Navigating through the intricacies of tax obligations can be daunting for any business, especially when it comes to specific forms like the T-72 form utilized by public service corporations in Rhode Island. Officially known as the Public Service Corporation Gross Earnings Tax Return, this form serves a vital purpose in ensuring these entities accurately report their earnings for the calendar year, culminating on December 31. The form demands detailed information, including the corporation’s name, address, federal identification number, and the precise type of public service it provides, which could range from telecommunications to gas, electric, and even dining car services. Each category mandates filling out a corresponding schedule, all starting with a mandatory analysis of gross earnings. Beyond just reporting earnings, the T-72 form intricately breaks down deductions, taxable earnings, and the final tax due, ensuring corporations meet their fiscal responsibilities while also allowing for adjustments based on estimated tax payments or overpayments. The importance of accurate certification cannot be overstated, as this document requires attestation under penalty of perjury to the completeness and correctness of the information provided. With deadlines firmly set, understanding and correctly executing the T-72 form is paramount for public service corporations within Rhode Island to remain in good standing.

| Question | Answer |

|---|---|

| Form Name | Form T 72 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | T-72, 2010, turnouts, 1120S |

Form |

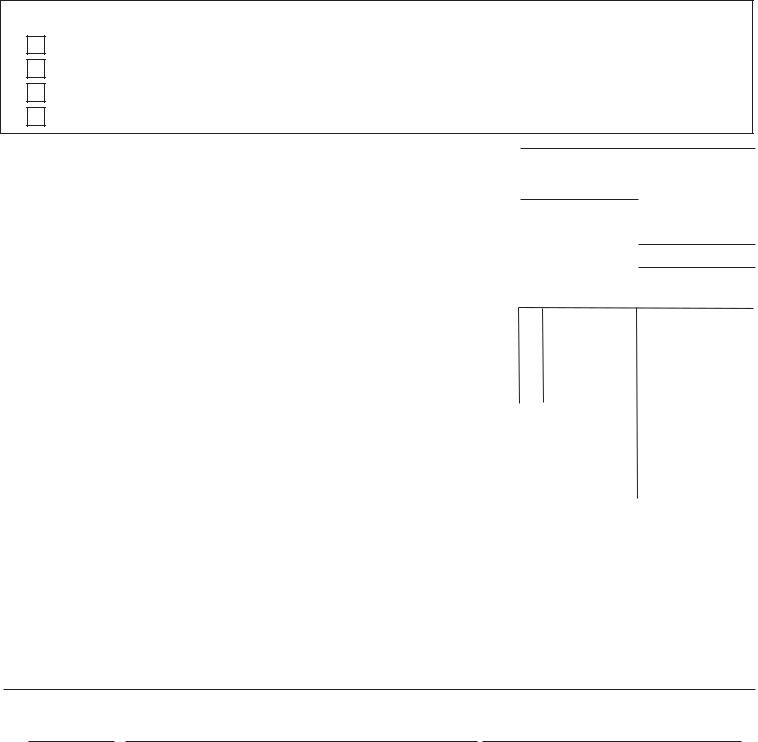

State of Rhode Island and Providence Plantations |

|||

PUBLIC SERVICE |

PUBLIC SERVICE CORPORATION GROSS EARNINGS TAX RETURN |

|||

for Calendar Year Ending December 31, 2009 |

||||

2010 |

||||

Due on or before March 1, 2010 |

||||

|

|

|||

|

|

|

|

|

|

NAME |

|

|

|

|

|

|

|

|

|

ADDRESS |

|

|

|

|

|

|

|

|

|

CITY |

STATE |

ZIP CODE |

|

|

|

|

||

|

FEDERALIDENTIFICATION NUMBER |

|

||

|

|

|

|

|

TYPE OFPUBLICSERVICECORPORATION: Please check the appropriate box below and complete the schedule that pertains to that public service type. All Public Service Corporations must complete schedule Abefore completing the appropriate tax type schedule.

