The TC-803 form, issued by the Utah State Tax Commission, serves as a comprehensive document designed to collect varied financial information from businesses operating within the state. At its core, this form requires businesses to disclose details ranging from basic identification such as name, address, and the nature of the business entity, to more intricate financial data including bank account balances, real estate, life insurance policies with the business as beneficiary, and information on accounts or notes receivable. Further breaking down into sections that meticulously analyze general financial information, asset and liability analysis, and a monthly income and expense analysis, the TC-803 form aims to provide a holistic view of a business's financial standing. Adaptations for accessibility under the Americans with Disabilities Act are considered, ensuring inclusivity in compliance. Additionally, this form acts as a declaration under oath regarding the veracity of the information provided, mandating accuracy and completeness under the penalty of perjury. By integrating such comprehensive data collection, the TC-803 form facilitates a robust framework for businesses to report essential financial information to the Utah State Tax Commission.

| Question | Answer |

|---|---|

| Form Name | Form Tc 803 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | tc 803 utah form tc 803 |

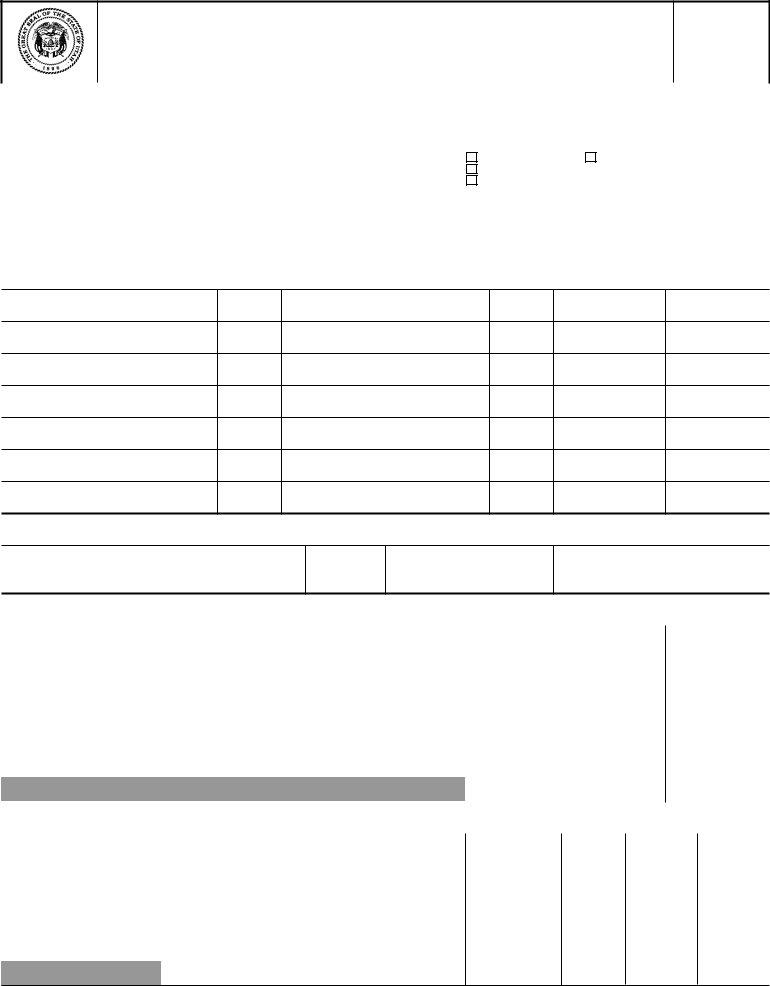

Utah State Tax Commission

210 North 1950 West - Salt Lake City - Utah 84134 - Telephone (801)

Collection Information For Businesses

1 |

. Name |

and A ddress of Business |

|

2 . Business Telephone Number |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 . (Check appropriate box ) |

