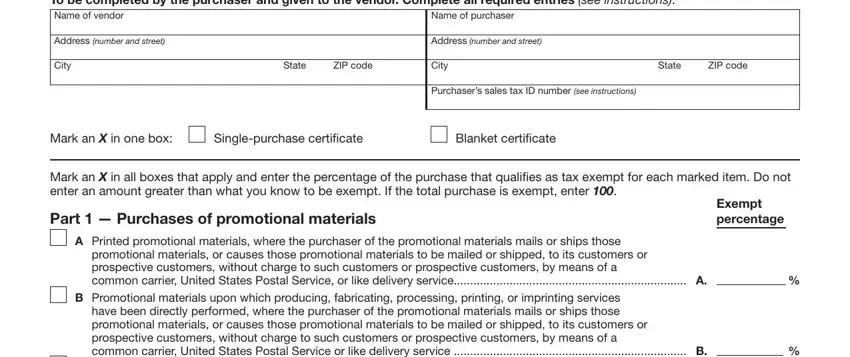

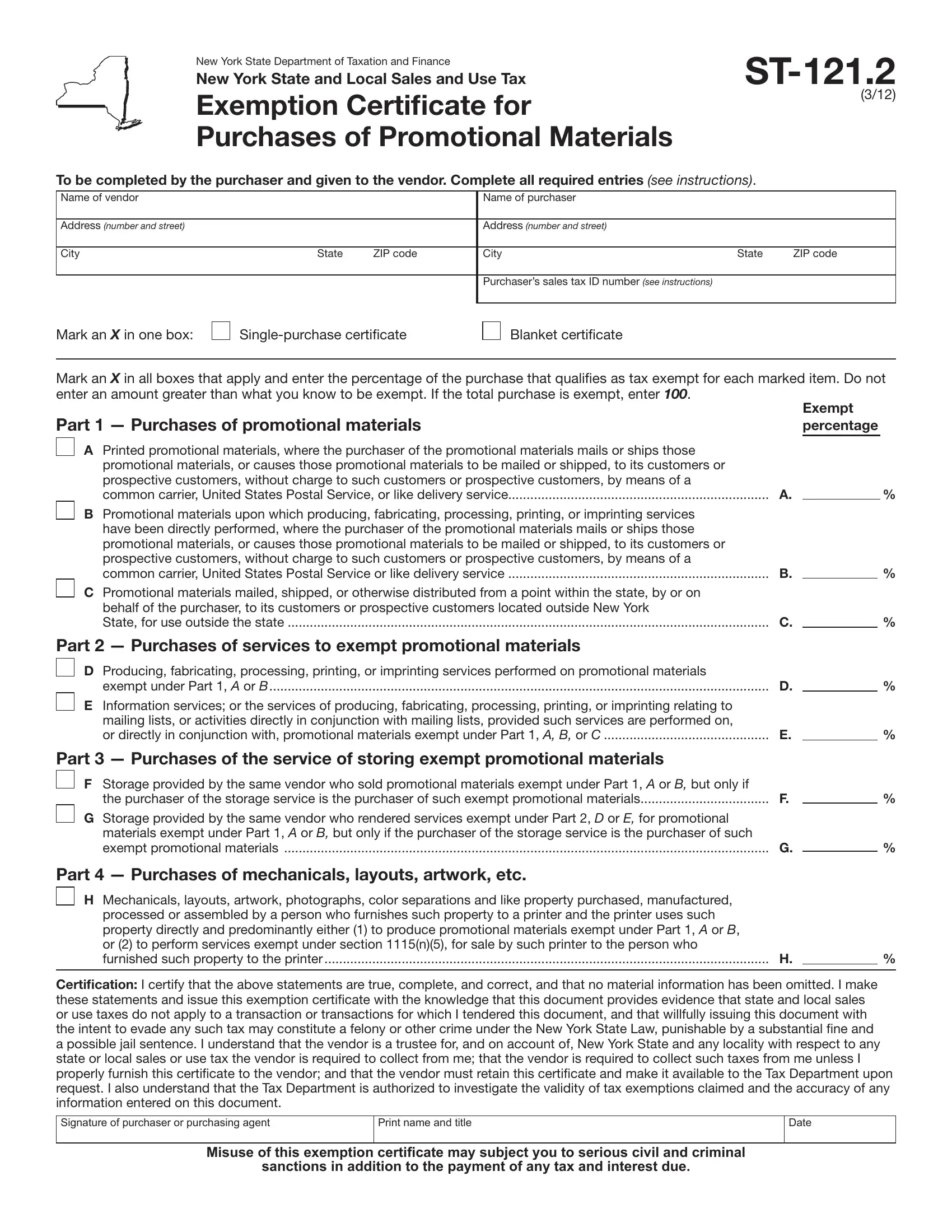

To the purchaser

If you are purchasing promotional materials, or services relating to promotional materials, you must complete this form and give it to the vendor to certify the percentage of the purchase that is exempt from sales tax. Promotional materials include any advertising literature such as catalogs and brochures, and related tangible personal property (for example, annual reports, complimentary maps, other free gifts, applications, and order forms), and the envelopes used exclusively to deliver the promotional materials. Account statements, invoices, or the envelopes used to deliver them are not promotional materials.

Purchaser’s sales tax vendor ID number

If you are registered with the Tax Department for sales tax purposes, you must enter your sales tax identiication number on this form. If you are not required to be registered, enter N/A.

Percentage

Enter the percentage of the purchase that qualiies as tax exempt for each category of exempt promotional materials and services you are purchasing. If you estimate too high a percentage as exempt, you must pay tax on the portion that turns out to be taxable. If you marked an X in the Blanket certificate box, you should periodically review the percentage(s). If any percentage changes, you must issue a new blanket certiicate. The new blanket certiicate covers subsequent purchases, and remains in effect until the percentages change again and you issue a newer certiicate.