Telegraph and Cable Corporations - Schedule C |

|

Gas and Electric Corporations - Schedules E, F and G |

|

|

|

Telecommunications Corporations - Schedule D |

|

Steamboat, Ferry, Toll Bridge, Water or Express - Schedule H |

Gas Corporations - Schedule E |

|

Steam or Electric Railroad or Street Railway Corps - Schedule I |

|

||

|

||

Electric Corporations - Schedule F |

|

Dining, Sleeping, Chair or Parlor Car Corporations - Schedule J |

|

||

|

||

|

|

|

Schedule A - Analysis of Gross Earnings |

or Federal Form 1065, line 1c |

|

1. |

|

|

|

|

||

|

|

|

|

|

|

|

|||

1. |

Gross Earnings from Federal Form 1120, line 1c |

|

|

|

|||||

|

Amount, if any, claimed not to be derived from operation (Itemized schedule of sources and |

|

|

|

|

|

|

||

2. |

|

2. |

|

|

|

|

|||

amounts must be attached) |

|

|

|

|

|

||||

3. |

Capital Investment Deduction |

|

3. |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

4. |

TOTALGROSSEARNINGSFROMOPERATION - Line 1 minus Lines 2 and 3 |

|

|

|

4. |

|

|

||

5. |

|

|

|

5. |

|

|

|||

6. |

TOTALRHODEISLANDGROSSEARNINGSFROMOPERATION - Line 4 minus Line 5 |

|

|

|

6. |

|

|

||

|

|

|

|

|

|

|

|

||

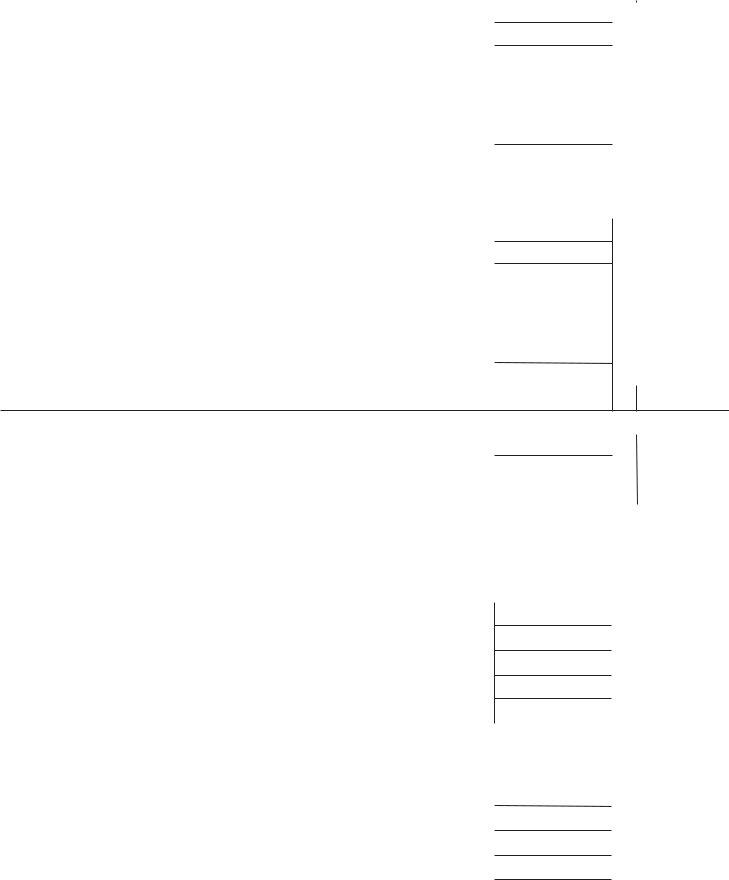

Schedule B - Amount of Tax Due |

|

|

|

|

|

|

|||

1. |

Amount of Tax Due from Tax Type Schedule |

1. |

|

|

|

|

|||

|

|

|

|

|

|

|

|

||

2. |

Appropriate Credits - Attach documentation |

2. |

|

|

|

|

|||

3. |

Tax Due - Line 1 minus Line 2, but not less than $100.00 MINIMUMTAXDUE $100.00 |

|

|

|

|

|

|||

3. |

|

|

|

|

|||||

|

Estimated Tax Payments made for this return’s taxable year on Form |

|

|

|

|

|

|

||

4. |

4. |

|

|

|

|

||||

Applied from prior taxable year’s return |

|

|

|

|

|

||||

5. |

Net Payment Due with Return - Line 3 minus Line 4 |

|

|

|

5. |

|

|

||

|

|

|

|

|

|

|

|

||

6. |

Overpayment - Line 4 minus Line 3 |

|

|

|

6. |

|

|

||

|

|

|

|

|

|

|

|

||

7. |

Amount of Overpayment on Line 6 to be Credited to Estimated Tax for 2010 Calendar Year |

