The St 9 form plays a pivotal role in the Massachusetts sales and use tax system, serving as a monthly sales and use tax return required by the Massachusetts Department of Revenue. As businesses navigate through the complexities of tax compliance, understanding the intricacies of the St 9 form becomes essential. Each section of the form is designed to capture a comprehensive snapshot of a business's taxable and non-taxable sales activities for a given month, emphasizing the importance of accurate reporting. Businesses are mandated to file this form even in instances where no tax is due, highlighting the state's commitment to thorough record-keeping. The form meticulously details the procedure for reporting gross sales, sales for resale, exempt sales, and other adjustments, alongside specific categories such as sales of materials, tools, fuel, machinery, and replacement parts. These distinctions play a crucial role in determining a business's total taxable amount, factoring into the calculation of the tax due. Penalties and interest are addressed for late filings, underscoring the importance of adherence to the submission deadline - the 20th day of the month following the reporting period. Moreover, the option to indicate a final return for businesses wishing to close their sales tax account adds an element of finality to the process. The declaration section at the end of the form reinforces the legal responsibility of the filer to ensure the accuracy and completeness of the information provided, under the penalties of perjury. Compliance with the St 9 form underscores a business's commitment to fiscal responsibility and adherence to state tax laws, serving as a critical component of the Massachusetts tax system.

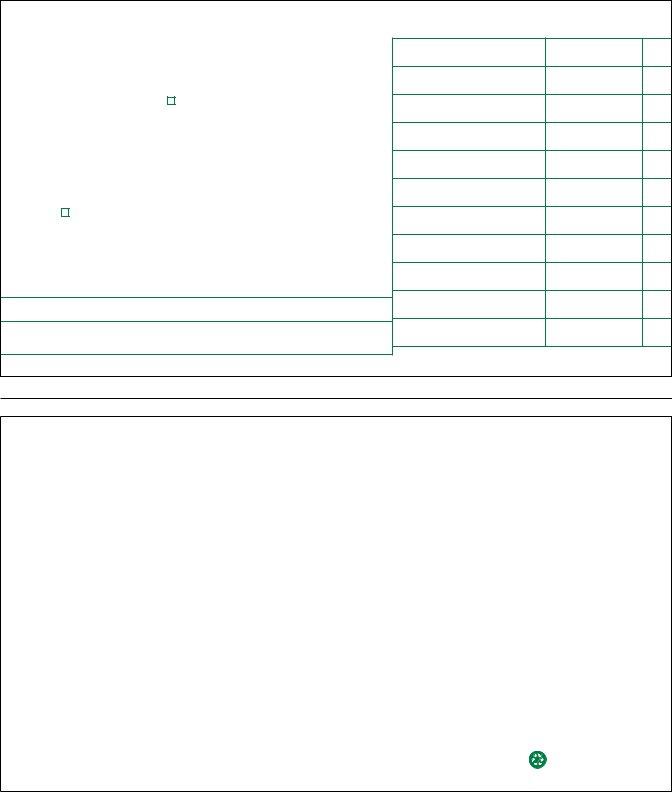

| Question | Answer |

|---|---|

| Form Name | Form St 9 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | st, form st 9 massachusetts, massachusetts st 9, fillable st 9 sales tax form |

FOR THE MONTH OF AUGUST 2008 AND PREVIOUS MONTHS

MASSACHUSETTS DEPARTMENT OF REVENUE |

||||

SM |

MONTHLY SALES AND USE TAX RETURN |

|||

YOU MUST FILE THIS FORM EVEN THOUGH NO TAX MAY BE DUE. |

||||

|

|

|

|

|

FEDERAL IDENTIFICATION NUMBER |

BE SURE THIS RETURN COVERS |

FOR MONTH |

||

|

|

|

THE CORRECT PERIOD |

|

|

|

|

Check here if EFT payment. |

|

|

|

|

|

|

IF ANY |

|

|

|

|

INFOR- |

|

|

|

|

MATION IS |

|

|

|

|

INCORRECT, |

|

|

|

|

SEE |

|

|

|

|

INSTRUC- |

|

|

|

|

TIONS. |

|

Check if final return and you wish to close your sales tax account. |

||

|

|

|||

|

|

|

|

|

Return is due with payment on or before the 20th day of the month following the month indicated above. Make check payable to Commonwealth of Mass. Mail to: Mass. Dept. of Revenue, PO Box 7039, Boston, MA

I declare under the penalties of perjury that this return (including any accompanying schedules and statements) has been examined by me and to the best of my knowledge and belief is a true, correct and complete return.

Signature |

Title |

Date |

Note: An entry must be made in each line. Enter “0,” if applicable.

1.GROSS SALES

2.SALES FOR RESALE / EXEMPT SALES OR OTHER ADJUSTMENTS

2A. SALES OF MATERIALS, TOOLS AND FUEL

2B. SALES OF MACHINERY AND REPLACEMENT PARTS

3.TOTAL NONTAXABLE SALES (ADD LINES 2, 2A AND 2B)

4.TAXABLE SALES (SUBTRACT LINE 3 FROM LINE 1; ZERO IF NEGATIVE)

5.USE TAX PURCHASES

6.TOTAL TAXABLE AMOUNT (ADD LINE 4 AND LINE 5)

7.TOTAL TAXES (LINE 6 × .05)

8.PENALTIES AND INTEREST

9.TOTAL AMOUNT DUE (ADD LINE 7 AND LINE 8)

Note: Lines 2A and 2B are for the sales of items becoming part of property sold or used directly in industrial or certain other production. These items are not to be used for income deductions.

52.5M 7/00 |

printed on recycled paper |