You can complete alternate base period form instantly in our PDFinity® editor. Our team is devoted to giving you the best possible experience with our tool by consistently presenting new capabilities and enhancements. Our editor has become a lot more intuitive with the latest updates! Currently, editing PDF forms is easier and faster than before. Getting underway is easy! Everything you need to do is take these easy steps below:

Step 1: Click the orange "Get Form" button above. It is going to open our pdf editor so that you can start filling out your form.

Step 2: As you start the PDF editor, you will get the form all set to be filled in. Besides filling in various blanks, you may as well perform many other actions with the PDF, including putting on custom textual content, editing the initial textual content, inserting graphics, affixing your signature to the PDF, and much more.

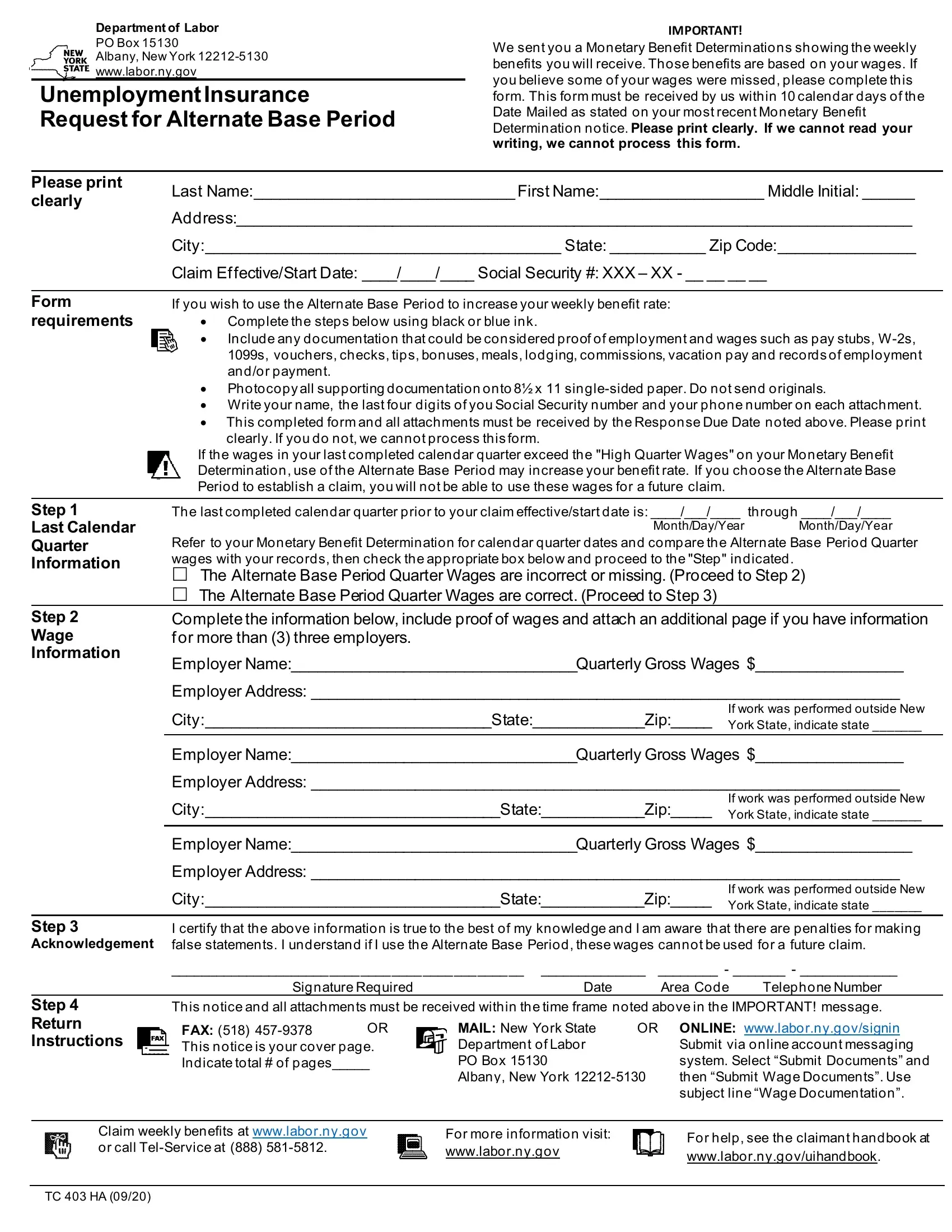

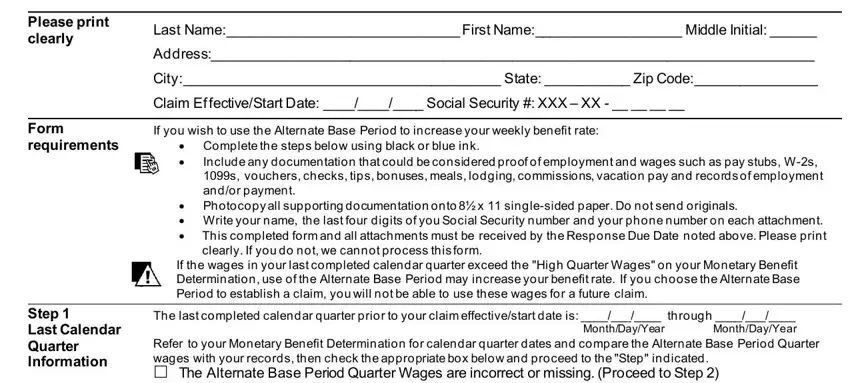

This document will require particular details to be filled in, so you need to take your time to enter what is expected:

1. To begin with, while filling in the alternate base period form, start with the form section that includes the subsequent fields:

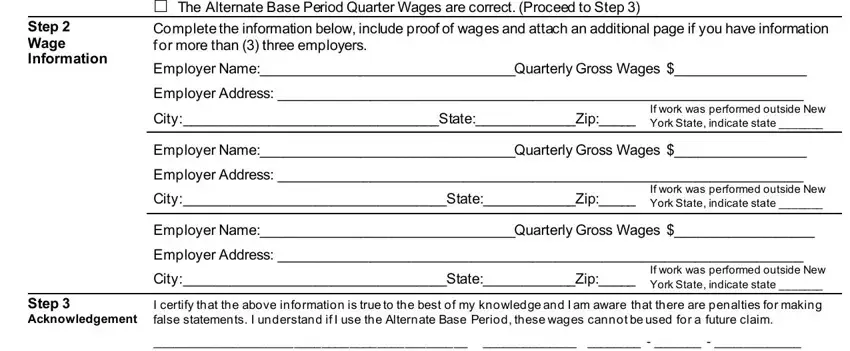

2. When this part is finished, you'll want to put in the required particulars in Step Wage Information, The last completed calendar, Employer NameQuarterly Gross Wages, Employer Address, CityStateZip, If work was performed outside New, Employer NameQuarterly Gross Wages, Employer Address, CityStateZip, If work was performed outside New, Employer NameQuarterly Gross Wages, Employer Address, CityStateZip, If work was performed outside New, and Step Acknowledgement allowing you to move forward further.

It is easy to make an error when filling in your Employer Address, hence make sure that you look again before you'll submit it.

Step 3: When you have reviewed the details in the file's blank fields, click on "Done" to conclude your form at FormsPal. Join FormsPal right now and immediately gain access to alternate base period form, ready for download. Every single edit made is conveniently preserved , making it possible to customize the pdf at a later stage if needed. Here at FormsPal, we aim to make sure your information is kept protected.