|

|

|

7. |

|

|

||

|

|

|

|

|

|

|

|

||

8. |

Amount of Overpayment on Line 6 to be Refunded - Line 6 minus Line 7 |

|

|

|

8. |

|

|

||

|

|

|

|

|

|

|

|

|

|

Schedule C - Telegraph and Cable Corporations |

|

|

|

|

|

|

|||

1. |

Gross Earnings from all sources within Rhode Island (Schedule A, Line 6) |

|

1. |

|

|

|

|

||

|

|

|

|

|

|

|

|

||

2. |

Tax (Line 1 times 4% (0.04) for telegraph corporations; Line 1 times 8% (0.08) for cable corporations) |

2. |

|

|

|||||

Enter this amount on Schedule B, Line 1 |

|

|

|

|

|

||||

Schedule D - TelecommunicationsCorporations - Attach copy of pages 1 and 2 of Federal 1120, Federal 1120S or Federal 1065 Return |

|||||||||

|

|

|

|

|

|

|

|||

1. |

Gross Earnings from operations within Rhode Island for calendar year ending 12/31/2009 |

|

1. |

|

|

|

|

||

|

|

|

|

|

|

|

|

||

2. |

Deductions - Rhode Island Bad Debt and Rhode Island Access Charges |

|

2. |

|

|

|

|

||

3. |

|

|

|

|

|

|

|

||

Taxable Earnings - Line 1 less Line 2 |

|

|

|

3. |

|

|

|||

|

|

|

|

|

|

|

|

||

4. |

Tax - Line 3 times 5% (0.05). Enter this number on Schedule B, Line 1 |

|

|

|

4. |

|

|

||

|

|

|

|

|

|

|

|

|

|

CERTIFICATION: This certification must be executed or the return must be sworn before some person authorized to administer oaths.

Under penalties of perjury, I hereby certify that Ihave personal knowledge of the statements and other information constituting this return, that the same are true, correct and complete to the best of my knowledge and belief.

|

Date |

|

|

Signature of authorized officer |

|

|

|

|

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

Signature of preparer |

|

|

|

|

Address of preparer |

|

MAYTHE DIVISION CONTACTYOUR PREPARER ABOUTTHIS RETURN? YES |

|

NO |

|

|

|

|||||

|

|

|

|

|||||||

|

|

|

|

|

||||||

|

|

MAILING ADDRESS: OVERPAYMENTS/REFUNDS - RI DIVISION OF TAXATION, ONE CAPITOLHILL, PROVIDENCE, |

||||||||

Key #22 |

|

|

PAYMENTS - RI DIVISION OF TAXATION, ONE CAPITOLHILL, PROVIDENCE, |

|||||||

Form |

Name |

|

|

Fed ID# |

|

|

|

||||

PUBLIC SERVICE |

|

|

|

|

|

|

|

|

|

||

|

Schedule E - Gas Corporations |

|

|

|

|

|

|

|

|||

1. |

Entire gross earnings from Rhode Island sources including sales (Schedule A, line 6) |

|

|

|

|

|

|

|

|||

1. |

|

|

|

|

|

|

|||||

2. |

Gross earnings from sale of gas and gas merchandise |

2. |

|

|

|

|

|

|

|||

3. |

Portion of such earnings representing merchandise sales |

3. |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||

4. |

NETInvoice price of such merchandise plus transportation costs prior to sales |

4. |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||

5. |

Gas Basis Taxable Gross Earnings (Line 2 less Line 4) |

5. |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||

6. |

Amount of Line 5 relating to manufacturing purposes for 2009 |

6. |

|

|

|

|

|

|

|||

7. |

Taxable Gross Earnings - (Line 5 less Line 6) |

7. |

|

|

|

|

|

|

|||

8. |

|

|

|

|

|

|

|

|

|

||

Gas Gross Earnings Tax - Line 7 times 3% (0.03) GAS ONLYEnter this number on Schedule B, Line 1 |

