Should you intend to fill out st7r form, you don't need to install any kind of applications - simply give a try to our online PDF editor. In order to make our editor better and easier to use, we continuously design new features, taking into consideration suggestions from our users. With just several easy steps, you'll be able to begin your PDF editing:

Step 1: Click on the "Get Form" button above. It'll open up our tool so that you can start completing your form.

Step 2: As you start the file editor, you will see the form all set to be completed. Apart from filling out different fields, you could also do various other actions with the form, such as writing your own text, editing the initial textual content, adding images, affixing your signature to the form, and more.

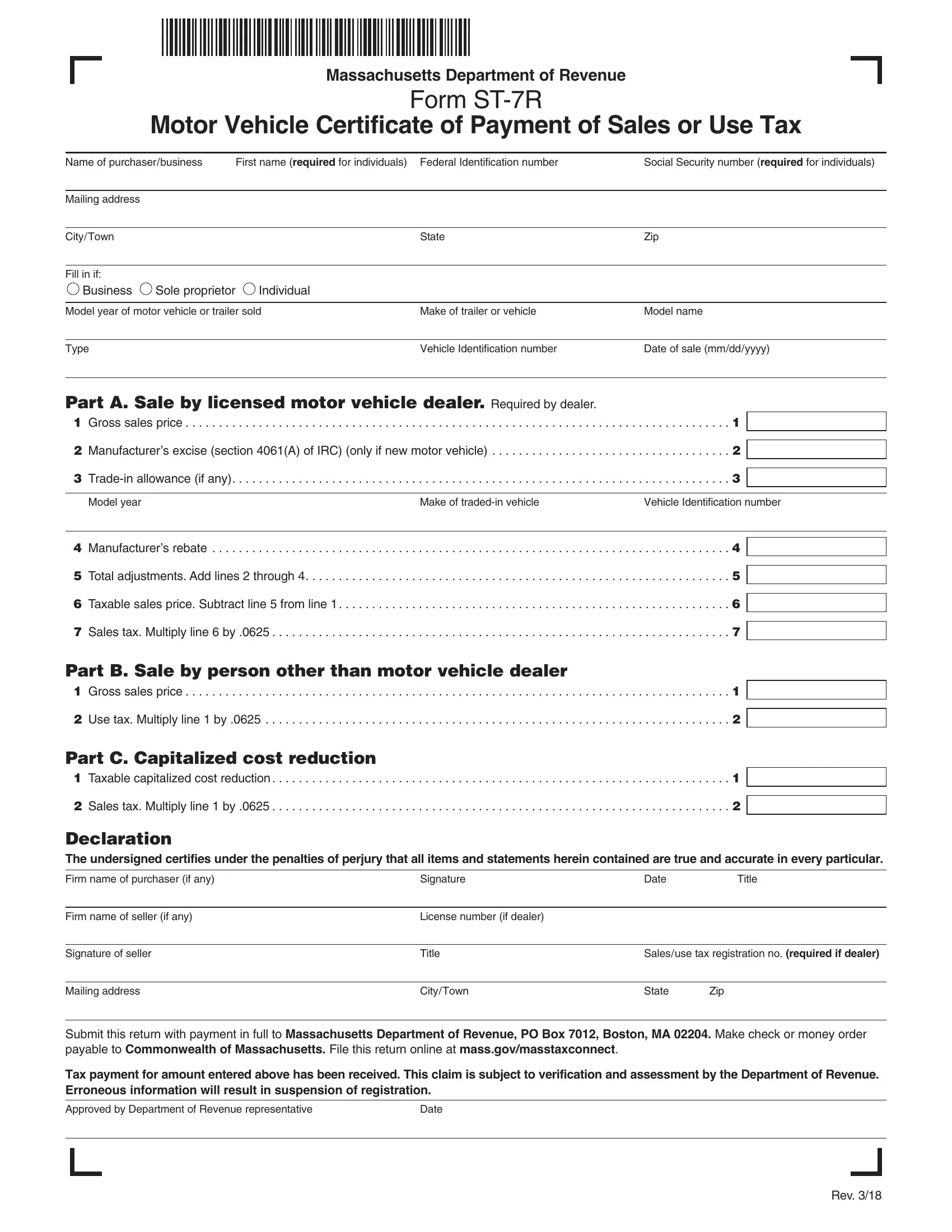

In an effort to complete this PDF form, ensure you enter the information you need in every single area:

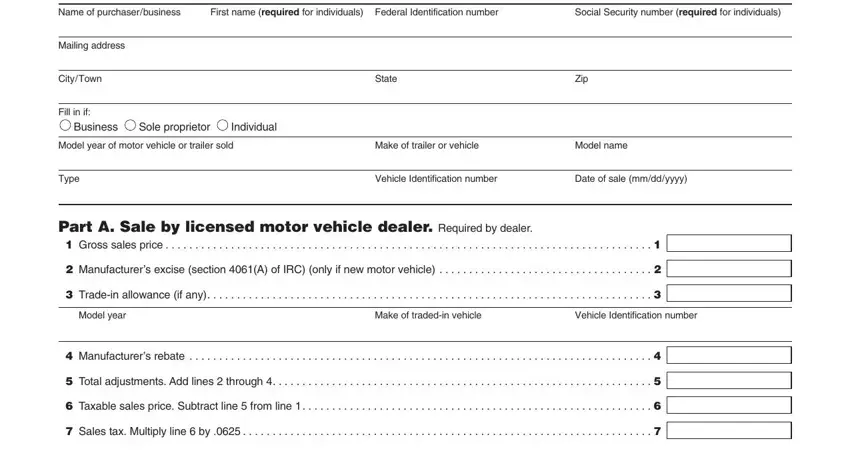

1. Begin filling out the st7r form with a group of major blanks. Note all the information you need and make sure there's nothing neglected!

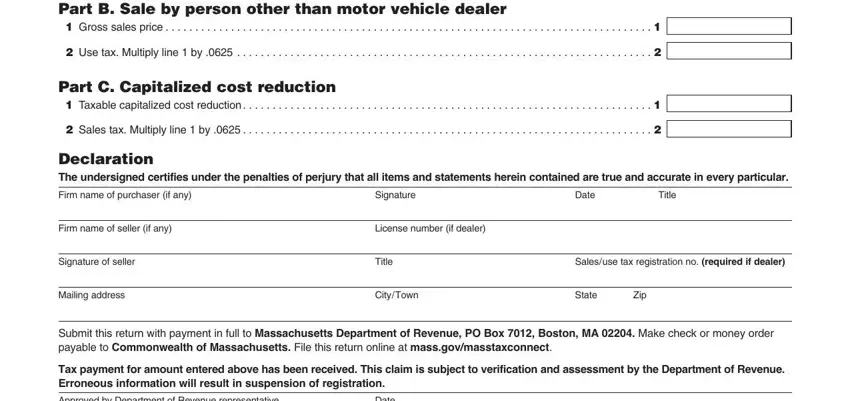

2. Right after performing this part, head on to the subsequent stage and enter the essential details in these fields - Part B Sale by person other than, Use tax Multiply line by, Part C Capitalized cost reduction, Sales tax Multiply line by, Declaration The undersigned, Firm name of purchaser if any, Signature, Date, Title, Firm name of seller if any, License number if dealer, Signature of seller, Mailing address, Title, and CityTown.

3. Throughout this part, have a look at Approved by Department of Revenue, Date, and Rev. Each of these need to be completed with highest awareness of detail.

Always be very mindful while completing Date and Approved by Department of Revenue, as this is the part in which many people make mistakes.

Step 3: Proofread everything you've inserted in the form fields and then press the "Done" button. Try a 7-day free trial account with us and gain immediate access to st7r form - download, email, or edit from your FormsPal account page. If you use FormsPal, you're able to complete forms without being concerned about personal data breaches or records being shared. Our secure platform helps to ensure that your personal details are kept safe.