Form Tc 40A can be filled out online easily. Just make use of FormsPal PDF editing tool to complete the task right away. In order to make our tool better and less complicated to use, we constantly develop new features, taking into account feedback from our users. All it requires is a few simple steps:

Step 1: Firstly, open the tool by pressing the "Get Form Button" in the top section of this site.

Step 2: After you launch the PDF editor, you will find the document prepared to be filled in. Aside from filling out various blanks, you can also perform various other actions with the Document, including putting on any textual content, editing the original textual content, adding images, signing the document, and much more.

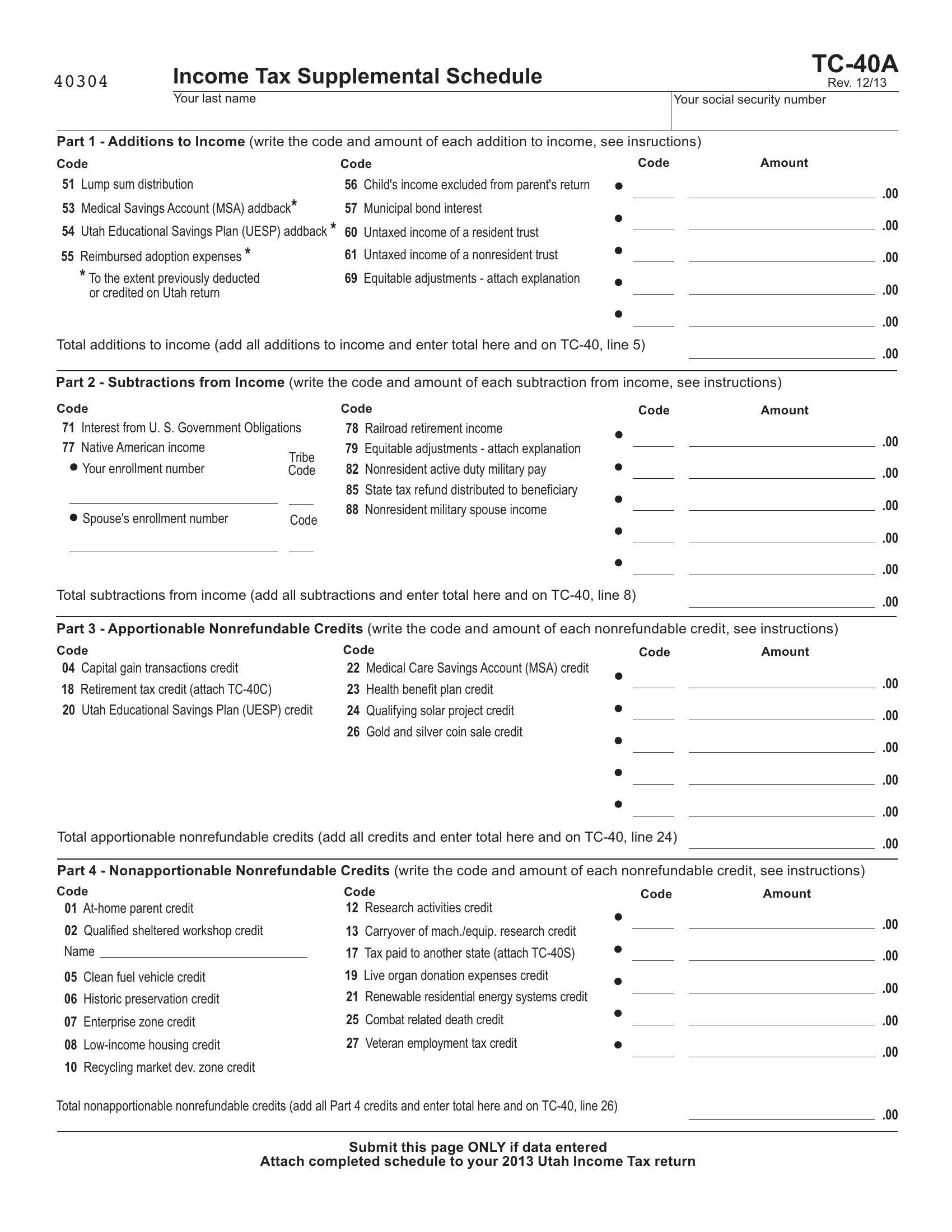

When it comes to blanks of this particular form, here is what you need to know:

