When you intend to fill out New_York, you won't need to download any kind of software - just make use of our PDF tool. Our tool is continually evolving to provide the very best user experience possible, and that's thanks to our dedication to continual development and listening closely to feedback from users. If you are seeking to begin, here is what it takes:

Step 1: First of all, access the pdf tool by clicking the "Get Form Button" above on this site.

Step 2: Using this handy PDF editor, you're able to accomplish more than simply fill in blank form fields. Express yourself and make your docs look high-quality with custom text put in, or optimize the file's original input to excellence - all that comes along with the capability to add stunning graphics and sign the PDF off.

This PDF form will require some specific information; to ensure accuracy, please make sure to consider the recommendations further on:

1. While completing the New_York, make certain to include all of the important blanks within its associated part. It will help to hasten the process, enabling your details to be handled swiftly and accurately.

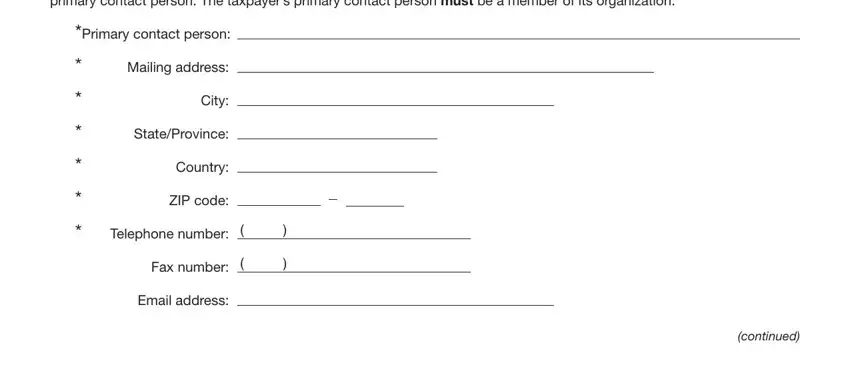

2. Right after finishing the last section, go to the next step and fill in the essential particulars in these blanks - Please indicate below the, Primary contact person, Mailing address, City, StateProvince, Country, ZIP code, Telephone number, Fax number, Email address, and continued.

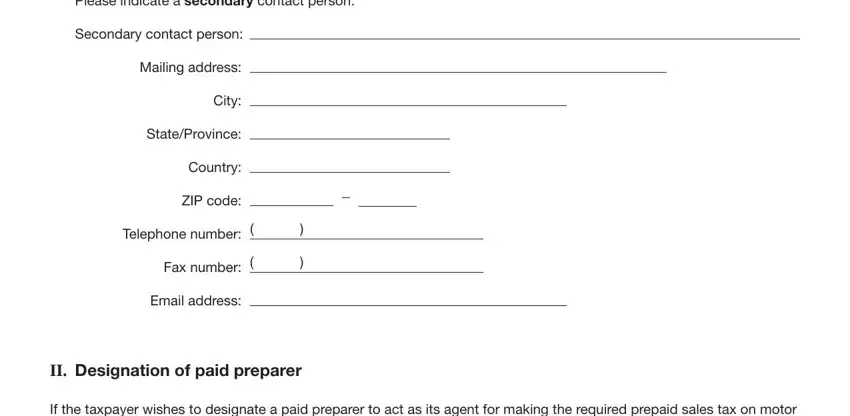

3. Completing Please indicate a secondary, Secondary contact person, Mailing address, City, StateProvince, Country, ZIP code, Telephone number, Fax number, Email address, II Designation of paid preparer, and If the taxpayer wishes to is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

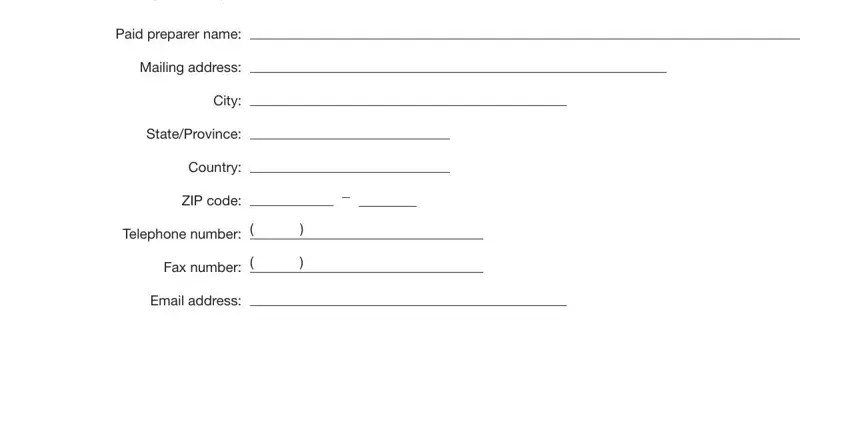

4. All set to fill out the next form section! In this case you've got all these If the taxpayer wishes to, Paid preparer name, Mailing address, City, StateProvince, Country, ZIP code, Telephone number, Fax number, and Email address empty form fields to fill in.

It's easy to make an error when completing your StateProvince, consequently make sure to go through it again prior to deciding to finalize the form.

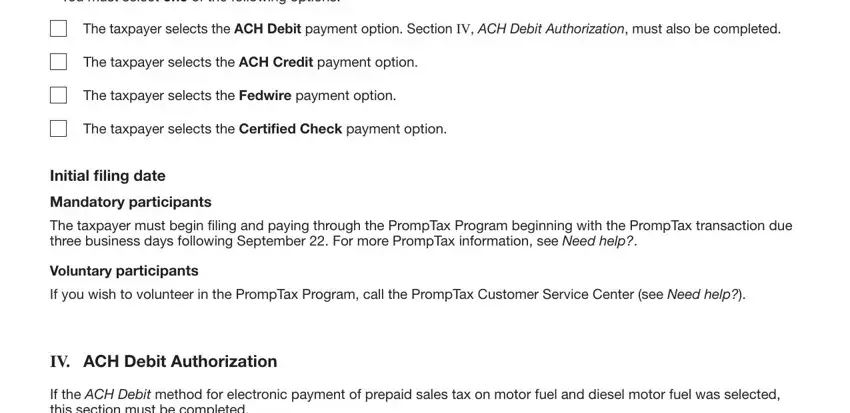

5. This very last section to submit this PDF form is critical. Make certain you fill out the mandatory form fields, including Refer to PrompTax information on, The taxpayer selects the ACH Debit, The taxpayer selects the ACH, The taxpayer selects the Fedwire, The taxpayer selects the Certified, Initial filing date, Mandatory participants, The taxpayer must begin iling and, Voluntary participants, If you wish to volunteer in the, IV ACH Debit Authorization, and If the ACH Debit method for, before submitting. Neglecting to do it can result in an incomplete and potentially invalid paper!

Step 3: Just after proofreading the filled in blanks, hit "Done" and you're all set! Sign up with FormsPal now and instantly gain access to New_York, ready for downloading. All adjustments you make are saved , meaning you can change the pdf at a later point anytime. FormsPal guarantees your information privacy by having a protected system that never saves or shares any private data typed in. Rest assured knowing your documents are kept protected whenever you use our service!