Handling PDF files online is definitely simple using our PDF tool. You can fill in Form St11 Aud here effortlessly. FormsPal team is focused on providing you with the absolute best experience with our tool by constantly adding new features and improvements. Our editor is now much more user-friendly thanks to the most recent updates! At this point, editing PDF documents is simpler and faster than ever before. It merely requires a few basic steps:

Step 1: Open the form inside our tool by pressing the "Get Form Button" at the top of this page.

Step 2: This editor helps you change PDF files in a variety of ways. Transform it by writing your own text, adjust what's already in the document, and include a signature - all at your disposal!

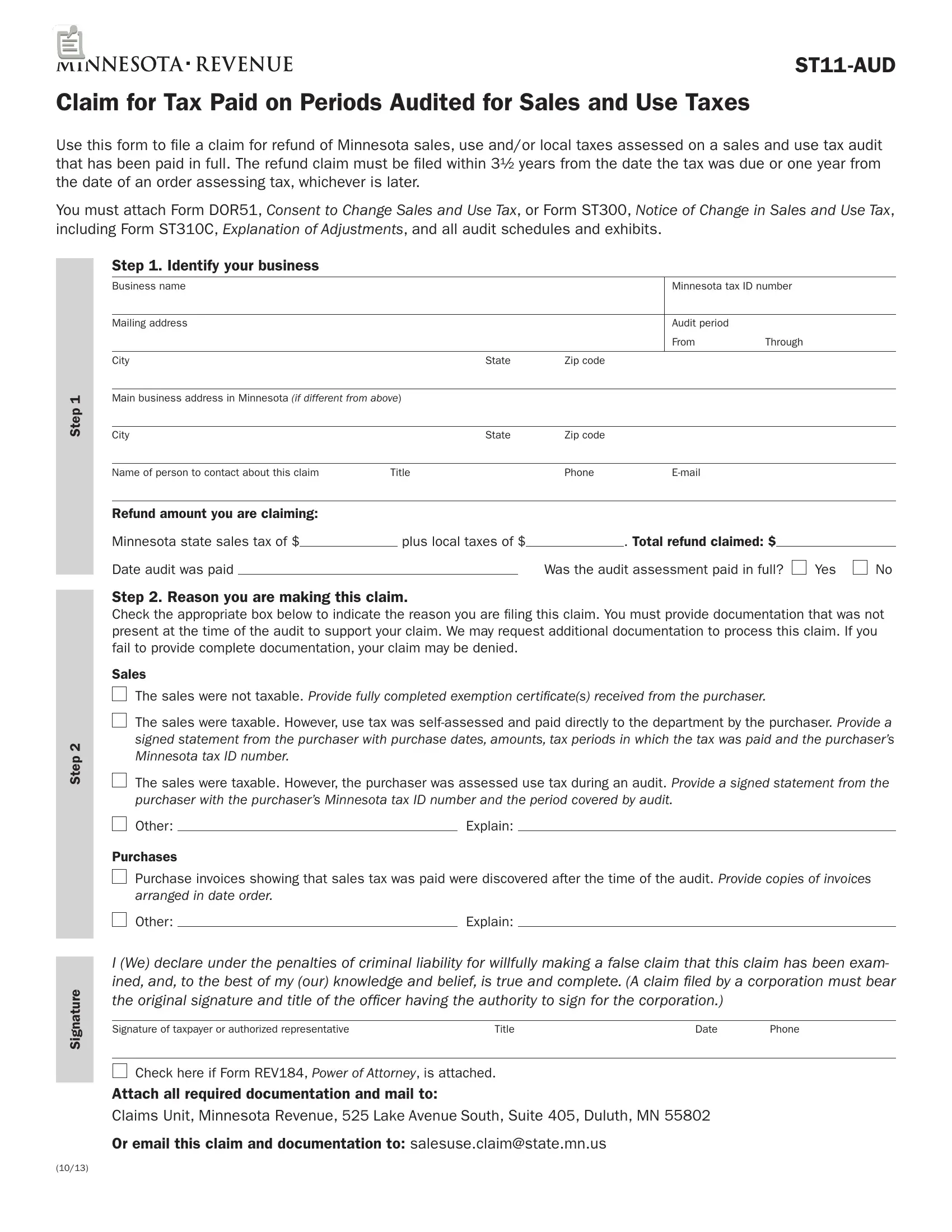

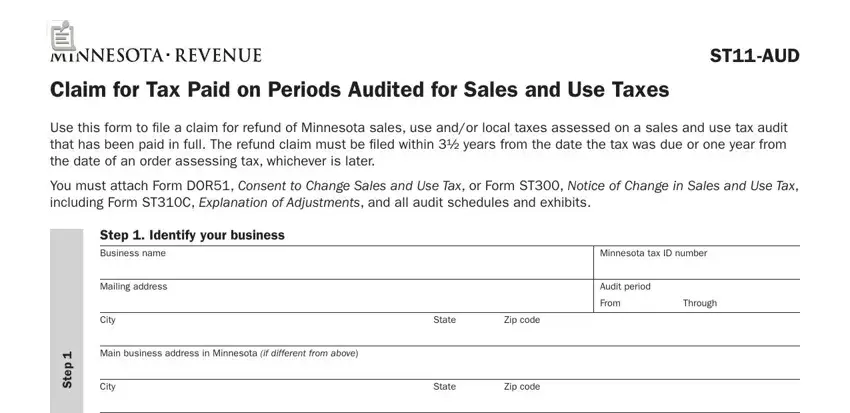

This PDF requires particular data to be filled out, hence be sure to take some time to enter what's requested:

1. Complete the Form St11 Aud with a selection of necessary fields. Note all the required information and make certain there is nothing neglected!

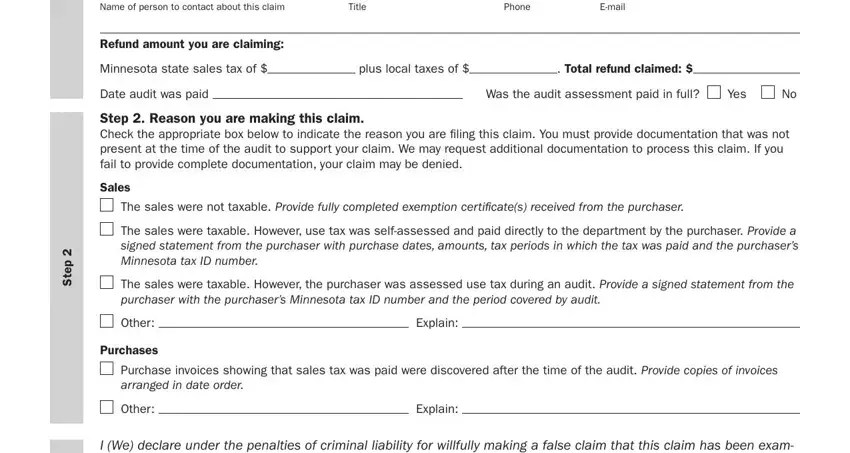