1. Firstly, once completing the Form Tc 40A, start in the page containing subsequent blank fields:

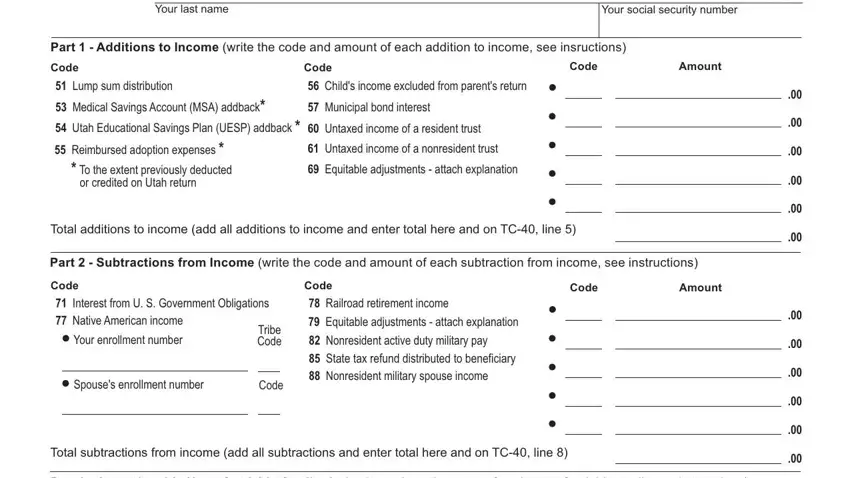

2. Once your current task is complete, take the next step – fill out all of these fields - Code Capital gain transactions, Code Medical Care Savings Account, Code, Amount, Retirement tax credit attach TCC, Health benefit plan credit, Utah Educational Savings Plan, UESP, credit, Qualifying solar project credit, Gold and silver coin sale credit, Total apportionable nonrefundable, Part Nonapportionable, Code, and Athome parent credit with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

You can certainly get it wrong while completing your Retirement tax credit attach TCC, consequently be sure to go through it again before you'll finalize the form.

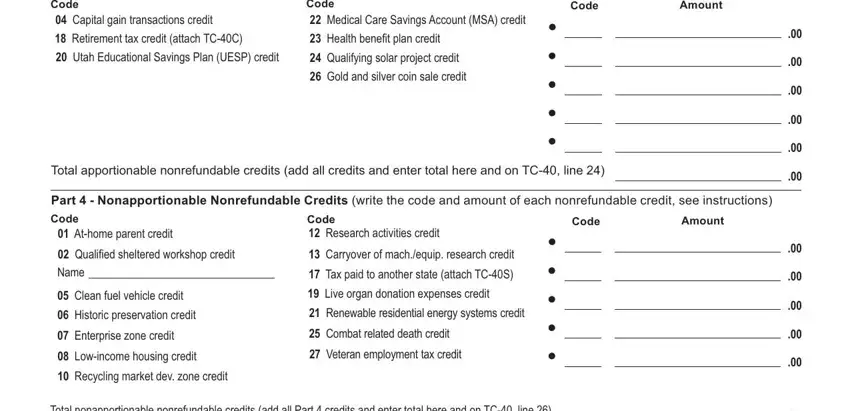

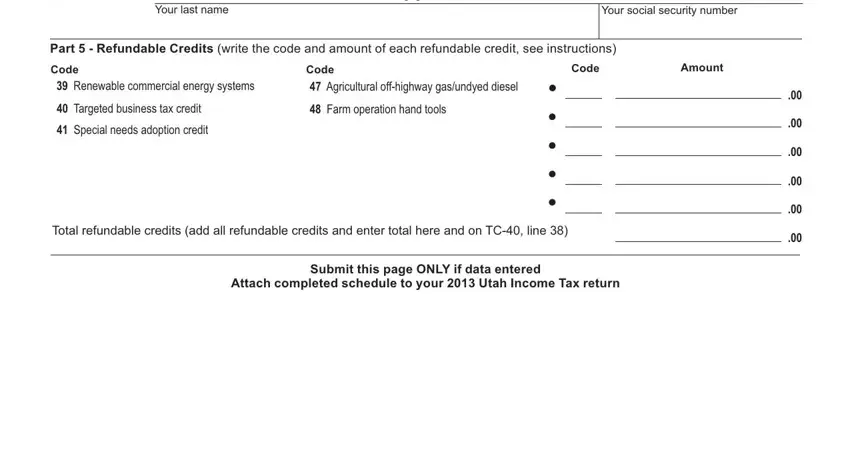

3. This third part is rather easy, Continued Income Tax Supplemental, TCA Rev, Your social security number, Part Refundable Credits write, Code, Renewable commercial energy, Code Agricultural offhighway, Code, Amount, Targeted business tax credit, Special needs adoption credit, Farm operation hand tools, Total refundable credits add all, Submit this page ONLY if data, and Attach completed schedule to your - each one of these empty fields will need to be filled in here.

Step 3: Prior to moving on, you should make sure that all blank fields are filled in right. Once you think it is all fine, click on “Done." Get the Form Tc 40A once you subscribe to a free trial. Quickly get access to the pdf inside your personal cabinet, together with any modifications and adjustments being all kept! We don't share or sell the information you enter while completing documents at our site.