Dealing with PDF forms online is certainly quite easy with our PDF editor. You can fill out Form Uben 142Cap here and try out a number of other functions we provide. To make our tool better and easier to utilize, we consistently implement new features, with our users' suggestions in mind. Here's what you will need to do to start:

Step 1: Simply click on the "Get Form Button" in the top section of this page to see our pdf form editing tool. This way, you will find all that is necessary to fill out your file.

Step 2: With this state-of-the-art PDF editing tool, you can accomplish more than just fill in forms. Try all the features and make your documents look perfect with custom textual content added in, or tweak the file's original input to perfection - all supported by an ability to add almost any graphics and sign the file off.

It's an easy task to finish the pdf using out practical guide! Here's what you have to do:

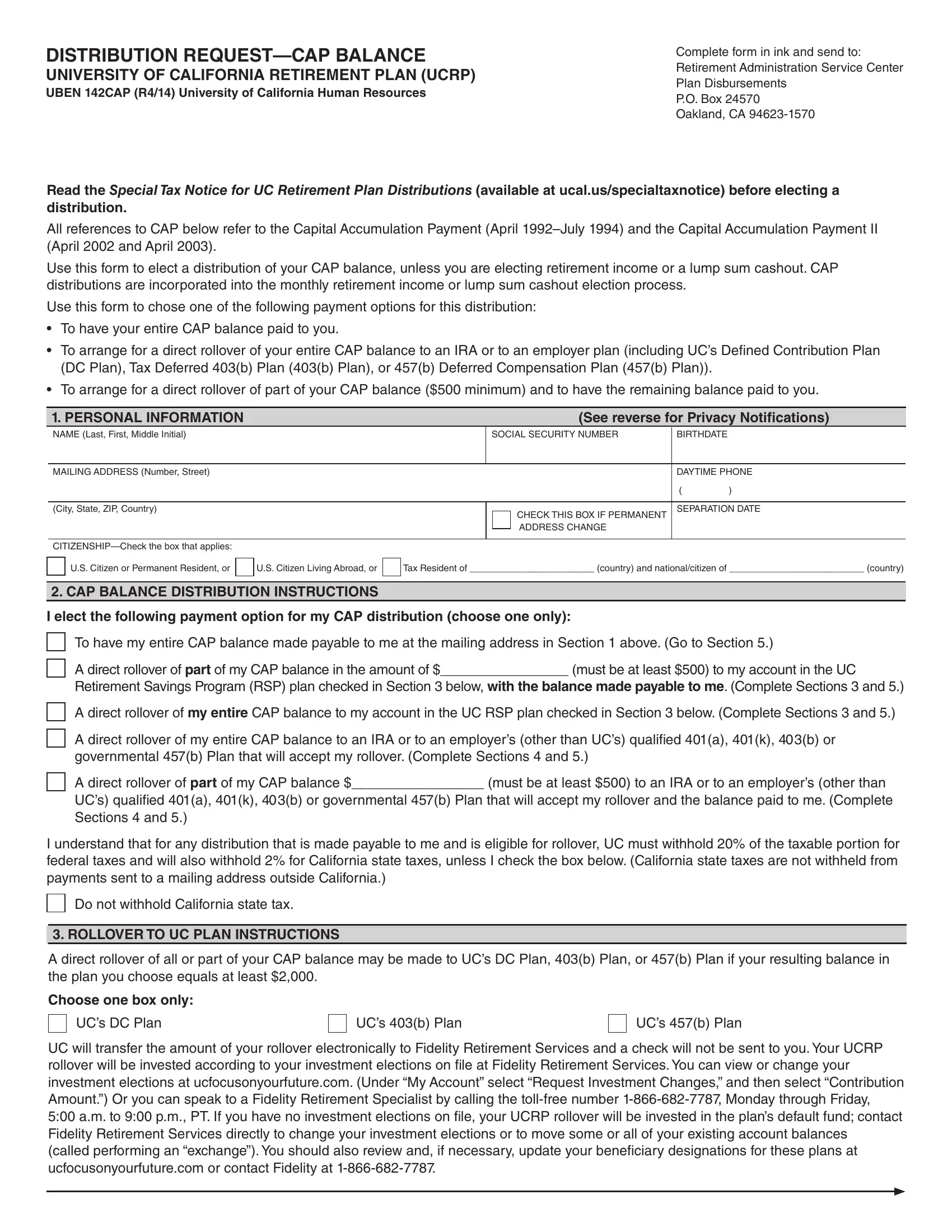

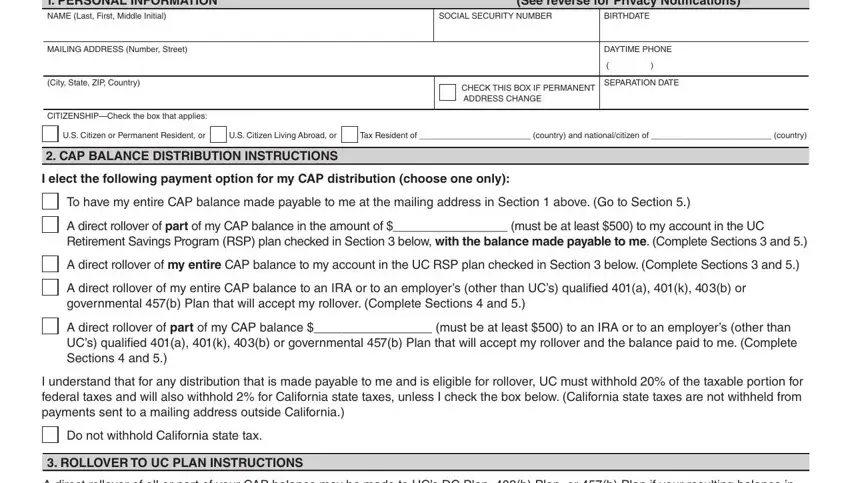

1. To start with, when completing the Form Uben 142Cap, start out with the page that features the next fields:

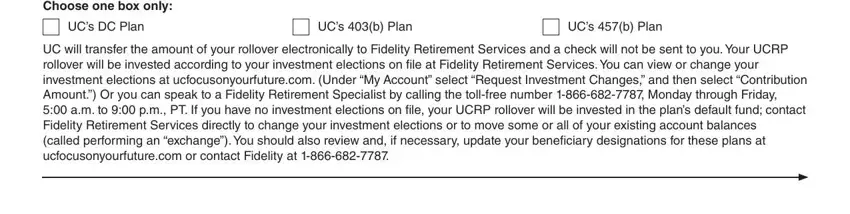

2. Given that the last section is finished, it is time to add the necessary specifics in Choose one box only, UCs DC Plan, UCs b Plan, UCs b Plan, and UC will transfer the amount of so you're able to proceed further.