If you cannot, in good faith, determine the exempt percentage, you must pay tax at the time of purchase and request a refund.

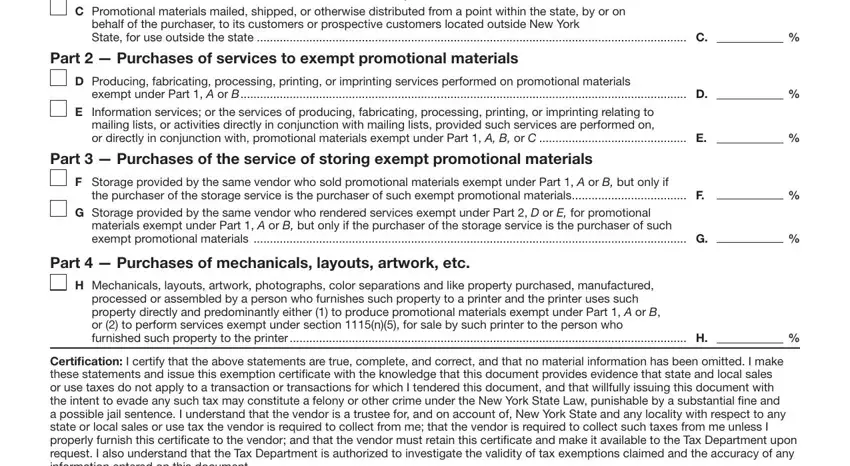

Part 1 — Purchases of promotional materials

Printed promotional materials include any printed materials such as catalogs, literature, and related tangible personal property (such as complimentary maps, applications, and order forms), and the envelopes used exclusively to deliver the promotional materials.

Part 2 — Purchases of services to exempt promotional materials

Other purchases exempt from sales tax include information sold in the form of printed matter relating to mailing lists, including merging names, labeling envelopes, and similar services when sold in conjunction with qualifying exempt promotional materials.

Part 3 — Purchases of the service of storing exempt promotional materials

The purchaser of promotional materials exempt as described in Part 1, paragraph A or B, may also purchase certain storage charges exempt from tax if the charges are for storing exempt promotional materials and the storage is provided by the same vendor who sold the exempt printed promotional materials, or by the same vendor who rendered exempt services to the promotional materials, as described in Part 1, paragraph D or E. Storage of other promotional materials is taxable.