8. |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

||

|

Schedule F - ElectricCorporations |

|

|

|

|

|

|

|

|||

1. |

Entire gross earnings from Rhode Island sources including sales (Schedule A, line 6) |

|

|

|

|

|

|

|

|||

1. |

|

|

|

|

|

|

|||||

2. |

Gross earnings from sale of electric and electric merchandise |

2. |

|

|

|

|

|

|

|||

3. |

Portion of such earnings representing merchandise sales |

3. |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||

4. |

NETInvoice price of such merchandise plus transportation costs prior to sales |

4. |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||

5. |

Electric Basis Taxable Gross Earnings (Line 2 less Line 4) |

5. |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||

6. |

Amount of Line 5 relating to manufacturing purposes for 2009 |

6. |

|

|

|

|

|

|

|||

7. |

Taxable Gross Earnings - (Line 5 less Line 6) |

7. |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

8. Electric Gross Earnings Tax - Line 7 times 4% (0.04) ELECTRICONLYEnter this number on Schedule B, Line 1... 8.

Schedule G - Gas and Electric Corporations - Complete Schedules E and F first

1. |

Gas Gross Earnings Tax - Schedule E, Line 8 |

|

1. |

|

|

|

2. |

Electric Gross Earnings Tax - Schedule F, Line 8 |

|

2. |

|

|

|

3. |

|

|

|

|

|

|

Total Tax - Add lines 1 and 2 - Enter this number on Schedule B, Line 1 |

|

3. |

|

|||

|

|

|

|

|

||

Schedule H - Steamboat, Ferry, Toll Bridge, Water or ExpressCorporations |

|

|

|

|||

1. |

.........................Gross Earnings from all sources within Rhode Island (Schedule A, Line 6) |

|

|

|

|

|

|

1. |

|

|

|

||

|

|

|

|

|

|

|

2. |

Tax (Line 1 times 1.25% for steamboat, ferry, toll bridge and water corporations; Line 1 times |

4% for express corpora- |

2. |

|

||

|

tions) Enter this number on Schedule B, Line 1 |

|

|

|

||

Schedule I - Steam or Electric Railroad or Street RailwayCorporations |

|

|

|

|

||

1. |

Total mileage of tracks within Rhode Island operated by such utility for steam or electric |

|

|

|

|

|

|

1. |

|

|

|

||

railroad or street railway purposes, exclusive of sidings and turnouts, on 12/31/2009 |

|

|

|

|

||

2. |

Total mileage of tracks both within and without RI operated by such utility for steam or elec- |

2. |

|

|

|

|

tric railroad or street railway purposes, exclusive of sidings and turnouts, on 12/31/2009 |

|

|

|

|||

3. |

Proportion in Rhode Island (Divide Line 1 by Line 2 - carry to 6 decimal places) |

3. |

_._ _ _ _ _ _ |

|

|

|

4. |

Entire Gross Earnings from Operation (Schedule A, Line 4) |

4. |

|

|

|

|

5. |

Gross Earnings Apportioned to Rhode Island - Line 4 times Line 3 |

5. |

|

|

|

|

6. |

|

|

|

|

|

|

Tax - Line 5 times 1.25% (0.0125). Enter this number on Schedule B, Line 1 |

|

6. |

|

|||

|

|

|

|

|

|

|

Asteam or electric railroad or street railway corporation operating such Schedule J - Dining, Sleeping, Chair or Parlor CarCorporations cars as part or incidental to its railroad or railway business within Rhode

Island should complete schedule I, not this schedule.

1. |

Number of miles within Rhode Island cars were operated during 2009 |

1. |

|

|

|

2. |

Number of miles both within and without Rhode Island cars were operated during 2009 |

2. |

|

|

|

3. |

Proportion in Rhode Island (Divide Line 1 by Line 2 - carry to 6 decimal places) |

3. |

_._ _ _ _ _ _ |

|

|

4. |

Entire Gross Earnings from Operation (Schedule A, Line 4) |

4. |

|

|

|

5. |

Gross Earnings Apportioned to Rhode Island - Line 4 times Line 3 |

5. |

|

|

|

6. |

|

|

|

|

|

Tax - Line 5 times 1.25% (0.0125). Enter this number on Schedule B, Line 1 |

|

|

6. |

|

|

|

|

|

|

|

|