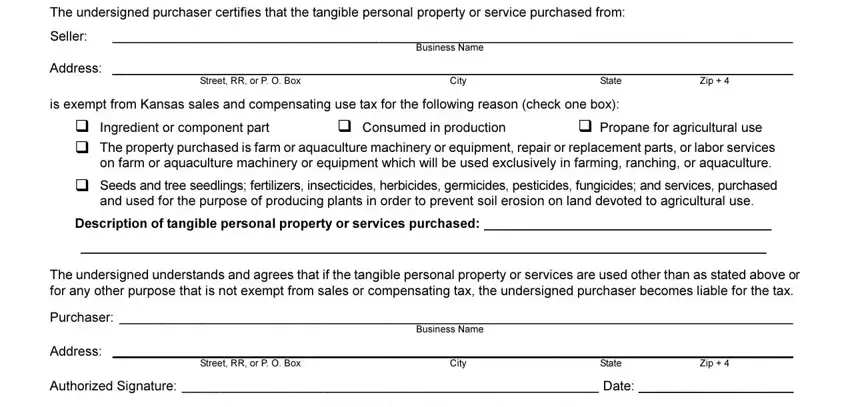

KANSASDEPARTMENTOFREVENUE

AGRICULTURALEXEMPTIONCERTIFICATE

The undersigned purchaser certifies that the tangible personal property or service purchased from:

Seller: |

__________________________________________________________________________________________________ |

|

|

BusinessName |

|

|

Address: |

__________________________________________________________________________________________________ |

|

Street,RR,orP.O.Box |

City |

State |

Zip+4 |

is exempt from Kansas sales and compensating use tax for the following reason (check one box):

q Ingredient or component part |

q Consumed in production |

q Propane for agricultural use |

qThepropertypurchasedisfarmoraquaculturemachineryorequipment,repairorreplacementparts,orlaborservices on farm or aquaculture machinery or equipment whichwill be used exclusively in farming, ranching, or aquaculture.

qSeedsandtreeseedlings;fertilizers,insecticides,herbicides,germicides,pesticides,fungicides;andservices,purchased and used for the purpose of producingplants in order to prevent soil erosion on land devoted to agricultural use.

Descriptionoftangiblepersonalpropertyorservicespurchased: _______________________________________

_________________________________________________________________________________________

Theundersignedunderstandsandagreesthatifthetangiblepersonalpropertyorservicesareusedotherthanasstatedaboveor for any other purpose that is not exempt from salesor compensatingtax, the undersigned purchaser becomesliable for the tax.

Purchaser: _________________________________________________________________________________________________

BusinessName

Address: __________________________________________________________________________________________________

Street,RR,orP.O.BoxCity State Zip+4

Authorized Signature: ____________________________________________________________ Date: _____________________