Part 4 — Purchases of mechanicals, layouts, artwork, etc.

Paper, ink, artwork, mechanicals, and other supplies that you purchase and furnish to the printer are exempt if the printer uses them to produce and sell to you promotional materials exempt under Part 1, A or B.

For more information on the production and use of promotional materials, see TSB-M-97(6)S, Expanded Sales and Compensating Use Tax Exemption for Promotional Materials, and TSB-M-01(4)S, Summary of Recently Enacted Sales and Use Tax Legislation.

Exemption of free gifts

Free gifts are not exempt promotional materials unless one of the following applies:

•they are shipped out of state, or

•they are printed materials or promotional materials upon which producing, fabricating, processing, printing, or imprinting services have been directly performed and the purchaser of the gifts mails or ships them, or causes them to be mailed or shipped, to its

customers or prospective customers, without charge to such customers or prospective customers, by means of a common carrier, United States Postal Service, or like delivery service.

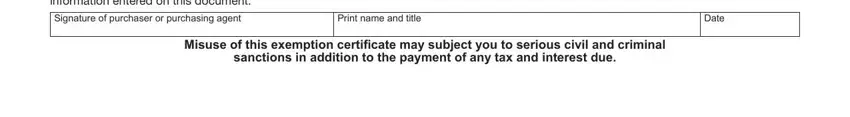

To the vendor

The purchaser must give you Form ST-121.2 with all required entries completed no later than 90 days after delivery of the property or services sold, or the sale will be deemed to have been taxable at the time of the transaction. If you receive the certiicate after 90 days, both you and the purchaser assume the burden

of proving the sale was exempt, and we may require additional substantiation.

In addition, if you fail to collect tax as a result of accepting an improperly completed Form ST-121.2, you become personally liable for the tax, plus any penalty and interest due, unless the certiicate is corrected within a reasonable period of time or you otherwise prove that the transaction was not subject to tax. You must keep any exemption certiicate you receive for at least three years after the due date of the last tax return to which it relates, or the date the return is iled, if later. You must also maintain a method of associating an exempt sale made to a particular customer with the exemption certiicate you have on ile for that customer.

If the Blanket certificate box is marked, you may consider this certiicate part of any order received from the purchaser during the period that the blanket certiicate remains in effect. However, each subsequent sales slip or purchase invoice based on this blanket certiicate must show the purchaser’s name and address and,

if applicable, the NYS sales tax ID number. A blanket certiicate remains in effect until the purchaser gives you written notice of revocation, or you have knowledge that the certiicate is false or was fraudulently presented, or until the Tax Department notiies you that the purchaser may no longer make exempt purchases.

Need help?

Visit our Web site at www.tax.ny.gov

•get information and manage your taxes online

•check for new online services and features

Telephone assistance |

|

Sales Tax Information Center: |

(518) 485-2889 |

To order forms and publications: |

(518) 457-5431 |

Text Telephone (TTY) Hotline (for persons with

hearing and speech disabilities using a TTY): (518) 485-5082

Persons with disabilities: In compliance with the

Americans with Disabilities Act, we will ensure that our lobbies, ofices, meeting rooms, and other facilities are

accessible to persons with disabilities. If you have questions about special accommodations for persons with disabilities, call the information center.

Privacy notification

The Commissioner of Taxation and Finance may collect and maintain personal information pursuant to the New York State Tax Law, including but not limited to, sections 5-a, 171, 171-a, 287, 308, 429, 475, 505, 697, 1096, 1142, and 1415 of that Law; and may require disclosure of social security numbers pursuant to 42 USC 405(c)(2)(C)(i).

This information will be used to determine and administer tax liabilities and, when authorized by law, for certain tax offset and exchange of tax information programs as well as for any other lawful purpose.

Information concerning quarterly wages paid to employees is provided to certain state agencies for purposes of fraud prevention, support enforcement, evaluation of the effectiveness of certain employment and training programs and other purposes authorized by law.

Failure to provide the required information may subject you to civil or criminal penalties, or both, under the Tax Law.

This information is maintained by the Manager of Document Management, NYS Tax Department, W A Harriman Campus, Albany NY 12227; telephone (518) 457-5181.