|

|

|

|

||||

|

|

|

|

|

|

|

Sole Proprietor |

Other (specif y) |

|

||||

|

|

|

|

|

|

|

Partnership |

|

|

|

|

||

|

|

|

|

|

|

|

Corporation |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||

4 |

. Name |

and Title of |

Person Interview ed |

|

5 . A ccount Number: |

6 . Type of Business |

|

||||||

|

|

|

|

|

Sales |

|

|

|

|

|

|

||

|

|

|

|

|

W ithholding |

|

|

|

|

||||

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

. Inf ormation about |

Ow ner, Partners, Of f icers, |

etc. |

|

|

|

|

||||||

Name and Title

Ef f ective Date

Home A ddress

Telephone

Number

Social Security Number

Total Shares

Section One: General Financial Information

8 . Latest Filed Income Tax Return

Form

Tax Year Ended

Net Income Bef ore Tax es

Bank A ccounts (List all types of accounts including payroll and general, savings, certif icates of deposit, etc.)

Name of Institution |

A ddress |

Type of |

A ccount |

Balance |

|

A ccount |

Number |

||||

|

|

|

|||

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 . Total |

(Enter in |

item |

1 6 ) |

|

|

|

|

|

|

|

|

|

Bank Credit A vailable (Lines of |

credit, etc.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Institution |

|

A ddress |

Credit |

A mount |

|

Credit |

Monthly |

|

Limit |

Ow ed |

|

A vailable |

Payment |

||

|

|

|

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 0 . Totals (Enter in Items 2 3 or 2 4 as appropriate)

FORM TC8 0 3 A 1 / 9 6

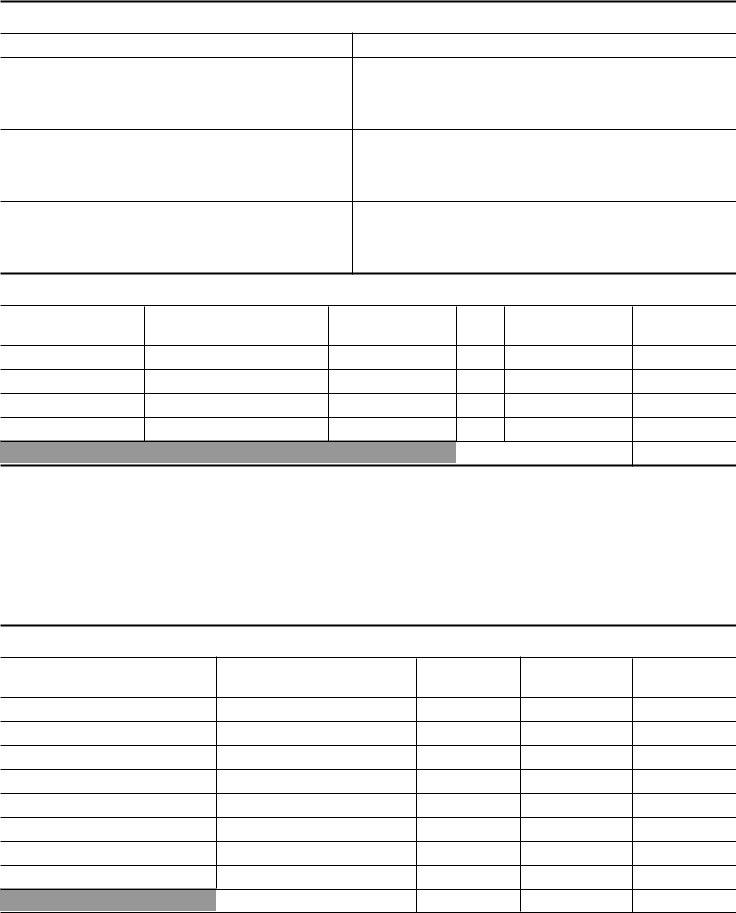

SECTION I, General Financial Inf ormation - Continued

1 1 . Real Estate: (Enter values, balance due, equity in asset, and monthly payment in item 1 9 .)

