Should you desire to fill out nys forms, you won't have to download and install any kind of software - simply try using our PDF tool. Our tool is consistently evolving to give the best user experience attainable, and that's because of our resolve for continuous development and listening closely to comments from customers. Getting underway is easy! All you should do is stick to these easy steps below:

Step 1: Just click the "Get Form Button" at the top of this webpage to launch our pdf form editing tool. There you will find everything that is needed to work with your file.

Step 2: The editor gives you the ability to work with PDF forms in a range of ways. Improve it with any text, adjust what's already in the file, and put in a signature - all doable within minutes!

It is actually simple to finish the pdf adhering to this practical tutorial! Here is what you must do:

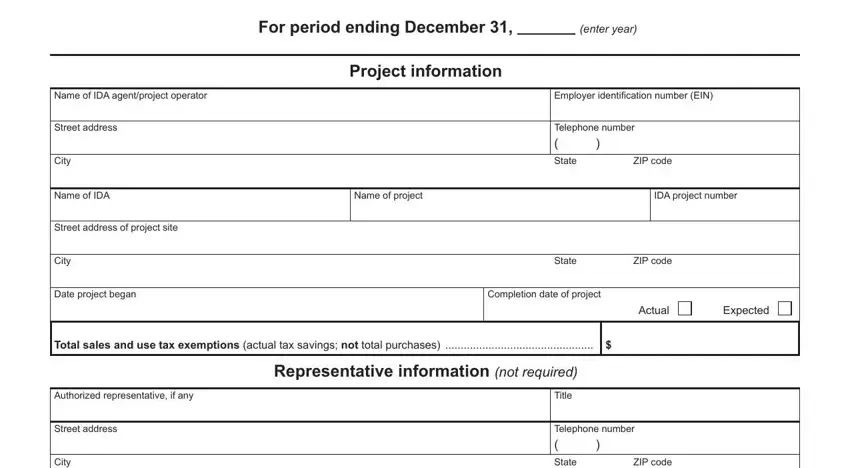

1. Begin completing your nys forms with a number of major blanks. Consider all the required information and be sure there is nothing missed!

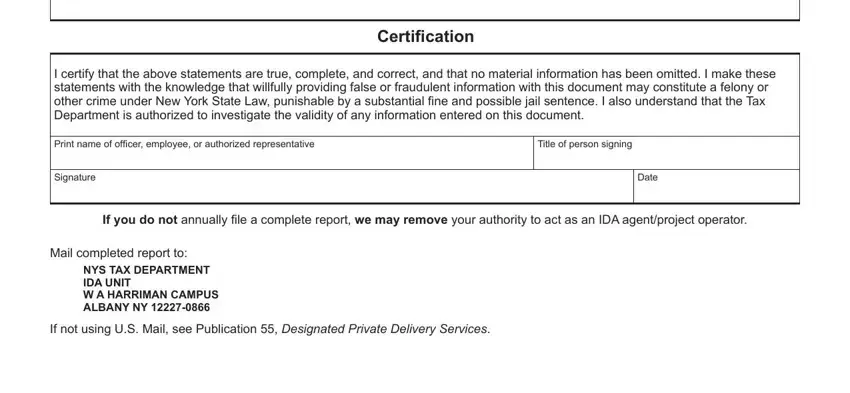

2. Once the previous section is complete, you're ready put in the essential particulars in City, State, ZIP code, Certiication, I certify that the above, Print name of oficer employee or, Title of person signing, Signature, Date, If you do not annually ile a, Mail completed report to, NYS TAX DEPARTMENT IDA UNIT W A, and If not using US Mail see allowing you to progress further.

Regarding Date and ZIP code, be sure you take a second look in this current part. Both of these are definitely the most significant fields in the document.

Step 3: Check the details you've entered into the blanks and click on the "Done" button. After registering a7-day free trial account with us, you will be able to download nys forms or email it right off. The PDF form will also be easily accessible via your personal cabinet with your each and every edit. When using FormsPal, it is simple to complete forms without stressing about data leaks or entries being distributed. Our protected platform helps to ensure that your private data is stored safe.