Understanding and filling out the UD-8 Child Support Worksheet is a crucial step for parents navigating the complexities of child support proceedings in New York State. This comprehensive form, designed to ensure fairness and accuracy in the calculation of child support obligations, demands a careful assessment of both parents' financial situations. It requires the annualization of incomes, including not only the base salary but also additional earnings such as investment returns, benefits, and other sources of income, ensuring a thorough and just consideration of each parent's financial capacity. Moreover, the form accounts for mandatory and non-mandatory income, as well as permissible deductions, which can significantly impact the final child support figures. With the welfare of the child at heart, the UD-8 form also addresses expenses beyond basic support, considering childcare, healthcare, and educational costs, and even allows for adjustments based on non-numerical factors to accommodate the unique situations of each family. For parents aiming to fulfill their child support obligations, understanding every line of this form is not just beneficial—it's imperative.

| Question | Answer |

|---|---|

| Form Name | Form Ud 8 |

| Form Length | 6 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 30 sec |

| Other names | ny child support worksheet, form ud 8 1, ny child support worksheet form, ud8 |

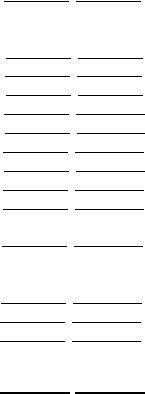

SUPREME COURT OF THE STATE OF NEW YORK

1COUNTY OF _______________

|

|

X |

||

2 |

|

|

|

|

3 |

|

|

|

Index/Docket No.: |

|

|

|

Plaintiff, |

|

|

|

|

|

CHILD SUPPORT |

|

|

|

WORKSHEET |

|

4 |

|

|

|

|

|

|

|

Defendant |

|

|

|

X |

||

5 |

Prepared by |

|

|

|

6 |

This Worksheet is submitted by |

‘ Plaintiff ‘ Defendant |

||

(All numbers used in this worksheet are YEARLY figures. Convert weekly or monthly figures to

annualized numbers.) |

|

7,8 STEP 1 MANDATORY PARENTAL INCOME (b)(5) |

PLAINTIFF DEFENDANT |

1.Gross (total) income (as reported on most recent Federal tax return, or as computed in accordance with Internal Revenue Code and regulations): (b)(5)(i)............................................................................

The following items MUST be added if not already included in Line 1:

2.Investment income: (b)(5)(ii)................................................................

3.Workers' compensation: (b)(5)(iii)(A)..............................................................

4.Disability benefits: (b)(5)(iii)(B)............................................................

5.Unemployment insurance benefits: (b)(5)(iii)(C)..................................

6.Social Security benefits: (b)(5)(iii)(D)...................................................

7.Veterans benefits: (b)(5)(iii)(E).........................................................................

8.Pension/retirement income: (b)(5)(iii)(F)..............................................

9.Fellowships and stipends: (b)(5)(iii)(G)................................................