Brief Description and Type of Ow nership

A ddress (Include County and State)

a.

b.

c.

1 2 . Lif e Insurance Policies Ow ned w ith Business as Benef iciary

Name Insured

Company

Policy Number

Type

Face A mount

Accumulative Cash V alue

$

$

1 2 . Total (Enter in Item 1 8 )

1 3 . A dditional Inf ormation Regarding Financial Condition (court proceedings, bankruptcies f iled or anticipated, transf ers of assets f or less than f ull value, changes in market conditions, etc.; including inf ormation regarding company participation in trusts, estates, prof it- sharing plans, etc.)

1 4 . A ccounts/ Notes Receivable (Include loans to stockholders, of f icers, partners, etc.)

Name

A ddress

A mount Due

Date Due

Status

$

1 4 , Total (Enter in Item 1 7 )

$

For additional information, you may access the Tax Commission's W orld W ide Home Page at: http://www.tax.ex.state.ut.us |

FORM TC8 0 3 B 1 / 9 6 |

|

If you need an accommodation under the Americans with Disabilities Act, contact the Tax Commission at (801)

S e c tio n Two : As s e t and Liability Analys is

|

|

|

Description |

|

Current |

Liabilities |

Equity |

A mount of |

Name and A ddress of |

Date |

Date of |

|

|

|

|

|

|

|

Market |

Balance |

in |

Monthly |

Final |

||

|

|

|

|

|

|

Lien/ Note Holder/ Obligee |

|

|||||

|

|

|

|

|

|

V alue |

Due |

A sset |

Payment |

Pledged |

Payment |

|

|

|

|

|

(a) |

|

(b) |

(c) |

(d) |

(e) |

(f ) |

(g) |

(h) |

1 5 |

. Cash |

|

|

|

|

|

$ |

|

|

|

|

|

1 6 |

. Bank |

A ccounts (f rom item |

9 ) |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

1 7 |

. |

A ccounts/ Notes Receivable |

|

|

|

|

|

|

|

|

||

|

|

(f rom |

item 1 4 ) |

|

|

|

|

|

|

|

|

|

1 8 |

. |

Lif e Insurance Loan V alue |

|

|

|

|

|

|

|

|

||

(f rom |

item 1 2 ) |

|

|

|

|

|

|

|

|

|||

|

|

|

|

a |

|

$ |

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 9 |

. Real |

|

b |

|

|

|

|

|

|

|

|

|

Property |

|

|

|

|

|

|

|

|

|

|||

|

c |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

2 0 |

. V ehicles |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||||

Model, Year, |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||||

|

License |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

2 1 |

. Machines |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||||

|

|

and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equipment |

|

|

|

|

|

|

|

|

|

|||

(Specif y) |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||

2 2 |

. Merchan- |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||||

|

|

dise |

|

|

|

|

|

|

|

|

|

|

|

Inventory |

|

|

|

|

|

|

|

|

|

||

|

(Specif y) |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

2 3 |

. Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

