2010 can be filled out online effortlessly. Just make use of FormsPal PDF editing tool to perform the job quickly. Our tool is consistently evolving to give the best user experience attainable, and that's because of our resolve for constant improvement and listening closely to customer opinions. It merely requires a few simple steps:

Step 1: Access the PDF inside our editor by clicking the "Get Form Button" in the top part of this webpage.

Step 2: Once you start the editor, there'll be the document ready to be filled out. Other than filling in different blank fields, you may as well do other sorts of actions with the PDF, that is adding custom words, editing the initial textual content, adding graphics, putting your signature on the document, and a lot more.

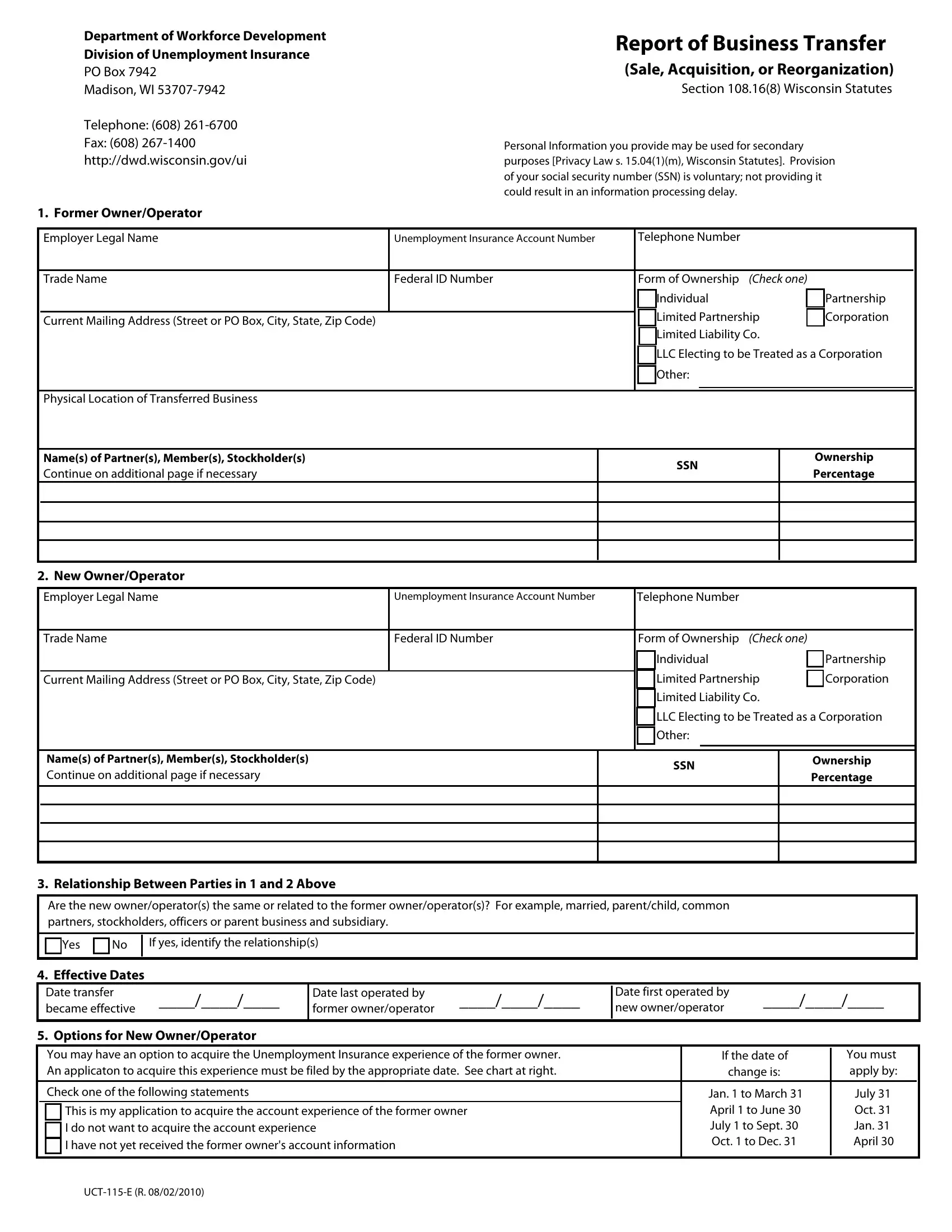

As for the blank fields of this particular form, this is what you need to do:

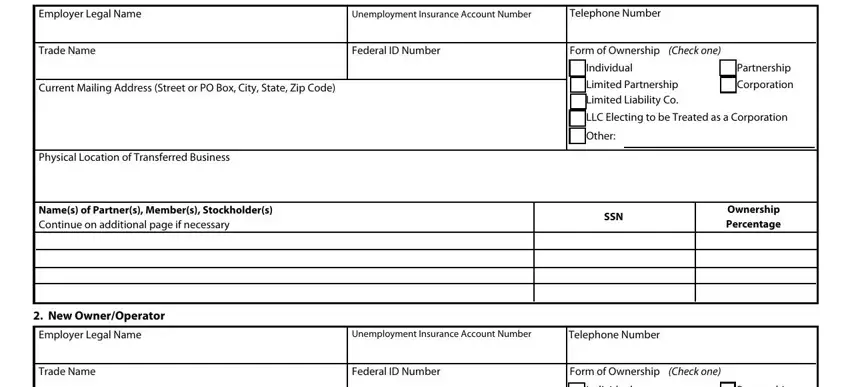

1. While completing the 2010, be sure to complete all of the needed blank fields within its corresponding part. This will help to facilitate the work, allowing for your details to be processed fast and properly.

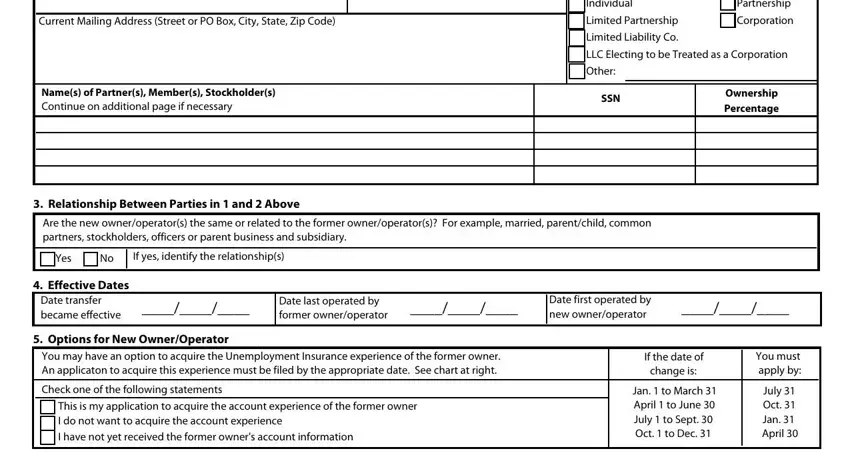

2. Your next step would be to fill out the following blank fields: Current Mailing Address Street or, Names of Partners Members, Individual, Limited Partnership, Limited Liability Co, Partnership, Corporation, LLC Electing to be Treated as a, Other, SSN, Ownership Percentage, Relationship Between Parties in, Are the new owneroperators the, Yes, and If yes identify the relationships.

