You'll be able to fill out Form Tpg 196 without difficulty using our online PDF editor. Our team is constantly working to develop the tool and enable it to be even faster for users with its cutting-edge functions. Take advantage of the latest revolutionary prospects, and discover a trove of new experiences! Here's what you will need to do to get going:

Step 1: Just hit the "Get Form Button" at the top of this webpage to see our pdf editor. This way, you'll find all that is necessary to fill out your document.

Step 2: With the help of this state-of-the-art PDF editor, you could accomplish more than simply fill out blank fields. Express yourself and make your docs seem faultless with customized text incorporated, or fine-tune the file's original input to perfection - all that comes with the capability to insert your personal photos and sign the file off.

It will be simple to finish the document with this practical tutorial! Here is what you want to do:

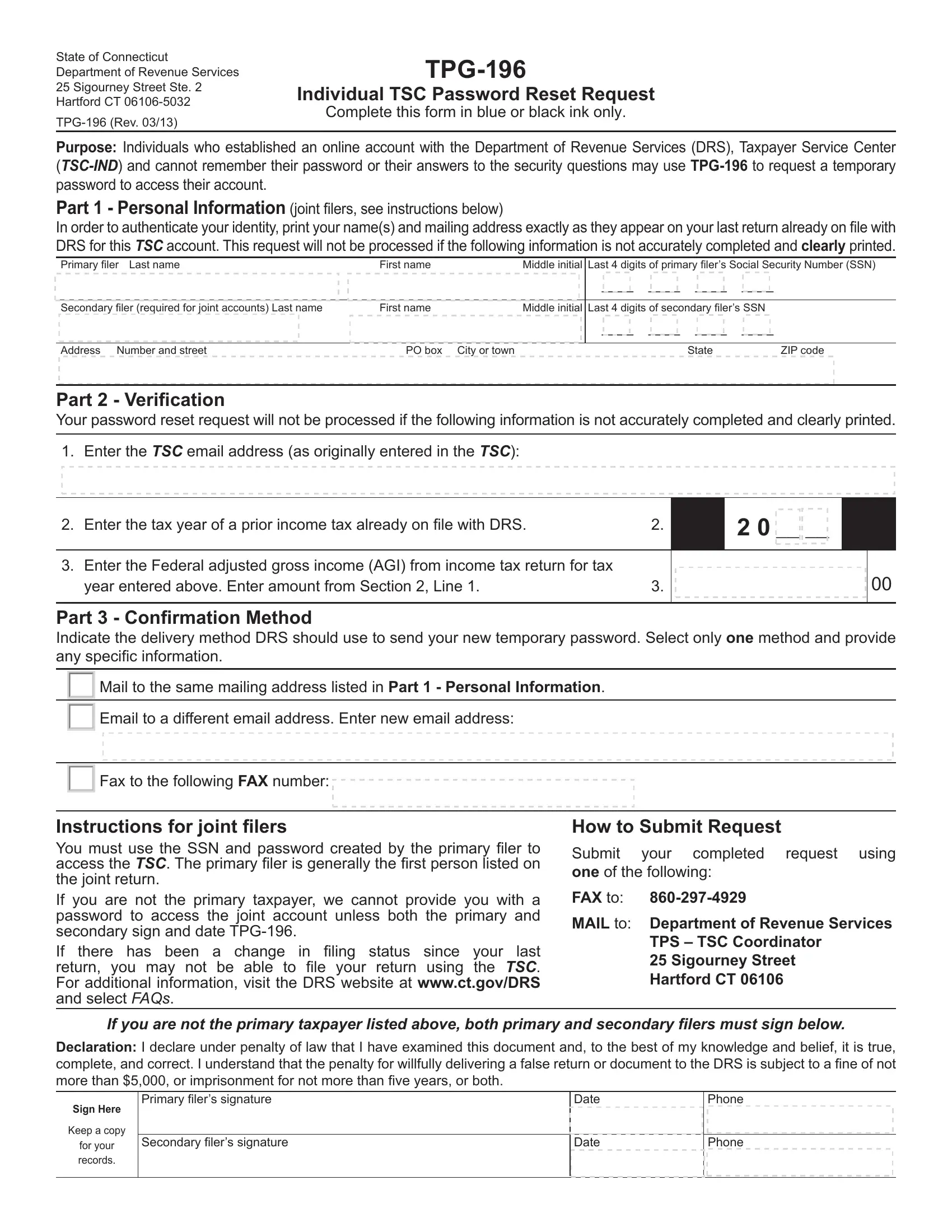

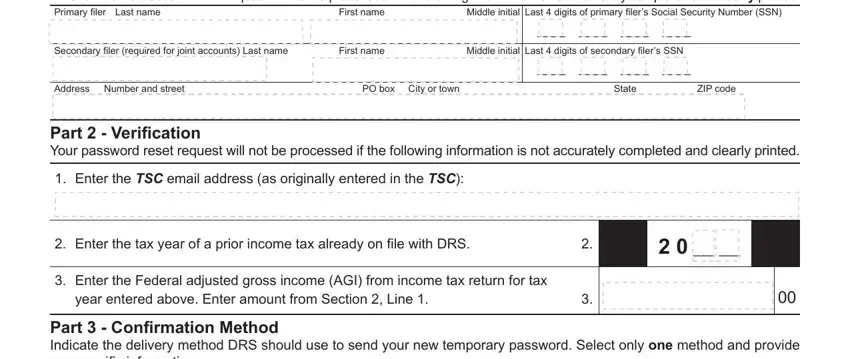

1. It is crucial to complete the Form Tpg 196 correctly, therefore be mindful when filling out the areas comprising all these fields:

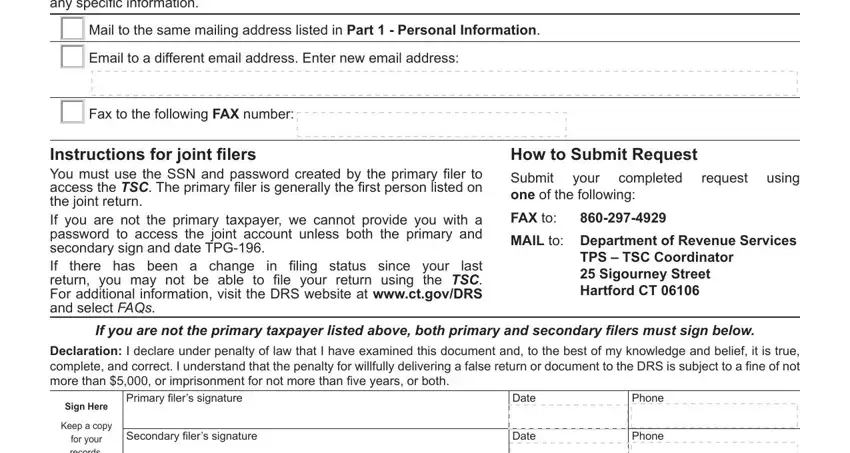

2. Just after performing the last step, go on to the next step and fill out the essential particulars in these blank fields - Part Confi rmation Method, Mail to the same mailing address, Fax to the following FAX number, Instructions for joint fi lers You, in fi ling status since your, How to Submit Request, Submit one of the following, your, completed, request using, FAX to, MAIL to Department of Revenue, TPS TSC Coordinator Sigourney, If you are not the primary, and Declaration I declare under.

Always be extremely mindful while filling in How to Submit Request and in fi ling status since your, because this is the section in which many people make a few mistakes.

Step 3: Prior to moving forward, make sure that blanks were filled in correctly. The moment you determine that it is correct, click on “Done." Join FormsPal now and easily access Form Tpg 196, ready for download. Each modification made is handily saved , which means you can edit the document at a later stage as required. Here at FormsPal, we aim to ensure that your information is stored private.