A ssets |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|||

(Specif y) |

|

|

|

|

|

|

|

|

|

|

||

(f rom item |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||||

1 0 ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 4 |

. Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||

Liabili- |

|

|

|

|

|

|

|

|

|

|

||

|

ties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(included |

|

|

|

|

|

|

|

|

|

|

||

notes |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|||

|

and |

|

|

|

|

|

|

|

|

|

|

|

j udg- |

|

|

|

|

|

|

|

|

|

|

||

ments) |

|

|

|

|

|

|

|

|

|

|

||

(f rom |

|

|

|

|

|

|

|

|

|

|

||

item 1 0 ) |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

2 5 |

. Federal Tax es Ow ed |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

2 6 |

. State |

Tax es Ow ed |

|

|

|

|

|

|

|

|

||

2 7 |

. Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM TC8 0 3 C 1 / 9 6

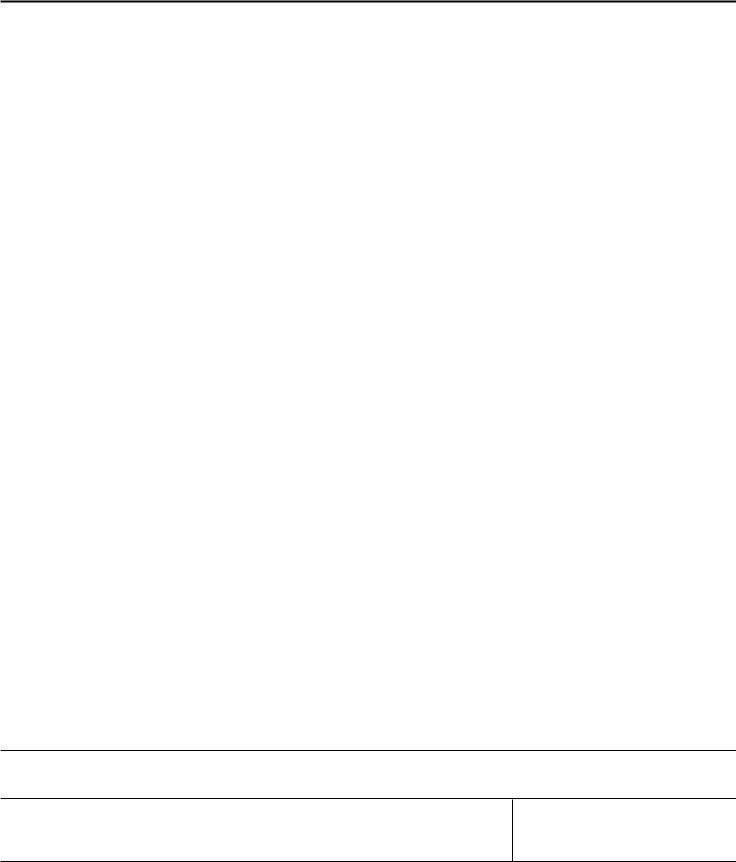

S e c tio n Thre e : Mo nthly Inc o me and Expe ns e Analys is

The following information applie s to inc ome and e xpe ns e s |

|

A ccounting method |

used: (cash or |

accrual) |

||||||

during the pe riod _ _ _ _ _ _ _ _ _ |

to _ _ _ _ _ _ _ _ _ _ |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Income |

|

|

|

|

Ex penses |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

2 8 |

. Gross |

receipts f rom sales, |

services, etc. |

$ |

3 4 |

. Materials purchased |

|

$ |

||

|

|

|

|

|

|

|

|

|

|

|

2 9 |

. Gross |

rental income |

|

|

3 5 |

. Net w ages |

and |

salaries |

|

|

|

|

|

|

|

|

|

|

|

|

|

3 0 |

. Interest |

|

|

3 6 |

. Rent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

3 1 |

. Dividends |

|

|

3 7 |

. Installment |

payments |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

3 2 |

. Other |

income (specif y) |

|

|

3 8 |

. Supplies |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

3 9 |

. Utilities/ Telephone |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 0 |

. Gasoline/ Oil |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

4 1 |

. Repairs and maintenance |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 2 |

. Insurance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 3 |

. Current tax es |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 4 |

. Other (specif y) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 3 |

. TOTA L |

|

$ |

4 5 |

. TOTA L |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

4 6 |

. NET DIFFERENCE |

|

$ |

||

|

|

|

|

|

|

|

|

|

|

|

CERTIFICATION

Under penalties of perj ury, I declare that to the best of my know ledge and belief , this statement of assets, liabilities, and other inf ormation is true, correct, and complete.

Signature:

Date:

FORM TC8 0 3 D 1 / 9 6