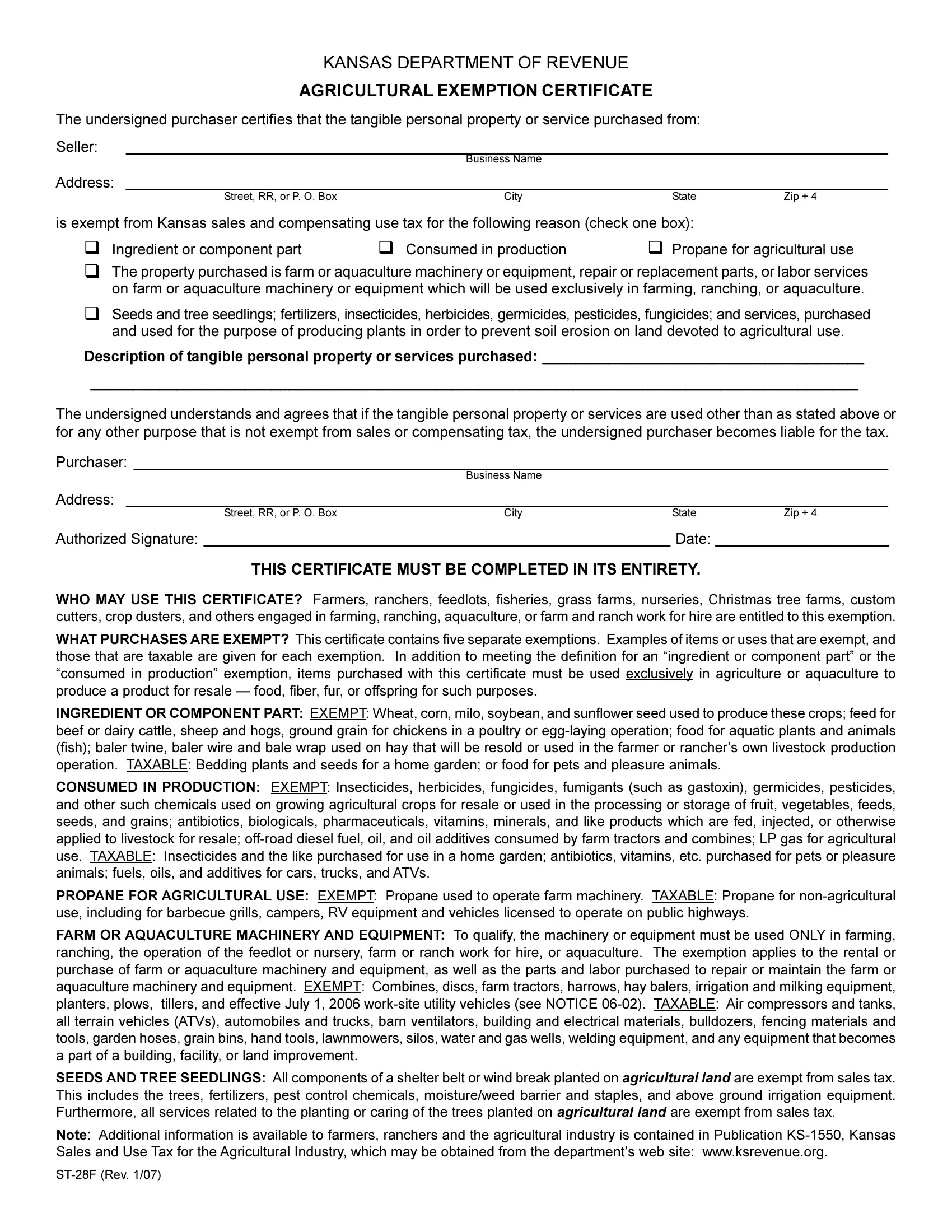

THISCERTIFICATEMUSTBECOMPLETEDINITSENTIRETY.

WHO MAY USE THIS CERTIFICATE? Farmers, ranchers, feedlots, fisheries, grass farms, nurseries, Christmas tree farms, custom cutters,cropdusters,andothersengagedinfarming,ranching,aquaculture,orfarmandranchworkforhireareentitledtothisexemption.

WHATPURCHASESAREEXEMPT? Thiscertificatecontainsfiveseparateexemptions. Examplesofitemsorusesthatareexempt,and those that are taxable are given for each exemption. In addition to meeting the definition for an ingredient or component part or the consumed in production exemption, items purchased with this certificate must be used exclusively in agriculture or aquaculture to produce a product for resale food, fiber, fur, or offspring for such purposes.

INGREDIENTORCOMPONENTPART: EXEMPT:Wheat,corn,milo,soybean,andsunflowerseedusedtoproducethesecrops;feedfor beef or dairy cattle, sheep and hogs, ground grain for chickens in a poultry or egg-laying operation; food for aquatic plants and animals (fish); baler twine, baler wire and bale wrap used on hay that will be resold or used in the farmer or ranchers own livestock production operation. TAXABLE: Bedding plants and seeds for a home garden; or food for pets and pleasure animals.

CONSUMED IN PRODUCTION: EXEMPT: Insecticides, herbicides, fungicides, fumigants (such as gastoxin), germicides, pesticides, and other such chemicals used on growing agricultural crops for resale or used in the processing or storage of fruit, vegetables, feeds, seeds, and grains; antibiotics, biologicals, pharmaceuticals, vitamins, minerals, and like products which are fed, injected, or otherwise applied to livestock for resale; off-road diesel fuel, oil, and oil additives consumed by farm tractors and combines; LP gas for agricultural use. TAXABLE: Insecticides and the like purchased for use in a home garden; antibiotics, vitamins, etc. purchased for pets or pleasure animals; fuels, oils, and additives for cars, trucks, andATVs.

PROPANE FORAGRICULTURAL USE: EXEMPT: Propane used to operate farm machinery. TAXABLE: Propane for non-agricultural use, including for barbecue grills, campers, RV equipment and vehicles licensed to operate on public highways.

FARM ORAQUACULTURE MACHINERYAND EQUIPMENT: To qualify, the machinery or equipment must be used ONLY in farming, ranching, the operation of the feedlot or nursery, farm or ranch work for hire, or aquaculture. The exemption applies to the rental or purchase of farm or aquaculture machinery and equipment, as well as the parts and labor purchased to repair or maintain the farm or aquaculturemachineryandequipment. EXEMPT: Combines,discs,farmtractors,harrows,haybalers,irrigationandmilkingequipment, planters, plows, tillers, and effective July 1, 2006 work-site utility vehicles (see NOTICE 06-02). TAXABLE: Air compressors and tanks, all terrain vehicles (ATVs), automobiles and trucks, barn ventilators, building and electrical materials, bulldozers, fencing materials and tools,gardenhoses,grainbins,handtools,lawnmowers,silos,waterandgaswells,weldingequipment,andanyequipmentthatbecomes a part of a building, facility, or land improvement.

SEEDSANDTREESEEDLINGS: Allcomponentsofashelterbeltorwindbreakplantedonagriculturallandareexemptfromsalestax. This includes the trees, fertilizers, pest control chemicals, moisture/weed barrier and staples, and above ground irrigation equipment. Furthermore, all services related to the planting or caring of the trees planted on agriculturalland are exempt from sales tax.

Note: Additional information is available to farmers, ranchers and the agricultural industry is contained in Publication KS-1550, Kansas

Sales and Use Tax for theAgricultural Industry, which may be obtained from the departments web site: www.ksrevenue.org.