You can potentially make an error when filling in the UCs DC Plan, consequently be sure to take another look prior to deciding to submit it.

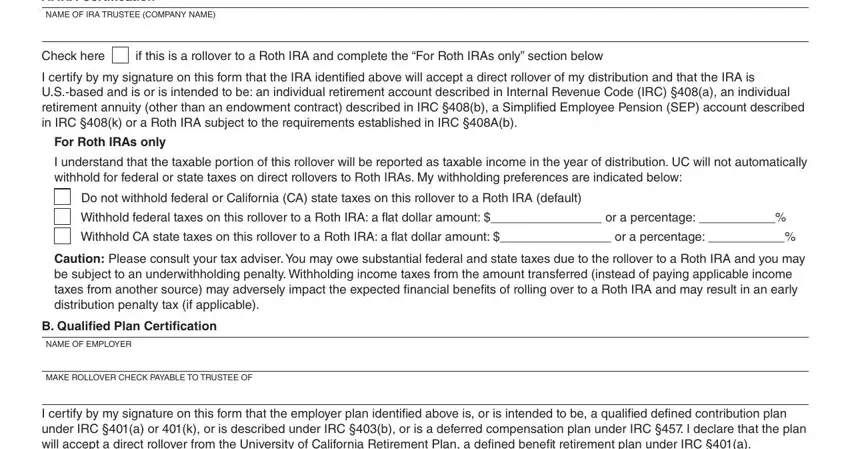

3. This next section is focused on A IRA Certiication, NAME OF IRA TRUSTEE COMPANY NAME, Check here, if this is a rollover to a Roth, I certify by my signature on this, For Roth IRAs only, I understand that the taxable, Do not withhold federal or, Withhold federal taxes on this, Withhold CA state taxes on this, Caution Please consult your tax, B Qualiied Plan Certiication, NAME OF EMPLOYER, MAKE ROLLOVER CHECK PAYABLE TO, and I certify by my signature on this - complete all of these blanks.

Step 3: Check that your information is correct and then simply click "Done" to proceed further. Right after creating a7-day free trial account at FormsPal, you will be able to download Form Uben 142Cap or send it via email immediately. The form will also be at your disposal in your personal cabinet with all of your adjustments. With FormsPal, it is simple to complete forms without the need to get worried about information leaks or records getting distributed. Our secure system helps to ensure that your personal information is stored safe.