10. Annuity payments: (b)(5)(iii)(H).......................................................................

11. If

12. If

13. Former income voluntarily reduced to avoid child support: (b)(5)(v).

14. Income voluntarily deferred: (b)(5)(iii)........................................................

A. TOTAL MANDATORY INCOME:...........................................

Form reproduced by permission of Author: Steven L. Abel, Esq. |

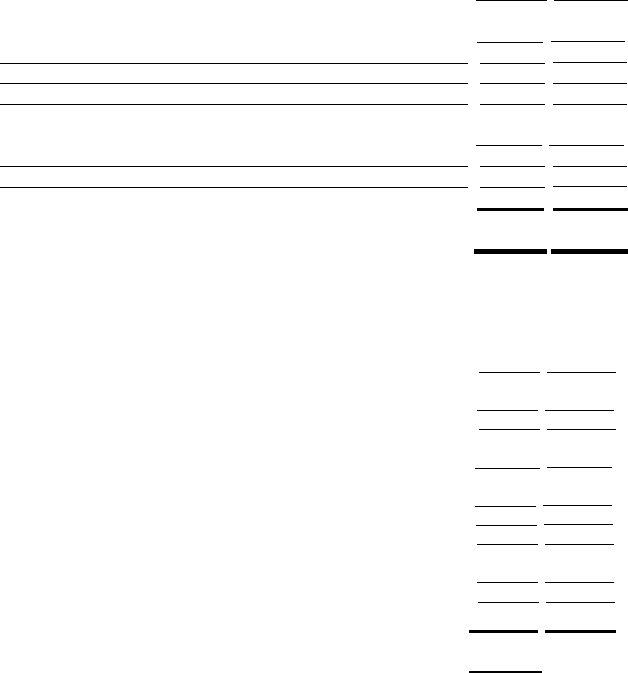

9, 10 STEP 2

These items must be disclosed here. Their inclusion in the final calculations, however, is discretionary. In contested cases, the Court determines whether or not they are included. In uncontested cases, the parents and their attorneys or mediators must determine which should be included.

15.Income attributable to

16.Employment benefits that confer personal economic benefits: (b)(5)(iv)(B) (Such as meals, lodging, memberships, automobiles, other)....................

17.Fringe benefits of employment: (b)(5)(iv)(C)

18.Money, goods and services provided by relatives and friends: (b)(5)(iv)(D)

B. TOTAL

11, 12 C. TOTAL INCOME (add Line A + Line B):..................................

13, 14 STEP 3 DEDUCTIONS

19.Expenses of investment income listed on line 2: (b)(5)(ii).............................

20.Unreimbursed business expenses that do not reduce personal expenditures: (b)(5)(vii)(A).............................................................................

21.Alimony or maintenance actually paid to a former spouse: (b)(5)(vii)(B)......

22.Alimony or maintenance paid to the other parent but only

if child support will increase when alimony stops: (b)(5)(vii)(C)..................

23. Child support actually paid to other children the parent

is legally obligated to support: (b)(5)(vii)(D).................................................

24. Public assistance: (b)(5)(vii)(E)......................................................................

25. Supplemental security income: (b)(5)(vii)(F).................................................

26. New York City or Yonkers income or earnings taxes actually paid:

(b)(5)(vii)(G)....................................................................................................

27. Social Security taxes (FICA) actually paid:(b)(5)(vii)(H)..........................

D. TOTAL DEDUCTIONS:..................................................................

15 |

E. Plaintiff’s Income (Line C minus Line D): |

$ |

Form reproduced by permission of Author: Steven L. Abel, Esq. |

16 |

F. Defendant’s Income (Line C minus Line D): |

$ |

17STEP 4 (b)(4)G. COMBINED PARENTAL INCOME (Line E + Line F):..$

18STEP 5 (b)(3) and (c)(2)

MULTIPLY Line G (up to $141,000) by the proper percentage (insert in Line H):

For 1 child |

17% |

For 3 children |

29% |

For 5 or more children |

35% (minimum) |

For 2 children |

25% |

For 4 children |

31% |

|

|

H. COMBINED CHILD SUPPORT:.............................................................

STEP 6 (c)(2)

19DIVIDE the noncustodial parent's amount on Line E or Line F:

20by the amount of Line G:.......................................................................................

to obtain the percentage allocated..........................

21 |

I. to the noncustodial parent: |

% |

|

22 |

STEP 7 (c)(2) J. MULTIPLY line H by Line I: |

|

|

|

STEP 8 (c)(3) |

|

|

23K. DECIDE the amount of child support to be paid on any combined parental income exceeding $141,000 per year using the percentages

in STEP 5 or the factors in STEP

24L. ADD Line J and Line K:.........................................................................................

This is the amount of child support to be paid by the

STEP 9 SPECIAL NUMERICAL FACTORS

CHILD CARE EXPENSES

25M. Cost of child care resulting from custodial parent's:

‘ seeking work (c)(6)[discretionary] ‘ working ‘ attending elementary education ‘ attending secondary education ‘ attending higher education

‘attending vocational training leading to employment: (c)(4)..............................