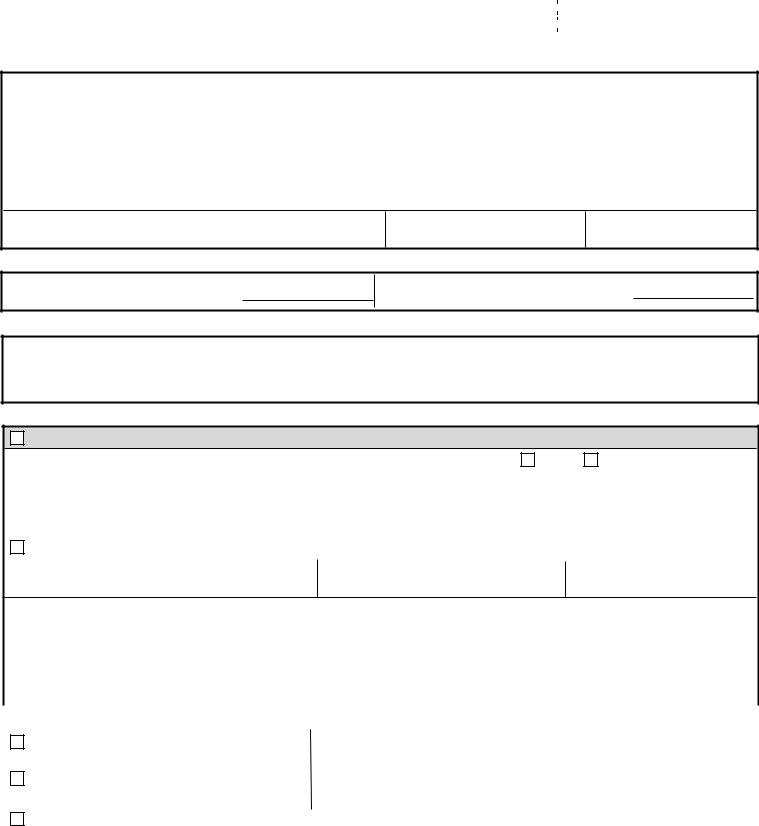

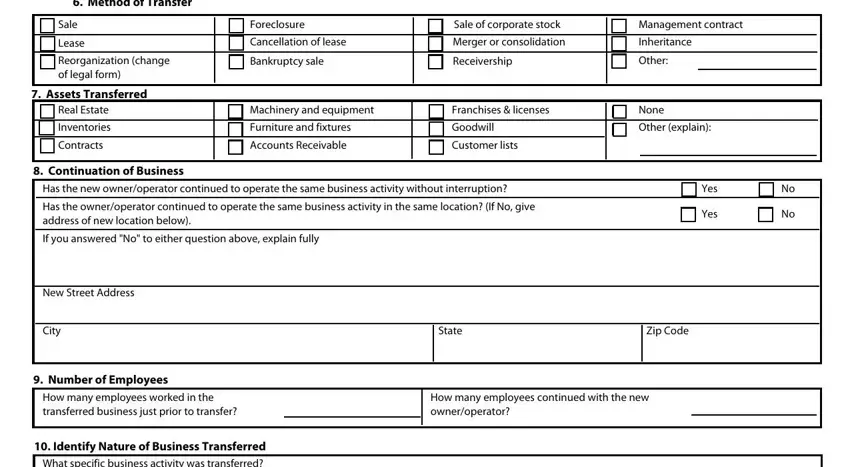

3. This third step is generally straightforward - complete all the form fields in Method of Transfer, Sale, Lease, Reorganization change of legal form, Assets Transferred, Real Estate, Inventories, Contracts, Continuation of Business, Foreclosure, Cancellation of lease, Bankruptcy sale, Sale of corporate stock, Management contract, and Merger or consolidation in order to complete the current step.

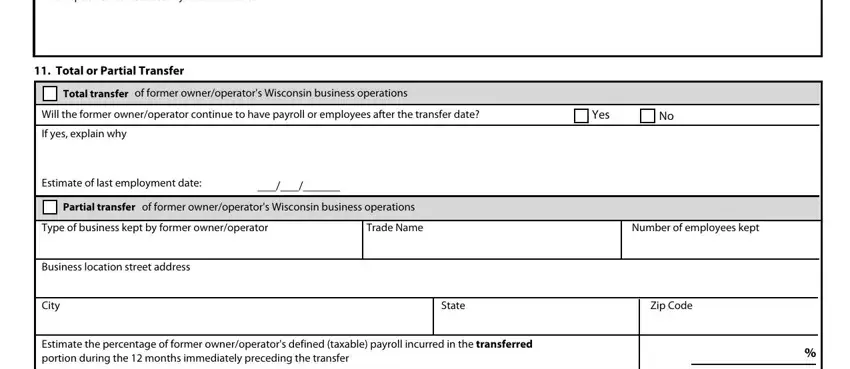

4. Now start working on this next part! In this case you'll have these Identify Nature of Business, Total or Partial Transfer, Total transfer of former, Will the former owneroperator, Yes, If yes explain why, Estimate of last employment date, Partial transfer of former, Type of business kept by former, Trade Name, Number of employees kept, Business location street address, City, State, and Zip Code blank fields to do.

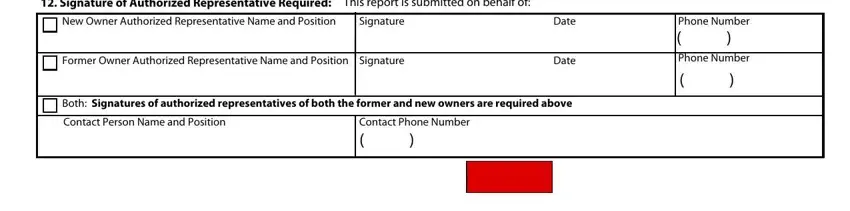

5. To conclude your form, the final area incorporates a number of additional blank fields. Typing in Signature of Authorized, This report is submitted on behalf, New Owner Authorized, Signature, Former Owner Authorized, Signature, Date, Date, Phone Number Phone Number, Both Signatures of authorized, Contact Person Name and Position, and Contact Phone Number will wrap up the process and you're going to be done in the blink of an eye!

Be extremely careful while filling in This report is submitted on behalf and Phone Number Phone Number, because this is where a lot of people make mistakes.

Step 3: Make certain the information is accurate and press "Done" to finish the process. Acquire your 2010 when you register online for a 7-day free trial. Easily access the pdf form in your personal account page, along with any edits and changes automatically synced! We do not share or sell any information that you provide whenever dealing with forms at our site.