2. Once your current task is complete, take the next step – fill out all of these fields - Name of person to contact about, Title, Phone, Email, Refund amount you are claiming, Minnesota state sales tax of, plus local taxes of, Total refund claimed, Date audit was paid, Was the audit assessment paid in, Yes, Step Reason you are making this, Sales, The sales were not taxable Provide, and The sales were taxable However use with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

People often get some things wrong while filling in Total refund claimed in this part. Don't forget to re-examine whatever you enter here.

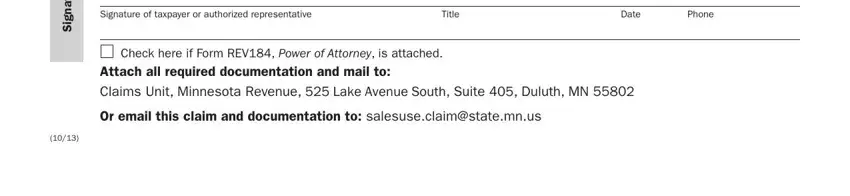

3. Completing Signature of taxpayer or, Title, Date, Phone, Check here if Form REV Power of, Attach all required documentation, Or email this claim and, and e r u t a n g S is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Step 3: Soon after taking one more look at the fields and details, hit "Done" and you're done and dusted! Right after starting a7-day free trial account at FormsPal, you will be able to download Form St11 Aud or send it through email immediately. The PDF file will also be available from your personal account menu with all of your modifications. We do not share the information you use whenever working with documents at our site.