26 N. MULTIPLY Line M by Line I:.................................................................

This is the amount the

Form reproduced by permission of Author: Steven L. Abel, Esq. |

HEALTH EXPENSES (c)(5)

27O. Reasonable future health care expenses not covered by insurance:

28P. MULTIPLY Line O by Line I: ................................................................................

This is the amount the

29Q. EDUCATIONAL EXPENSE, if appropriate, see STEP 11(b) (c)(7) .................

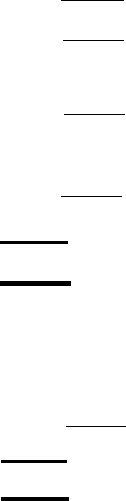

STEP 10 LOW INCOME EXEMPTIONS (d)

30R. INSERT amount of noncustodial parent's income from Line E or Line F:..

31S. ADD amounts on Line L, Line N, Line P and Line Q

(This total is "basic child support"):.................................................................

32 T. SUBTRACT Line S from Line R:..............................................................

If Line T is more than the

If Line T is less than the poverty level†, then

33U. INSERT amount of

34V.

35W. SUBTRACT Line V from Line U: .......................................................... .........

If Line W is more than $300 per year, then Line W is the amount of basic child support. If Line W is less than $300 per year, then basic child support shall be $300 per year, unless the Court decides this amount is “unjust or inappropriate” based on the

If Line T is less than the

36 |

X. INSERT amount of noncustodial parent's income from Line E or Line F: |

|

|||

|

|

|

|

||

37 |

Y. |

||||

*The |

This figure changes on April 1 of each year. For the most current, go to |

||||

https://newyorkchildsupport.com/quick_links.html The current

household as promulgated by the U.S. Department of Health and Human Services.

†The poverty level. This figure changes on April 1 of each year. The current Federal poverty level for a single person household in any year is as

promulgated by the U.S. Department of Health and Human Services. For the most current , go to https://newyorkchildsupport.com/quick_links.html

Form reproduced by permission of Author: Steven L. Abel, Esq. |

38Z. SUBTRACT Line Y from Line X:...............................................................

If Line Z is more than $600 per year, then Line Z is the amount of basic child support. If Line Z is less than $600 per year, then basic child support must be a minimum of $600 per year. In addition the Court also has discretion to award child care expenses, health care expenses, and college,

STEP 11

(a)

A portion of

(b) EDUCATIONAL EXPENSES (c)(7)

New York's child support law does not contain a specific percentage method to determine how parents should share the cost of education of their children. Traditionally, the courts have considered both parents' complete financial circumstances in deciding who pays how much. The most important elements of financial circumstances are income, reasonable expenses, and financial resources such as savings and investments.

(c) ADDITIONAL FACTORS (f)

The child support guidelines law lists 10 factors that should be considered in deciding on the amount of child support for:

Pcombined incomes of more than $141,000 per year or

Pto vary the numerical result of these steps because the result is “unjust or inappropriate”. However, any court order deviating from the guidelines must set forth the amount of “basic child support” (Line S) resulting from the Guidelines and the reason for the deviation.

These factors are:

1.The financial resources of the parents and the child.

2.The physical and emotional health of the child and his/her special needs and aptitudes.

3.The standard of living the child would have enjoyed if the marriage or household was not dissolved.

4.The tax consequences to the parents.

5.The

6.The educational needs of the parents.

7.The fact that the gross income of one parent is substantially less than the gross income of the other parent.

8.The needs of the other children of the

9.If a child is not on public assistance, the amount of extraordinary costs of visitation (such as

10.Any other factor the court decides is relevant.

)

Form reproduced by permission of Author: Steven L. Abel, Esq. |

Outside of court, parents are free to agree to any amount of support, so long as they sign a statement that they have been advised of the provisions of the child support guidelines law, the amount of “basic child support” (Line S) resulting from the Guidelines and the reason for any deviation. Further, the Court must approve any deviation. In addition, the courts retain discretion over child support.

39___________________________________________

Signature (check which applies) QPlaintiff QDefendant

(The name signed must be printed beneath)

Subscribed and Sworn to before me on

NOTARY PUBLIC

Form reproduced by permission of Author: Steven L. Abel, Esq. |